In 2022, the rules for filling out payment orders were updated. Some changes take effect immediately, while others take effect later.

At the beginning of the year there were a lot of questions about processing payments in 1C:

- Why is BIC 004525987 not in the bank classifier, but BIC 004525988 and BIC 024501901 are not in 1C?

- Does this change in payments to public sector contractors apply?

We will tell you in this article how changes in filling out payment orders to the budget are implemented in Accounting 8.3.

What is KBC?

BCC, or budget classification code, is the main digital identifier of the source of income or expenditure of the state budget of the Russian Federation and a number of other countries.

Thus, there are 2 main types of CBC:

- classifying state budget revenues;

- classifying budget expenses.

But in the practice of Russian accountants, the term “budget classification code” is most often used in the context of the 1st category, that is, budget revenues. This is quite logical: accountants are directly involved in replenishing the state treasury by directing taxes and fees there.

For the first time, the concept of the BCC in relation to budget revenues was enshrined at the legislative level in the provisions of the Budget Code of the Russian Federation (as amended on December 23, 2004). Then the term “receipt administrator code” appeared in the BC RF. Subsequently, in the process of lawmaking, it was transformed into an income classification code, and then into a budget classification code.

According to the idea of the Russian legislator, each receipt of funds into the treasury should be accompanied by an information message, according to which the departments that received the funds are obliged to distribute them. KBK is intended to be such an information message. The legislator requires taxpayers to indicate the budget classification code in payment orders for the transfer of taxes and fees.

Russian-style KBK is 20-digit. A little later we will look at its structure in detail.

What laws of the Russian Federation regulate the use of BCC for 2022 in a payment order?

Indication of the KBK in payments is a mandatory condition for correctly filling out the relevant instructions based on the norms contained in Appendices No. 2 and No. 3 to the order of the Ministry of Finance of Russia “On approval of codes ....” dated 06/08/2021 No. 75n. According to this order, the BCC established for a particular budget income must be indicated in field 104 of payment orders generated by taxpayers.

The list of BCCs that correlate with a particular tax or fee is recorded in the order of the Ministry of Finance of Russia “On the Procedure for the formation and application of budget classification codes of the Russian Federation, their structure and principles of purpose” dated 06.06.2019 No. 85n.

The approved BCC may not change for quite a long period, but opposite examples are observed regularly. Almost every year the legislator makes adjustments to the BCC and also issues the necessary clarifications on the new BCC.

Find out how the KBK has changed in 2022 here.

All of these legal acts, as well as those that supplement them, are one way or another published with the aim of implementing the provisions of the Budget Code of the Russian Federation.

In what form should the BCC be recorded, including the BCC in 2022?

Order for payment

The form of this document was developed specifically for making non-cash payments and was put into circulation by the Central Bank of the Russian Federation in 2012 regulation number 383-P.

In addition to the description of the form itself, the regulatory document of the Central Bank of the Russian Federation also specifies other details that must be filled out. These include field 104. In the 2019 payment order, it remained unchanged.

In 2013, the Ministry of Finance of our state issued Order No. 107n, which approved the developed rules for entering information that allows the payment to be identified. According to paragraph 5 of this order, all transactions must be completed indicating the BCC. However, its format must meet a number of requirements.

- KBK consists of 20 characters. Deviation up and down is unacceptable.

- In KBK, all 20 values cannot be zeros.

In addition, each digit of this code must have its own meaning. In the order of the Ministry of Finance of 2013 No. 65n they are described in detail. According to these regulations, the budget classification code must follow this format (see table below).

Also see “Payment order at the request of the Federal Tax Service: details of filling out”.

| Decryption of any KBK | |

| Number order | What does it mean |

| First 3 | Contains information about the payee |

| From 4th to 13th | They talk about the type of income that goes to the budget |

| From 14th to 20th | Subtype of income |

KBK structure

Based on the current requirements of the legislation of the Russian Federation, the corresponding codes in payment orders must be 20-digit. The KBK 2022 is represented by 8 blocks of numbers.

The 1st block contains 3 numbers. They designate the administrator of the budget revenue of the Russian Federation. For example, the Federal Tax Service is designated by the numbers 182, the Social Insurance Fund - 393, the Federal Customs Service - 153.

In the 2nd block there is 1 digit. It denotes a group of receipts.

The 3rd block contains 2 numbers. With their help, a specific type of budget revenue is recorded. These may be, in particular:

- taxes;

- government fees;

- payments against debts on canceled taxes and fees;

- payments for the use of natural resources;

- fines, sanctions, compensation for damages;

- revenue from the provision of paid services.

The 4th and 5th blocks (sometimes they are considered as one) have 2 and 3 digits, respectively. They mean items as well as subitems of income.

The 6th block contains 2 numbers. With their help, the budget level to which the tax is transferred is indicated.

The 7th block contains 4 numbers. They determine the current status of the payment obligation (tax, penalty, collection, etc.).

