Declaration according to the simplified tax system income for 2022

More details

Attention ! You can generate payments to pay tax according to the simplified tax system via online banking on our website.

Entrepreneurs using the simplified tax system pay advance payments and tax according to the simplified tax system. Advance payments are paid for each quarter, tax according to the simplified tax system - at the end of the year.

Advance payments (tax) under the simplified tax system are calculated in full rubles. Amounts less than 50 kopecks are discarded, and 50 kopecks or more are rounded up to the full ruble.

Subscribe to our Telegram channel so you don't miss important news for entrepreneurs.

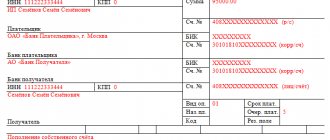

An example of filling out a payment order for the simplified tax system “income minus expenses”

In conclusion, it is worth noting that errors in the details of the tax office can lead to the payment being irretrievably lost. So when filling out this data in the fields of the payment order, you need to be extremely careful. The remaining details, if there is an error in them, can be clarified by submitting a corresponding application to the Federal Tax Service. However, until the payer himself discovers his mistake and submits such clarification, the tax payment will “hang” in the outstanding payments, or it may be credited to another budget (in case of an error in the KBK), and the payer will be credited tax debt. The result could be, for example, a forced write-off of the declared amount of tax from the current account.

Calculation of the advance payment for the 3rd quarter of 2022 using the simplified tax system “Income minus expenses”

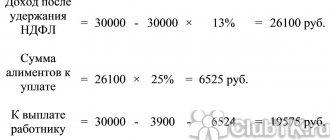

The company operates on the simplified tax system “Income minus expenses”, the rate is 15%. Income from product sales for 3 months amounted to 1,900,000 rubles. Expenses for the purchase of raw materials and utilities amounted to 450,000 rubles. 300,000 rubles were spent on wages for hired employees, and insurance contributions in the amount of 100,000 rubles were transferred to the budget.

Let's calculate the tax base:

1,900,000 – 450,000 – 300,000 – 100,000 = 1,050,000 rubles.

Let's calculate the amount of the advance payment for the 3rd quarter of 2022:

1,050,000 × 15% = 157,500 rubles.

Thus, the organization must pay 157,500 rubles to the budget as an advance payment for the 3rd quarter according to the simplified tax system.

Minimum amount of advance payment for the 3rd quarter of 2022 according to the simplified tax system “Income minus expenses”

The application of the simplified tax system “Income minus expenses” obliges you to pay an advance payment in the minimum amount. This is done when losses are incurred at the end of the quarter or expenses are almost equal to income. The minimum advance payment is 1% of income.

The entrepreneur’s task in such a situation is to calculate the “regular tax” on the difference between income and expenses and the minimum tax as 1% of total income, compare these two values and pay the larger one to the budget.

Example

Let's look at a specific example for clarity. For the 3rd quarter of 2022, the organization received the following results:

- income - 800,000 rubles;

- expenses - 750,000 rubles.

The tax amount will be: 800,000 – 750,000 = 50,000 × 15% = 7,500 rubles.

Minimum tax amount: 800,000 × 1% = 8,000 rubles.

The entrepreneur needs to pay the minimum tax amount, since it turned out to be higher.

How to pay an advance under the simplified tax system with the object “Income minus expenses” for the 3rd quarter of 2022

You can also pay your budget using a payment order via Internet banking or directly at the bank. The algorithm for filling out the document is exactly the same as for the simplified tax system “Income”. But you should indicate the tax payment identifier for the simplified tax system “Income minus expenses”: KBK 182 1 0500 110.

The name of the payment will also be slightly different. Look at the example of filling out the payment order so as not to make mistakes when filling it out.

How to calculate advance payments and tax according to the simplified tax system

To calculate advance payments (tax) according to the simplified tax system, you will need two amounts:

- amount of income for the period (1st quarter, half year, 9 months, year),

- the amount of insurance premiums paid by individual entrepreneurs during this period.

The amount of income is taken from section I, the amount of contributions - from section IV of the book of accounting of income and expenses (KUDiR) for the corresponding period.

Attention ! All calculations in this article are suitable only for individual entrepreneurs on the simplified tax system for income without employees.

Advance payments (tax) under the simplified tax system are calculated using the formula:

N = D × 6% − B − C, where

- N is an advance payment (tax) according to the simplified tax system,

- D is the amount of income for the period (1 quarter, half year, 9 months, year),

- B are the insurance premiums paid in this period,

- C is the amount of previous advance payments.

Example . If in 2022 an entrepreneur earned 1.5 million rubles, he paid insurance premiums of 40,874 rubles. and advance payments under the simplified tax system are 20 thousand rubles, then the tax under the simplified tax system will be: 1,000,000 × 6% − 40,874 − 20,000 = 29,126 rubles.

General approach

Thus, in 2022, organizations and individual entrepreneurs will need to cover the final tax under the simplified taxation system for the previous year 2017. Along with the submission of the relevant declaration, payment must be made before the end of March.

Typically, simplified taxation system payers have on their agenda the question of the exact amount of money that must be indicated in the payment order at the time of transfer of this tax. However, the purpose and period for which the tax is paid are also of great importance. Let's look at these questions further.

How to pay advance payments (tax) according to the simplified tax system

Advance payments (tax) under the simplified tax system can be paid in cash using a receipt at any Sberbank branch, via the Internet on the tax office website or from a current account.

How to pay tax according to the simplified tax system via the Internet

- Go to nalog.ru. Agree to the processing of personal data and select Fill in all payment details of the document.

- Specify Taxpayer - Individual Entrepreneur, Payment Document - Payment Document and click Next.

