What is the document for?

The book of accounting for income and expenses (abbreviated as KUDiR) is necessary to calculate the tax base of an individual entrepreneur, on the basis of which tax deductions for the reporting period will be calculated.

For each taxation system that requires maintaining KUDiR, it will have its own characteristics. An individual entrepreneur located on a common system (OSNO) must be guided by the relevant requirements. Entrepreneurs using PSN and USN will fill out KUDiR differently.

REMEMBER! In the general taxation system, only individual entrepreneurs are required to maintain KUDiR; companies are exempt from this obligation.

Simplified taxation system (STS)

Can be used if the following conditions are met:

- annual turnover of the company is up to 150 million rubles;

- number of hired employees up to 100 people;

- cost of fixed assets (real estate, transport, equipment) – up to 150 million rubles.

It can be used by both solo entrepreneurs and large organizations.

There are two options for the simplified tax system:

- The object of taxation is “income minus expenses” - the tax rate will be 15% on the difference between income and expenses.

- The object of taxation is “income” - the tax will be 6% on all income.

When submitting an application to switch to the simplified tax system, an entrepreneur chooses which tax calculation object is suitable for him. You can only take into account income and pay 6% of income. This is beneficial if the costs are small, for example, when renting out premises. All cash receipts are reflected by the entrepreneur in the Income and Expense Book, and based on these data the amount of tax payable is calculated.

If the business involves large expenses, for example in the case of wholesale trade or construction, it is more profitable to pay a tax of 15% on the difference between income and expenses. In this case, both income and expenses are reflected in the Accounting Book. This option takes more time, but allows you to reduce the tax burden.

To optimally select the object of taxation, namely the amount on which tax will need to be paid, it is necessary to have a good knowledge of the structure of money flows. If you keep financial records, choosing an object is easy and simple.

You need to pay tax every quarter. Important – payments are calculated on an accrual basis, taking into account the previous period. Let's show it in more detail using an example:

An entrepreneur uses the “income minus expenses” object . Suppose that in the first quarter (from January to March) things were not going so well, and he managed to earn 70 thousand rubles, but had to spend 50 thousand:

70,000 - 50,000 = 20,000 (rub.) - profit for the first quarter

20,000 x 0.15 = 3,000 (rub.) – the amount of tax payable (15% of the profit amount)

In the second quarter (from April to June), the situation improved, and income amounted to 150 thousand rubles, and expenses - 30 thousand rubles:

150,000 - 30,000 = 120,000 (rub.) - profit for the second quarter

Let's sum up the profit for two quarters:

20,000 + 120,000 = 140,000 (rub.)

140,000 x 0.15 = 21,000 (rub.) – you need to pay to the budget for two quarters (15% of the profit amount)

This calculation scheme may seem complicated, because you can simply calculate payments separately for each quarter. However, in the declaration the tax amounts are reflected on an accrual basis. This calculation is also useful for correctly calculating deductions.

To get the payment amount for the second quarter, subtract the advance payment for the previous period (3,000 rubles):

21,000 - 3,000 = 18,000 (rub.) - advance payment for the second quarter.

The deadline for making advance payments is no later than 25 calendar days from the end of the reporting period. Thus, the payment for the first quarter must be paid before April 25, for the second - before July 25, for the third - before October 25. If you miss a payment, there will be no fines, but the tax office will charge penalties. The final payment for the year is due by April 30 of the following year; the tax for 2019 will need to be paid in full in 2022.

The amount of the advance payment is reduced:

- the amount of insurance premiums paid by the employer for employees (the deduction will be up to 50% of the tax amount);

- for the amount of insurance premiums paid by individual entrepreneurs “for themselves” (up to 100% of the tax amount).

If the entrepreneur from the previous example works alone and pays fixed insurance premiums, for this he can reduce the amount of tax by the entire amount of insurance premiums paid (9059.5 rubles for the first quarter) and pay nothing. In the second quarter, the situation is as follows: the amount of advance payments for two quarters can be reduced by 18,119 rubles (the amount of fixed contributions for two quarters):

21,000 - 18,119 = 2881 (rub.) - the amount that will need to be paid.

Important - if the object of taxation “income minus expenses” is selected, at the end of the year you will need to calculate:

- The standard tax rate is 15% of the difference between income and expenses.

- Minimum tax rate of 1% of income.

You must pay the tax whose amount is greater. Even if there are more expenses than income and the business closes the year with a negative result, you need to pay 1% of the income. Let's take the following data as an example:

Tax according to the simplified tax system: (290,000 - 262,000) x 0.15 = 4,200 (rub.)

Minimum tax: 308,000 x 0.01 = 2900 (rub.)

You need to pay 4,200 rubles.

