We present to our readers a complete list of taxpayers who are required to submit a 3rd personal income tax declaration to the Federal Tax Service:

1. Citizens who independently calculate and pay personal income tax to the budget. These include, firstly, entrepreneurs on the general taxation system, regardless of whether they received income in the reporting year or not (Article 229 of the Tax Code of the Russian Federation). Secondly, residents who receive income from sources outside of Russia. And thirdly, citizens who received income from the sale of their own property (Articles 227, 228 of the Tax Code of the Russian Federation).

Exceptions in this category are citizens whose income from the sale of property is less than the property deduction; they may not submit 3-NDFL. Deductions for them are determined by Part 2 of Article 220 of the Tax Code of the Russian Federation:

- 1,000,000 – property deduction for the sale of residential real estate that was owned for less than 3 (for some categories 5) years;

- 250,000 – deduction from the sale of other real estate that was owned for less than the minimum period of ownership of the property.

That is, if, for example, an apartment was sold for 950,000 rubles, the tenure of which was 1.5 years, then the deduction will cover taxable income, therefore, there is no need to submit 3-NDFL (Law 321 Federal Law of September 29, 2019).

2. Notaries engaged in private practice, lawyers who have established law offices, and other persons who are engaged in private practice (subparagraph 2, paragraph 1, paragraph 5 of Article 227 of the Tax Code); 3. Foreign citizens who are employed by individuals on the basis of a patent are required to submit a declaration in the cases specified in paragraph 8 of Article 227.1 of the Tax Code; 4. An individual entrepreneur applying a special regime, but due to exceeding one of the thresholds of the special regime, must pay taxes according to the general system (clause 1, 5 of Article 227 of the Tax Code). For example, an individual entrepreneur was on the simplified tax system and lost the right to apply it, since he began to produce excisable goods that did not fall under the exceptions specified in subclause 8 of clause 3 of Article 346.12 of the Tax Code (clause 4 of Article 346.13 of the Tax Code).

Be careful: even when there is nothing extra to pay into the budget and, as a result of the calculation, the tax base is equal to zero, it is necessary to submit 3 personal income taxes to the categories listed above. For example, if, when selling a car, its value was completely covered by a property tax deduction. The tax office still needs to be notified for what reasons the tax does not need to be paid. It is for these purposes that a zero declaration is needed.

An individual entrepreneur using the simplified tax system or PSN does not pay income tax for himself, therefore, following paragraph 3 of Article 346.11 of the Tax Code of the Russian Federation, he does not submit a 3-NDFL declaration.

The deadline for submitting 3-NDFL for 2022 is approaching. You should not put off submitting this report until the last minute, but think about filling it out now. The Declaration program can help you fill out the report. You can download the “Declaration” 3 personal income tax program for 2022 for free using the button at the bottom of this page. For each reporting year, you must fill out data in the appropriate software for exactly the period for which you want to receive a tax deduction.

If you need to receive a deduction for 2022, then you need to fill out the 3-NDFL declaration for 2022, and similarly for other years. Let's figure out how to use this program.

From January 1, 2022, for reporting for 2022, we fill out a new form 3-NDFL, approved by Order of the Federal Tax Service dated October 15, 2021 No. ED-7-11/903. There have been minor changes in the new Form 3 of personal income tax for 2022:

1. Title page - barcodes have changed, information about who issued the identity document and when was canceled.

2. Appendix to Section 1 - removed the line - tax or billing period code.

3. Section 2 – instead of indicating information by rates, indicate information by income. New lines added:

- 061 – for the base at a rate of 13%;

- 062 – for the base at a rate of 15%;

- 063 – for other bets;

- 081 - for personal income tax at a rate of 15%.

4. Appendix 2 - now indicate 2 country codes: the country of the source of payments and the country of enrollment. Lines 071-073 were combined into one.

5. Appendix 3 – calculation included, field for OKVED excluded.

6. Appendix 7 – two codes for the object number were left: 1 – cadastral number; 2 - number is missing. Included lines 2.3.1 and 2.4.1 for simplified deduction.

The advantages of filling out the 3-NDFL declaration for 2022 in a special program on the Federal Tax Service website is that the program has built-in functions that allow you to check the correctness of filling out the required details. The software already contains control ratios that are relevant for this reporting form for the current period.

Filling out the declaration does not cause problems. It is enough to write down all the necessary information in the sections of the program one by one. The software is configured in such a way that the output will be generated only those sheets and pages in which the information is filled out. There is no need to print out all pages of the declaration (15 sheets in total) and submit it to the Federal Tax Service.

