An order on the right to sign primary documents is written in cases where the head of an enterprise needs to authorize one of his subordinates to endorse various documentation. As a rule, this practice is common in large and medium-sized organizations, where the director does not physically have the opportunity to get acquainted with and endorse all current papers.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

What are primary documents

Primary documentation includes any accounting and tax accounting documents:

- invoices,

- money orders,

- acts,

- extracts,

- certificates,

- waybills, etc.

For the most part, these documents must be drawn up without a single mistake and at the same time endorsed by the signatures of responsible employees and/or the director of the company.

Bank documents

The chief accountant may not have the right to sign bank documents (clauses 7.5, 7.6 of the Bank of Russia Instruction No. 153-I dated May 30, 2014).

The right to sign them belongs to the sole executive body of the client (the head of the organization). This right can also be granted to other employees - on the basis of an administrative act or power of attorney.

Legal entities draw up a card in form No. 0401026, which is approved by Instruction No. 153-I.

A card with sample signatures and seal impressions is filled out when opening a current account. It is valid until the bank account agreement is terminated or until this card is replaced with a new one.

You will have to change the card in the following cases:

- replacement or addition of at least one signature;

- replacement or loss of seal;

- changing the full name of the person indicated on the card;

- changing the name, organizational and legal form of the organization;

- early termination or suspension of powers of management bodies.

Thus, hiring a chief accountant without the right to sign will not affect the bank card in any way.

If, in the event of the director’s absence, such a right is granted to the chief accountant, he will first have to issue an order about this, and then replace the bank card during the director’s absence.

Procedure for granting signature rights

First of all, the management of the enterprise identifies employees who, due to their line of work, constantly encounter various types of documents. Then it is decided how to grant them the right to sign. This can be done in two ways:

- drawing up a special power of attorney,

- writing an order.

A power of attorney is appropriate in cases where documents are signed not only on the territory of the enterprise, but also in other places: for example, when a freight forwarder driver receives cargo from a warehouse of a partner organization or when an accountant receives a bank statement, etc. Another distinctive feature of a power of attorney is that it can be issued not only to a full-time employee of the enterprise, but also to an outside person. The order applies only to those employees who are registered in the company and receive the right to sign strictly internal corporate documents.

After drawing up the order, the head of the enterprise must verify the signatures of the subordinates mentioned in it with his autograph. The duration of the order is determined individually: it can be of an indefinite nature, or it can be drawn up for a period of one quarter, six months, a year, etc. depending on the situation within the company.

What to do before placing an order

The first part of the changes to 63-FZ came into force on July 1, 2021, and the second will take effect on January 1, 2022. In fact, after 07/01/2021, nothing will change in the work of customers and suppliers. If an organization has a valid signature issued by an accredited certification center, then it does not need to be changed. According to the new regulations, digital signature will have to be used only from 01/01/2022. If the validity period of the electronic signature expires before 01/01/2022, then it should be changed, but only in a certification center accredited (re-accredited) according to the new rules. If the signature was made before 07/01/2021 in a center that has not been accredited under the new rules, then it is valid only until 01/01/2022. The accreditation order and the list of accredited certification centers (ACCs) will be released closer to the beginning of 2022.

IMPORTANT!

All key changes will take effect from 01/01/2022. From January 1, not only the director, but also authorized persons, including procurement specialists, are required to use a personal electronic signature both for work and for their own documents (clause 2, clause 1, article 17.2, clause 2, article 17.3 476-FZ). To issue a personal signature of an individual, an order is not required: it indicates only the full name of the recipient without reference to his employer. Such electronic signature should be obtained only from CAs accredited according to the new rules. And you will have to use the signature together with a special electronic power of attorney.

Managers and individual entrepreneurs from 07/01/2021 receive an electronic digital signature from the Federal Tax Service. Signatures are issued by territorial inspectorates or their authorized representatives - certification centers that have passed additional selection (Federal Tax Order No. VD-7-24 / [email protected] dated December 30, 2020). Before you issue an order to empower the persons responsible for placement in the Unified Information System to obtain an electronic signature, check whether the certification center has been accredited according to the new rules.

ConsultantPlus experts reviewed innovations in working with electronic signatures from 07/01/2021. Use these instructions for free.

