What is a certificate of foreign exchange transactions 2022

A certificate of currency transactions is a report on transactions carried out using currency. This reporting includes information about the currency received into the account of a company resident in the Russian Federation.

The certificate must include information about the company, banking organization, as well as the document that served as the basis for the accrual or debiting of foreign currency. In addition, the current account number, transaction and currency code, amount and other information are also indicated.

If the condition is provided for in the agreement with the bank, then the bank itself can fill out the certificate. In other cases, a legal entity is required to do this. The certificate must be issued on the day the funds are written off, or within 15 days from the moment they are received into the account (

Results

A certificate of currency transactions must be submitted to authorized banks by residents of the Russian Federation who use foreign currency in their activities.

A special form approved by the Central Bank of the Russian Federation is provided for this document. In addition, there are time limits for filing it, violation of which entails penalties in the form of fines or blocking of the account. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to fill out a certificate of foreign exchange transactions 2022

The certificate form contains the following fields that the legal entity will have to fill out independently:

- First line: indicate the name of the bank in full or in an abbreviated version.

- Second line: indicate the name of the legal entity (abbreviated) or full name of the individual.

- Field “Account number”: here indicate the number of the resident’s account to which funds were credited, or the account from which funds were debited. In certain cases, this field does not need to be filled in. We are talking about when the certificate reflects currency transactions under a lending agreement, for which there is an issued transaction passport, and the transactions were carried out through a resident’s account opened with non-resident banks. Also, filling out the field will not be required if the certificate contains data on currency transactions under the loan agreement made by third parties.

- Field “Country code”: indicates the code of the country to which the financial company belongs.

- Last field: the symbol “*” is indicated, indicating the sign of adjustment, and, if necessary, a number is placed next to it, for example “*1”. The field is filled in when a certificate is drawn up indicating new data on a previously completed transaction. In other cases, this field does not need to be filled in.

This is followed by a table containing information about the currency transaction:

- The first column is the serial number.

- The second column is the number of the notification (other document) confirming the operation.

- The third column indicates the date of the currency transaction.

- The fourth column indicates the sign that determines the withdrawal or crediting of funds to the account.

- Fifth column - you should indicate the currency transaction code, which can be found in the directory of the same name.

- The sixth column indicates the currency code.

- The seventh column indicates the transaction amount.

- The eighth column – the number of the passport (other document) of the transaction is entered.

- The ninth column indicates the transaction code, which can be found in the contract.

- Tenth column - enter the amount indicated in column 7, converted into the currency indicated in 9.

- The eleventh column indicates the period within which the advance will be returned.

- The twelfth column sets the deadline within which the obligations under the contract must be fulfilled.

Important! The notes line may contain any additional information regarding the execution of a currency transaction.

At the bottom of the certificate form, you need to fill in information about the bank. The document can also be submitted electronically, in which case it is signed with an electronic signature.

Is it necessary to indicate a currency transaction code in a payment order?

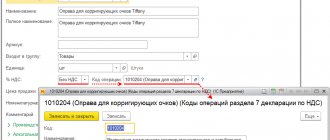

The Law also lists transactions carried out in Russian currency. In this case, you need to pay attention to one feature of filling out the payment order. In such payments it is important to indicate the VO code.

The current currency transaction codes are indicated in our material .

The required code is entered in the “Purpose of payment” field of the payment document.

Read about the code display format in the article “How to specify a currency transaction code in a payment order?” .

Requirements for filling out a certificate of currency transactions

Each document, including reporting ones, must be completed in compliance with certain requirements and rules. A certificate of currency transactions is no exception. The certificate is drawn up in one copy and in compliance with the following rules:

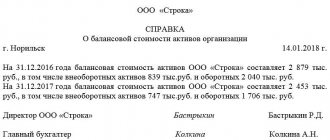

- When filling out the name of a company or banking organization, it is possible to use abbreviated versions.