If the object of taxation is “income” , then only income is taken into account. Let's calculate the tax for the year using the data from the previous example:

290,000 x 0.06 = 17,400 (rub.) – amount of tax payable (6% of income)

If an entrepreneur has hired employees, he can reduce the tax by the entire amount of insurance premiums, but not more than 50% of the tax amount.

17,400 / 2 = 8,700 (rub.) – 50% of the tax amount, which can be written off from insurance premiums for employees.

In our example, the amount payable, taking into account the maximum deduction, will be 8,700 rubles.

If the entrepreneur in the example works alone, he can use a deduction in the amount of insurance premiums paid for himself (their fixed amount for the year is 36,238 rubles) and reduce the tax to zero.

The declaration is submitted to the tax office at the place of registration of the entrepreneur once a year, before April 30 of the year following the reporting year. For 2022, reporting will be required by April 30, 2020. The declaration is submitted in any case, even if the tax at the end of the year is zero or if no activity was carried out at all.

The simplified tax system allows you to reduce the time spent on accounting. Another advantage is that the tax amount can be reduced using deductions. However, there remains the need for constant accounting, reflection of all income and expenses, and tax calculation.

Ekaterina Danilova , PR specialist at the TaxCOACH Business Structuring Center:

“This is the second time I have been operating as an individual entrepreneur. For the last few years I have been providing marketing services. I chose a simplified taxation system, income only, 6%. I have no employees, I report only for myself. Once a year I submit a declaration, which I fill out myself. It contains 3 pages. Filling out takes about 30-40 minutes + I spend 10-15 minutes filling out receipts and paying taxes (online). After which I either go to the post office to send the declaration by registered mail, or take it to the Federal Tax Service office. This takes about an hour. I spend another 10-15 minutes filling out receipts for paying fixed contributions (insurance and pension) in December. Thus, I spend 2-2.5 hours a year on accounting. In the first year of work, in addition to the main declaration, I had to submit 2 “clarifications”; the correct version turned out only the third time, but I remembered the procedure for filling it out. Now I use it as a sample, and the declaration is accepted from the first “take”. Thanks to the fact that I studied this issue on my own, I save at least 24 thousand rubles annually.”

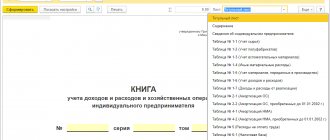

Features and general information about KUDiR

The book has a unified form. It can be maintained either in paper form, entering the necessary data by hand, or electronically.

If the book is kept on a computer, after the expiration of the accounting period it should be printed, the sheets numbered and stitched using thick, coarse thread. The final page is affixed with the individual entrepreneur’s stamp (if any) and signature, and the number of pages is also indicated. The book is then registered with the local tax office.

In the case when a paper version of KUDiR is used, it is registered with the tax office before filling out.

The book includes six sections that reflect all income and expenses of the individual entrepreneur made during the reporting period. It should be noted that sections are filled out depending on the area of work of the individual entrepreneur.

In other words, information needs to be entered only into those KUDiR blocks that are related to the activities of the individual entrepreneur.

General requirements for filling out KUDiR

If the book is not printed from an electronic medium, but is kept in paper form, you must purchase a form. The entrepreneur is required to do this according to the law. The following requirements must be filled out:

- chronological order of reflection of income and expenses;

- confirmation of them with primary documents;

- completeness and continuity of recording data that forms the tax base;

- numbering and lacing of book sheets, a signature certifying the number of sheets on the last page;

- correction is allowed by carefully crossing out one line and certifying the correction with the signature of the individual entrepreneur and the date;

- KUDiR and accounting are carried out in parallel, one and the other are required;

- at the beginning of each new reporting period, a new Book should be created;

- The completed KUDiR should be retained for 4 years.

ATTENTION! If KUDiR is maintained in electronic form, which is permitted, it should be printed and the same actions should be performed with it as with paper.

Sample document

At the beginning of the book, on the title page, information about the individual entrepreneur is entered - this section should not cause any difficulties, since information from personal and constituent documents is included here:

- FULL NAME;

- TIN;

- residential address;

- information about the tax authority where the taxpayer was registered;

- data from the registration certificate, etc.

Information is also provided about the bank where the individual entrepreneur has an account and the cash register number if he uses it in his work. Then the entrepreneur puts his signature on the page and dates the form.

Filling out section 1 KUDiR

This includes raw materials, semi-finished products and other inventory items for the acquisition of which the individual entrepreneur spent his own funds. They must be taken into account even if the expenses were made in the previous reporting period, and the de facto receipt occurred in the current one.

Advances that are planned to be provided in the coming periods are also indicated here.

Expenses take into account actual expenses that have occurred for the purpose of subsequently obtaining financial benefits from business operations.

