Who should issue a consignment note?

If transportation of inventory items occurs directly by the owner or seller of the goods, then the execution of the document is his prerogative.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

If an agreement with a carrier is used, which can occur both on behalf of the sender and on behalf of the recipient of the goods, then the preparation of this document may be the competence of both parties.

In other words, the 1-T form is drawn up by the company that hires the carrier.

Current regulatory framework

By Order of Rosstat No. 404 of July 15, 2022 (hereinafter referred to as the Order), updated reporting forms for business entities in Form 1-T were approved for the implementation of federal statistical surveillance. Statistics provide three independent reports with a similar designation:

- 1-T on the number and wages of employees (Appendix No. 1 to the Order);

- 1-T (working conditions) on working conditions and compensation for preferential categories of workers (Appendix No. 2 to the Order);

- 1-T (GMS) – on the number and wages of government employees (Appendix No. 5 to the Order).

According to clause 1 of the above Order No. 404, the new edition of the forms comes into effect from the final report for 2022. You will find a list of reporting forms sent to Rosstat in our article.

Document structure

The invoice can be roughly divided into two parts.

- First - commodity, - includes information

- about the sender and recipient of the goods,

volume,

- name, etc. options.

- Second part - transport. It contains information

- directly about transportation,

information about the carrier company and the specific driver,

- car make,

- travel time and mileage,

- product, etc.

This part of the document is the basis for the decommissioning of cargo from the sender's warehouse and at the same time for its receipt by the recipient.

The cost of transportation is also indicated here.

Rules for registration and procedure for working with the form

This document refers to primary documentation, so when filling it out, you should adhere to certain standards. In particular, you must not leave cells empty (where dashes should be placed), allow inaccuracies and errors, or enter incorrect information into the form.

Additional documents may be attached to Form 1-T:

- certificates,

- passports,

- certificates,

- contracts, etc.

All of them must be indicated in the “Attachment” line of the delivery note.

The document is printed in four copies , one of which remains with the sender of the goods, the other three are handed over to the driver who will deliver the goods.

All documents must be certified with the required signatures. Then the driver must hand over the second copy to the consignee, and the third and fourth copies must be handed over to the management of the transport company (they must have the signatures of both the sender and the recipient of the goods). After this, the third copy with the issued invoice for payment for transportation services is sent to the customer (i.e., the company that entered into an agreement for the delivery of the goods), and the fourth remains with the carrier and becomes part of its accounting records.

Instructions for filling out the bill of lading form

- First, you need to indicate in the document its number (according to the internal document flow of the company issuing the invoice), enter the date of completion, then in the “Shipper” line enter information about the company sending the goods - here you need to indicate its full name, actual address and telephone number.

- After this, in exactly the same way, you should enter information about the addressee in the “Consignee” line.

- Opposite the designation “Payer” you must indicate the company that pays for the carrier’s services.

- Opposite each company in the appropriate box you need to indicate its OKPO code (All-Russian Classifier of Enterprises and Organizations).

Filling out the first section of form 1-T

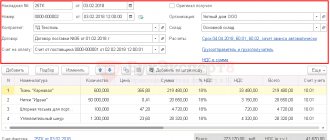

The first section of the invoice must be filled out almost completely by the shipper. First, detailed information about the product is entered into the table.

in the first column (but only if such an accounting system is used by the enterprise), in the second and third - the price list number and article number (also only if available). The fourth column “Quantity” must be filled in - a figure corresponding to the number of goods transported for each item separately is placed here. Columns that go further cannot be skipped either: they include -

- price per unit of goods,

- his name,

- unit of measurement (kilograms, meters, cubes, etc.),

- type of packaging (boxes, crates, barrels, bags, etc.).

Then the number of pieces, weight (in tons) and total cost for each type of product separately are entered there. If there is a markup for volume or storage or transportation costs, this should also be indicated in the table. The next step is to enter the total cost of the goods for all items and in the last column the number of the goods according to the shipper’s warehouse card is entered.

If the waybill has a continuation, then you need to note the number of additional sheets in the corresponding cell (in words) and also the total number of types of goods and places (the values are duplicated from the first table).

Next, the weight of the cargo is entered in words and figures, and after that it is necessary to indicate all available attachments (number of sheets) and below, in words, the total cost of the goods released from the warehouse.

At the bottom of the product section on the left there should be signatures with transcripts of representatives of the shipper: the person authorized to release the goods (indicating his position), the chief accountant, as well as the storekeeper who directly carried out the shipment.

On the right side, the driver’s data is entered, including information about the power of attorney that the carrier company issued for him.

Later, here below is the signature of the representative of the consignee (usually this is also a storekeeper), who, with his autograph in this part of the document, certifies the fact of acceptance of the goods after transportation safe and sound.

New report form 1-(personnel) approved

Resolution No. 36 comes into force on July 31, 2021. By this resolution, Belstat approved a new form 1-(personnel) and Instructions No. 36 for its completion. They will come into force starting with the report for 2021 (clause 1 of Resolution No. 36). Let's look at the main differences between the new Form 1 (personnel) and the rules for filling it out from the current ones.

