For constant growth and competent formation of the enterprise’s economic strategy, the manager must have all the complete data and reporting. In this review, we will take a closer look at one of the most important indicators, on the basis of which plans for the development of the company as a whole are based. Let's look at what the turnover ratio of working capital and assets shows, the balance sheet formula, calculations in days and other related points.

We will also determine what to do next with the information received, how to use the obtained information, which of the values are considered normal for a particular structure of the company. After all, competent and, no less important, timely analysis is in almost all cases the main factor in achieving efficiency.

What are these indicators?

The fundamental element is the company's revenue. A specific period is often taken for study. The general rule is considered to be annual. But this is not the only time range.

The relationship of this figure to various expenses, such as accounts payable or the size of investments in assets, shows us the intensity of movement of the enterprise as a whole. Are there any trends towards stagnation, or is there systematic growth? Moreover, it is worth understanding that the pace of each company is purely individual.

And any manager needs to understand exactly how the working capital turnover ratio is determined - in the general case, this is the ratio of revenue to assets. That is, we literally divide the total income (not the margin, this is an important point) by the average cost of resources allocated to production or purchasing, coupled with delivery and placement.

What does the information we receive tell us? First of all, we will find out how quickly the finances are returned. How many sales cycles does this or that department manage to complete in a selected period of time? This means that we know how quickly the money will return and be ready to be sent into the circulation again. Or, based on high indicators, we can exclude part of the income volume in favor of direct capital, for example. This way we will work on the enterprise itself, we will be able to scale it, open branches, simplify and automate work, reducing personnel or increasing emissions based on innovative and more efficient equipment. Knowing which positions characterize the working capital turnover ratio, we can always say whether stagnation exists in a certain area. Is there a dependence on the season that goes beyond the established standards? Are there any delays in the movement of branches compared to each other? This is comprehensive information that will be useful at almost all stages. And it is not possible to construct an economic strategy productively without this data.

As noted, it is important to understand that the rates of different firms should not be directly correlated with each other. Speed is influenced by many individual factors. This:

- The type of product that the company has been working with all this time.

- Average value of a single transaction.

- Time of year used for analysis.

- Market behavior and demand for goods or services in the current period.

- Dimensions of the legal entity itself. Of course, it is much easier to turn around when the entire volume of purchased goods and materials in value terms fits into 10 thousand than if the value reaches 10 million.

Moreover, these are only the fundamental factors that immediately catch the eye. The working capital turnover ratio is calculated as the ratio of total revenue to a certain financial array. It does not necessarily consist only of purchases. This may be a loan, and in some cases, accounts receivable.

Now let’s move specifically to the various indicators that are calculated for further economic research, and consider turnover factors.

Assets

This is the most general research. It cannot be said that it gives a specific understanding of the performance of individual sectors of the company, departments, and areas. But it is still quite possible to construct generalized judgments on the basis.

To work, we will need to divide all income by the entire set of available assets. That is, not only those who directly went into circulation at the designated moment. And the entire amount is in full. But the average is calculated, because we need to find out the number of cycles.

This value can be easily taken from the balance sheet, specifically the balance. And, accordingly, we will receive the total amount of income from the financial report. results."

What does this value tell us? First of all, growth rates. Thus, a slowdown in the turnover of current assets will lead to a drop in traffic intensity. Fewer cycles per period means a decrease in revenue. This means that the enterprise will either roll back, or it will have to use reserve funds to maintain the dynamics at the established level. Neither option looks promising. Therefore, as soon as a negative movement is outlined, it is immediately worth taking measures for financial recovery. It may be more logical to distribute material and production resources, conduct a new marketing campaign, or even completely change the policy perspective, adjust the price tag for some types of products or the entire range as a whole. There are many options.

Working capital turnover ratio

This is a narrower concept. Now for the study we take exclusively resources aimed at acquiring goods and materials. And only in price terms. And now we do not know the general picture of the dynamics of the entire company as a whole, but only the speed of the cycles. It is worth understanding that it depends not only on how well the product sells. But also from all aspects of its use. How is delivery organized, what time frame does production take, under what conditions does storage take place, are product losses within the normal range.

To ensure automation of business processes, contact Cleverens.

Our software is:

- Quick solution to the problem from the moment of purchase to integration of the software into the overall system.

- Timely service.

- Full compliance of the software with the current established standards of Russian legislation.