- If foreign currency funds are received through the banking organization of a foreign partner, then his TIN should be indicated (you can find it out in OKMS).

- When preparing a corrective certificate for currency transactions, the date of actual preparation of the document should be indicated.

- Column 3 of the certificate indicates the date of the transaction. If we are talking about receipts, then the date of crediting to the account is indicated, and if we are talking about write-offs, then the date of write-off.

- Column 5 contains a code that indicates the nature of the operation.

Instruction No. 138-I: payment indicator, adjustments and other features of entering data into the certificate

The procedure for filling out a certificate of foreign exchange transactions is established by the Bank of Russia in a special regulatory act - BR Instruction No. 138-I dated June 4, 2012. A certificate of foreign exchange transactions for 2022 (the document form of which can be filled out at your authorized bank) is submitted by the resident in a single copy.

Among the features of filling out the certificate, the following should be highlighted:

- when writing the name of the resident in the title part, the certificate of currency transactions may contain abbreviations of the organizational and legal form, for example, individual entrepreneur, LLC, PJSC, etc.;

- the name of the authorized bank can also be written in an abbreviated (company) form;

- if currency transactions were carried out through an account opened with a non-resident bank, then in the corresponding column of the certificate of currency transactions it is necessary to indicate the digital code of this bank (the codes of such banks are contained in OKMS);

You will learn about what kind of currency transactions there are from our article “Currency transactions: concept, types, classifications”.

- the “asterisk” symbol is entered in a special field indicating an adjustment only if a certificate of currency transactions is submitted to clarify previously submitted information;

- if an adjustment certificate on currency transactions is being filled out, then in the column indicated “from__” (after the name of the document) the date of the document being adjusted is indicated;

- in column 3 of the tabular part of the certificate of currency transactions, the date of crediting funds to the resident’s account (transit or opened in an authorized bank), or the date of drawing up the order to transfer money (settlement document), or the date of transfer/write-off of money or the transaction;

- Column 4 contains the payment attribute indicator:

- number 1 means that funds are credited to the resident’s account;

- 2 – that a debit is being made from his account;

- 7 – that funds are credited to a financial agent (factor) who is a resident if the certificate is filled out by a resident who issued a transaction passport;

- 8 – that the funds are credited to another person - a resident or a resident who does not issue a transaction passport, if the certificate is filled out by a resident who has issued a transaction passport;

- 9 – that funds are debited from the account of a resident acting as a third or other party or not issuing a transaction passport, if the certificate is filled out by a resident who has issued a transaction passport;

- 0 – that funds are being transferred to a non-resident under a letter of credit.

Detailed information about codes for types of currency transactions is contained in our article “Directory of codes for types of currency transactions (2016-2017)”.

- Columns 9, 10 of the tabular part of the certificate of foreign exchange transactions are filled out only if the foreign exchange transaction is related to the execution of the agreement under which the transaction passport is issued.

For information about what package of documents banks require when operating enterprises with foreign currency, read the material “What documents are required for currency control?”

Read more about the rules for issuing a transaction passport in the article “How to issue a transaction passport for foreign exchange transactions?”

Expected time

In the certificate, the expected period is indicated in column 11. This column is filled in based on the data specified in the contract. This is the deadline within which the non-resident is obliged to fulfill his obligations, or the expiration date of the obligations. When specifying this period, the period required for importing the goods into the Russian Federation should be added to it.

If the contract does not provide for a specific period, then the resident must calculate it. The date indicated in column 11 should not be higher than the date indicated in column 3 of section 3 of the Transaction Passport.

In the documents confirming the transaction, this date is determined by the conditions under which the contract was executed. The time specified must be no earlier than that specified in the contract. Otherwise, the transfer will already be considered as late.

Important! Failure to comply with tax laws may result in the violator's account being blocked.

Transaction passport

The transaction passport, based on the requirements of paragraph 6.1 of the Instructions, is the main document of the company that the bank requires to control the movement of currency. Appendix No. 4 to the Instructions provides 2 forms of passport form (for a contract and a loan agreement).