1. Presentation of the new form 1-t (frames)

Let us highlight the main nuances of presenting the new form of 1-t (frames) in comparison with the current one.

1. It has been established that the submission of the new form 1-t (personnel) will only be possible in the form of an electronic document (clause 3 of Instructions No. 36, clause 3 of Instructions No. 63). In other words, it will no longer be possible on paper . To fill out and submit the new form 1-t (personnel) in the form of an electronic document, you should use specialized software, which is posted along with the necessary instructional materials for its deployment and use on the official website of Belstat (clause 3 of Instructions No. 36, part 1 p 3 Instructions No. 63).

Note! The report in form 1-(personnel) should be signed with an electronic digital signature, the public key verification certificate of which was issued in the State SUOC (paragraph 3, part 2, article 29 of the Law on Electronic Documents).

2. The list of organizations that do not need to submit form 1-t (personnel) has been added (clause 2 of Instructions No. 36, clause 2 of Instructions No. 63). It includes non-profit organizations with an average number of employees per calendar year of up to 15 people inclusive.

3. It is provided that non-profit organizations with an average number of employees per calendar year from 16 to 100 people inclusive will have to draw up a report in form 1-t (personnel) for the entire legal entity (part 4, paragraph 4 of Instructions No. 36). Instructions No. 63 do not contain such a clause.

Note! The deadline and frequency for submitting the new form 1-t (personnel) have not changed compared to the current one. As currently, it will need to be submitted once a year, with a submission deadline of 6 February. For the first time, a report on the new form 1-personnel will need to be submitted with data for 2022 no later than 02/07/2022, because February 6th falls on a Sunday.

2. Filling out a new form 1-t (personnel)

The new form 1-t (personnel), like the current one, consists of two sections. And if section 2 of the new form 1-t (personnel) and the rules for filling it out actually remained the same as the current form 1-t (personnel), then in section 1 of the new form and the rules for filling it out there are significant differences. Let's look at them.

1. Section 1 of the new form 1-t (personnel) contains one table , and not two, as in section 1 of the current form 1-t (personnel). At the same time, you only need to fill out one column - “Total, person.” In the current form 1-t (personnel) there are eight fields to fill out.

2. Columns 2 - 7 of Table 1 of the current form 1-t (personnel) have been moved to the indicators of Table 1 of the new form 1-t (personnel) (lines 02 - 07). The same applies to all indicators in Table 2 of the current form 1-t (personnel), which contains background information (lines 08 - 11, 15, 16 of the new form 1-t (personnel)).

The new rules establish that in lines 02 - 06 of Table 1 of the new form 1-t (personnel), it will be necessary to reflect the payroll number of the organization’s employees at the end of the reporting year by personnel category (employees, including by job category, workers). In the current form 1-t (personnel), columns 2 - 6 of Table 1 are provided to reflect similar data (clause 7 of Instructions No. 36, clause 7 of Instructions No. 63).

Note The rules for assigning personnel to one or another category have not changed (clause 8 of Instructions No. 36, clause 8 of Instructions No. 63).

As for the data on indicators that were transferred from Table 2 of the current form 1-t (personnel), the rules for filling them out in the new form 1-t (personnel) remained the same as now (clauses 9, 11 of Instructions No. 36, clauses 11-1, 11-2 of Instructions No. 63).

3. The payroll number of employees at the end of the reporting year will need to be distributed only among three age groups : up to 31 years old, up to 16 years old and 16 - 17 years old. Currently, there are significantly more of them (lines 12 - 14 of table 1 of the new form 1-t (personnel), lines 07 - 17 of the current form 1-t (personnel)). Such distribution, as now, will be made according to the number of full years completed by employees at the end of the reporting year (clause 10 of Instructions No. 36, clause 10 of Instructions No. 63).

Example At the end of the reporting period (2021), A.A. Petrov’s age is 30 years 5 months, G.G. Ivanov’s age is 15 years 9 months, and N.A. Sidorov’s age is 16 years 2 months. When filling out form 1-t (personnel), these employees will be distributed by age groups as follows: information about A.A. Petrov will be reflected on line 12, about G.G. Ivanov - on line 13, and about N.A. Sidorov - on line 14.

4. There will be no need to reflect data on employees (including by category) with education . Let us recall that at present, Form 1-t (personnel) provides for the need to indicate data on the number of employees with completed education (including higher, specialized secondary, vocational, general secondary, general basic) at the end of the reporting year (Table 1 new form 1-t (personnel), lines 02 - 06 of the current form 1-t (personnel), clause 9 of Instructions No. 63).

5. to distribute the payroll number of women by personnel categories age groups has disappeared (line 07 of Table 1 of the new form 1-t (personnel), line 18, column 7 of the current form 1-t (personnel)).

Thus, we can conclude that, compared to section 1 of the current form 1-t (personnel), filling out section 1 of the new form 1-t (personnel) will become easier.

Read this material in ilex >>* *follow the link you will be taken to the paid content of the ilex service