Card of quantitative and total accounting of material assets according to form 0504041

The quantitative and total accounting card, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n, is used in government agencies to provide analytical accounting of the following assets:

- fixed assets;

- materials used in the manufacture of experimental devices;

- spare parts and components installed on vehicles to replace those that have failed;

- transferable badges of merit (awards, prizes, cups);

- inventory items in safekeeping;

- OS, MPZ on the way;

- materials;

- materials as customer-supplied raw materials;

- leased assets;

- assets for free use and storage.

Thus, f. 0504041 is used both for own assets and for those that are taken into account off the balance sheet.

This document is filled out by an accountant. First of all, you need to carry forward the balance to the beginning of the year. Then, during the period, data on the movement of the asset is entered into the card based on primary documents, and at the end of the period the balance is displayed. Receipts are indicated in the “Debit” column, disposals - in the “Credit” column. Information is filled in in rubles and in units of measurement. Information about the useful life of the asset and the expected write-off date is also provided.

A separate card is drawn up for each name. In addition, a separate card must also be filled out for each financially responsible person, even if the names of the assets under their control are identical. Also, for certain types of material assets, the following analytics are provided, listed in the table, that is, separate cards are compiled for each characteristic.

| Types of material assets | Characteristics |

| Valuables for rent | Lessor's inventory number |

| Non-financial assets in transit | Provider |

| Inventory in safekeeping | Owner |

| Provided raw materials and supplies | Customer, type, grade of materials and their location |

Form 0504041 is available on our website.

In addition, we suggest that you familiarize yourself with a sample of filling out this document.

If you need an example of filling out a book of accounting for material assets (f. 0504042), get free access to ConsultantPlus and go to the sample.

New forms of primary documents

Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n (hereinafter referred to as Order No. 52n) approved new forms of primary documents and accounting registers used by state (municipal) institutions, as well as Guidelines for their application (hereinafter referred to as Guidelines). These documents and registers should be used when developing accounting policies for 2015. With the entry into force of Order No. 52n, the previously existing Order No. 173n[1] becomes invalid. In the article we will conduct a comparative analysis of new and old forms of primary documents.

First of all, let us recall that the direct order of the Ministry of Finance, as before, approves only those forms of primary documents that belong to class 05 “Unified system of accounting, financial, accounting and reporting documentation for the public management sector” OKUD[2]. Now the list of such documents has expanded, primarily due to the inclusion of those documents that were previously approved by various resolutions of the State Statistics Committee of the Russian Federation and belonged to class 03 “Unified system of primary accounting documentation” OKUD.

Let's look at how much the codes and names of the forms of primary documents have changed in the table:

| In accordance with Order No. 52n | In accordance with Order No. 173n | ||

| Primary document form number | Name of the primary document form | Primary document form number | Name of the primary document form |

| 0504101 | Certificate of acceptance and transfer of non-financial assets | 0306030 | Certificate of acceptance and transfer of a building (structure) |

| 0306031 | Act on acceptance and transfer of groups of fixed assets (except buildings, structures) | ||

| 0306001 | Certificate of acceptance and transfer of fixed assets (except for buildings, structures) | ||

| 0504102 | Invoice for internal movement of non-financial assets | 0306032 | Invoice for internal movement of fixed assets |

| 0504103 | Certificate of acceptance and delivery of repaired, reconstructed and modernized fixed assets | 0306002 | Certificate of acceptance and delivery of repaired, reconstructed, modernized fixed assets |

| 0504104 | Act on write-off of non-financial assets (except for vehicles) | 0306003 | Act on write-off of fixed assets (except for vehicles) |

| 0306033 | Act on the write-off of groups of fixed assets (except for vehicles) | ||

| 0504105 | Certificate of write-off of a vehicle | 0306004 | Act on write-off of motor vehicles |

| 0504143 | Act on write-off of soft and household equipment | 0504143 | Act on write-off of soft and household equipment |

| 0504144 | Act on the write-off of excluded objects of the library collection | 0504144 | Act on the write-off of excluded objects of the library collection |