You can also not print it at home, but download it to a flash drive. Then, when visiting the Federal Tax Service Inspectorate, the inspector will be able to check the declaration and tell you whether there are errors in it and how to correct them.

If you are confident that you have correctly filled out the 3-NDFL declaration for 2021, you can save it and print it in two copies for submission to the INFS. 3-NDFL programs for all years are collected on the Federal Tax Service page here.

If you are registered in your personal taxpayer account, then you will be able to create a program in your personal account on the website of the Federal Tax Service of the Russian Federation.

You can also fill out Form 3 Personal Income Tax for 2021 yourself by downloading it at the bottom of the page.

The procedure for filling out 3-NDFL in the “Declaration” program

After installing the program, prepare all the necessary documents, including those that are the basis for receiving property social and standard deductions:

- your passport

- TIN

- income certificate 2 personal income tax

- certificate of registration of ownership

- contract of sale.

Then you can open the program and start filling out.

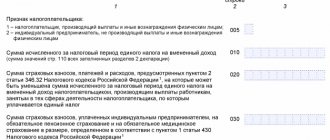

Section "Setting conditions"

The first thing to do is set the primary conditions. Namely:

1. Select the type of declaration - 3-NDFL.

2. Indicate the number of your tax office. You can find out the tax office number by going to the Federal Tax Service website at https://service.nalog.ru/addrno.do

Then you need to enter your registration address indicated in your passport in the field that opens. The service will give you the tax office number at your place of registration.

You can also select the tax office code in the program for filling out the declaration in the drop-down window by clicking on the square with dots opposite the “tax office number” window.

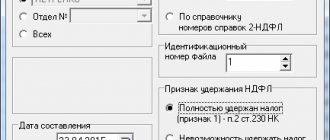

3. Indicate the correction number of the submitted 3-NDFL declaration. If you submit your first declaration for the reporting year, enter “0”. If a declaration has already been filed for the reporting year, and now you need to correct and submit another declaration, enter “1” or “2” depending on the number of previously updated declarations submitted.

4. In the “taxpayer attribute” column, indicate the attribute you require. In this case, put a dot next to the words “other individual”.

5. In the “have income” item, put a mark in the circle of the first item.

6. In the “accuracy is confirmed” section, choose how you will submit the declaration.

Section “Information about the declarant”

We proceed to filling out the next section of the personal income tax declaration 3 “Information about the declarant”. The section consists of two tabs: personal data and address. Click on the personal data tab. This section records your details exactly with your documents. Fill out all the data in the specified items; there are no difficulties in filling out this section. In the “citizenship data” section, enter country code 643. This is the code for Russia.

Then go to the address tab and fill in your information.

Section “Income received in the Russian Federation”.

The next section to fill out is “Income received in the Russian Federation.”

Let's start filling out this section by choosing a tax rate. The following tax rates are shown at the top: 13%, 9%, 35% and 13%. By placing your cursor over each bet, you will read in which case it applies. To fill out the declaration, in our case, we settle on the first rate of 13% - income received from tax agents or other sources of payments, including from individuals.

The next item is adding a payment source. Click on the green plus and enter your employer’s details. The necessary data is available in the 2-NDFL certificate issued by your employer.

Section "Deductions"

The last stage of filling out the 3-NDFL declaration is data on the provision of deductions:

- property tax deduction - if you purchased housing;

- standard child tax credit - if you did not receive a child tax credit from your employer;

- social tax deduction.

If you plan to take only one of the above deductions, then you will need to uncheck the box placed on the standard deductions tab to “allow the standard deduction.” If you plan to receive several deductions, then you do not need to uncheck the box.

By opening a tab for each deduction, you enter the necessary data confirmed by your primary documents.

Print this article, download the “Declaration” program and fill out Declaration 3 of personal income tax step by step.

“Declaration 2020” programto fill out the 3-NDFL declaration for 2020

Program “Declaration 2020”, version 1.1.0 dated January 27, 2021.

(download a free program for filling out (preparing) a tax return in 2021 in form 3-NDFL for 2022):

1) InsD2020.msi – installation file

2) Installation instructions (install)

3) Abstract to the program (readme)

About the “Declaration 2020” program

GNIVTS Federal Tax Service of Russia annually develops and offers free programs for filling out (preparing) the 3-NDFL declaration.

