Is accounting of work books required at an enterprise?

From 09/01/2021, new rules for maintaining and storing paper work books are in effect.

In addition, according to the new procedure, it is no longer necessary to use the established unified forms of books and journals, but you need to approve your own. As for the new sample work books themselves, they will need to be applied from 01/01/2023. Whether it is necessary to exchange old workers for new ones and what to do with the old-style forms unused by 2023, read here.

How to keep work books according to the new rules is explained in detail in the ready-made solution from ConsultantPlus. Get trial access to the system for free and proceed to the material.

Let us remind you! Starting from 2022, there is no need to create a paper work book for an employee who gets a job for the first time. For such an employee, issue only an electronic version of the document. See details here.

The acquisition by an employer of work record forms, like any other business transaction, is subject to reflection in accounting. Write-off of work books is also subject to accounting. Thus, maintaining accounting records of work books is a mandatory procedure for organizations. If the employer is an individual entrepreneur, he will keep records of work books only in terms of compliance with the requirements for filling them out and storing them.

You can learn more about the specifics of maintaining and storing work books in the article “Instructions for filling out work books.”

Options for maintaining a work record in 2020

From 2022, data included in work books for all (without exception) persons working under an employment contract is accumulated in electronic form. The Pension Fund is responsible for the accumulation process, where employers submit relevant information as necessary.

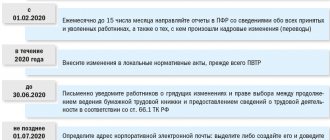

2020 is a transitional year, with:

- the employee needs to decide whether his work record will continue to be kept not only electronically, but also on paper;

- the bulk of information is generated on the status of persons working under employment contracts as of 01/01/2020;

- there is a special (monthly, and not as personnel events occur) frequency of submission to the Pension Fund of the Russian Federation of information that requires inclusion in the work book;

- a paper work book may also be issued for the first time (from 2021, only an electronic version will be available for those seeking employment for the first time).

Persons who have chosen the electronic method of maintaining a work record book will be given a paper form with a record of the choice made. The employee himself will have to keep it, remembering that this document is the only one confirming his work activity for the period until 2020.

For those who choose to duplicate electronically accumulated information on paper, the work book will continue to be drawn up on its standard form. If necessary, an insert can be added to the book, which is (like the work book itself) a strict reporting form.

What object should a work book be taken into account as?

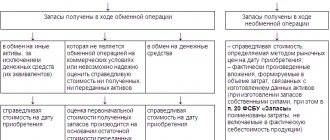

This issue is not regulated by law and remains controversial to this day. In our opinion, the following approach is correct:

- The work book is accepted for accounting as a strict reporting form (SRF), since it is legally recognized as such in the period between the moment of its acquisition from the supplier and the moment of registration for the employee (clause 42 of the Rules).

- From the moment the form is issued for an employee, the employee’s debt for the work book issued to him becomes the object of accounting. Subsequently, the accounting reflects the operation to repay the debt (or the fact of its inclusion in expenses).

At the same time, the financial department (letter of the Ministry of Finance dated May 19, 2017 No. 03-03-06/1/30818) considers this issue as follows:

- work books should be taken into account with the allocation of VAT (that is, as goods and materials);

- when compensation is collected, non-operating income arises, and when compensation is not provided, a gratuitous sale occurs.

In other words, within the framework of the scheme proposed by the Ministry of Finance, it is planned to keep records of work books using account 41.

At the same time, in earlier clarifications, for example in letter dated June 10, 2009 No. 03-01-15/6-305, the Ministry of Finance cites completely different theses - that:

- work books are purchased by the employer not for the purpose of selling to employees;

- Providing a work book to an employee is not a service.

Taking into account the contradictory positions of officials, the enterprise needs to independently assess all possible risks and choose the optimal accounting scheme, which must be enshrined in the accounting policy. However, our opinion is that a work book is not a product, and now we will tell you why.

Basic norms in document flow

At enterprises, work books are recorded as strict reporting forms (SSR). Despite the prevalence of the document in retail, the only legal way to purchase is to purchase BSO forms from legal representatives of Goznak. The enterprise was organized on the basis of a federal institution and has been a joint-stock company since 2014. The company produces products marked with state marks, including work books.