It should be noted that the amount of financial expenses when carrying out business activities is written off as expenses only if the produced inventory items are sold. If there are statutory expense norms for this part, then accounting is carried out based on them.

The first section contains several block tables. Blocks 1-1 to 1-7 must be filled out by individual entrepreneurs who are employed in the manufacturing sector. Moreover, each block has two options, the first of which (version A) is used by entrepreneurs working with VAT, and the second (version B) is used by those who do not allocate VAT in their operations.

If you go in order, then Table 1-1 contains data on raw materials purchased and consumed in the process of the individual entrepreneur’s work.

Cells of block 1-2 include semi-finished products (purchased and spent) for production needs.

Block lines numbered 1-3 are intended to account for auxiliary raw materials and materials (purchased and consumed).

Block 1-4 contains other material costs, i.e. energy, water, fuel, etc. which were spent in the course of the activities of the individual entrepreneur.

Block 1-5 indicates the price of finished products that the individual entrepreneur produced during the reporting period, and also provides the cost of work performed and services provided during this time.

Blocks 1-6 and 1-7 show the result of production and sale of manufactured products at the time of commission and based on the results of the monthly period.

Filling out section 2 KUDiR

The second section of KUDiR concerns depreciation of fixed assets, small business enterprises and intangible assets. Depreciation can only be calculated in relation to the property of the entrepreneur, which was purchased with cash and used to carry out his work. Intangible assets include all types of intellectual property (trademarks, electronic programs, databases, etc.) that the individual entrepreneur uses in his activities. The rules for calculating depreciation are given in tables 3-1, 3-2, 3, 4-1, 4-2.

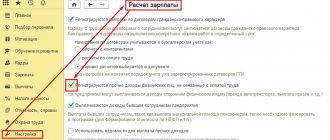

Filling out section 5 KUDiR

The fifth section of the book provides calculations of wages and taxes. The table given here is, in fact, a payroll sheet and is formed for each month separately. It contains

- calculated income tax,

- various other deductions,

- date of issue of funds

- and the employee’s signature upon receipt.

The table includes all types of payments, including wages themselves, material incentive payments, the price of goods issued in kind, etc.

Filling out section 6 KUDiR

The sixth section of KUDiR allows you to determine the tax base. It is formed after a year (according to the calendar) and is the basis for filling out the 3-NDFL form.

Block 6-1 includes income from sales indicated in table 1-7 and others. Data from blocks 1-7, 2-1, 2-2, 3-1, 4-1, 4-2, 5-1, 6-2 are given as expenses.

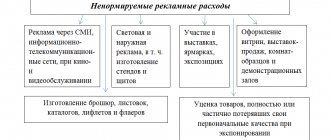

Block 6-2 includes all expenses of an individual entrepreneur not shown in other blocks, including expenses for fire safety and security systems, travel expenses, fees for consulting, information and legal services. services, Internet, telephone, costs for household and repair needs, etc.

The last block KUDiR (6-3) includes expenses made in the current reporting period, but income for which will be taken into account in the upcoming period. These include seasonal expenses, rental payments, etc.

Pros and cons of OSNO

Each tax calculation mode has its pros and cons. Let's talk about the positive aspects. Probably the most important plus is that individual entrepreneurs on OSNO are VAT payers. Of course, some may regard this plus as a minus, because the obligation to pay VAT leads to the obligation to keep appropriate records and submit returns. But the general regime allows individual entrepreneurs to work with large and medium-sized companies for which input VAT is important when purchasing goods/services. This point is really important: often in practice, large companies actually refuse to work with simplified individual entrepreneurs precisely because of VAT. For individual entrepreneurs, cooperation with large companies also has a plus - the opportunity to develop their business by entering new markets.

Another “FOR” in favor of OSNO is the absence of restrictions on the use of the mode. Let us remind you that any of the special modes has limitations, among which the following data are usually distinguished:

- volume of revenue;

- number of employees;

- size of fixed assets;

- Kind of activity;

- list of expenses.

OSNO does not have all these restrictions. The amount of revenue, the number of employees and the amount of fixed assets cannot have any impact on the application of the regime. Restrictions are not imposed on types of activities (as on UTII or a patent), expenses are determined according to the list that was developed for calculating income tax for legal entities.

As for the disadvantages, everyone can name them for themselves: paying all taxes, submitting several declarations, keeping accounts - all this can be combined into the complexity of accounting. Indeed, most often, individual entrepreneurs on OSNO are forced to resort to the services of a full-time accountant, who will be responsible for accounting and reporting to the tax office, because the individual entrepreneur himself simply does not have enough knowledge and time to understand all the intricacies. In most cases, extensive business activities cannot be managed not only without an accountant, but also without a special accounting program.