Performing the duties of a temporarily absent employee

There are several ways to replace vacationers:

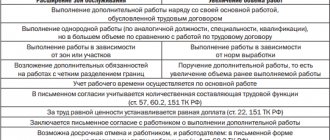

- Combination. The employee combines his own work and the work of a vacationer (Article 60.2 of the Labor Code of the Russian Federation).

- Temporary transfer. The employee performs only the duties of a vacationer (Article 72.2 of the Labor Code of the Russian Federation).

- Part-time job. The employee spends time free from his main job on vacation work (Article 60.1 of the Labor Code of the Russian Federation).

- Hiring a temporary employee. An employee is hired with the conclusion of a fixed-term contract for a period corresponding to the vacation period of the replaced employee (Article 59 of the Labor Code of the Russian Federation).

Temporary replacement and combination

A combination is established when a full-time position is vacant in an organization. A temporary replacement is established when the employee holding the position is temporarily absent. For example, in connection with:

- vacation;

- illness;

- business trip;

- advanced training, etc.

In addition, when combining, you can perform additional work only in another profession or position. During temporary substitution, an employee can perform duties both in the same positions (professions) and in different ones.

This follows from the provisions of Article 60.2 of the Labor Code of the Russian Federation.

Expansion of responsibilities or combination

If one employee goes on vacation, another may be assigned to perform his duties without releasing him from his main job. This work may correspond to his position or not (Article 60.2 of the Labor Code of the Russian Federation).

If the additional work is similar to the employee’s work, this is an expansion of responsibilities; if not, it is a combination.

Is a full-time deputy manager entitled to additional payment if the manager goes on vacation and his responsibilities are assigned to the full-time deputy? The answer to the question is debatable, because according to the official duties of the deputy. must “pick up” the manager’s affairs during his absence. Find out the authoritative opinion of a ConsultantPlus expert by getting free trial access to the system.

An employee cannot be forced to perform additional work. The employee must give written consent to this.

Additional payment for performing the duties of a temporarily absent employee is specified in an additional agreement and can be made for actual work performed or calculated in proportion to the time worked (Article 151 of the Labor Code of the Russian Federation). The combination order must indicate how the replacement is paid for during the vacation and the period for which it is issued.

Each party to the employment relationship may terminate it early. To do this, the initiator of termination must notify the opposite party in writing 3 working days in advance.

How to correctly draw up an order for combining positions, read the article “Order for combining positions - sample for 2020-2021.”

But it may happen that no one receives additional payment for an absent employee. This happens when an employee replaces a colleague with similar job functions and his job description clearly stipulates such substitutions. In this case, the employee’s written consent is also not required.

What you need to pay attention to when attracting part-time employees of your organization, read the article “Registration of combining positions in one organization.”

Example

LLC "Cuckoo" In January, the cashier goes on vacation for 14 calendar days (10 working days). During his vacation, a second accountant agreed to perform his duties.

An order is issued to combine positions. It states that the additional payment for combined work will be calculated in proportion to the time worked.

The accountant's salary is 20,000 rubles.

The cashier's salary is 17,000 rubles.

We calculate the amount of payment for one working day: 17,000 rubles. / 17 days (number of working days in January) = 1000 rub.

The amount of additional payment for 10 working days was: 10 days. × 1000 rub. = 10,000 rub.

Total, in January the accountant will receive a salary of 20,000 rubles. + 10,000 rub. = 30,000 rub.

From this amount it is necessary to withhold personal income tax (13%) and pay contributions.

extra work

With this method, one of the company’s employees takes on additional responsibilities. That is, he fulfills his labor function and the function of a vacationer. Moreover, the employee performs both functions within the established working day.

Additional work assigned to an employee can be carried out by:

1. Combination of positions.

When an employee takes over the functions of a vacation worker with another position.

For example: an accountant takes over the functions of a cashier who went on vacation.

2. Expanding the service area or increasing the scope of work.

When an employee assumes the functions of a vacation worker of the same profession.

For example: one of the HR department employees went on vacation, and the second one performs duties for two during his absence.

An employee can be assigned to perform additional work only with his consent. The employer and employee must stipulate in an additional agreement the duration of the work, its content, volume and payment procedure.

The employee has the right to refuse to perform additional work ahead of schedule. But in this case, he is obliged to notify the employer about this three working days in writing.

Additional pay for a deputy can be set in proportion to the time worked or for the amount of work performed. The minimum or maximum amount of additional payment is not established by labor legislation.

Example: a personnel officer of an organization with a salary of 33,000 rubles goes on vacation in July for 28 calendar days (he will be absent for 20 working days). The functions of the vacationer are taken over by the accountant. The accountant will receive an additional payment for combining positions in proportion to the time worked. Let's calculate the amount of the surcharge.