In the document flow, responsible persons are guided by the Rules approved by GD dated March 16, 2003 No. 225 (hereinafter referred to as the Rules). To make entries, a journal is used - a receipt and expenditure book for recording forms and inserts.

Sample accounting book 2022

Arguments in favor of the fact that a work book is not a product

The workbook should not be considered a product because:

- A product is property that is sold or is subject to sale, that is, transferred from one person to another on a reimbursable basis (clause 3 of Article 38 of the Tax Code of the Russian Federation, clause 1 of Article 39 of the Tax Code of the Russian Federation). The transfer of goods on a reimbursable basis is secured by an agreement (Article 423 of the Civil Code of the Russian Federation). An agreement (or transaction) presupposes the expression of the will of 2 or more parties (Article 154 of the Civil Code of the Russian Federation, paragraph 50 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 23, 2015 No. 25). At the same time, the transfer of a work book from an employer to an employee occurs not by virtue of their will, but by virtue of the requirements of the Labor Code of the Russian Federation and the Rules. In fact, the law obliges them to carry out a legal relationship in the form of transferring a work book, while citizens and legal entities are free to enter into contracts (clause 1 of Article 421 of the Civil Code of the Russian Federation).

- According to paragraphs. 3–4 of the Procedure approved by Order of the Ministry of Finance of the Russian Federation dated December 22, 2003 No. 117n, the only “legal” seller of books is GOZNAK (or authorized organizations). Other persons do not have the right to implement them (appeal ruling of the Bryansk Regional Court dated 05/07/2013 in case No. 33 1206/2013).

- A company that charges an employee a fee for a work book receives an amount no more or less than it spent, that is, it actually reimburses its own costs for acquiring it. Such operations are not recognized as sales (resolution of the Federal Arbitration Court of the North-Western District dated March 2, 2007 No. A56-44214/2006).

There is one more nuance: the collection of compensation is provided for only by the Rules, while the Labor Code of the Russian Federation - a legislative act higher in the legal hierarchy - does not mention it and does not impose such an obligation on the employer.

What transactions should be used when purchasing or writing off a workbook in 1C and other programs?

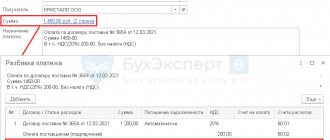

The fact of purchasing a work book within the framework of the scheme that we offer is reflected in the accounting registers by posting Dt 76 Kt 51 (in the amount corresponding to the purchase price of the forms).

Next, before the first entry is made in them, the books are placed on off-balance sheet accounting as BSO - posting Dt 006.

When registering a copy of the work book for an employee, the registers reflect the fact that the form has been written off - Kt 006. At the same time, the employee’s debt to the employer is reflected: Dt 73 Kt 76 (in the amount that corresponds to the purchase price of the form).

When compensating the cost of the book, the employee deducts the amount from his salary: Dt 70 Kt 73 (or Dt 50 Kt 73, if the compensation went through the cash register).

If the employee refused to compensate for the cost of the work book (and, as we already know, he has the right to do so), the registers reflect the occurrence of other expenses: Dt 91 Kt 73.

You can learn more about the features of BSO accounting in 1C in the article “Procedure for maintaining BSO accounting in 1C: Accounting (nuances).”

What work logs should be used?

In accordance with clause 40 of the Rules, approved by order of the Ministry of Labor of Russia dated May 19, 2021 No. 320n, the employer must independently develop and maintain logs for accounting:

- Movements of work books and inserts into them. The journal must indicate the series and number of work books accepted from employees upon entry to work, as well as work books and inserts into it issued to employees again, indicating their series and number.

- Forms of the work book and an insert in it. This journal records information about all operations related to the receipt and use of work book forms and the insert in it, indicating the series and number of each form.

The specified books (magazines) must be numbered, laced, certified by the signature of the head of the organization, individual entrepreneur, and the seal of the organization (if any).

Journal forms valid until 08/31/2021, approved by Decree of the Ministry of Labor of Russia dated 10/10/2003 No. 69, have become invalid. But they can be taken as a basis when developing your own books (magazines). You can download the forms for free using the links below.

