Companies and individual entrepreneurs pay insurance premiums on salaries and most other payments to employees (including under GPC agreements). The rules for calculating payments are regulated by Ch. 34 of the Tax Code of the Russian Federation, and in terms of contributions for “injuries” - by Federal Law of July 24, 1998 No. 125-FZ. The calculation of insurance premiums in 2022 is made taking into account the new provisions that came into force on January 1 of this year.

Tariff selection

The amount of payments depends on what premium rates the policyholder applies. The Tax Code has approved different tariffs:

- basic – for most companies;

- reduced – for preferential categories of taxpayers;

- additional – for productions recognized as harmful or dangerous based on the results of a special assessment.

The company or individual entrepreneur will calculate insurance premiums in 2022 according to the appropriate tariff. The legality of applying preferential rates is checked by tax authorities.

The rate of contributions for “injuries” is approved by the FSS based on the main type of activity of the employer, according to the class of its professional risk (Article Law No. 125-FZ). Tariffs range from 0.2 to 8.5%.

Payroll calculation in 2022

Let’s look at several examples of how in 2022 it is necessary to calculate an employee’s wages in “standard” cases.

Payroll calculation from an income of 100,000 tenge

The income of employee I. I. Nikiforova in January 2022 amounted to 100,000 tenge (salary + monthly bonus).

An employee has the right to a deduction under OPV, a deduction under VOSMS and a deduction in the amount of 1 minimum wage - 42,500 tenge. OPPV is not paid.

OPV calculation

There is no minimum limit on employee income. Max limit - 50 minimum wage (2,125,000 tenge). 100,000 * 10% = 10,000 tenge

OPV calculation

There is no minimum limit on employee income. Max limit - 50 minimum wage (2,125,000 tenge). 100,000 * 10% = 10,000 tenge

Calculation of personal income tax

There is no minimum limit on employee income. There is no maximum limit on employee income.0 (OPV) – 2,000 (VOSMS) – 42,500 = 45,500 tenge; 45,500 * 10% = 4,550 tenge.

CO calculation

Min limit - 1 minimum wage (42,500 tenge). Max limit - 7 minimum wage (297,500 tenge). 100,000 – 10,000 (OPV) = 90,000; 90,000 * 3.5% = 3,150 tenge.

CH calculation

Min limit - 1 minimum wage (42,500 tenge). There is no maximum limit on an employee's income. 100,000 – 10,000 (OPV) – 2,000 (VOSMS) = 88,000 tenge; 88,000 * 9.5% = 8,360 tenge; 8,360 – 3,150 (CO) = 5,210 tenge

Calculation of compulsory medical insurance

There is no minimum limit on employee income. Max limit - 10 minimum wage (425,000 tenge). 100,000 * 2% = 2,000 tenge.

| Index | Calculation |

| OPV | 10,000 tenge |

| IPN | 4550 tenge |

| CO | 3150 tenge |

| CH | 5210 tenge |

| OOSMS | 2000 tenge |

| VOSMS | 2000 tenge |

| At the expense of the employer | 10360 tenge |

| At the expense of the employee | 16550 tenge |

| Amount "on hand" | 83450 tenge |

Let's calculate the salary for low-paid workers (monthly income does not exceed 25 MCI), who are subject to a 90% reduction in taxable income under the personal income tax.

The procedure for calculating insurance premiums according to the basic tariff

The basic rate of insurance premiums is indicated in Art. 425 Tax Code of the Russian Federation. It is used by companies that were not provided with benefits:

- for pension insurance from the established maximum tax base (MTB) - 22%;

- for social insurance in case of disability and maternity (VNIM) from the maximum base - 2.9%, from the income of foreigners and stateless persons within the base (except for highly qualified specialists) - 1.8%;

- for health insurance (compulsory medical insurance) - 5.1%, while the base limit is not set.

The policyholder will use these rates for OPS and VNiM until the individual’s income reaches the maximum level. The amount of payments is calculated by multiplying taxable income by the current rate.

Amounts not subject to insurance premiums are listed in Art. 422 of the Tax Code of the Russian Federation and Art. 20.2 of Law No. 125-FZ. The procedure for calculating insurance premiums provides that the taxable base is calculated from the beginning of the year on an accrual basis. All accruals are made in rubles and kopecks.

