The founders of the organization, having invested money or property in the authorized capital at one time, receive the right to income in the amount of a portion of the profit proportional to the amount of the investment. In this article we will tell you whether dividends are subject to insurance premiums and answer common questions on this topic.

The decision on how to distribute the organization's net profit is made by the board of founders. This can be like transferring money to special funds, developing production, paying dividends, etc.

Procedure for paying dividends

The procedure for paying dividends step by step is as follows:

| Step | Action | A comment |

| 1 | Calculate net profit | The basis for the payment of dividends is the profit determined after the closing of the reporting period and payment of all taxes |

| 2 | Making a payment decision | The decision is made by the general meeting of founders based on the results of the reporting period. The decision must be documented by drawing up special minutes of the meeting and an order for the payment of dividends |

| 3 | Distribute dividends | After completing the previous steps, you need to determine how much to pay each participant. Usually distributed proportionally depending on the share of each individual. Although the payment may be larger, this is fraught with certain consequences and may affect the payment of taxes |

| 4 | Pay taxes | Once all the formalities have been completed, the order has been issued, the amounts have been determined, the next step is to pay taxes. In fact, dividends are income, and therefore taxes are paid on them accordingly:

|

Payments to participants of dividends in case of loss

When a business entity decides to carry out its business activities as a legal entity, its owners can receive their income from participation in the activities of the company through the dividend payment procedure, which is regulated by law. How dividends are paid to the founders of an LLC in 2022, let's look at the step-by-step instructions.

Dividends are usually called a part of the net profit received by the company, which, by decision of the participants of the legal entity, is directed to payment to them in proportion to the share of their contribution to the authorized capital or by another method of distribution established in the company’s charter.

Net profit is the profit that remains at the disposal of the company after making all obligatory payments to the budget.

Payment of dividends to the founders of an LLC is possible under certain conditions from net profit, which are defined in the relevant legislation.

Therefore, the source of dividends to the founders is profit. It is calculated on the basis of accounting information. To decide on the payment of dividends to an LLC, the owners must first approve the financial statements, which reflect the presence of net profit.

The legislation provides for the possibility of paying interim dividends. Their source is the retained earnings of the current year. However, such an opportunity exists if the enterprise received it during the selected period of time (quarter, half-year).

Attention! Since the current algorithm for calculating profit determines the need to determine it on an accrual basis for the year, its final size can only be determined based on the results of the past year. Then, if the founders decide to pay dividends, it will be necessary to take into account the amounts they received interim during the year.

The following payments made by owners are not considered dividends:

- Payments to a liquidated organization in an amount not exceeding the owner’s contribution to the authorized capital.

- Payments to the founders in the form of the organization buying out their shares in the company into ownership.

- Payments to a non-profit organization for its activities provided for by its charter, if it is one of the owners of the company.

The basis for paying dividends is either a decision of the owner of the company or the minutes of a meeting of its participants. Therefore, to accept these documents, it is necessary to gather the owners of the company. For the meeting itself, it is also necessary to prepare financial statements for the relevant period, which will establish the fact that the business entity has received a profit.

It must be remembered that the decision to pay dividends is made not by the management of the company, but by its owners, who may also be more than one person.

We suggest you read: Return high-quality and defective outerwear to the store

Since annual reports are submitted to regulatory authorities no later than March 31, the meeting is held from March 1 to April 30 of the following reporting year.

A decision or protocol reflecting the will of the owners regarding the payment of such income must necessarily contain:

- The year for which such payment will be made.

- Part of the profit that the owners used to pay dividends.

- In what form will payments be made, as well as their schedule indicating the final deadline for making such payments.

Attention! In this case, it is sufficient to indicate in the decision or protocol only the total amount of dividends to be paid. This is due to the fact that the procedure for their distribution is determined in the company’s charter or in proportion to the share of participation of each owner.

The legislation defines the conditions under which an organization has the right to pay dividends to its owners:

- The amount of net assets exceeds its own capital and reserve capital. – This condition must be observed both before and after the payment is made.

- The debt of the founders for the formation of the authorized capital must be fully repaid, that is, it must be paid in full.