The 8th block contains 3 numbers. They determine which economic category a particular budget revenue belongs to. So, if we are talking about taxes, then the main economic categories will be:

- tax income - with code 110;

- income from property transactions - with code 120;

- income from the provision of paid services - with code 130;

- cash receipts in the form of forced seizure - with code 140;

- contributions for social needs - 160.

Blocks 2–6 of the BCC can also be considered within the single category “type of income”.

For example:

BCC according to the simplified tax system “income” in 2022: 182 1 0500 110.

BCC according to the simplified tax system “income minus expenses” in 2022: 182 1 05 01021 01 1000 110.

BCC for personal income tax in 2022 for a tax agent: 182 1 01 02010 01 1000 110 - for income up to 5 million rubles, 182 1 010 110 - for income over 5 million rubles.

What does KBK look like?

In payment documentation, budget classification codes are reflected as a chain of 20 numbers. To a non-specialist, this numerical sequence may not seem entirely clear.

These are not random numbers that many people don’t pay attention to. This numerical chain represents the path through which funds enter the budget. In a simpler form, this process can be explained as follows:

- An entrepreneur pays income tax.

- The main administrator (tax authority) processes the payment.

- When forming the country’s budget, it will be clear exactly how much money the state received from taxes of citizens and organizations.

This scheme is used in all other cases. The key value here is the budget classification code, thanks to which it is possible to “identify” each payment to the state. The BCC for personal income tax on income received by individual entrepreneurs is as follows: 182 1 01 02020 01 1000 110.

KBK 2022: what's new?

What fundamental legislative innovations regarding the regulation of BCC came into force in 2022?

As we said above, the regulatory codes of legal acts have changed. Despite this replacement, the BCC for 2022 for taxes and contributions has remained almost unchanged compared to 2022. Some were excluded from the list: the code for mineral extraction tax for mining on the continental shelf of the Russian Federation was removed.

Check whether you correctly indicated the KBK for payment of contributions and taxes using the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Note! In 2022, there were changes in filling out bank details in payment orders for paying taxes. From 05/01/2021, be sure to fill out field 15 “Current account number”; the Treasury account and the name of the bank have also changed. For all the details, see our material.

Features of reflecting OKTMO in the payment slip

Reconciling the invoices did not take much time - both merchants successfully completed the task of filling them out. But a dispute still broke out over one prop. The OKTMO code, reflected in everyone’s payment document in field No. 105, for some reason had a different length. For individual entrepreneur M.N. Zakharov it consisted of 11 characters, and the founder of Sadko LLC counted only 8 digits in his code. Did someone really miss some characters or add extra ones?

IMPORTANT! OKTMO codes can be found using the All-Russian Classifier of Municipal Entities (approved by order of Rosstandart dated June 14, 2013 No. 159-st).

In addition, it turned out that friends used different sources to obtain information about OKTMO.

In fact, both turned out to be correct. The classifier included both 8- and 11-digit OKTMOs. However, it must be taken into account that the OKTMO code in the payment order must match the OKTMO code in the tax return.

If you have access to ConsultantPlus, check whether you filled out the payment order for taxes correctly. If you don't have access, get a free trial of online legal access.

In what cases does the KBK predetermine the classification of a payment as unclear?

One of the criteria for classifying a payment as unclear is the absence of a KBK in the payment order, an indication of an incorrect or ineffective KBK (Order of the Federal Treasury dated May 14, 2020 No. 21n). It is assumed that the responsibility for indicating the correct BCC rests entirely with the taxpayer, since the BCC data is published in regulations. If the company indicated an incorrect BCC, as a result of which the payment did not reach its destination, it is advisable to send an application to the Federal Tax Service to clarify the payment (clause 7 of Article 45 of the Tax Code of the Russian Federation).

For information on how to fill out such an application, read the article “Sample application for clarification of tax payment (error in the KBK)” .

If you do not pay your tax on time, the Federal Tax Service will charge a penalty. The BCC for the payment of penalties differs from the BCC for the payment of taxes and contributions. ConsultantPlus experts explained what codes need to be indicated when transferring penalties. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

It will be useful to consider what legal consequences, in principle, could result from an incorrect indication by the taxpayer in the KBK payment order in 2022.

What is a payment order

Payment orders (payment orders) are used everywhere when making payments between legal entities and individual entrepreneurs.

With their help, organizations pay taxes, fees, and fines to regulatory authorities. A payment order is an order drawn up in a certain form to the bank about the need to transfer funds from the payer’s account to the recipient’s account.

For a correct money transfer, it is necessary that all fields of the payment order be filled out correctly.

The payment form is approved by Bank of Russia Regulation No. 383-P dated June 19, 2012. you can at the beginning of our material. The filling procedure is described in the same Regulations.

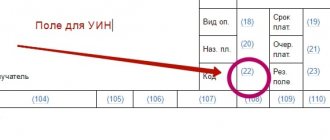

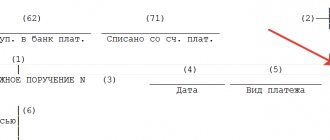

The payment looks like this:

It is not always necessary to fill out all fields. For example, fields 104–110 are filled in when transferring taxes, fines, and penalties.