The “Declaration 2020” program is designed for automated completion (preparation) of personal income tax returns in 2022 in form 3-NDFL for 2020.

The “Declaration 2020” program will help you fill out the tax return form for personal income tax 3-NDFL for 2020.

1. Introduction

The “Declaration 2020” program is designed to provide automated completion of tax returns for personal income tax for 2022.

Program functionality:

- entering input information from taxpayer documents;

- calculation of derivative (final) declaration indicators;

- arithmetic control of tax return data;

- checking the correctness of calculation of benefits and tax deductions;

- checking the correctness of calculation of the tax base and tax amount;

- generation of an XML file with Declaration data;

- generation of completed forms with Declaration data and barcode;

New versions of the program are distributed via the Internet and posted on the website of the Federal Tax Service of Russia.

2. Computer and software requirements

Minimum hardware requirements:

- 14.5 MB of free disk space.

- Microsoft Mouse or compatible.

- Printer (or virtual printer)

Windows operating system and other software:

Operating system Windows 7, Windows 8, Windows 10 (with Russian regional settings).

Work on Windows Vista and Windows XP (SP3) is possible, but technical support for these operating systems is not provided.

Installation

To install the Declaration 2020 program on your computer, you must:

1. Copy the InsD2020.msi file to your computer’s hard drive;

2. Run the InsD2020.msi file under an administrator account and follow the installation program instructions.

The program automatically generates 3-NDFL declaration sheets based on the data entered by the user:

- for all taxable income received from sources in the Russian Federation and received from sources outside the Russian Federation;

- on income from business activities and private practice;

- data for calculating professional tax deductions for royalties and civil contracts;

- property tax deductions;

- data for calculating the tax base for transactions with securities, financial instruments of futures transactions and taxable income from participation in investment partnerships;

- for calculating standard, social and investment tax deductions.

WAYS TO SUBMIT THE 3-NDFL DECLARATION FOR 2022

There are several ways to submit your 3-NDFL declaration for 2022:

- submit the declaration in person by visiting the tax authority;

- instruct your representative by issuing a notarized power of attorney for him to submit the report;

- send by registered mail with a list of the contents;

- using the taxpayer’s personal account using an electronic signature.

The deadline for filing the 3rd personal income tax declaration depends on who is filing the declaration and the type of income received:

1. No later than April 30 of the year following the reporting year (clause 1 of Article 229 of the Tax Code of the Russian Federation) the following is submitted:

- entrepreneurs working on the general taxation system (for income received from activities in accordance with paragraph 1 p1 of Article 227 of the Tax Code of the Russian Federation);

- persons engaged in private practice (including notaries and lawyers who have established law offices) (based on income received from the activities of subclause 2, clause 1, article 227 of the Tax Code of the Russian Federation);

- a taxpayer who is not an individual entrepreneur (for income in respect of which a person must independently calculate and transfer tax in accordance with clause 1 of Article 228 of the Tax Code of the Russian Federation).

2. At any time after the end of the calendar year (clause 2 of Article 229 of the Tax Code of the Russian Federation), it is necessary to provide 3 personal income taxes to an individual who is not registered as an individual entrepreneur for income in respect of which this individual must independently calculate and transfer the tax (clause 1 Article 228 of the Tax Code of the Russian Federation). Provided that only deductions are declared in his declaration.

3. No later than one month before leaving Russia (paragraph 2, clause 3, article 229 of the Tax Code of the Russian Federation), a foreigner who is not an individual entrepreneur who is leaving Russia during the calendar year must submit 3 personal income tax if the income indicated is received in paragraph 1 of Article 228 of the Tax Code of the Russian Federation.

Where does an individual need to submit a declaration in form 3-NDFL?

The declaration is submitted to the Federal Tax Service at your place of residence, that is, at the address where you are registered. In the absence of permanent registration, the declaration is submitted at the place of residence. If you previously had a place of residence or stay, but at the time of filing the declaration there is no such place anymore, submit 3-NDFL at the last place of residence or stay (letters of the Federal Tax Service dated March 24, 2016 No. BS-3-11/1265, dated April 16, 2015 No. BS-4-11/6543).

EXCEPTIONAL CASE: an individual who, on the date of filing 3-NDFL, does not have registration at the place of residence or registration at the place of stay, received income from the sale of real estate or transport. In this case, guided by the letter of the Federal Tax Service No. BS-4-11/6543, the declaration should be submitted at the place of registration of the sold property. This rule is relevant for all individuals – both residents and non-residents.