Now, how to find the working capital turnover ratio is calculated using the formula - K=B/C.

- K - in this version is the very indicator, everything is clear with it.

- B is the total revenue for the required period.

- C is the average value of assets.

Now let's look at how to find C. To do this, we need to add the initial cost expression with the balance at the end of the specified period and divide by two. For example, 430,000 on the 1st day of the year, 340,000 on the last. C is calculated as (430000 + 340000)/2 = 385000.

To compare the final results, it is permissible to present a competing parallel exclusively with organizations in the same field or branch of activity. After all, it is easy to understand that a huge and clumsy plant-research center in terms of economic strategy will definitely lose to a small store that operates disproportionately smaller volumes with ten times the liquidity of inventory items.

Capital asset turnover ratio

This value affects basic financial indicators. And it no longer reflects the effectiveness of marketing or the sales cycle, but the proper management of the resources of the legal entity itself. Their distribution in domestic politics, so to speak.

Based on the information, it is worth drawing conclusions about the following factors:

- the extent to which the company's movement depends on borrowed finance;

- growth of total capital;

- intensity of its use.

Indirectly, the analysis also reports data on the effectiveness and pace of sales. But it is better to use it for calculations in this area in the form of additional information. After all, the influence exists only indirectly.

Receivable

In this option, a standard formula is used, only the ratio of revenue to the average balance of receivables is revealed. It is also a very important value that shows us how quickly the organization gets rid of accounts receivable. That is, he receives payment for goods and services. The higher the efficiency in this area, the faster the goods and materials acquire monetary form. And accordingly, they are sent to their financial flows, for example, to purchase raw materials, pay for the services of intermediaries and outsourcing companies, and so on.

Creditor

This aspect already shows the speed of repayment of loan funds. It is no less important than the previous point. After all, if borrowed finances are repaid significantly late, this will cause serious difficulties. Penalties, penalties, and penalties will be imposed. And according to Russian legislation, the total amount of fines reaches three times the amount of the debt. Which often seriously impacts the financial stability of a business entity.

Reserves

In fact, the indicators characterizing the turnover of working capital are the main ones, but this one is additional. Yes, it is also used in general analysis, but in its base it explains the logic of purchase volumes in relation to the product being sold. Yes, at some points the accumulation of inventory items can play a major role if there is suddenly a shortage in the market. Or the supplier will simply freeze shipments, and you will have to look for a new one for some time. And in order to avoid stagnation at this point, it would be logical to use your own reserves. But their too high volume indicates that a significant part of the organization’s resources is simply not used at this stage and is wasted as a measure of diversification. It goes without saying that it is important to maintain a balance in this aspect.

Standardization methods

The main methods for rationing working capital are used:

- direct counting method;

- analytical calculation method;

- coefficient calculation method.

direct counting method provides for the calculation of inventories by element of working capital, taking into account changes in the level of organizational and technical development, transportation of inventory items, and the practice of settlements between certain enterprises. This method requires high qualifications and the involvement of employees from many departments of enterprises. This allows you to most accurately calculate the enterprise’s need for all working capital.

The analytical method is also used in the case when the designated period does not provide for significant changes in the operating conditions of the enterprise compared to the previous one. In this case, the calculation of a certain working capital standard is increased, taking into account certain relationships between the growth rate of production volume, as well as the size of the normalized working capital in the previous period. When analyzing working capital, their actual reserves change, and excess ones, in turn, are eliminated.

Analytical and coefficient methods are used in those enterprises that have been operating for more than a year, have mainly created a production program and drawn up the production process, and do not have a sufficient number of qualified economists for the most detailed work in the field of working capital planning.

In life, the most common method of counting is more direct. The advantage of this method is its reliability, which makes it possible to make the most accurate calculations of individual and aggregate standards.

The characteristics of different elements of working capital affect the specifics of their rationing. Let's consider the main methods of rationing the most important elements of working capital: raw materials, basic materials and semi-finished products.

The financial analysis

So, the formula for the working capital turnover ratio is K=B/C, this is the main and most important indicator on the basis of which most of the analytics are carried out. As we have already explained, for research we take not only the balance of production in monetary terms, but also receivables, accounts payable and inventories. As a result, we get a universal tool that always becomes the foundation for analyzing the overall level of development of an enterprise. And based on it, various industry indicators, dynamics and costs are calculated.