| 0504202 | Menu-requirement for issuing food products | 0504202 | Menu-requirement for issuing food products |

| 0504203 | Statement for the issuance of feed and fodder | 0504203 | Statement for the issuance of feed and fodder |

| 0504204 | Request-invoice | 0315006 | Request-invoice |

| 0504205 | Invoice for the release of materials (material assets) to the side | 0315007 | Invoice for issue of materials to the side |

| 0504206 | Card (book) for recording the issuance of property for use | – | |

| 0504207 | Receipt order for acceptance of material assets (non-financial assets) | – | |

| 0504210 | List of issuance of material assets for the needs of the institution | 0504210 | List of issuance of material assets for the needs of the institution |

| 0504220 | Certificate of acceptance of materials (material assets) | 0315004 | Certificate of acceptance of materials |

| 0504230 | Act on write-off of inventories | 0504230 | Act on write-off of inventories |

| 0504401 | Payroll | 0504401 | Payroll |

| 0504402 | Payslip | 0301010 | Payslip |

| 0504403 | Payment statement | 0504403 | Payment statement |

| 0504417 | Help card | 0504417 | Help card |

| 0504421 | Time sheet | 0504421 | Time sheet and payroll calculation |

| 0504425 | Note-calculation on the calculation of average earnings when granting leave, dismissal and other cases | 0504425 | Note-calculation on the calculation of average earnings when granting leave, dismissal and other cases |

| 0504501 | Statement for issuing money from the cash register to accountable persons | 0504501 | Statement for issuing money from the cash register to accountable persons |

| 0504505 | Advance report | 0504049 | Advance report |

| 0504510 | Receipt | 0504510 | Receipt |

| 0504514 | Cash book | 0504514 | Cash book |

| 0504608 | Children's attendance sheet | 0504608 | Children's attendance sheet |

| 0504805 | Notice | 0504805 | Notice |

| 0504816 | Act on writing off strict reporting forms | 0504816 | Act on writing off strict reporting forms |

| 0504817 | Notification on settlements between budgets | 0504817 | Notification on settlements between budgets |

| 0504822 | Notice of budget commitment limits (budget allocations) | 0504822 | Notice of budget commitment limits (budget allocations) |

| 0504833 | Accounting information | 0504833 | Reference |

| 0504835 | Inventory results report | 0504835 | Inventory results report |

| – | 0531728 | Certificate of acceptance and transfer of cash payments and receipts during the reorganization of participants in the budget process | |

| – | 0531811 | Certificate of financing and cash payments | |

Next, we will consider the procedure for filling out new forms of primary documents (they are highlighted in the table) in accordance with the Guidelines given in Appendix 5 to Order No. 52n .

Recommendations for filling out new forms

Act on acceptance and transfer of non-financial assets (form 0504101). This document immediately replaced three forms previously used by institutions, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7 (hereinafter referred to as Resolution No. 7):

- act of acceptance and transfer of fixed assets (except for buildings, structures) (f. 0306001);

- act of acceptance and transfer of a building (structure) (f. 0306030);

- act on the acceptance and transfer of groups of fixed assets (except for buildings, structures) (f. 0306031).

In this regard, an act in form 0504101 is now drawn up when registering transactions for the acceptance (transfer) of property related to non-financial assets, including investments in real estate (buildings, structures, etc.).

In addition, this act is used when registering the acceptance and transfer of both one and several objects of non-financial assets (that is, groups of objects). According to the methodological instructions, the act in form 0504101 is used to formalize the following operations:

- transfer of non-financial assets between institutions, institutions and organizations (other right holders), including when securing the right of operational management (economic management);

- transfer of property to the state (municipal) treasury, including when the body exercising the powers of the owner of state (municipal) property withdraws non-financial assets from operational management (economic management);

- transfer of property as a contribution to the authorized capital (property contribution);

- changing the legal holder of state (municipal) property on other grounds, with the exception of the acquisition of property for state (municipal) needs (needs of budgetary (autonomous) institutions), the sale of state (municipal) property. In this case, the institution is given the right, as part of the formation of accounting policies, to establish the procedure for applying the act in form 0504101 when acquiring, gratuitously transferring, or selling non-financial assets.