Program for filling out the 3-NDFL tax return for 2022

The program for filling out personal income tax declarations for 2019 - “Declaration 2019” is intended for filling out personal income tax returns in forms 3-NDFL and 4-NDFL, in accordance with the Order of the Federal Tax Service of Russia from the Order of the Federal Tax Service No. ММВ-7-11 / [email protected] October 7, 2022:

1) installation program (InsD2019.exe file):

- version 1.1.0;

- version 1.0.1;

- version 1.0.0;

2) installation instructions;

3) abstract.

Description of the program for filling out the declaration

The most convenient and easiest way to fill out a declaration is to use the “Declaration 2019” program, designed to automatically fill out a personal income tax return for the corresponding year.

To use the “Declaration 2018” program, the taxpayer only needs to enter the initial data, on the basis of which the program will not only automatically generate declaration sheets for all taxable income received from sources in the Russian Federation and received from sources outside the Russian Federation, but will also calculate tax amounts for payment or return from the budget.

Program for filling out the 3-NDFL tax return for 2018

Order of the Federal Tax Service dated October 3, 2018 No. ММВ-7-11/ [email protected] approved a new form of personal income tax return, the procedure for filling it out and the format for submitting it electronically, in connection with which a new version of the program for filling out income declarations for individuals is expected 2018 - “Declaration 2018” for filling out the personal income tax return using forms 3-NDFL.

The program for filling out personal income tax returns for 2018 - “Declaration 2018” is intended for filling out personal income tax returns in forms 3-NDFL and 4-NDFL, in accordance with Order of the Federal Tax Service of Russia dated October 3, 2018 No. ММВ-7- 11/ [email protected] :

The program for preparing a tax return on personal income is intended for filling out tax returns in forms 3-NDFL and 4-NDFL, distributed free of charge in the form of 3 components:

1) installation program (InsD2018.exe file):

- version 1.0.0 (from December 29, 2018)

- version 1.1.0 (from 01/25/2019)

- version 1.2.0 (from 04/04/2019)

- version 1.2.2 (from 08/16/2019)

2) installation instructions;

3) abstract.

The “Declaration” program allows you to automatically generate a tax return in form 3-NDFL. As you fill out the data, the program automatically checks its correctness, which reduces the likelihood of errors.

Program for filling out the 3-NDFL tax return for 2017

The program for filling out personal income tax declarations for 2017 - “Declaration 2017” is intended for filling out personal income tax returns in forms 3-NDFL and 4-NDFL, in accordance with Order of the Federal Tax Service of Russia dated October 25, 2017 No. ММВ-7- 11/ [email protected] :

1) installation program (InsD2017.exe file):

- version 1.0.0 (dated 12/28/2017);

- version 1.0.1 (from 01/17/2018);

- version 1.1.0 (from 02/05/2018);

- version 1.1.1 (from 04/11/2018);

- version 1.2.0 (from 05/15/2018);

2) installation instructions;

3) abstract.

This might also be useful:

- Penalty for failure to submit 3-NDFL for 2022

- Declaration 3-NDFL 2022 for 2022

- Rules for filling out the 2-NDFL certificate

- Insurance premiums for individual entrepreneurs “for themselves” in 2022

- Changes in the field of insurance premiums in 2022

- New form 6-NDFL 2022

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Instructions for filling out form 3-NDFL in the program for 2022

The Declaration 2022 program allows you to calculate personal income tax and deductions based on the entered data, check the received data and generate a ready-made completed report form for submission to the Federal Tax Service.

The filling process depends on the purpose of preparing the tax return.

Form 3-NDFL is filled out in the following cases:

- Individual entrepreneur for submitting information about income from business activities;

- notaries, lawyers, private practitioners to submit information about income received;

- individuals who wish to independently pay tax on their income;

- individuals who want to receive a deduction for expenses and return part of the previously paid personal income tax.

After starting the program, a window opens with tabs on the left, in which you need to fill in the necessary data depending on the basis for filing 3-NDFL.

Setting conditions

This is the first tab in the program, which must be completed by all persons filing 3-NDFL.