The document is sent to the bank in which the company has a foreign currency account used for settlements on the transaction (in this case, a separate passport is made for each contract). In addition to the passport, the organization, in view of clause 6.6 of the Instructions, must submit to the bank the concluded agreement and other papers that are indicated in the passport or are required to confirm the information indicated in it.

When sending a draft agreement along with a passport, the requirements of paragraph 6.12 of the Instructions oblige the company to send an already signed contract within 15 days from the date of its conclusion. The bank, in turn, is given 3 days to verify the submitted documents. If they meet the requirements, he must draw up an electronic passport for this transaction and also assign an account number to it. In this case, the document is recognized as ready from the moment it is signed by a bank employee and assigned a number.

The law does not establish a specific deadline for providing a transaction passport, but you should know that it must be sent to the bank, in accordance with paragraph 6.5 of the Instructions, simultaneously with the SVO or SPD (depending on which of the specified certificates is issued earlier).

Who is required to issue a certificate of currency transactions?

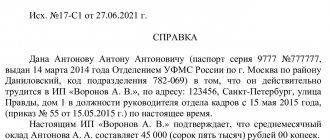

Residents conducting currency transactions (crediting money to a transit currency account or debiting currency from a current account) are recognized as obligated to issue a certificate. The certificate is not completed by residents and non-residents who are individuals (not individual entrepreneurs or persons engaged in private practice).

According to the agreement on maintaining and servicing a foreign currency account, the company has the right to transfer to the bank to independently fill out a certificate. But if the bank provides a certificate with information with which the resident does not agree, then a corrective document must be provided.

Certificate of supporting documents

The need to draw up the SPD, as well as the documents attached to it confirming the execution of the transaction, is provided for in clause 9.1 of the Instructions. This certificate is completed on a unified form, which can be found in Appendix No. 5 to the Instructions (you can also familiarize yourself with the filling procedure there).

It should be remembered that the SPD is issued only if a passport was previously issued for the transaction. Accordingly, a certificate is submitted, in accordance with clause 9.1 of the Instructions, to the bank branch that issued (or will issue) the passport.

The list of documents that confirm the fulfillment of the resident’s obligations under the transaction is contained in paragraphs 9.1.1–9.1.4 of the Instructions and is determined taking into account the content and features of the specific commercial transaction. Thus, when importing (exporting) goods, supporting documents are a customs declaration (or an application for conditional release), as well as commercial, shipping, transportation or other similar documents. When performing work or providing services, acceptance certificates, invoices, accounting and other papers will serve as confirmation.

Clause 9.4 of the Instructions allows the organization to enter into an agreement according to which the responsibility for preparing the SPD will be assigned to the servicing bank. In this case, the organization is only required to submit supporting documents in a timely manner.

Procedure for making adjustments

If any data in the certificate needs to be changed, then it must be corrected, with the exception of information about the resident and the bank. In order to change the information in the certificate, the company submits a new certificate to the financial institution. The correct data is entered into it, while the order and filling rules remain the same, but where necessary, new data is indicated. Documents confirming the changes made are attached to the certificate.

Important! After drawing up the certificate, the resident must submit it to the bank, and the bank must accept it.

How changes are made to a certificate filled out by the bank

If the certificate is filled out by the bank, then the same applies to the corrective document. But this condition must be provided for in the agreement with the bank. When the authority to fill out the certificate is transferred to the bank, the client does not need to fill out the certificate, nor does he need to monitor the contents of the certificate. Even if the document is not submitted on time, the resident will not be held liable. However, the client still has the obligation to provide a certificate within the time limits provided for when filling out the document independently.

After the bank fills out the certificate, it must be given to the client. If the client does not agree with the contents of the certificate, he submits a certificate with corrected data within 15 days. The following documents are attached to the certificate:

- a statement indicating that the bank certificate contains incorrect information;

- other documents that have not previously been submitted to the bank.