There are 22 working days in July, which means the amount of additional payment for one day will be:

33,000 rub. / 22 days = 1,500 rub.

Additional payment to the accountant for the entire period of replacement:

1,500 rub. * 20 days = 30,000 rub.

The amount of the additional payment is subject to personal income tax and insurance premiums in the general manner.

Execution and payment of temporary transfer

It happens that the combination cannot be performed. In this situation, the employer has the right to release the employee from his current duties and transfer him to the vacationer’s workplace. The transfer period corresponds to the vacation period of the absent employee (Article 72.2 of the Labor Code of the Russian Federation).

Transfer is possible only with the written consent of the employee. The additional agreement to the employment contract specifies the terms of the transfer. After this, a transfer order is issued.

You will learn what to pay attention to when drafting it from the article “Order to transfer an employee to another position - sample.”

After the transfer is completed for the employee, this workplace becomes the main one, and, therefore, he must undergo all the training, like other employees.

The work book does not reflect the transfer and return to the main place of work.

Additional payment for performing the duties of a temporarily absent employee occurs in the amount specified in the additional agreement.

Upon return to work of the main employee, it is necessary to send a notice to the replacement employee about the end of the transfer period and draw up an order to terminate the duties of the temporarily absent employee.

If the transfer period has expired and the employee is not given the opportunity to return to his main job and he has not demanded his reinstatement to it, then the agreement on the temporary transfer becomes invalid. Temporary work becomes the main one.

Substitution by another employee

Most often, employers are faced with the need for a replacement suddenly, which greatly shortens the time to find a replacement. Therefore, they prefer to transfer the functions of the absent employee to another employee. This is permitted subject to the rules outlined in Art. 72.2 Labor Code of the Russian Federation.

Unfortunately, many employers shift some of the responsibility of absent employees to current employees without paying extra for it. This practice violates workers' rights. If someone else's job responsibilities have been imposed on you, remind the employer that he must pay extra for this. Moreover, in most cases, in order to transfer these powers, the employer must obtain consent from the employee who will be assigned these functions.

A conscientious employer must make the replacement in full compliance with the law . He must comply with the following rules:

- replacement by another employee of the enterprise is possible, but with an increase in the final salary (if part-time);

- the deputy may be charged with duties other than his position;

- the appointment of an employee to the role of a substitute is possible only with his written consent (except for the cases prescribed in paragraph 2 of Article 72.2 of the Labor Code of the Russian Federation);

- when registering a replacement, an additional agreement is drawn up if information about the replacement is not specified in the employment contract;

- there is a maximum duration of substitution (in emergency situations and without the consent of the employee - 1 year, in other cases these rules are prescribed in the internal regulatory documents of the organization).

All these rules indicate the rights and obligations of each party in the event of replacing one employee with another.

Is it possible to refuse a substitution?

An employer can place a person in another position during the absence of the main employee only after receiving written consent to do so from the replacement. However, there are exceptions to this rule. So, in para. 2 tbsp. 72.2 of the Labor Code of the Russian Federation states in what situations a person can be temporarily transferred to another job even if he refuses. This applies to the following situations:

- natural and man-made disasters;

- accidents that occurred at work;

- accidents that occurred during work;

- fires and fires;

- earthquakes;

- floods;

- strikes and hunger strikes;

- epidemics, as well as mass animal diseases;

- other situations in which there is a direct threat to the life of the population or its normal existence.

If any of this happens, the employer has the right to appoint another employee to the position. However, the duration of such a transfer cannot be more than 1 month. Moreover, the absence of indications of these duties in the employment contract does not exempt a person from fulfilling them.

When the absence of an employee has nothing to do with the listed circumstances, the employer has to negotiate with another worker so that he takes on additional responsibilities. Without this, it makes no sense to draw up orders and other internal documents. Moreover, coercion may entail administrative liability for the employer.

Registration procedure

So, the employee agreed to temporarily perform the duties of an absent employee. What should you do in this case? How to register a replacement for a temporarily absent employee? Step by step it will look like this:

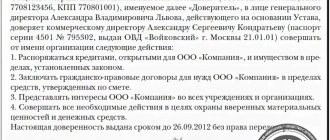

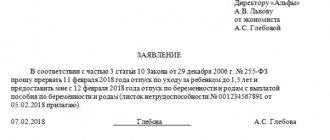

- Obtaining written consent from the employee . The legislation does not establish a uniform form, so it is enough to write it on the organization’s letterhead and express your readiness to fulfill the duties of the absent employee. The document must reflect: information about the parties (employee and employer), the reason for the replacement and its duration, the position to which the employee is transferring (or holding a combined position). Next, the application is signed and the originator’s signature is affixed. If the replacement is related to emergency situations, this item is skipped.