Invoice for internal movement of non-financial assets (form 0504102). The structure and purpose of this form largely repeats the form 0306032 “Invoice for internal movement of fixed assets” previously used by institutions, approved by Resolution No. 7, with the only difference that the new form is used more widely.

The new form of the invoice, in comparison with the previously used form, is used to register and record the movement within the institution of not only fixed assets, but also other objects of non-financial assets, in particular:

- intangible assets;

- finished products produced by the institution.

The invoice (f. 0504102) is issued by the transferring party (structural unit - sender) in triplicate, signed by the responsible persons of the structural units of the receiving and transferring parties.

The first copy is transferred to the accounting department, the second remains with the financially responsible person transferring the object, the third copy is transferred to the financially responsible person accepting the object. Certificate of acceptance and delivery of repaired, reconstructed and modernized fixed assets (f. 0504103). This act is used by institutions instead of form 0306002 approved by Resolution No. 7 with the same name and almost completely coincides with it. However, in the new form, unlike the previously used form, it is additionally necessary to indicate the details of contracts for work and the deadlines for their completion.

It has been established that an institution has the right to use an act in form 0504103 when modernizing intangible assets, if this is recorded in the accounting policy.

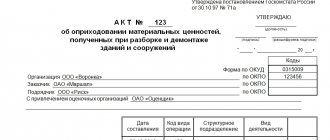

Act on the write-off of non-financial assets (except for vehicles) (f. 0504104). This act combines information previously indicated separately in the following forms approved by Resolution No. 7:

- in the act of writing off fixed assets (except for vehicles) (f. 0306003);

- in the act on the write-off of groups of fixed assets (except for vehicles) (f. 0306033).

Thus, now an act in form 0504104 is drawn up for one or more objects of non-financial assets for one group of state (municipal) property (real estate, especially valuable movable, other).

For real estate objects, an act is drawn up indicating the information contained in the cadastral passport of the real estate object. In accordance with the Methodological Instructions, an act in form 0504104 is drawn up by the commission for the receipt and disposal of assets based on its decision on the need to write off fixed assets, intangible assets, and other tangible assets (except for raw materials, supplies, as well as finished products produced by the institution) and serves as the basis to reflect in the accounting records of the institution the disposal of non-financial assets.

Certificate of write-off of a vehicle (form 0504105). This act replaced the form 0306004 “Act on the write-off of motor vehicles” previously used by institutions, approved by Resolution No. 7. Both forms are used to reflect transactions on the write-off of a motor vehicle.

It is worth noting that the structure and procedure for filling out these documents is almost the same, with the only difference being that the new form of the act is more adapted for use by public sector institutions.

Request-invoice (f. 0504204). This form is more compact compared to the previously used form of the same name 0315006, approved by Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a (hereinafter referred to as Resolution No. 71a).

Despite this, the purpose of these forms and the rules for filling out are the same. As before, the invoice requirement is used to record the movement of material assets within the organization between structural divisions or materially responsible persons, as well as to formalize operations for the delivery of leftover materials to the warehouse resulting from disassembly and disposal of fixed assets.

The claim-invoice is drawn up by the materially responsible person of the sending structural unit, transferring material assets to the receiving unit (for example, from a warehouse to a warehouse; from a warehouse to a structural unit, etc.) or to another materially responsible person, in two copies, one of which serves as the basis for the transfer of values, and the second – for their acceptance.

Invoice for the release of materials (material assets) to the third party (f. 0504205). Institutions are required to draw up such a document instead of the previously used form 0315007 “Invoice for the release of materials to the third party,” approved by Resolution No. 71a.

The invoice in the form 0504205 is used to record the release of material assets by the sending institution to third-party institutions (organizations) - recipients, organizations, including with the involvement of organizations carrying out transportation, on the basis of agreements (contracts) and other documents.