Accordingly, every manager, even a small one, should always be able to independently carry out work of this nature. Be able to determine the working capital turnover ratio; an analysis based on this data will be the most accurate and closest to reality.

Setting up optimal decision making

It is now clear that the final figure for the time period of the need for money is the result of effective management of inventories, accounts receivable, and cash.

You will be required to make decisions on the following issues:

- What should be the minimum required level of reserves and how to ensure their safety and rational use;

- What should be the acceptable level of accounts receivable;

- How to combine internal and external sources of financing;

By developing a comprehensive system of technical, economic and organizational measures, you will achieve the optimal duration of the financial cycle.

A management balance sheet will help you track the situation with working capital.

In operational mode, it is enough to provide information in the context of “Assets-liabilities” in the form of current assets and short-term liabilities.

This will be quite sufficient for making operational decisions.

Still have questions? Order a free consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

General meaning

Own working capital (SOC) is an absolute value. They show how many financial resources from free sources of formation were put into circulation. After all, borrowed capital in the total assets of the company should not exceed a certain level.

If operating activities are carried out only through paid sources of financing, this indicates the organization’s inability to pay off its obligations in the current period.

This, in turn, significantly reduces liquidity and financial stability indicators. The company operates at a loss, because at the end of the operating period, net profit will go to pay interest for the use of creditors' capital. And sometimes it is simply not enough to pay off the debt.

Therefore, own working capital must have a positive value. If the number is negative, the company has a shortage.

Calculation

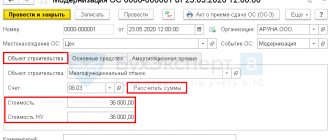

To quickly carry out calculations, special software is often used. All the necessary formulas are filled in in advance. This is especially useful if the company has many industries and branches, and research is carried out based on various time factors.

Cycle duration

This value should not be understood as a factor that determines the stability of the company. On the contrary, it only shows the specifics of the enterprise. It is obvious that larger legal entities and huge holdings operate large amounts of inventory and materials. And make a full circle of tasks for them in the long term. Therefore, always make allowances for the scope and general array of values intended for implementation. Do not compare micro-projects, all of whose cash revenue per cycle easily fits in one wallet with full-fledged industry flagships.

Remember that this is only a relative point - the turnover of current assets; the formula on the balance sheet shows the dynamics in existing conditions. And each organization should have its own personal standard. But getting it out is actually a much more difficult task. And this is exactly what financial analysis is needed for. And at a minimum, a comparison of asset growth rates relative to their cycle speed.

Loading funds in circulation

An auxiliary element that allows you to evaluate the effectiveness of cash flow injections. The dependence on investments is directly visible. That is, information about how much finance needs to be contributed in order for the total revenue to reach 1 ruble.

Used for assessment, standards for different business entities, again remain purely individual. But the correlation can be traced with our desired formula. That is, the turnover ratio of material working capital characterizes and shows the pace of cycles, and this value demonstrates the effectiveness of each of them separately. And usually, the more of them, the lower the effectiveness of an individual, and with growth the effect decreases, accordingly.

The concept of working capital and their role in the activities of the enterprise

Definition 1

Working capital of an economic entity in the general sense is usually understood as funds advanced to the funds of the enterprise in order to ensure the continuity of production processes and sales of its products.

In fact, working capital are objects of labor that have a monetary (value) valuation and meet the following criteria:

- full use during one production cycle;

- continuous change of natural material form;

- transferring value to the final product.

Working capital consists of production working capital and circulation funds, each of which includes a number of elements (Figure 1).

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

Figure 1. Composition and structure of working capital of a business entity. Author24 - online exchange of student work

Note 1

As a rule, working capital is formed mainly from production assets, represented mainly by inventories (raw materials, consumables, fuel, etc.). The circulation funds account for about 30% of all working capital.

A similar ratio of individual elements of an enterprise’s working capital characterizes its structure. At the same time, it should be understood that it is not of an obligatory nature and can be modified depending on the specific business conditions and the industry specifics of the enterprise.

Finished works on a similar topic

Course work Working capital: formulas 440 ₽ Abstract Working capital: formulas 230 ₽ Test work Working capital: formulas 200 ₽

Receive completed work or specialist advice on your educational project Find out the cost

One way or another, working capital is an integral part of the enterprise’s property and plays a huge role in its financial and economic activities. It is they, in the process of their circulation, that ensure the continuity of the reproduction process, constantly changing their forms (cash - production inventories and raw materials for the manufacture of products - finished products - cash, and so on).