- The full cost of the participation share was paid to the withdrawing participant.

- If the company does not have signs of bankruptcy or this procedure is not already underway in relation to it.

Important! Dividends can be paid if all conditions are met. Otherwise, the company's management must refuse to pay dividends to its owners.

The company can make payments to its founders when carrying out activities that result in a positive financial result. It can be determined intermediately based on data from interim financial statements, that is, for 1 quarter, half a year, 9 months.

It is prohibited to make payments within a shorter period of time. The main thing is that this procedure is provided for by the company’s charter. The final financial result for the year can be determined after its end.

Since a loss may be incurred by the end of the year, it is recommended to make payments to the founders throughout the year, only if you are confident that in the end a profit will be made during the year. Most often, interim dividend payments are observed in small enterprises.

Attention! Once a decision is made to pay dividends, in accordance with the law, they must be paid within 60 days. However, other payment terms may be established in the organization’s charter.

The owners of the company can be either one person or several participants. In the first case, the need to distribute dividends does not arise. However, if there are several founders, then it is necessary to determine the procedure for distributing dividends.

The minutes of the meeting of company participants can only contain the total amount of net profit that the founders allocated for the payment of dividends. The method of distribution of dividends is determined in the articles of association.

Most often, this document provides for distribution in proportion to the owner’s share of participation in the authorized capital. That is, each founder has a percentage ratio (for example, 50%).

The total amount of dividends is multiplied by this percentage, as a result of which the amounts due to be paid to the owners are determined in monetary terms.

Attention! The charter may also provide for a different procedure for the distribution of dividends. If payments are made to owners without following the distribution procedure, these amounts cannot be considered dividends.

For the company, this may lead to the fact that it will have to tax the amounts paid with insurance premiums. Since in this case, payments will be considered not as dividends, but as income paid to an individual (if the owner is an individual).

Tax on the payment of dividends is levied on both individuals and legal entities.

The calculation of tax for individuals depends on whether they are considered residents of the country or not:

- Personal income tax for residents - 13%;

- Personal income tax for non-residents - 15%.

The status is determined based on the number of days over the last year the person was on the territory of Russia (the days do not necessarily have to be consecutive). If the number is at least 183, then the person is considered a resident.

In addition, legal entities can also be recipients of dividends. The procedure for calculating tax for them is established by the Tax Code.

We invite you to familiarize yourself with: Taxation of payments under civil contracts

The tax amount is set as follows:

- For a Russian company - 13%;

- For a Russian company, if it owned at least 50% of the number of shares at least 365 days before the date of the decision to pay dividends - 0%;

- Foreign company - 15% or another rate when it is established by foreign tax legislation in order to avoid double taxation.

To confirm a Russian company’s right to a benefit, it must submit one of the forms included in the following list of documents:

- Purchase and sale agreement;

- Deciding on division, conversion, etc.

- Court decisions;

- Memorandum of association;

- Transfer certificate

- Etc.

Attention! Dividend tax must be paid not only by persons on OSNO, but also by those using special regimes (under the simplified tax system, UTII, UST). This is indicated in the relevant chapters of the Tax Code.

An organization can pay dividends if its net assets are greater than its authorized capital. The amount of capital is known; it is necessary to calculate net assets.

This indicator can be calculated according to data from the balance sheet.

Net assets = (line 1600 - Debt of the founders) - (line 1400 line 1500 - Income of future periods).

Important! If the resulting result turns out to be less than the amount of the authorized capital (and this may happen if the balance sheet reflects the loss of previous years), then dividends cannot be paid.

If the conditions for payment are met, then it is necessary to gather all the founders and make a decision whether to pay dividends or not. In the latter case, they can be sent to develop the company.

In addition, the owners must decide whether to pay all or any part of the net profit as dividends. Another issue that needs to be resolved at the meeting is how to distribute profits among participants. This can be done in proportion to the available shares, or according to some algorithm (it must be recorded in the Charter).

The decision to pay must be made by a majority. If there is only one owner of the company, then he makes the decision alone.