- Under the OKTMO Code line, check the Define by address checkbox. Please provide your residential address. Click OK. The Federal Tax Service and OKTMO codes will be determined automatically. Click Next.

- Specify KBK 18210501011011000110 (for simplified tax system income) and click Next. The remaining fields will be determined automatically.

- Indicate the status of the person: 13 - individual entrepreneur, notary engaged in private practice, lawyer who established a law office, head of a peasant (farm) enterprise.

- Basis of payment: TP - payments of the current year.

- Tax period: Quarterly payments, then quarter and year (for payment of advance payments under the simplified tax system) or Annual payments and year (for payment of tax under the simplified tax system).

- Enter the payment amount.

- Please indicate your full name and tax identification number. Under the Residence address line, select Same as the property's location address. Click Next and then Pay.

- To pay online, select the payment method by Bank card. To pay in cash through Sberbank, select - Generate a receipt. To pay via online banking, select - Via the credit institution’s website and then your bank.

Attention ! You can pay advance payments (tax) under the simplified tax system via the Internet on the tax website only from a personal card or account. To pay from an individual entrepreneur’s current account, create payments on our website

How to fill out a payment order

Attention ! From October 1, 2022, the rules for filling out payment orders for paying taxes and contributions have changed. Read more about the changes on our Telegram channel.

To pay advance payments and tax according to the simplified tax system from a current account, indicate the following details in the payment order:

- Payer status - 13

- Gearbox - 0

- Your data: Full name (IP) //Residence address//

- Tax details

- KBK code

- OKTMO code

- Basis of payment - TP

- Taxable period

- Payment order: 5

- Code - 0

- Fields 108, 109, 110

- Purpose of payment

- In the Payer Status field, enter 13.

- Enter 0 in the checkpoint field.

- In the Payer field, indicate your full name (IP) //Residence address//.

- In the Recipient field, enter the details of the tax office.

- In field 104, enter the KBK code 18210501011011000110 (for the simplified tax system for income).

- In field 105, enter the OKTMO code (municipality code) for your address.

- In the Reason for payment field, enter the TP.

- In the Tax period field, enter:

- KV.01.2021 - to pay the advance payment under the simplified tax system for the 1st quarter,

- GD.00.2021 - to pay tax according to the simplified tax system for the year.

- In the Payment sequence field, enter 5.

- In the Code field, enter 0.

- In fields 108, 110, enter 0. In field 109 (document date), enter:

- 0 - when paying an advance payment according to the simplified tax system or tax according to the simplified tax system before filing a declaration,

- date of the declaration under the simplified tax system - when paying tax under the simplified tax system after filing the declaration.

- In the payment purpose please indicate:

- Tax levied on taxpayers who have chosen income as an object of taxation for the 1st quarter of 2022 - upon payment of an advance payment under the simplified tax system for the 1st quarter,

- Tax levied on taxpayers who have chosen income as an object of taxation for 2022 - when paying tax according to the simplified tax system for the year.

General procedure for processing tax payment orders

Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n determines the mandatory details for paying taxes and insurance premiums:

- 101 - status of the payer who issued the payment document;

- 104 - twenty-digit budget classification code, where the first three digits correspond to the tax administrator number;

- 105 - OKATO;

- 106 - basis of payment, consists of two letters (TP, ZD, AR);

- 107 - frequency of tax payment - month, quarter, half year, year;

- 108 — document date, filled in depending on the indicator of field 106;

- 109 - document number, if the debt is repaid on demand;

- 110 - payment type, currently not filled in.

Checking tax calculations with the budget under the simplified tax system

To check calculations with the budget for tax under the simplified tax system (Income), you can create a report Account analysis 68.12 “Tax under the simplified taxation system”, section Reports - Standard reports - Account analysis.

See also:

- Paying tax under the simplified tax system (Income-expenses)

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Paying tax under the simplified tax system: object Income - expenses In this article we will talk about how to fill out a payment form...

- Transition from the simplified tax system (Income - Expenses) to the simplified tax system (income) ...

- Transition from the simplified tax system (Income) to the simplified tax system (income - expenses) ...

- Calculation of land tax 2022. Taxpayers, object, tax base...

What is important when paying a simplified taxation system in advance?

In contrast to the deadlines for transferring the simplified tax system for the year, linked to the deadline for filing a declaration on it (they differ for legal entities and individual entrepreneurs), advances under the simplified tax system, regardless of which category the payer belongs to, are paid within the same period. This happens in the month following the end of the next reporting period (quarter), no later than the 25th (clause 7 of Article 346.21 of the Tax Code of the Russian Federation). When the 25th day turns out to be a weekend, the end date is shifted forward to the nearest weekday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Taking into account these rules, the deadline for paying the simplified taxation system advance for the 1st quarter of 2022 is 04/26/2021 (postponed from Sunday, April 25).

Payment of tax under the simplified tax system to the budget

After paying tax to the budget under the simplified tax system (Income), based on the bank statement, you need to create a document Write-off from current account transaction type Tax payment. A document can be created based on a Payment Order using the link Enter document debited from current account . PDF

The basic data will be transferred from the Payment order .

Or it can be downloaded from the Client-Bank or directly from the bank if the 1C: DirectBank service is connected.

It is necessary to pay attention to filling out the fields in the document:

- from – date of tax payment, according to the bank statement;

- In. number and input date – number and date of the payment order;

- Tax – Tax under the simplified tax system (income) , selected from the Taxes and Contributions directory and affects the automatic completion of the Debit account ;

- Type of liability – Tax .

- Reflection in accounting : Debit account - 68.12 “Tax under the simplified taxation system”;

- Types of payments to the budget - Tax (contributions): accrued / paid .

Postings according to the document

The document generates the posting:

- Dt 68.12 Kt – tax debt to the budget under the simplified tax system (Income) has been repaid.