- A journal of blank forms and inserts - that is, a receipt and expenditure book that contains information about BSO suppliers. Accounting is usually responsible for its maintenance.

- Journal of completed work books and inserts. Maintaining this document is usually the responsibility of the personnel department.

Storage period for journals (Order of the Federal Archive of Russia dated December 20, 2019 No. 236):

- registration of forms in the organization’s archive - 5 years;

- accounting of work books and inserts - 75 years.

How to receive forms

The employer acquired the forms as property. Meanwhile, the completed form, that is, the work book with entries about the employee included in it, is no longer the property of the employer. The work book is only kept by the employer, and upon termination of the employment contract it is issued to the employee (Article 84.1 of the Labor Code of the Russian Federation).

To what account should the form be sent?

Clause 47 of the “Rules for maintaining and storing work books, producing work book forms and providing them to employers”, approved by Decree of the Government of the Russian Federation dated April 16, 2003 No. 225, indicates that when issuing a work book to an employee, the employer charges him a fee, the amount of which is determined by the amount of expenses for their purchase. Please note: the fee is not charged when drawing up a work book, as most accountants are convinced, but precisely when handing it over, which is done upon termination of the employment contract. The date of issue of the work book upon dismissal is reflected in column 12 of the Book of Accounting for the movement of work books and inserts in them, the form of which was approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69. Until the book is issued to the employee, charging a fee for the form is obviously unlawful.

Now let's turn to paragraph 42 of the Rules, which determine the procedure for charging a fee for the form. It establishes: at the end of each month, the person responsible for maintaining work books is obliged to submit to the organization’s accounting department a report on the amounts received for issued work books and inserts in them, attaching a receipt order from the organization’s cash desk. But this order is subject to execution only in conjunction with the order of paragraph 47 of the Rules. Upon registration of the work book, no money will be charged for the form. This is not surprising: after all, the employee does not actually use the work book during the period of the employment contract. The employer “uses” it.

On a note

The employer is obliged to constantly have in stock the required number of work book forms (clause 44 of the Rules, approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225).

Meanwhile, the employer, not being the official distributor of the forms, has no right to sell them. Therefore, there can be no question of posting them to account 41 “Goods”. It is not prohibited to accept forms for accounting into account 10 “Materials”. After all, in the future they are used for the management needs of the organization. Then the accounts take the form:

DEBIT 10 CREDIT 60

- work book forms have been capitalized (excluding VAT);

DEBIT 73 CREDIT 10

- the cost of the form is written off when issuing a work book for an employee (based on the assumption that he will reimburse the cost of the form in the future).

Let us understand the nature of the asset that arises in account 73 “Settlements with personnel for other operations.” As stated above, it is payable no earlier than the date of dismissal. PBU 8/2010 (clause 13) classifies such a “debtor” as a contingent asset: it arises in an organization as a result of past events in its economic life, when the existence of an asset in the organization at the reporting date depends on the occurrence (non-occurrence) of one or more future uncertain events, not controlled by the organization. And the occurrence of such an event as dismissal really does not depend on the organization. Meanwhile, based on paragraph 14 of PBU 8/2010, contingent assets are not recognized in accounting. Information about them is disclosed in the financial statements. But with regard to forms, such a need does not arise - due to the insignificance of the cost of their stocks. This means that writing off forms does not create an asset, but an expense.

Now it will not seem surprising to us that the Ministry of Finance of Russia, in letter dated January 29, 2008 No. 07‑05‑06/18, proposes that the costs of purchasing work book forms should be immediately attributed to other expenses. Officials recommend taking into account data on the movement of forms in off-balance sheet account 006 “Strict reporting forms.” The accounting entries will look like this:

DEBIT 91 CREDIT 76

- reflects the costs of purchasing forms from distributors (excluding VAT);

DEBIT 006

- forms accepted for off-balance sheet accounting;

LOAN 006

- forms are used to prepare work books for employees.

The VAT presented by the distributor is deducted by the employer in the generally established manner.

Technical nuances: how to flash a work record book

The technology for flashing workbook logs is not legally established anywhere. To resolve this issue, we suggest that you use the recommendations of the Ministry of Finance, reflected in letter No. 03-02-RZ/62336 dated October 29, 2015, and concerning the rules for preparing copies of documents required by the Federal Tax Service during tax audits.

