In law

The situation with the absence of an accounting service and the position of chief accountant in an organization is quite typical. Moreover, this opportunity is provided by law; it is directly provided for in Article 7 of the Federal Law “On Accounting”. This norm allows for several options for organizing accounting depending on the type and size of the business. Thus, for small and medium-sized companies, the presence of such an employee in the staffing table and office is not necessary. Here the question may arise - how to understand whether my company belongs to these types of legal entities? Let me remind you that in Russia there is a Federal Law “On the development of small and medium-sized businesses in the Russian Federation.” It defines the criteria for classifying organizations as small and medium-sized businesses, including: the total share of participation of the state and large businesses (up to 25%); average annual number of employees (up to 250 people); the amount of annual revenue (no more than one billion rubles) and the book value of assets. It is necessary to understand that the indicators established by law may change over time.

The accounting option chosen by the manager must be specified in the accounting policy. In the future, it can be changed by the director of the company at any time. It is worth keeping in mind that the company may exceed established indicators. True, not systematically. If violations of the criteria are repeated for two years in a row, the company may lose its status as a small or medium-sized business, which will entail corresponding changes in the organization of accounting.

May not be included

In accordance with current legislation, the head of the organization must assign accounting responsibilities to the chief accountant or enter into an agreement for the provision of accounting services (Article 7 of the Federal Law of December 6, 2011 No. 402-FZ).

However, in small and medium-sized enterprises, the manager can conduct accounting personally, assigning the responsibilities of the chief accountant to himself. In this case, there is no chief accountant in the staffing table.

The exception is credit organizations (for example, banks). The head of a credit institution is obliged to entrust accounting to the chief accountant. Therefore, in banking staff, the position of chief accountant is mandatory.

Is there a requirement by law for a chief accountant in an LLC?

According to Article 20 of the Labor Code of the Russian Federation, the parties to labor relations can be the employee and the employer - an individual who is an entrepreneur.

From the moment of registration as an individual entrepreneur, the entrepreneur becomes the sole “founder” who regulates business activities and labor relations with his employees.

Thus, the entrepreneur independently determines the required number of employees and their positions, including the entrepreneur may well establish the position of director or manager, who, by proxy, will manage his business activities, of course with the consent of the individual entrepreneur.

The following questions arise.

What position should an individual entrepreneur indicate in contracts and primary accounting documents?

The position “Individual entrepreneur” does not exist.

The contracts always state “Individual entrepreneur Last name, First name, Patronymic, acting on the basis of………”. In the primary accounting documents, “Individual entrepreneur” or “IP” is also written in the place where the title of the position is supposed to be.

Can an individual entrepreneur take himself to work and appoint himself to the position of director or any other position, calculate and pay himself a salary?

Although the entrepreneur himself can be an employee in any organization, he cannot act as an employer in relation to himself.

Article 413 of the Civil Code of the Russian Federation states that civil obligations cannot arise between a debtor and a creditor who are the same person.

Letter of Rostrud No. 358-6-1 dated February 27, 2009 clearly states that an individual entrepreneur does not have the right to appoint himself to a position and pay himself a salary.

The Ministry of Finance in its Letter No. 03-11-11/665 dated January 16, 2015 also supports this position.

If you liked the article, share it!

Return to list

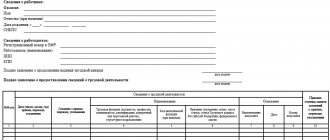

Example of a certificate of absence of a chief accountant

its functions, the certificate can only be signed by the head of the enterprise (organization). In this case there should be

a copy of the order assigning the functions of the chief accountant (another official performing his functions) was provided

to the manager, certified by the signature of the head of the enterprise (organization) and the seal"

I am looking for the form of this order.

An individual entrepreneur is not an enterprise (organization).

NIKITENKO DMITRY VLADIMIROVICH

"09" January 2008

Due to the absence of the position of chief accountant in the staffing table

Individual entrepreneur D. V. Nikitenko

swetlaya, if you adhere to the text that you quoted, you should not write any order - you are not an organization or an enterprise