How to write an order: basic rules and sample

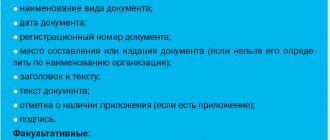

Today there is no single unified form for an order for the right to sign primary documents, so enterprises and organizations can write it in any form or according to a model approved in the accounting policy of the enterprise. However, some standards must still be adhered to. In particular, the order must indicate:

- order number,

- date of compilation,

- Company name,

- the locality in which the enterprise is registered.

In the main part, it is necessary to list everyone who is given the right to sign primary documents, indicating:

- positions,

- surname-name-patronymic,

- a list of documents that a particular employee has the right to sign.

It should be noted that the order may concern either one employee of the organization or an entire group of persons.

Why do you need an order for the right to sign?

The Ministry of Finance of the Russian Federation in information dated December 4, 2012 No. PZ-10/2012, commenting on the provisions of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, expressed the opinion that the head of an economic entity is obliged to approve lists of persons who are authorized to sign primary accounting documents.

The position of the department is based on the provisions of Art. 7 and 9 of Law No. 402-FZ and can be considered as defining a successive rule of law relative to the one established in paragraph 3 of Art. 9 of the Law “On Accounting” dated November 21, 1996 No. 129-FZ, which was previously in force. The previous legal acts regulating accounting contained a direct requirement for the manager to approve the list of persons who have the right to sign on the primary document.

The current legislation does not regulate how the relevant persons should acquire their powers. In practice, in Russian organizations it is common to consolidate these powers by issuing by management:

- an order for the right to sign the primary document by a specific person or a list of persons;

- power of attorney for the right to sign the primary document.

Let us consider the specifics of both methods of transferring rights to sign a primary document in more detail.

How to place an order

The approach to drawing up orders can also be absolutely anything: companies have the right to use simple A4 or A5 sheets or their own letterhead to write these administrative documents. In this case, the order can be written by hand or printed on a computer - this does not play any role in determining the legality of the document.

However, with all this, the order must be certified by the signature of the head of the enterprise or any other employee authorized to endorse such papers.

In addition, everyone who is mentioned in it, as well as the employees appointed responsible for its execution, must be familiarized with the document for signature. Whether to put a seal on the order or not is the choice of the drafter, since it relates to the internal document flow of the company; moreover, since 2016, the requirement for the mandatory use of seals and stamps in the activities of legal entities has been abolished by law.

The order is usually drawn up in a single original copy.

Nuances in signing papers by the chief accountant

Before changes were made to legal acts in 2014, the mandatory presence of a chief accountant’s visa in some papers, as well as the understanding that this is the right of a second signature, were enshrined at the legislative level.

Currently there is no definition provided in the legislation. In essence, this is the approval of some acts by another employee, in addition to the manager, the chief accountant. It is not provided on its own upon appointment to the position of chief accountant. The order states that the chief accountant receives the authority to sign specific papers, and this right of financial signature in the event of his vacation or illness will be temporarily transferred to another person.

After writing the order

An order to transfer the right to sign documents is issued in situations where the director of a company wants to authorize an official to endorse various documents. In most cases, this right is vested in:

- Specialists from accounting and economics departments.

- Heads of product sales departments.

- Forwarding drivers.

- Heads of branches, etc.

After the publication of this order, this document must be kept together with other administrative acts of the enterprise until it loses relevance, with its subsequent transfer to the archive for storage, in accordance with the legislative norms of the Russian Federation. At the same time, it must be stored at the enterprise for at least 3 years.

How to draw up an order for the right to sign?

The form of the order is not regulated by law - it can be developed independently, based on the rules applied in the organization’s document flow. An order can be printed on a computer, or it can be written by hand - from a legal point of view there is no difference (however, the latter method of creating orders is used extremely rarely - every organization, even a small individual entrepreneur or a warehouse with a warehouseman, has a printer on which you can print the document ).

The order for the right to sign includes:

- name of company;

- date and place of document preparation;

- the serial number of the document under which it will be recorded in the order register;

- name of the order;

- a link to a regulatory document that allows you to transfer the right to sign from a manager to an employee of the enterprise;

- the contents of the order indicating the names of the documents, the right to sign which passes from the manager to a third party, as well as full name. the employee who will sign these documents;

- the validity period of the powers granted to the employee - if it is not specified, it is considered that such powers are valid indefinitely;

- signature of the employee, which will be considered a sample signature used when endorsing primary documents for the director;

- signature of the head of the organization.