- Drawing up an additional agreement . Its registration is necessary, since the main employment contract does not stipulate the terms of replacement. The additional agreement specifies what position the employee will hold and what functions are assigned to him. The terms of payment and the duration of such replacement must be specified here.

- Making a replacement order . It is imperative to specify in it who is replacing whom and for what reasons. The form of the order itself is no different from the one that is usually issued. It is possible to use the T-5 or T-5a form. After drawing up and signing the order, you need to familiarize the employee (if he agrees, he puts his signature). The document also specifies the terms of payment (tariff rate, salary or other forms of remuneration).

Download an application to replace a temporarily absent employee (sample)

replacement order

It is noteworthy that sometimes an employee is not transferred to the position of an absent employee, but is assigned an internal part-time job. It turns out that he simultaneously performs the duties of his own and temporarily assigned positions. Then all the nuances of the relationship are established on the basis of Art. 60.2 Labor Code of the Russian Federation. The registration itself occurs somewhat differently, since the person does not vacate his main position.

Termination of employment in a temporary position does not require the consent of the replacement, since such an appointment is temporary. At the end of the predetermined period, he returns to perform exclusively his duties, and the absent employee returns to his position.

If suddenly the main employee during his absence decides to quit completely, then the employer in his place can leave a temporary one performing duties (upon receiving his consent) or find a new employee. If the employee agrees, the additional agreement becomes invalid, and a new employment contract is concluded with him. It is usually assumed that such a person vacates his previous position. People most often react positively to such an offer; if the salary is higher, there are prospects for future growth.

How to register and pay for a part-time job

If expanding job responsibilities is impossible, the employer can arrange a part-time job (Article 60.1 of the Labor Code of the Russian Federation).

Part-time work is the performance of additional duties in your free time from your main job. But this time is standardized and should not exceed half of the monthly working time norm. It is the employer’s responsibility to ensure that this standard is not exceeded. All other functions remain unchanged (Articles 282, 284 of the Labor Code of the Russian Federation). Internal part-time work is formalized by concluding a separate employment contract.

Read more about external part-time work in the article “How to properly arrange external part-time work?” .

Payment for part-time workers can be made in proportion to the time worked or for the amount of work actually completed. This must be reflected in the employment contract.

Example

At the Lukoshko store in February, the cashier went on vacation for 14 calendar days (10 working days). During his vacation, a part-time worker was appointed to take his place.

The salary for a combined position is 15,120 rubles.

We calculate the amount of payment for one working day: 15,120 rubles. × 50% / 18 days (number of working days in February) = 420 rubles.

The amount of payment for 10 working days was: 10 days. × 420 rub. = 4200 rub.

From this amount it is necessary to withhold personal income tax (13%) and pay taxes to the funds (30%).

ConsultantPlus experts provide separate explanations on combination issues.

Get trial access to the system and find out the answers for free.

Hiring a temporary employee

Another way to replace an employee who has gone on vacation is to hire a new employee in his place by concluding a fixed-term contract with him (Article 59 of the Labor Code of the Russian Federation).

This replacement method will be preferable for enterprises that have technically complex positions. And if you try to combine them, the entire labor process may suffer. For example, this could be a large manufacturing enterprise. The adjuster of technically complex equipment goes on vacation. The advantages of hiring a temporary employee are obvious: the manager gets a full-time employee, and the work process does not stop.

Payment, conditions and duration of work are negotiated and indicated when concluding a fixed-term employment contract.

Results

If an employee goes on vacation at an enterprise, then a replacement will most likely need to be selected to take his place. There are several options for such a replacement. Choose the one that is convenient for you. But no matter which one you choose, remember that the obligation to make additional payments for performing the duties of a temporarily absent employee cannot be neglected.

Sources: Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When is the replacement processed?

It is not always possible to predict the replacement of an employee. If the time of going on vacation or maternity leave is at least approximately known in advance, then it is impossible to guess when a person will go on sick leave or recover. Most often, a replacement is issued if the main employee:

- got sick;

- went on vacation (including maternity leave);

- cannot temporarily work due to other circumstances (in the event of the death of a loved one, for example).

How much time the employer has to find a person who will be assigned the responsibilities of a temporarily absent employee depends on the prevailing circumstances. There are only two options here: arrange for a combination/replacement of one of the existing employees, or hire a new one under a fixed-term contract. When time is short, they usually choose the first option, and for long-term replacement (during maternity leave) they can hire a new employee.