All company managers understand that an on-site tax audit is very serious. But many still do not know how much material the inspectorate collects on a company even before the inspection. When inspectors come to a company, they know very well which way to dig. They have the information they need thanks to pre-test analysis.

The document used to document the result of the pre-test analysis is divided into blocks. Let's go through them.

Basic information about the taxpayer

Formal information is collected here - name, INN/KPP, category, address of registration and actual location, taxation regime, structure of management bodies, manager, chief accountant, actual types of activities, OKVED codes.

Here you can find information about reorganization, bankruptcy, and licenses.

In which banks are accounts opened, does the company own land, buildings, transport (remember how many tax claims the tax authorities have against companies that their counterparties do not own transport?).

The most interesting point in this block is information about

the director, founders, officials of the company , their personal income and expenses, as well as the income and expenses of their family members and the family as a whole .

We are all under guard, dear businessmen! So, the tax office knows who the family members of the manager and founders are and what these people live on.

There is also information about the availability of movable and immovable property of the family as a whole. The inspection knows who has what apartment, what house, what car, etc.

This block also contains:

- structure and dynamics of tax revenues;

- comparison of a company with a similar one.

If in 2022 a company paid, for example, 10 million rubles in taxes, and in 2022 suddenly started paying 3 million rubles, then the inspectorate will obviously be interested in what happened, why did taxes fall? Is there a diagram?

Also: comparison with a similar “average” company is a convenient assessment tool. If the audited company has paid taxes of 1 million, and the “average” company in the same region of the same industry has 5 million, then there will be questions.

The tax burden is also calculated there. Imagine the tax inspector’s thinking if the “average” company has a tax burden of 7.6%, and the audited company has a tax burden of 0.6%.

Analyst's work

Using technical capabilities

In his work, the analyst, however, also uses information systems. In particular, “Tax 3” , which contains the taxpayer’s dossier. The complex gives an idea of how funds flow through its accounts and helps analyze the company’s property, as well as its owners and management. In relation to individuals, not only their income and personal property, but also the assets of their close relatives are subject to analysis.

The purpose of this analysis is to determine whether potentially additional accrued amounts can be recovered. A conclusion is made about whether the company is conducting real business. If it leads, it means you can take something from it.

Another interesting program is PC “VAI” (visual analysis of information). It helps to identify the interdependencies of individuals, sources of their income and other information.

After all technical possibilities have been exhausted, the analyst proceeds to a “manual” analysis of the potential subject.

"Manual" analysis

The goal of the work at this stage is to find transactions as a result of which the taxpayer received an unjustified tax benefit. Work is being carried out in two directions:

- Search for suspicious counterparties . We are talking about cooperation with one-day companies for “cash out” or the use of gray tax optimization schemes.

- Search for controlled entities - companies and entrepreneurs using a simplified taxation system, as well as signs of business fragmentation .

By using such mechanisms, unscrupulous taxpayers evade paying VAT and underestimate income tax.

Manual analysis allows you to examine a taxpayer’s transactions and find shell companies and controlled entities among his counterparties.

Application of databases and special systems

However, “manual” analysis also involves the use of programs and databases. Thus, PIK “Odnodnevka” . This is a database that contains companies with signs of anonymous structures. With its help, analysts find out whether there are any such organizations among the counterparties of a potentially audited person. If any are found, at the next stage their counterparties are checked, and so on. As a result, the entire network of problematic companies with which the taxpayer dealt is revealed. After analyzing transactions with them, the analyst determines approximately the amount to be charged.

Thus, as a result of the analysis, two conclusions are drawn:

- The taxpayer definitely participated in gray schemes, which means he has something to pay extra.

- When conducting an on-site inspection, it is necessary to move precisely towards the interaction of the subject with one-dayers and dependent persons.

Let us also mention special systems for verifying counterparties, which tax authorities also use in their analysis. They allow, on the basis of open data, to establish relationships between persons through management, owners, addresses and other details.

Working with open sources

When analyzing open sources, Federal Tax Service specialists can not only look for references to the taxpayer and its owners in the media and the Internet, but also visit the personal pages of management representatives (owners) on social networks, look at photos from corporate events, and so on. Businessmen themselves often set their companies up and increase the risks of GNP with their own careless statements.

For example, a businessman’s mention of his holding or group of companies may indicate the presence of a network of controlled organizations. This means that there may be a fragmentation of the business or the use of other off-the-cuff tax optimization schemes.

The analysis of the file cabinet of arbitration cases is very indicative. 5% - have never acted as one of the parties to the arbitration process . This means that the majority of taxpayers who actually conduct business are in the arbitration database. Accordingly, if the taxpayer’s counterparty is not in this database, then most likely it is a one-day company.

Requesting information from banks and government services

Banks actively cooperate with the Federal Tax Service - this is no secret to anyone. And they help tax authorities not only by blocking accounts and refusing to carry out transactions for “suspicious” taxpayers. But also because, upon request, they provide information about the cash flow of the companies and individual entrepreneurs they serve.

During the analysis, inspectors request information from banks about the accounts of the subject itself and its dubious counterparties . Especially if they are individual entrepreneurs.

Example. The company makes periodic payments to the individual entrepreneur. The entrepreneur's account statement indicates that he transfers all funds received to his personal account. Conclusion: transactions between a company and an individual entrepreneur may be of a transit nature.