Example

The company employs 1 person - a director, whose monthly salary is 53,411.30 rubles. The company does not have any benefits; it is not included in the SME register, so contributions are calculated at the basic rate. For payments for “injuries,” the FSS approved a rate of 0.9%. For clarity, here is the calculation of insurance premiums in the company for January and February 2021:

For January, the salary amounted to 53,411.30 rubles, contributions were accrued on it:

- on OPS:

53,411.30 x 22% = 11,750.49;

- on VNiM:

53,411.30 x 2.9% = 1,548.93 rubles,

- for compulsory medical insurance:

53,411.30 x 5.1% = 2,723.98 rubles,

- in the FSS for “injuries”:

53,411.30 x 0.9% = 480.70 rub.

To calculate February payments, contributions are calculated based on the salary for January-February on an accrual basis:

(53,411.30 + 53,411.30) = 106,822.60 rubles,

then the amounts of contributions accrued in previous months (in this case, for January) are deducted from the taxable base:

- OPS for February:

106,822.60 x 22% - 11,750.49 = 11,750.48 rubles;

- VNiM for February:

106,822.60 x 2.9% - 1,548.93 = 1,548.93 rubles,

- Compulsory medical insurance for February:

106,822.60 x 5.1% - 2,723.98 = 2,723.97 rubles;

- FSS for “injuries” for February:

106,822.60 x 0.9% – 480.70 = 480.70 rub.

Calculation in the following months of the reporting year is made using a similar method.

The example shows that even with the same monthly salary, the amount of contributions for the month may differ in kopecks due to rounding.

About the salary insurance premium calculator

The payroll insurance premium calculator is designed largely to make the work of accountants easier. The calculator will significantly reduce the time spent on calculating insurance premiums and will allow the accountant to avoid mistakes, which, in turn, can lead to the accrual of penalties, penalties and the need to correct statements.

Calculating insurance premiums is a painstaking task that takes into account many variables.

It will be necessary to take into account the total amount of remuneration, the taxable base, and periods of incapacity for work.

The calculator will be equally useful for employees who want to check the correctness of deductions from their salaries.

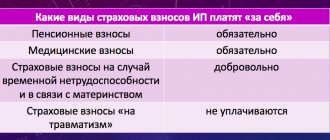

Employers pay four types of insurance contributions for their employees:

- In the Pension Fund of Russia;

- to the health insurance fund;

- to the social insurance fund. Contributions to the Social Insurance Fund are divided into contributions in case of disability and contributions for industrial accidents and occupational diseases.

The transfer occurs by deducting the amounts of contributions from the salaries of employees. So, in accordance with Art. 419 Tax Code of the Russian Federation:

- employer - organization or individual entrepreneur, deduct insurance premiums from employees' wages or from remuneration under civil contracts);

- individual entrepreneurs, notaries, lawyers, appraisers and other individuals transfer insurance premiums for themselves.

The amount of insurance premiums is determined based on the taxable base, that is, the totality of all remunerations received by the employee, including remunerations for work performed under civil contracts.

In accordance with Art. 422 of the Tax Code of the Russian Federation, the totality of remuneration, that is, the taxable base, can be reduced by excluding from it:

- benefits for certificates of incapacity for work;

- maternity benefits;

- benefits assigned to care for a child up to one and a half years old;

- provided material assistance in the amount of up to 4 thousand rubles;

- payments upon dismissal, with the exception of the amount of compensation for unused vacation.

By Decree No. 1378 of the Government of the Russian Federation of November 15, 2022, the following maximum base values for calculating insurance premiums were established for payers of insurance premiums:

- 912,000 rubles when calculating contributions for compulsory social insurance;

- 1,292,000 rubles for compulsory pension insurance.

The maximum base for health insurance contributions has been abolished since 2015.

If the employee's total remuneration exceeds the base limit, then:

- the employee is not accrued contributions to OSS in the event of temporary disability and in connection with maternity;

- Contributions to the Pension Fund are charged at a rate of 10%.

In accordance with Art. 426 of the Tax Code of the Russian Federation, employers calculate insurance premiums at the following rates:

- 22% within the established base value;

- 10% – if the amount of remuneration exceeds the limit;

- 2.9% in the Social Insurance Fund in case of temporary disability and in connection with maternity, if the total remuneration is less than or equal to the maximum base value;

- 5.1% for compulsory medical insurance.

In total, the amount of insurance payments for most payers is 30% of the total compensation.

Calculation of insurance premiums in 2022 for income above the taxable base limit

For income exceeding the base limits for contributions to compulsory health insurance and VNiM, different rates are applied. The size of the maximum bases is revised every year, in 2021 this limit is (Resolution of the Government of the Russian Federation of November 26, 2020 No. 1935):

- for community pension insurance contributions - 1,465,000 rubles;

- for VNiM contributions - 966,000 rubles.

