About legal entities

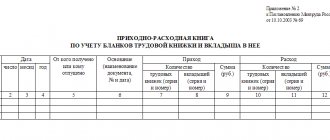

Is accounting of work books required at an enterprise? From 01.09.2021 new rules apply

The founders of the organization, having invested money or property in the authorized capital at one time, receive

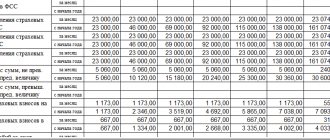

Failure to withhold personal income tax as a result of a calculation error In case of an error with the calculation, additional tax must be withheld

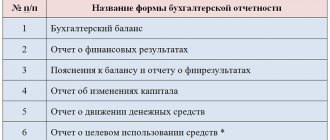

Who is responsible for preparing accounting reports? Preparation of financial statements and their presentation to

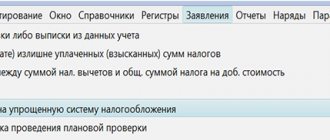

Published by: Marina Shmeleva Category: Finance and Law 4,316 We answer the question, can

Personal income tax is a special tax - it is transferred to the budget from the amount of income of an individual. This

We present to our readers a complete list of taxpayers who are required to submit a 3rd personal income tax declaration to the Federal Tax Service:

Who will need the letter and when? Current legislation provides for several tax system options to choose from.

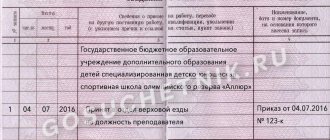

How to correctly fill out the Rules and procedure for maintaining and storing work books and entering them into

Accounting statements: forms 1 and 2 Accounting statements are prepared and presented in accordance with the forms approved