What you need to fill out:

| Declaration type | It should be about, which will mean the preparation of a declaration by a resident of the Russian Federation. |

| general information | Inspection number – click on the button with the ellipsis and select the desired branch of the Federal Tax Service where the report will be submitted (at the taxpayer’s place of residence). You can scroll through the directory in search of your branch, but it’s easier to find it by a four-digit number - just start entering the digits of the Federal Tax Service branch number, and it will be found. After finding the desired branch, click on the “Yes” button, thereby confirming the choice. Adjustment number - leave 0 if the declaration is completed and submitted for the first time in 2022. If a previously submitted form is changed or clarified, then the serial number of the changes is indicated. OKTMO - this code for a taxpayer can be clarified in the classifier. If the Federal Tax Service and OKTMO numbers are not known, then you can find them on the tax website at the link: service.nalog.ru/addrno.do?t=1611198692029. Here you need to indicate your address, after which the Federal Tax Service and OKTMO code will automatically appear. |

| Taxpayer attribute | The appropriate option is selected depending on the reasons for filling out 3-NDFL. For an individual to independently pay tax, for example, on a sold property (apartment, car) or to receive a deduction (for an apartment, treatment, education), indicate “Other individual.” |

| Income available | The type of income received in the reporting year is indicated. Individual entrepreneurs must put o, then the tab on the left “Entrepreneurs” will become available to them. If in 2022 there was income from foreign companies, then you need to, and the “Income outside the Russian Federation” section will become available. If a citizen fills out a declaration who wants to return the tax or pay it themselves, and there were no foreign sources of income, then the first item must be left checked, which is selected by default when loading the program. |

| Statement data | A new function in the Declaration 2022 program that allows you to generate a return application. In this case, you will not need to write it separately and attach it to the completed 3-NDFL form. If you need to make a tax refund or offset, for example, in connection with receiving a deduction, then you should check this box, in which case a corresponding application will be generated automatically. In this case, you do not need to prepare it separately, but you will need to fill out the bottom tab “Tax Credit/Refund”. |

| Reliability is confirmed | When submitting in person Fr. When submitting through a proxy, indicate his full name and details of the power of attorney, which gives the right to file a 3-NDFL declaration on behalf of an individual. |

An example of filling out the “Set conditions” tab for a tax refund when purchasing an apartment:

Information about the declarant

The next tab in the Declaration 2022 program, which all persons must fill out, is “Information about the declarant.” This page displays data about the taxpayer who submits 3-NDFL to the tax authority.

An individual must fill out:

- last name, first name, patronymic - exactly as in the passport;

- TIN - if you don’t know this number, you can check it on the Federal Tax Service website using the link, you need to fill out information about yourself and click “send request”, after which information with the TIN number will appear;

- date of birth;

- place of birth - as in the passport;

- citizenship data - Russian citizenship is already automatically indicated with code 643;

- information about the document - you need to click on the ellipses in the “Type of document” line and select the one you need, usually it’s a passport, its details are written below;

- contact phone number - valid for communication with tax authorities.

An example of filling out the “Declarant Information” tab:

Income received in the Russian Federation

For individuals, income is reflected here, the source of which is Russian companies and citizens.

This tab is filled out by citizens who want to pay the tax themselves or return it due to deductions. Individual entrepreneurs, lawyers, and notaries should reflect income from their activities in the “Entrepreneurs” tab.

The source of income can be the employer, the buyer of the property.

If data on wages for 2022 is provided for the return of personal income tax, then you will need a 2-NDFL certificate, which should be obtained in advance at your place of work. From this certificate you can take the employer’s details, data on accruals, deductions and deductions.

If information about the buyer of property (apartment, car) is provided for the purpose of paying tax, then information about the buyer can be found in the purchase and sale agreement.

Instructions for filling out 3-NDFL when selling an apartment in the Declaration 2022 program.

The procedure for filling out the income tab in the Declaration 2020 program:

- Tax rate - the desired tax rate is selected at the top, most often it is 13 percent, and you need to select the first digit 13 (the last digit 13 is the rate at which dividends are taxed).

- Adding a source of payments - click on the green plus - indicate the name of the source of payments (name of the organization or full name of the individual), TIN, KPP and OKTMO (for the employer you can find out in paragraph 1 of the 2-NDFL certificate; for individuals to whom the property was sold, indicate this data is not necessary), check the box “Calculate standard deductions using this source” only if the employer did not provide these deductions and you want to receive them through the Federal Tax Service.

- Adding income - click on the green plus in the next field. If the source of payments is the employer, then the income codes and monthly amounts from clause 3 of the 2-NDFL certificate for the entire reporting year are indicated. If the source is the buyer of the property, indicate the income code depending on the type of property and fill in information about the funds received based on the purchase and sale agreement.