When taxable income calculated from the beginning of the year becomes higher than the limit value, a reduced rate of 10% is applied to contributions to compulsory pension insurance, and contributions to VNiM are no longer accrued. The amount of income of the insured person does not affect the tariffs for calculating insurance premiums to the Federal Compulsory Medical Insurance Fund, as well as to the Social Insurance Fund for “injuries”.

Example

The salary of the company director is 130,000 rubles. per month. To simplify the calculation, let’s assume that all months in 2022 were fully worked by the manager. For contributions for “injury” the rate for the company is 1.2%, for other insurance premiums the basic rate is used.

In January-July 2022, regular rates were used to calculate insurance premiums, because... the taxable base has not reached the maximum level (130,000 x 7 months = 910,000 rubles). Each month from January to July inclusive, the amount of contributions was:

- for OPS - 28,600 rubles. (130,000 x 22%);

- for compulsory medical insurance - 6,630 rubles. (130,000 x 5.1%);

- at VNiM - 3,770 rubles. (130,000 x 2.9%);

- for “injuries” - 1,560 rubles. (130,000 x 1.2%).

In August, the taxable base for VNiM contributions exceeded the limit of 966,000 rubles. (130,000 x 8 months = 1,040,000 rubles), therefore, VNiM contributions for August were accrued only from 56,000 rubles, i.e. from the difference between the limit amount and the base for January-July:

966,000 – 130,000 x 7 months = 56,000 rubles.

VNiM contributions for August were:

56,000 x 2.9% = 1,624 rubles.

VNiM contributions will no longer be accrued until the end of the year; the amount of other insurance premiums until December 2022 remains the same.

In December 2022, the director’s income exceeded the maximum base for OPS contributions of RUB 1,465,000. (130,000 x 12 months = 1,560,000 rubles), therefore, the calculation of insurance contributions to the Pension Fund for December was made as follows:

- from amounts within the base limit:

1,465,000 – 130,000 x 11 months. = 35,000 rub. – taxable base at a rate of 22%;

35,000 x 22% = 7,700 rubles;

- For amounts above the established limit, December contributions are accrued at a reduced rate of 10%:

(130,000 – 35,000) x 10% = 9,500 rubles;

- total insurance premiums to the Pension Fund for December amounted to:

7,700 + 9,500 = 17,200 rub.

In total for 2022, the company accrued contributions from the director’s income:

- 28,600 x 11 months. + 17,200 (December) = 331,800 rubles. – on the OPS;

- 6,630 x 12 months. = 79,560 rub. – on compulsory medical insurance;

- 3,770 x 7 months. + 1,624 (August) = 28,014 rubles. – at VNiM;

- 1,560 x 12 months = 18,720 rub. - for “injury”.

How to fill out a calculation: examples

Let's look at an example of how to apply a reduced tariff when calculating pension insurance contributions and filling out the calculation.

Example 1. The base is less than the minimum wage

Let's take the case mentioned above: in February, an employee received 16,000 rubles, 5,000 of which were disability benefits.

Contributions for February need to be calculated only at the basic tariff, since 16,000 - 5,000 = 11,000 (< minimum wage 13,890 rubles).

If we assume that the employee is paid 16,000 rubles every month and only in April there was a non-taxable amount of 5,000 rubles, then in section 3 you need to fill out two subsections 3.2.1.

- Subsection 3.2.1 with category code HP:

- Subsection 3.2.1 with category code MS:

Accordingly, in section 1 in subsection 1.1 of Appendix 1 with tariff code “01” these amounts will be reflected as follows:

And in Appendix 1 with the tariff code “20” - this way:

Example 2. The base is greater than the minimum wage

Let’s say an employee’s monthly payments are 20,000 rubles. In February, part of this amount was an allowance of 5,000 rubles.