Based on the results of the meeting, minutes are drawn up. It must contain the name of the company, a list of the owner of the company and the size of the shares, the agenda, the decision made, the amount, timing, payment format.

You can specify the payment period in the protocol. If it is not indicated, then this must be done within 60 days from the date of the decision.

The clerk, secretary or other responsible person issues an order for the payment of dividends. In it, the manager instructs the chief accountant or other person to ensure the implementation of the decision made at the meeting and documented in the form of minutes. The latter is included as an annex to the order.

Dividends are calculated according to the selected algorithm. At the same time, the amount of tax that is withheld from each amount is determined.

Dividends can be paid either from the cash register or from a current account. After this, no later than the next day, the business entity transfers the tax to the budget.

At the end of the year, the LLC had a net profit of 313,440 rubles. The authorized capital is formed by three participants: Ivanov with a share of 20%, Petrov with a share of 35% and Sidorov with a share of 45%.

Taxes payable on dividends

The following taxes must be paid on dividends:

| Resident/Non-Resident | Persons | Tax | Bid |

| Residents | Individuals | Personal income tax | 13% |

| Legal entities | Income tax | 13% | |

| Legal entities with a share of more than 50% | Income tax | 0% | |

| Non-residents | Individuals | Personal income tax | 15% |

| Legal entities | Income tax | 15% |

Restrictions on payment of dividends to founders

We must never forget that every operation within the framework of the activities of any organization is subject to clear regulation by the relevant authorities. Therefore, before making a decision on the distribution of profits, it is necessary to make sure whether the organization has the right to take this action. There are a number of restrictions under which dividends cannot be paid:

- the authorized capital has not been fully paid up; depending on the situation, the share may be redistributed among the remaining founders or, in the worst case, the organization may be liquidated due to a claim from the tax authorities;

- the organization did not repay the debt to one of the share investors who expressed a desire to leave the share ownership;

- the organization, for some reason, is on the verge of bankruptcy or there are obvious reasons that could lead to it;

- the amount of net assets after the closing of the reporting period according to accounting data turned out to be less than the amount of the authorized capital, this condition is mandatory for all organizations and is enshrined in a regulation approved by the Ministry of Finance;

- at the end of the reporting period there is an uncovered loss.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Pravo-info » Articles from magazines » NON-PROPORTIONAL DIVIDENDS: WHAT ABOUT PIT AND CONTRIBUTIONS

Based on materials from the magazine "Glavnaya Ledger"

N. Matsepuro

Since 2015, the personal income tax rate in relation to the income of individuals who are residents of the Russian Federation in the form of dividends has become equal to the general tax rate of 13% <1>. Participants in some LLCs considered that there are now no obstacles to distributing net profits disproportionately to their shares in the authorized capital. After all, residents of the Russian Federation will no longer be able to charge additional personal income tax on the amount exceeding the proportional distribution, which is not dividends. Let's see whether in such a situation the LLC and its participants really have nothing to fear.

Personal income tax

If dividends are paid disproportionately, then that part of the payments that is proportional to the share in the authorized capital is dividends, and the part that is above is another income <2>. The same personal income tax rate as for dividends is applied to such other income - 13% <3>. In this case, the LLC acts as a tax agent in both cases <4>. Therefore, the participant will not have to calculate and transfer personal income tax himself.

LLC only needs to remember the following:

— in the 2-NDFL certificate, the amounts paid must be divided into two types of income: dividends with code 1010 and other income with code 4800 <5>;

— standard and other tax deductions <6> do not apply to dividends. But there are no such restrictions regarding the amount exceeded.

Insurance premiums

Insurance premiums are not charged on dividends, including disproportionate ones. Since these are payments based on the decision of the general meeting of participants, and not for the performance of labor duties and civil contracts <7>. However, if the participants are employees of the LLC, then fund inspectors may consider that the “super-dividend” amounts were paid as part of an employment relationship. To dissuade them from this, show the decision of the general meeting and the charter. These documents will confirm the purpose of payments.