Determination of the coefficient

Together with the solvency (liquidity) coefficients, the indicator of the provision of own resources in circulation is determined. Unlike the previous analysis, percentage, or relative, expressions are already considered here.

The coefficient of provision with own working capital is as follows:

Kos = (Equity - Non-current assets) / Current assets

In balance, this technique looks like this:

Kos = (p. 1300 - p. 1100)/s. 1200

If you multiply the result by 100, you can express it as a percentage. A negative result indicates an ineffective balance sheet structure. Own financial sources must be in such quantity as to fully cover non-current assets and partially ensure operating activities.

Therefore, a negative value indicates the inability of the enterprise to cover even its non-current assets.

Formula for the average annual value of assets on the balance sheet

Asset classification

How to calculate the average cost of working capital on the balance sheet

The company's assets include the cost expression of the resources that support the production process of the enterprise. Assets include:

- Non-current assets (structures, buildings, machinery and equipment, transport, etc.),

- Working capital (cash, accounts receivable, short-term investment, etc.).

Asset accounting is mandatory for most Russian enterprises. All assets are concentrated on the left side of the balance sheet and are divided according to their purpose:

- The first section of the balance sheet is represented by non-current assets (fixed assets and intangible assets), which are accounted for in accordance with their residual value less depreciation (line 1100 of the balance sheet);

- The second section of the balance sheet is represented by working capital, which is directly involved in the production process (line 1200 of the balance sheet).

Formula for the average annual value of assets on the balance sheet

To calculate the average amount of assets of an enterprise for a year, it is necessary to add up the amount of assets at the beginning and end of the year. This amount is then divided by 2 or multiplied by 0.5.

The formula for the average annual value of assets on the balance sheet uses financial reporting data.

In general, the formula for the average annual value of assets on the balance sheet is as follows:

SA avg = (SAnp + SAkp) / 2

Here CA av is the average annual value of assets,

SAnp – asset value at the beginning of the period,

The formula for the average annual value of assets on the balance sheet allows you to make calculations both for the assets of the enterprise as a whole, and separately for current and non-current assets.

Calculation features

The total assets of the enterprise are recorded on line 1600 of the balance sheet, which is compiled by accountants at the end of each year. When applying this formula, they use balance sheet indicators for several years, while the indicator on line 1600 is taken from the balance sheet for each year, summed up and subsequently divided by 2.

In the case of calculations for current assets, the formula for the average annual value of assets on the balance sheet will require information from line 1200 of the balance sheet. If calculations for non-current assets are required, then the accountant uses the indicators on line 1100 of the balance sheet. The indicators must be used in a similar way by finding the average value of assets and comparing balance sheet data for the corresponding years.

The value of the average annual value of assets on the balance sheet

The average annual value of assets, which is calculated by analysts, is subsequently used when calculating coefficients that can characterize the state and efficiency of any enterprise:

- Return on assets

- Asset turnover ratio, etc.

The indicator is also used to find the reasons that led to changes in the operation of the enterprise and make decisions in the field of resource management.

The average annual value of assets indicator can give a more accurate understanding of the size and value of assets, while it neutralizes circumstances that can distort the real amount of assets.

If the asset turnover indicators of different enterprises for different years are compared, then it is necessary to check the uniformity of the assessment of the average annual amount of assets.

Examples of problem solving

| Exercise | Calculate the average annual value of assets if at the beginning of the year their value was 3,215,200 rubles, and at the end of the year 3,520,000 rubles. |

| Solution | The formula for the average annual value of assets on the balance sheet to solve this problem is as follows: |

SA avg = (SAnp + SAkp) / 2

CA avg = (3215200 + 3520000) / 2 = 3367600 rubles

Answer SA avg = 3,367,600 rub.

| Exercise | Calculate the average annual value of assets using the example of an enterprise using balance sheet data. |

The following values are given:

The value of assets as of December 31, 2016 was 350,000 rubles,

As of December 31, 2017 – 285,000 rubles,

Solution To solve the problem, we use the following formula for the average annual value of assets on the balance sheet:

SA avg = (SAnp + SAkp) / 2

SA avg = (350000+285000) / 2 = 317500 rubles.