In this case, the base for February is greater than the minimum wage:

20 000 — 5 000 = 15 000 > 13 890

This means that there is an excess from which contributions are calculated at a reduced rate. Let's look at the formula that the Federal Tax Service requires to calculate contributions. The payment for compulsory pension provision for February amounts to 3,166.80 rubles:

13 890 × 2 × 22 % + (35 000 — 13 890 × 2) ×10 % – 3 666,80 = 6 111,6 + 722 — 3 666,80 = 3 166,80

In the calculation in section 3 this will be reflected as follows:

1. In subsection 3.2.1 with code HP, in each month the payments and base are equal to the minimum wage.

2. In subsection 3.2.1 with the MS code, the base in the second month is indicated minus the benefit.

Calculation of contributions at reduced rates

Reduced tariffs are established for certain categories of payers. All of them are listed in Art. 427 Tax Code of the Russian Federation. In particular, from 2022 new provisions will apply regarding:

- SMEs - reduced tariffs are applied from the 2nd quarter of 2022 (law dated 04/01/2020 No. 102-FZ, clause 17 clause 1 clause 2.1 of Article 427 of the Tax Code of the Russian Federation);

- developers and designers of electronic products and component base - tariffs have been reduced since the beginning of 2022; previously they were not provided with benefits (clause 18, clause 1, clause 8, clause 2, article 427 of the Tax Code of the Russian Federation).

In general, insurance premiums are calculated by multiplying the tax base by the established tariff, however, a different calculation methodology is provided for SMEs (clause 2.1 of Article 427 of the Tax Code of the Russian Federation):

- for monthly income within the federal minimum wage, the basic tariff rates are applied;

- from the amount of income exceeding the minimum wage, contributions to the Pension Fund are 10% (within and above the base limit), to the FFOMS - 5%, to social insurance - 0%. No reduction is provided for contributions for “injury”.

In 2022, the federal minimum wage is 12,792 rubles. (Federal Law No. 473-FZ dated December 29, 2020).

Example

The small enterprise has been included in the register of SMEs since 2022. In January 2022, the company paid employees the following salaries:

- director - 58,000 rubles;

- accountant, because he was on vacation (vacation pay accrued in December) - 9,720 rubles.

For contributions for “injuries” the tariff is 0.6%.

After the salary is calculated, the accountant calculates the contributions, reflecting the calculation results in the table:

Job title Total accrued for January 2021 Insurance premiums at the basic rate Insurance premiums at a reduced rate FSS “injury” (0.6%) Base (within the minimum wage) Pension Fund (22%) FFOMS (5.1%) FSS VNiM (2.9%) Base (above minimum wage) Pension Fund (10%) FFOMS (5%) Director 58 000,00 12 792,00 2 814,24 652,39 370,97 45 208,00 4 520,80 2 260,40 348,00 Accountant 9 720,00 9 720,00 2 138,40 495,72 281,88 0,00 — — 58,32 Total 67 720,00 22 512,00 4 952,64 1 148,11 652,85 45 208,00 4 520,80 2 260,40 406,32 In total, the company transferred to the Pension Fund for January:

4,952.64 + 4,520.80 = 9,473.44 rubles. – Pension Fund contributions,

1,148.11 +2,260.40 = 3,408.51 rub. – FFOMS contributions,

RUB 652.85 – contributions to VNiM,

RUB 406.32 - “trauma”.

Reduced tariffs for SMEs are valid only during the period of recognition of the policyholder as a small or medium-sized business. For other preferential rates, policyholders must also comply with those established in Art. 427 of the Tax Code of the Russian Federation criteria (for example, by type of activity, volume of revenue, etc.).

If your payer status changes during the calendar year, your contribution rates may also change.

Taxes and contributions from wages

When calculating wages, an important step is the deduction of taxes, contributions and deductions from it.

Today, 6 types of payments and income established by law are calculated from the employee’s income:

- Income tax (IIT);

- Pension contributions (OPC);

- Health Insurance Contributions (VOSHI);

- Contributions for health insurance (OSHI);

- Social tax (SN);

- Social contributions (SC).

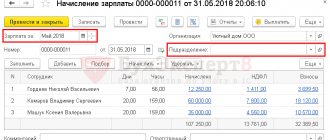

Conduct calculations of taxes and contributions required to be paid by the employer by law in 1C: Salaries and personnel management for Kazakhstan.

Each type of tax and contribution has individual features when calculating (different rates, composition and limits of income, calculation techniques, terms of transfer, etc.).

One share of taxes and contributions is paid by the employee, the other by the employer.