Order form

The Law “On Accounting” (Article 9 No. 402 of December 6, 2011) notes that every event in the company’s activities must be recorded in primary accounting documents, which must bear the signatures of responsible persons. Letter No. PZ-10/2012 of the Ministry of Finance of the Russian Federation explains that the head of an enterprise has the right to appoint specialists, with the transfer of the right to second sign the primary documents of the enterprise in the absence of the head. To do this, the director of the company is obliged to publish an order about this. The standard form of such an administrative document is not provided for by the legislation of the Russian Federation, however, a procedure has been established for the formation of such an order, taking into account generally accepted rules in office work.

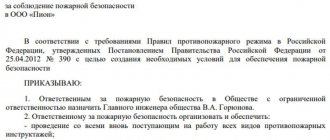

Such an order looks like this:

- The details of the company are displayed on a simple sheet of paper.

- The title of the form and its number are filled in.

- The date it was completed is noted.

- Links to the legislative norms of the Russian Federation are provided.

- The administrative text reflects the essence of the order, assigning subordinate specialists the authority to sign documents, as well as indicating the validity period of the order and the types of documentation to be signed.

- The person responsible for executing the order is noted.

- Sample signatures of authorized persons are provided.

- The order is signed by all involved entities.

The order receives valid status after written acquaintance with it by designated persons.

Note : The right to sign cannot be granted to subjects who are not on the staff of the enterprise, that is, to third parties.

Why and when are they given the right to sign papers?

For normal operations of the company, it is necessary to periodically endorse certain papers. Documents can be signed not only by the director, but also by specialists within the scope of their activities. For example, accountants sign documents related to their functional responsibilities (balance sheets, accounts, payment orders, reconciliation reports), economists sign plans and calculations, lawyers sign contracts, claims and complaints, personnel officers sign orders and work books, etc.

Such an order should be published on granting authority to sign documents. At the same time, it must be borne in mind that the director of the company has the prerogative of the first signature, and the rest of the entities noted in the order are given the right of the second signature. This information may be displayed in:

- Order.

- Employment contract.

- Job description.

- Intradepartmental regulations.

- Powers of attorney.

The first four points relate to internal departmental documents. Therefore, the right to sign cannot be given to persons who do not work for the company. But a power of attorney can be issued to a third party.

What is written in the order

The order must describe in detail the procedure for vesting responsible persons with powers for electronic signatures. There is no unified form of the decree - all examples and samples are advisory in nature. But there is a requirement for mandatory information that must be indicated in the act.

To avoid problems at the TOFK or CA when submitting documents to receive an electronic signature, write down the following information:

- full and short (if any) name of the organization according to the statutory documents;

- basic details of the act (number, date);

- the number of persons authorized to electronically sign documents, their full names (in full), positions and areas of functional responsibility.

If you are drawing up an order for the transfer of authority in the event of replacing a key employee, indicate at least two responsible employees.

The administrative act on the transfer of authority to sign electronic documents is called “On granting the right to sign.” In the order itself, be sure to include the phrase “Grant the right to digital signature to employees.”

General information

According to the legislation of the Russian Federation, the first signature always belongs to the head of the organization. The right to second signature can be given to the financial director or chief accountant of the company. As a rule, the right to sign primary documentation is transferred to the chief accountant. It is recommended to secure the right of the second signature by an appropriate order. In addition, in case the chief accountant goes on vacation or sick leave, you can delegate such powers to another employee who has the necessary competencies. This is important to ensure the continuous operation of the company.

Sign only during the absence of the director

If we are talking about signing documents for the director during the period when he is not at work due to being on vacation, business trip, illness, etc., then this is a temporary substitution. In such situations, it is advisable to establish the term of office not by a specific date or period of time, but by indicating the event with which such powers will be terminated (return from vacation, arrival from a business trip, end of a period of temporary disability, etc.), since in practice it often happens that the dates initially assumed do not later coincide with the actual ones.

Let us say right away that the issue of replacing the head of an organization has not been clearly regulated by law; in practice, several options are possible for registering a temporary position:

- staff replacement; temporary transfer to the position of director;

- part-time work during the absence of the director (both internal - when the part-time director is an employee of this organization, and external - if a third-party person works part-time as director);

- performing the duties of a temporarily absent director without release from the main job.