* * *

Sometimes dividends distributed by decision are proportional, but actual payments are not. So, if one of the participants refuses his dividends in favor of another participant, then the refused participant will still have income, the tax on which must be withheld by the LLC <8>. In addition, the recipient participant must pay personal income tax on such a gift (if the donor participant is not his close relative), but on his own <9>.

———————————

<1> clause 3 art. 214, paragraph 1, art. 224, paragraph 5 of Art. 275 of the Tax Code of the Russian Federation (as amended by Law dated November 24, 2014 N 366-FZ)

<2> clause 1 art. 43, sub. 10 p. 1 art. 208 Tax Code of the Russian Federation; Letters of the Ministry of Finance dated July 30, 2012 N 03-03-10/84; Federal Tax Service dated August 16, 2012 N ED-4-3/ [email protected] ; Resolutions of the Federal Antimonopoly Service NWZ dated 04/28/2012 N A13-7191/2010, dated 04/18/2012 N A13-13347/2010

<3> clause 1 art. 224 Tax Code of the Russian Federation

<4> clause 1 art. 226 Tax Code of the Russian Federation

<5> Appendix No. 3 to the Order of the Federal Tax Service dated November 17, 2010 N ММВ-7-3/ [email protected]

<6> clause 3 art. 210 Tax Code of the Russian Federation

<7> Part 1 Art. 7 of the Law of July 24, 2009 N 212-FZ; clause 1 art. 20.1 of the Law of July 24, 1998 N 125-FZ; Letter from the FSS dated November 17, 2011 N 14-03-11/08-13985

<8> clause 1 art. 210, subp. 1 clause 1 art. 223 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated October 4, 2010 N 03-04-06/2-233

<9> sub. 7 clause 1, paragraphs. 2, 4 tbsp. 228 Tax Code of the Russian Federation

First published in the journal "Glavnaya Ledger" 2015, N 10

Accounting for reflecting dividends

When taxed, the following transactions are charged:

| Debit | Credit | Description |

| 84 | 70 (75) | Calculation of dividends to the founders of the organization |

| 70 (75) | 68 | Taxes are calculated depending on whether an individual works in a given organization or not. For a working employee it is personal income tax, for a non-working employee it is income tax. |

| 70 (75) | 50 (51) | Dividends paid |

| 70 (75) | 90 | Revenue from payment of dividends on products |

| 90 | 41 (43) | Reflection of the cost of products transferred as dividends |

| 90 | 68 | VAT accrual on property transferred as income from equity participation |

An example of calculating tax withholding on income from equity participation

Initial data: Balanov O.P. owns a 10% share of Severny Wind LLC, O.P. Balanov. is an employee of this organization. owns a 20% share of Severny Wind LLC. The net profit for 2016 amounted to 4 million rubles. At the board of founders, it was decided to direct all net profit to pay dividends.

Calculation:

- Amount of payments for O.P. Balanova = 4,000,000.00 * 10% * (100% – 13%) = 348,000.00 rubles

- Amount of payments for CJSC "Cotton swab" = 4,000,000.00 * 20% * (100% - 13%) = 696,000.00 rubles

- Explanations: The income tax rate for income from equity participation in other enterprises is 13%.

Payment of insurance premiums from dividends

A common question that has been actively discussed lately is whether it is necessary to pay insurance premiums on dividends. As already mentioned, dividends are income from equity participation, on which, under Russian law, recipients must pay appropriate taxes. It should be understood that dividends are not remuneration for the founders for performing any duties as management companies; they are their income from investments in cash or property.

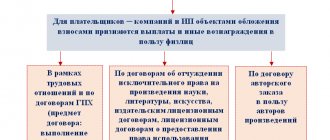

In accordance with existing legislation, the basis for calculating contributions to extra-budgetary funds are:

- Income received under an employment contract concluded for the performance of agreed work and provision of services to the organization by the employee;

- Payments and rewards within the framework of fulfilling contract orders, licensing agreements, etc.

To summarize, we can conclude that only payments for specific work and services are subject to insurance premiums.

That is, if the founder does not have an employment contract with the organization, then the payments due to him cannot be the basis for charging contributions to extra-budgetary funds. Consequently, income from equity participation is not subject to the calculation of insurance premiums transferred to extra-budgetary funds.

