About legal entities

Which financial statements are considered simplified? Art. 6 of the Federal Law on Accounting dated December 6, 2011 No.

BSO or strict reporting form - a document that until 2021 inclusive could be

What are the grounds for calculating penalties? A penalty is not a measure of tax liability, but a payment

Who must submit a report on financial results The legislation determines that accounting is

Rosstat - official website Rosstat is the federal state statistics service. The activities of this federal body

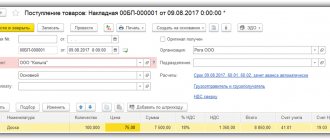

An order on the right to sign primary documents is written in cases where the head of the enterprise has

Introductory information From July 2022, the Tax Code will contain a list of grounds for which

In detail The authorized capital of a legal entity is the initial support for the organization’s activities by depositing funds

Social tax deduction for treatment - procedure for obtaining Russians can request a state tax deduction from the Federal Tax Service

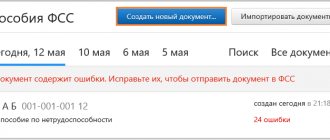

According to the new rules, benefits are paid to employees not by the employer, but directly by the Social Insurance Fund (see Government resolutions