In our material we will focus on the important details of the payment order - KBK. You will learn what KBK is in a payment order, how this abbreviation stands for, what it means and where KBK is indicated in the payment order.

Is it critical to indicate an incorrect BCC on a payment order?

It should be noted that the BCC in 2022 cannot predetermine, in particular, the refusal of a bank or the Federal Treasury to credit funds to the accounts of departments administering one or another type of budget revenue.

The reasons that may lead to such consequences, in accordance with sub. 4 p. 4 art. 45 of the Tax Code of the Russian Federation can be:

- indication of an incorrect Federal Treasury account;

NOTE! From 2022, if errors are detected in the treasury account number, you can not pay tax with penalties, but submit an application to clarify the payment. Under what conditions, find out here.

- indication of the incorrect name of the bank in which the payee's current account is opened.

In turn, in accordance with sub. 4 paragraph 7 art. 26.1 Federal Law No. 125-FZ dated July 24, 1998 (it regulates the payment of accident insurance premiums to the budget), an incorrect BCC 2022 may already be the reason for the non-transfer of funds to the accounts of departments that administer the corresponding budget revenues.

Thus, the Federal Tax Service does not have the formal right not to offset a payment in which an incorrect BCC is indicated or is not indicated at all (and, as a result, recognize the taxpayer’s obligations to the budget as unfulfilled, impose fines and penalties), but the insurance fund does.

However, taxpayers are actively challenging such actions of government departments in the courts. The subject of the claim in this case is the demand to recognize the actions of the Federal Tax Service or the Social Fund to identify arrears, as well as accrue fines and penalties on them, as unlawful. Tax officials, therefore, sometimes decide to impose certain sanctions on payers, although the Tax Code of the Russian Federation, as we noted above, does not give them the formal right to do so.

Judicial practice shows that when considering taxpayer claims filed against both the Federal Tax Service and insurance funds, arbitrators usually side with the plaintiff.

Let's study some notable arbitration cases concerning disputes between taxpayers and the state in terms of assessing the quality of the payment discipline of the former in relation to obligations to the budget.

Arbitration practice: old or incorrect BCC for tax - there will be no penalties

An interesting precedent involving the taxpayer and the Federal Tax Service, which assessed penalties for taxes paid under the outdated BCC, that is, once included in the list of the Ministry of Finance, but subsequently replaced by another.

In the resolution of the Federal Antimonopoly Service of the Central District dated October 8, 2013 in case No. A14-18051/2012, the court considered the claim of an entrepreneur who paid the simplified tax system in 2011 under the old BCC. The Federal Tax Service considered this a violation of the individual entrepreneur’s obligation to transfer taxes, recorded the arrears and assessed penalties. Subsequently, the Federal Tax Service counted the payments that ended up in the department’s accounts under the erroneous BCC against current taxes, but sent the individual entrepreneur a request to pay penalties.

The court in three instances declared the actions of the Federal Tax Service illegal and annulled the penalties. The arbitration found that, in accordance with the provisions of Art. 45 of the Tax Code of the Russian Federation (as amended, relevant for the period under review), the payer’s obligation to transfer tax to the treasury is considered unfulfilled only if the payment order contains incorrect details of the Federal Treasury and the name of the recipient’s bank. The cassation, in particular, indicated that the entrepreneur’s incorrect indication of the KBK cannot be a reason to consider him as having evaded paying tax, since the corresponding amount was transferred to the budget system of the Russian Federation.

In a similar situation, the Moscow District Arbitration Court issued a ruling in favor of the taxpayer dated May 23, 2016 No. F05-6154/2016 in case No. A40-168537/2015 regarding payment for a patent made by an individual entrepreneur on time, but according to an incorrectly specified BCC. The Federal Tax Service considered that the deadline for payment should be the date of filing the application to clarify the details, which went beyond the period allotted for paying for the patent, but several courts did not support this position.

Similar conclusions are also found in the decisions of the Volga District Court of Justice dated 06/06/2018 in case No. A65-32834/2017, the Volga-Vyatka District Court of Justice dated 01/24/2018 in case No. A82-5449/2017, etc.

Thus, if in the payment order, instead of the 2022 BCC, the company indicated an outdated or incorrect one, then it is possible to prove that the tax was paid and there is no tax arrears, relying on the decision in the above-mentioned arbitration case. An additional argument in defense of the taxpayer in the event of incorrect application of the BCC in 2022 can also be letters from the Ministry of Finance dated January 19, 2017 No. 03-02-07/1/2145, dated July 17, 2013 No. 03-02-07/2/27977 and dated March 29 .2012 No. 03-02-08/31, Federal Tax Service dated 10.10.2016 No. SA-4-7/ [email protected]

Results

In 2022, BCCs began to be regulated by the new regulatory legal acts of the Ministry of Finance.

However, there were no large-scale changes in the codes because of this. Those who pay certain tax fines need to be careful: new BCCs have been introduced for them. Otherwise, everything remains the same. And errors made when specifying the BCC still lead to the payment being classified as unclear and entail the need to clarify it. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.