- Adding deductions - in the lower field, by clicking on the green plus, all standard, social, property deductions provided by the specified source of payments for the year are added - the deduction code and its amount are taken from clause 4 of the 2-NDFL certificate.

- Total amounts by payment source - based on the entered data, the total income value is generated automatically. These amounts can be checked against clause 5 of the 2-NDFL certificate received from the employer. From clause 5 of 2-NDFL, the total amount of tax withheld is also rewritten.

An example of filling out a tab if the source of payments is the employer organization:

Income outside the Russian Federation

This tab in the Declaration 2022 program is filled out only by those individuals who received funds in foreign currency for the reporting year 2022. In this case, on the first tab “Setting conditions” the corresponding item must be checked.

Here you also need to indicate the name of the source of payments (foreign entity), country code, dates of receipt of income and payment of tax, deductions, as well as information about the currency in which the amount received was expressed.

Entrepreneurs

This tab of the program is filled out only if on the first tab “Setting conditions” the item on receiving income from business activities is checked, that is, it is filled out by individual entrepreneurs, lawyers, notaries, heads of peasant farms and other private practitioners who want to report using a declaration 3- Personal income tax before the Federal Tax Service.

Depending on who fills out the declaration, you need to select the appropriate type of activity and indicate the amount of income.

For example, for an individual entrepreneur, filling out this program tab will look like this:

Deductions

The “Deductions” tab in the Declaration 2022 program is filled out by those individuals who wish to return 13 percent of the costs of purchasing real estate (houses, apartments, rooms, land, cottages), paying for education, treatment, and voluntary insurance contributions.

In addition, the tab is completed if the taxpayer wishes to return personal income tax due to incomplete application of standard deductions at the place of work.

At the top, you select what type of deduction the declarant wants to receive, then the necessary data is provided.

Property

Entitled to the buyer of real estate, including when purchasing housing with a mortgage - 13 percent of the costs of paying for real estate and mortgage interest are subject to refund within the limits of property deductions.

The program tab provides information about the purchased object and expenses.

Instructions for filling out 3-NDFL in the Declaration 2022 program when purchasing an apartment.

Registration of 3-NDFL in the program for mortgage deduction.

Social

A deduction is due if an individual in the reporting year had expenses for treatment, medications, training, payment of contributions under voluntary insurance contracts, charity, and qualification assessment.

13 percent is also subject to a refund, taking into account the amount of the required social deduction.

The tab indicates the amount of expenses.

Instructions for filling out 3-NDFL in the Declaration 2022 program for deductions for treatment.

How to fill out 3-NDFL in the program for deduction for education?

Standard

The program tab is completed if the individual has not fully received the required standard deductions from the employer - for children, due to a special status.

Investment

The Declaration 2022 program tab is intended to be filled out by those citizens who claim a tax refund in connection with receiving investment tax deductions.

Tax credit and refund

The last tab of the program is filled out by citizens who wish to return or offset income tax amounts. This innovation in the 2022 Declaration allows you to automatically generate a statement, which eliminates the need for its separate preparation.

The tab indicates what the person wants to do: return or offset the tax. The required amounts and bank details are provided where the Federal Tax Service should transfer the funds.

Comments

Abduaziz 07/30/2019 at 08:55 pm # Reply

What is needed for acquisition documents

Konstantin 02/13/2020 at 09:02 # Reply

Is it possible to open a declaration from the previous year?

In order not to re-enter all the details, is it possible to transfer data from the Declaration 2022 program (saved file) to the Declaration 2019

Tatyana 12/21/2020 at 10:04 am # Reply

Good afternoon Is it possible to apply a social tax deduction for the purchase of medicines if 1) the original receipt is lost, but the pharmacy gave a copy? 2) during the pandemic, were drugs purchased without a prescription because the doctor did not come for several days?

When you don't need to download anything

The most advanced individuals who need to report on their income for 2016 actively use the capabilities of the “Taxpayer Personal Account for Individuals” service on the official website of the Russian Tax Service - www.nalog.ru. In this case, they do not need to find and download the “Declaration” program for 3-NDFL for 2016 .

Using this service, users can fill out the 3-NDFL declaration online. Then there is the opportunity to immediately send it to the inspection online with an enhanced non-qualified electronic signature and along with a package of attached documents. That is, in electronic form directly from the website of the Federal Tax Service of Russia. And there is no need to separately download 3-NDFL in 2017 .

Also see “What documents to attach to the 3-NDFL declaration.”