Are dividends subject to insurance premiums in 2022?

No. Insurance deductions from dividends were not made in the past; nothing has changed in 2022. Art. 420 of the Tax Code of the Russian Federation defines objects subject to insurance premiums, and dividends do not apply to them.

Are insurance premiums paid on dividends if the recipient is a company employee?

The director of the company is at the same time its founder; the shareholder works in the company whose shares he owns. This is not that uncommon. Why not add interest on contributions to the organization to your salary? In this case, they would be subject to mandatory deductions.

But! Profit from investments and wages should not be confused. Payments on shares are not included in the wage fund; they must be taken into account separately. They are also not subject to contributions.

Directions for using profit by an individual entrepreneur

The income of an individual entrepreneur is his net profit, which remains after deducting all expenses, paying all prescribed taxes and other obligatory payments. According to existing legislation, an entrepreneur has every right to freely dispose of his income, since he is the sole owner of all money earned from business activities. Also, there is no regulation of the areas of use of profit; accordingly, payment of income from equity participation to oneself in this situation cannot be.

Typical errors in dividend calculation

Mistake #1. Exemption from taxes for organizations applying special regimes

The application of any special taxation regime does not constitute a basis for exemption from payment of the corresponding taxes established on income from equity participation. Although the special regime itself acts as an alternative to paying three taxes, including income tax, this applies only to the main activity. An exception may be the situation when dividends are paid in kind and are essentially sales.

Mistake #2. Refund of personal income tax paid to the budget

On dividends that are required to be paid to a non-resident, the organization must calculate personal income tax at a rate of 15%. In a situation where a non-resident has changed his status of residence in our country and has completed all the documents for obtaining residency, he has the right to apply for a tax recalculation for the current year in which he received a new status at a rate of 13%. However, the tax office will recalculate and return it.

Mistake #3. Payment of income from equity participation in kind by an organization using a special tax regime (UTII)

In the case where an organization applies UTII, the transaction for the transfer of property as income from shared ownership must be taxed within the limits established for the special regime.

Dividend tax for legal entities in 2022

A participant in a limited liability company can be not only an individual, but also a legal entity (Russian or foreign company). Taxation of dividends paid by legal entities in 2022 is carried out according to the standards established by Article 284 of the Tax Code of the Russian Federation.

| Tax rate on dividends in 2022 for organizations | |

| Russian organization | 13 percent |

| A Russian organization, if for at least 365 calendar days before the decision to pay dividends is made, it owns a share of at least 50% in the authorized capital of the organization that is the source of the payment. | zero |

| Foreign organization | 15 percent or other rate if provided for by an international agreement for the avoidance of double taxation |

As we can see, if a Russian organization has at least 50% in the authorized capital of another Russian company, then no income tax is levied on dividends received (zero rate). To confirm this benefit, the participant-legal entity must submit to the inspection documents confirming the right to a share in the capital of the organization paying the income.

Such documents may be:

- contract of sale or exchange;

- decisions to divide, spin off or convert;

- court decisions;

- agreement on establishment;

- deeds of transfer, etc.

Income tax on dividends in 2022 is also established for legal entities that operate under special regimes (USN or Unified Agricultural Tax). In relation to the income they receive from their activities, such legal entities do not pay income tax. However, exceptions are made for income received from participation in other organizations:

- for companies using the simplified tax system, the provisions of paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation apply;

- For companies on the Unified Agricultural Tax, the norms of paragraph 3 of Article 346.1 of the Tax Code of the Russian Federation apply.

These articles explicitly state that the special tax regime does not apply to profits received from participation in other enterprises.

Thus, the tax on dividends of a legal entity for 2022 is paid in the form of income tax (at the rates indicated in the table), even if, in general, a company under a special regime is exempt from paying this tax.

As in the case of an individual participant, the tax agent obligated to withhold and remit income tax is the organization that paid the dividends. The tax payment deadline is no later than the day following the day of payment (Article 287 of the Tax Code of the Russian Federation).