The invoice in form 0504205 is issued in two copies by the sending institution on the basis of agreements (contracts), orders and other relevant documents when presented by a representative of the recipient institution (organization); the organization carrying out the transportation, on the basis of a power of attorney to receive material assets, filled out in the manner prescribed by law. One copy is the basis for the release of materials, the second is transferred to the representative of the institution (organization) - the recipient of material assets.

Card (book) for recording the issuance of property for use (f. 0504206). This form was introduced for the first time and had no analogues before. According to the Methodological Instructions, the card (book) (f. 0504206) is used to record property that is issued for personal use to an employee (employee) during the performance of his official duties.

The card records the property issued for use by name reflected in column 1, indicating the rate of issue, the standard period of use (if any), and the number of material assets issued.

When returning property, the quantity of property handed over is recorded by name, indicating the quantity of property returned (surrendered), the date of return and the signature of the person who accepted the property handed over by the employee (employee).

When creating a card (book) (f. 0504206) for the purpose of accounting for the property of an institution issued to employees (employees), details reflecting the individual characteristics of the person who received the property (sizes of headgear, clothes, shoes, etc.) may not be filled in .

Receipt order for acceptance of material assets (non-financial assets) (f. 0504207). This is a completely new form. Institutions will have to compile it upon receipt of material assets (including fixed assets, inventories), including from third-party organizations (institutions). The receipt order serves as the basis for accepting incoming material assets for accounting and reflecting on the balance sheet of the institution. It contains information about the name of the product, its quantity, and cost.

The accounting department of the institution reflects the correspondence of accounts in the receipt order and issues a note on the acceptance for accounting and posting of material reserves (material assets).

If there is a quantitative and (or) qualitative discrepancy, as well as a discrepancy between the range of accepted material assets and the accompanying documents of the sender (supplier), the institution’s commission for the receipt and disposal of assets draws up an acceptance certificate for materials (f. 0504220), which is the legal basis for filing a claim with the sender (supplier) ).

Certificate of acceptance of materials (material assets) (f. 0504220). Now such an act is drawn up instead of the previously used form 0315004 “Act on acceptance of materials”, approved by Resolution No. 71a.

Comparing these forms, we note that the information indicated in them is almost the same. Therefore, it will not be difficult for institutions to switch to a new form.

Payroll (f. 0504402). The structure of such a statement largely repeats the form of the same name 0301010, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1 . At the same time, the new form is more adapted for use by institutions in the public sector.

In accordance with the Methodological Instructions, the payroll (f. 0504402) is used to reflect accruals on employees' wages, scholarships, benefits, and other payments made on the basis of agreements (contracts) with individuals, as well as to reflect deductions from the amounts of accruals (taxes, insurance contributions, deductions under writs of execution and other deductions).

Advance report (f. 0504505). According to Order No. 52n, the advance report was transferred from the accounting registers to the primary documents. Due to this, the form code has changed. Previously, the code 0504049 was used.

As before, the advance report is used to record settlements with accountable persons. At the same time, the instructions for filling it out have been slightly adjusted.

According to the new version of such instructions, the accountable person, when drawing up an advance report, provides information about himself on the front side of the advance report and fills out columns 1 - 6 on the back side about the amounts actually spent by him, indicating the documents confirming the expenses incurred. The documents attached to the advance report are numbered by the accountable person in the order in which they are recorded in the report.

The advance report is approved by the head of the institution or a person authorized by him.

On the reverse side of such a report, columns 7–10, containing information about expenses accepted by the institution for accounting, and accounting correspondence are filled out by the person entrusted with accounting.

Amounts paid in foreign currency are recorded both in foreign currency and in ruble equivalent. Advances received by an accountable person are reflected indicating the date of their receipt.

