About legal entities

When starting his own business, an individual entrepreneur is faced with the problem of choosing the most suitable mode for himself.

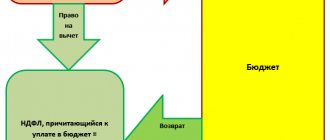

Asking a lawyer online is faster. It's free! When purchasing an apartment, citizens have the right to use the property tax

It all started in 2016, when the Federal Tax Service introduced a new form of control - tax monitoring.

From salaries and most other payments to employees (including under GPC agreements) of the company and

All company managers understand that an on-site tax audit is very serious. But many

Nowadays, a situation where the tax authority requires a pensioner to pay property tax

Invoice under the simplified tax system All organizations and individual entrepreneurs using the simplified system are not VAT payers, but

Who should draw up a bill of lading If transportation of inventory items occurs directly by the owner or seller

Fulfilling the duties of a temporarily absent employee There are several ways to replace vacationers: Combination. The employee combines his

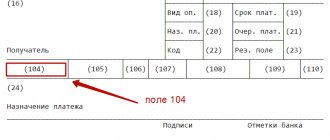

In 2022, the rules for filling out payment orders were updated. Some changes take effect immediately,