How to find the average annual value of assets - an example

Calculating the average annual value of assets is usually not difficult. At the same time, it underlies a rather interesting and at the same time simple methodology for determining the type of development of an enterprise. Let's see how it is implemented in practice. To do this you need to calculate:

- average annual value of assets;

- average annual net asset value;

- their turnover and profitability.

Calculations are based on data from the balance sheet and income statement of PJSC Saratov Oil Refinery (Refinery) for 2018.

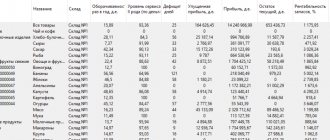

Table 3 – Excerpt from the balance sheet, million rubles

| Index | |||

| 3.1 Total assets (line 1600 BB) | 26 231 | 28 498 | 32 133 |

| 3.2 Long-term liabilities (line 1400 BB) | 1 639 | 1 540 | 1 619 |

| 3.3 Current liabilities (line 1500 BB) | 3 284 | 3 328 | 3 424 |

| 3.4 Deferred income (line 1530 BB) |

Table 4 – Excerpt from the report on financial results (OFR), million rubles.

| Index | Growth rate, units | ||

| 4 (3 ÷ 2) | |||

| 4.1 Revenue (line 2110 OFR) | 11 832 | 13 484 | 1,140 |

| 4.2 Net profit (line 2400 OFR) | 2 581 | 3 715 | 1,439 |

Table 5 – Estimated indicators

| Index | Growth rate, units | ||

| 4 (3 ÷ 2) | |||

| 5.1 Average annual value of assets, million rubles. (arithmetic average of line 3.1 by year) | 27 365 | 30 316 | 1,108 |

| 5.2 Average annual value of net assets, million rubles. (arithmetic average of the values for years, which are obtained as) | 22 473 | 25 364 | 1,129 |

| 5.3 Asset turnover, turnover (line 4.1 ÷ line 5.1) | 0,432 | 0,445 | 1,029 |

| 5.4 Net asset turnover, turnover (line 4.1 ÷ line 5.2) | 0,527 | 0,532 | 1,010 |

| 5.5 Return on assets, rub./r. (line 4.2 ÷ line 5.1) | 0,094 | 0,123 | 1,299 |

| 5.6 Return on net assets, rub./r. (line 4.2 ÷ line 5.2) | 0,115 | 0,146 | 1,275 |

| 5.7 Geometric mean for changes in turnover, units. (square root of the product of lines 5.3 and 5.4 by column 4) | 1,019 | ||

| √(1,029 × 1,010) | |||

| 5.8 Geometric mean for changes in profitability, units. (square root of the product of lines 5.5 and 5.6 by column 4) | 1,287 | ||

| √(1,299 × 1,275) | |||

| 5.9 Extensity coefficient, % (÷ × 100) | 6,7 | ||

| 5.10 Intensity factor, % (100 – line 5.9) | 93,3 |

Conclusions:

- an increase in the average annual value of assets is always a good sign, which indicates that the enterprise is not “eating away” its capital, but, on the contrary, is increasing it;

- comparison of the growth rate of the average annual value of assets (110.8%) with the growth rate of revenue (114.0%) gives another signal about the development of the enterprise. This is so because every ruble invested in assets provides the organization with an increase in income in the amount of more than one ruble;

- the increase in the average annual value of net assets of PJSC Saratov Oil Refinery (12.9%) exceeds the increase in property (10.8%). This means that the share of the organization’s liabilities is reduced, and the share of equity capital is growing, because net assets are formed exclusively from its own sources. All this is an indicator of strengthening financial stability;

- the average growth rate for asset turnover and net assets is 101.9%, and for profitability - 128.7%. That is, the increase in profit per ruble of property exceeds the increase in income by the same amount. This situation is very desirable for any company. It means that costs are either decreasing or growing slower than income, as is the case with the Saratov Refinery;

- the ratio of factors of extensive and intensive development in the enterprise’s activities is 6.7% to 93.3%. And this is also a very positive point. It turns out that although new resources are involved in the turnover of the enterprise, business growth is determined mainly not by this, but by improving the quality of their use.

Important: when, as a result of calculations, you get a negative value for the extensiveness coefficient. This happens when profitability decreases against the background of increasing turnover

How to interpret this situation? How extremely negative. In this case, do not be confused by the significant value of the intensity coefficient, which will also exceed 100%. Remember that this technique is inherent in such distortion. The general rule for its use is this: both coefficients should ideally be positive, and the intensity value should be at least 50%.