In addition to the introduction of new forms of primary documents, it should be noted that there has been a change in the procedure for filling out existing forms, in particular:

- the rules for filling out the work time sheet are described in more detail (f. 0504421). A table is provided with the symbols that are used to draw up such a report card;

- notice (f. 0504805) is now used when processing settlements arising from transactions of acceptance and transfer of property, obligations not only between the institution and the separate structural divisions (branches) created by it, but also between other accounting entities, including in interdepartmental and interbudgetary settlements ;

- the basis for drawing up an act on the results of the inventory (f. 0504835) is now the inventory lists (matching sheets), and not the statement of discrepancies based on the results of the inventory (f. 0504092);

- The procedure for applying and filling out notifications for settlements between budgets has been significantly adjusted (f. 0504817).

* * *

Having analyzed the new forms of primary documents approved by Order No. 52n, which supplemented the list of existing forms of accounting documentation for the public sector, we note that most of them repeat the structure and procedure for filling out similar unified forms established by the relevant orders of the State Statistics Committee. Thus, taking single unified forms as a basis, the Ministry of Finance adapted them for use by public sector institutions. Some forms (0504206, 0504207) were introduced for the first time and had no analogues before.

Please also note that the adoption of Order No. 52n will entail significant changes to the accounting instructions established separately for state, budget and autonomous institutions. Let us remind you that draft amendments to these instructions are posted on the Ministry of Finance website, but they did not take into account the new forms of primary documentation. Perhaps, with the publication of Order No. 52n, these projects will be finally edited and adopted soon.

In the next issue of the magazine, read about new forms of accounting registers and the procedure for their application.

[1] Order of the Ministry of Finance of the Russian Federation dated December 15, 2010 No. 173n “On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal ) institutions, and guidelines for their use."

[2] All-Russian classifier of management documentation. OK 011‑93, approved. Resolution of the State Standard of the Russian Federation dated December 30, 1993 No. 299.

Source: Magazine “Institutions of Culture and Art: Accounting and Taxation”

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Wealth accounting card 0504043 (form)

If the first register of accounting for material assets is maintained by the accounting department, then form 0504043 is filled out directly by the financially responsible person according to warehouse accounting data and is used for accounting in places where assets are stored. This card is filled out for:

- materials,

- finished products,

- soft equipment,

- dishes,

- library items.

A separate sheet of card is created for each name, while a quantitative and total accounting card is created separately for each object. Also, the information entered by the financially responsible person in card 0504043 is checked, for example, by an accountant, and there is a separate last page in the form to mark the verification.

Form 0504043 can be found on our website using the link below.

You can also fill out this document.

Read about the rules for accounting for inventories for public sector employees in the article “Accounting for materials in budgetary institutions (nuances).”

And the basics of accounting for materials in non-governmental organizations can be found in the article “Accounting entries for accounting for materials.”

Results

The accounting registers discussed in the article are filled out by organizations participating in the state system: budgetary, autonomous, government institutions, government agencies, extra-budgetary funds. They are intended for two-way control both from the accounting department and from the financially responsible person. In conditions of automation of accounting, the compilation of such registers is carried out by an accounting program and will not take much time from accounting workers.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When is Form 0504206 applied?

The card (book) for recording the issuance of property for use, form OKUD 0504206, was approved by Order of the Ministry of Finance 52n dated March 30, 2015.

Its main purpose is to record uniforms and special clothing and footwear, personal protective equipment for each employee. The financially responsible person (storekeeper), who is responsible for the uniforms, special clothing and personal protective equipment received from suppliers, issues them according to the issuance sheet for the needs of the institution (0504210). Card for recording the issuance of property for use An example of filling out a card (book) for accounting for the issuance of property for use (f. 0504206) See and fill out form 0504206 in the State Finance System with tips for filling out

Each employee who receives the property puts his signature. For accounting, this document is the basis for writing off the Ministry of Health from account 0 105 35 000 and reflecting it on off-balance sheet account 27. The MOL that issued the property must create a card for recording the issuance of property for use f. 0504206 for each recipient. If a small number of employees in an institution receive protective clothing, you can keep records in a ledger using blank forms as sheets.