To test this assumption, the analyst will request information on IP and MAC addresses . It often turns out that the corresponding addresses are the same. This suggests that the management of the organization’s and individual entrepreneur’s accounts is carried out from one computer, that is, these business structures are controlled by one person. This means that there is a chance to exclude payments to individual entrepreneurs from the company’s expenses. Accordingly, it will be possible to charge additional income tax.

Banks provide the Federal Tax Service with information about their clients upon request

Moreover, requests to the bank can be made for both active and inactive accounts . Thus, closing the account of a company or individual entrepreneur in this example will not save the businessman who owns these structures.

Requests can be sent by tax authorities not only to banks, but also to government services, for example, the traffic police or Rosreestr. The goal is obvious - to find out the composition of the property that belongs to the company’s management, owners and their relatives. This is done in order to assess the reality of collecting additional charges. However, there is another goal - to compare the income of the mentioned persons with the standard of living . Clear dissonance may indicate that at some stage of business processes (before taxes), money is simply withdrawn from the company.

Working with the archive

Such work involves analyzing responses to requests and explanations that the taxpayer sent to the Federal Tax Service. This also became possible thanks to high technology. Previously, this data was provided on paper and collected dust on archive shelves. Now this is part of the AIS “Tax-3” , that is, information in electronic form that can be retrieved at any time.

General conclusions based on the results of the pre-test analysis with the predicted amounts of additional charges

The most dramatic point.

Here the inspectorate writes what additional assessments it plans to make after the on-site inspection and what taxes will be checked. And also what kind of events will be held, for example:

- request from LLC [inspected company] primary documents relating to the relationship with LLC Romashka. The inspectorate already knows which companies it will search for;

- study and compare invoices issued by LLC [verified;

- conduct an interrogation of Ivanov A.A. for the transfer of funds to the card during such and such periods, as well as non-calculation and non-payment of tax on the amount of income;

- investigate issues regarding the transfer of funds to LLC [inspected company] by individuals and individual entrepreneurs for the rental of vehicles, possibly transfer of funds for transport services.

What does this all mean?

Assess how comprehensively the inspectorate approaches the pre-inspection analysis. Everything is taken into account:

- and counterparties;

- and balance sheet;

- and comparison with another “average” company;

- and movement of funds in the account;

- and what the witnesses said during interrogations, etc.

You may ask - what does the family of the leader/founders have to do with it, what are these people doing in the pre-test analysis data? And this, dear businessmen, is in case the company begins to withdraw property and transfer it to relatives of the managers. Transactions can be challenged and taxes can be collected from this property.

Do you remember that today

the director, top managers and founders are liable for the company’s debts not only with their own property, but also with the property of their family?

Let's sum it up

So, from all of the above we can draw the following conclusions:

- If you are assigned an on-site inspection, then with a 99% probability they will find violations and additional taxes will be charged.

- Most likely, the additional charge will be more than 5 million rubles for large Russian cities and 11 million rubles for Moscow. Also, this amount will be almost 100% higher than the minimum for criminal for tax evasion.

- With a high degree of probability, the tax authority already knows how it will be able to collect additional accrued amounts . These can be assets not only of the organization itself, but also of persons associated with it.

conclusions

The inspectorate is already several steps ahead of the taxpayer when it sends him a decision to conduct an on-site inspection

. By this point, the tax office has already collected a lot of information as part of the pre-audit analysis.

By conducting this analysis, the inspectorate collects comprehensive information

, which will help her justify additional charges.

By the time the inspection goes to the field, it already knows what tax control activities it will carry out.

: what documents and on what counterparties to examine, who to interrogate and on what issues. Do you feel how ahead the inspection is of the company?

The best option for a company that has received a decision to conduct an on-site audit is to immediately contact Tax Lawyers

. This is what the director of the company did and saved 79 million rubles. The director of another company did the same, and we had time to prepare.

Automatic selection

At the first stage, the selection is carried out using various information systems and software systems , of which there are about two dozen. This is, so to speak, a rough filter through which taxpayers are automatically passed. Next, we will talk about the most significant programs and databases.

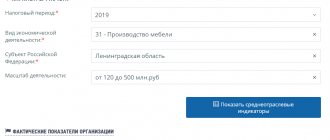

First of all, this is PIC GNP selection . The program analyzes the taxpayer according to certain criteria and compares it with other business representatives with the same OKVED code. In the end, she gives points. If there are too many points, the “client” is recommended for GNP.

Also worthy of attention are two programs of the ASK VAT family, which work together: RMS ASK VAT-2 the ASK VAT-2 software complex itself .

The ASK NDS-2 risk management system automatically distributes all companies and individual entrepreneurs into three groups:

- Low risk . They pay VAT, do not deal with fly-by-night companies, and have the necessary resources for business.

- High risk . They pay little or no VAT, have connections with suspicious contractors and lack resources.

- Medium risk . All business entities that do not fall into the categories listed above.

High technologies help the Federal Tax Service select taxpayers for on-site inspections

of ASK VAT-2, which intimidates all VAT payers, compares the transaction data indicated in the reports of buyers and sellers. They are included in the declarations from invoices. The goal is to analyze VAT chains and look for breaks. If discrepancies are detected, the system requires explanations from taxpayers.

Already in 2022, a new generation of the complex will be introduced - ASK NDS-3 . The system will give inspectors even more opportunities.

As a result, subjects fall into one group or another. And if this is not a low-risk category, then the analyst will then work with the potential auditee.