This table presents the main provisions for each type of tax and contribution:

| Type of tax, contribution, deduction | Short designation | Bid | Income limit | Calculation formula | "At whose expense?" |

| Income tax | IPN | 10% | No | (Employee Income – Income Adjustment – Tax Deductions) *10% | Employee |

| Pension contributions | OPV | 10% | Up to 50 minimum wage | Employee income * 10% | Employee |

| Medical fees | VOSMS | 2% | Up to 10 minimum wage | Employee income * 2% | Employee |

| Medical deductions | OOSMS | 2% | Up to 10 minimum wage | Employee income * 2% | Employer |

| Social Security contributions | CO | 3,5% | Not less than 1 minimum wage, not more than 7 minimum wage | (Employee income – OPV) * 3.5% | Employer |

| Social tax | CH | 9,5% | At least 1 minimum wage | (Employee income – OPV – VOSMS) * 9.5% – CO | Employer |

| Professional pension contributions* | OPPV | 5% | No | (Employee income – OPV – VOSMS) * 9.5% – CO | Employer |

*OPPV is paid only for employees engaged in hazardous working conditions, whose professions are provided for in the list.

In some cases, not all taxes and contributions are calculated from the employee. Such cases include pensioners, disabled people, foreigners, etc.

After income taxes are calculated, employees are given tax deductions. Not all deductions are available to every employee; some require specific reasons.

For example, if an employee pays a pension contribution (PPV) and a health insurance contribution (VOSMS), then he is given a deduction. Also, all employees are provided with a monthly deduction in the amount of 1 minimum wage.

Employees eligible for other tax deductions include:

- “Chernobyl”, “Afghan”;

- Parent or guardian of a disabled child;

- Parent of an adopted child;

- Paying voluntary pension contributions (to the UAPF);

- Those paying a mortgage to Zhilstroysberbank (Otbasy Bank);

- In the reporting month, those who received paid medical care.

Table of tax deductions when calculating income tax:

| Category | Deduction | Deduction amount |

| All employees | OPV VOSMS 1 minimum wage | Based on the size of OPV per month Based on the size of VOSMS per month Fixed amount of 1 minimum wage per month (in 2022 42,500 tenge) |

| “Chernobyl”, “Afghan”; | Fixed amount 882 MCI per year (in 2022 2,572,794 tenge) | |

| Parent or guardian of a disabled child | Fixed amount 882 MCI per year (in 2022 2,572,794 tenge) | |

| Parent of an adopted child | Fixed amount 882 MCI per year (in 2022 2,572,794 tenge) | |

| Payer of voluntary pension contributions | Based on the monthly allowance amount | |

| Mortgage payer in HCSB | Based on monthly remuneration amount | |

| Received paid medical services | Based on monthly remuneration amount |

There is one more feature in calculating income tax.

If the employee’s income for the month when calculating personal income tax was less than 25 MCI (in 2022, 25 MCI = 72,925 tenge), taxable income is reduced by 90%.

To determine whether it is necessary to reduce income by 90% when calculating personal income tax, it is necessary to calculate the total amount of the employee’s income for the month.

Taxable income under IPN = Employee income – Income adjustment — Tax deductions under IPN = (Taxable income under IPN – 90%) * 10%

The 90% reduction applies only to personal income tax; other taxes and contributions are calculated “in the general manner.”

Additional insurance rates

Contributions for additional tariffs are calculated along with the basic or reduced rates. In fact, these are funds additionally collected from employers whose working conditions are harmful or dangerous for employees or differ from normal ones, and therefore the employee acquires the right to early retirement.

Additional tariffs are specified in Art. 428, 429 Tax Code of the Russian Federation. They depend on the special assessment and range from 0 to 9 percent. There are usually no difficulties when calculating contributions for additional tariffs, and the procedure for calculating them has not changed in 2022: payments are calculated by multiplying taxable income by the established rate in addition to the applied basic or reduced tariffs.

Thus, calculations of contributions may differ for different categories of payers.

The policyholder must determine which tariff to use independently, guided by Art. 425-429 Tax Code of the Russian Federation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to apply the minimum wage when calculating contributions

The authors of the letter remind that the minimum wage is established simultaneously throughout the entire territory of the Russian Federation (Article 133 of the Labor Code of the Russian Federation). In the regions of the Far North and equivalent areas, remuneration is carried out using regional coefficients and percentage increases in wages. Thus, SMEs calculate insurance premiums from payments calculated taking into account regional coefficients and percentage premiums. In this case, the excess amounts taxed at reduced insurance premium rates are determined based on the minimum wage established at the beginning of the billing period (as of January 1, 2022 - 12,130 rubles).

In other words, the minimum wage for the purpose of determining the contribution rate is fixed. This amount does not increase by regional coefficients and percentage allowances for work in the Far North and equivalent areas. Also see “How to determine the minimum wage when calculating contributions at reduced rates.”

Calculate a “complex” salary with coefficients and bonuses Try for free