So, the Ministry of Finance advises:

- sew with a strong thread using 2–4 punctures when bringing the thread to the back of the document;

- affix the stapled document with the signatures of the responsible persons indicating their full names;

- indicate information about the number of sheets, the date of signing the journal;

- bind a document so that any page can be easily read or photocopied.

EXPLANATIONS from ConsultantPlus: From September 1, 2021, there is no need to seal the book (journal) for recording the movement of work books and inserts, since the Procedure for maintaining and storing work books does not provide for such a requirement. Exception... Get trial demo access to the K+ system and go to the Ready Solution for free to find out in what cases a book should be sealed.

Accounting for books provided free of charge

Free issuance of forms to employees occurs in the event of mass loss of books during storage at the enterprise or damage to the document due to the fault of the person in charge. In these cases, the company is obliged to provide forms to employed employees with no experience or in the absence of unfilled sheets free of charge. Legislative norms do not establish restrictions on the free issuance of work books and their inserts. When completing the procedure, the following features arise:

- To justify actions to issue forms free of charge, an order is issued.

- The procedure must be included in a local act, for example, a collective agreement.

- In calculating the base when calculating profits and the single tax, the costs of purchasing forms issued free of charge are not included. The cost of the issued book is subject to VAT; the seller's tax is not deductible.

Forms issued free of charge must be subject to personal income tax to the employee as income received. You can exclude taxation if you register 4,000 rubles as a non-taxable amount. If the form is issued in the form of a gift, the obligation to tax the amount does not arise (

Application of seals and wax seals

If a seal is preferable for the employer, then it must be made using a special device, the procedure for use of which is regulated by GOST 31282-2004.

Such a device must:

- have signs of identification;

- protect the journal from unauthorized changes in its structure;

- ensure protection of the seal from intentional violation of its integrity.

Among the most convenient seals, which are provided for by the specified GOST, are film ones. In their structure there are areas where you can record the date of sealing of the document.

The employer should also issue a local legal regulation regulating:

- procedure for using sealing devices;

- the procedure for recording seals (for example, in a separate journal);

- actions of employees upon detection of a violation of the integrity of seals.

As for the use of wax seals, it may look less preferable compared to fillings, because:

- sealing wax can crumble over time (while the magazines in question have a long shelf life);

- sealing wax must be heated using potentially flammable devices before use, and their use in an employer's office may not be advisable.

But if sealing with wax is still chosen, the following should be fixed at the level of local legal acts:

- print format (its content);

- the procedure for using the seal by employees;

- lists of documents that are certified by such a seal.

Violations in recording work records: responsibility

Violations in the accounting of work books, which lead to untimely provision of work books to employees, may be a reason for applying the following sanctions to the employer, provided for in paragraph 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation:

- a fine of 1,000–5,000 rubles for employers with the status of individual entrepreneurs and officials;

- a fine of 30,000–50,000 rubles for employers with the status of legal entities.

Violation of the procedure for accounting work books can lead to a fine of 5,000–10,000 rubles imposed on an official (Clause 1 of Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

In both cases, repeated violations lead to significantly increased sanctions.

If the work books are lost from the archives of the enterprise with the personal connivance of the employer, then the sanctions provided for in Art. 325 of the Criminal Code of the Russian Federation: a fine of up to 200,000 rubles, correctional labor, imprisonment.

You can learn more about the procedure for an enterprise to bear responsibility for violations of the procedure for recording and storing work books in the article “What is the responsibility for non-use or loss of BSO?”

Innovations in accounting for paper work books from 09/01/2021

Created 01/12/2022 09:07 Published 01/12/2022 09:07 Author: Administrator Since 01/01/2020, the Russian Federation has made the transition to electronic labor books (ETK). Such a transition is voluntary for all citizens and allows them to keep a paper work record book (WPK) for as long as they need it. Accordingly, the BTK form was not cancelled. According to the Pension Fund of the Russian Federation, the majority of insured persons preferred to keep their work records in paper format. Let us recall that with this choice, organizations, along with ETC, are obliged to continue to maintain BTK. Therefore, the Ministry of Labor decided to update the rules by which BTK is maintained and stored by approving Order No. 320n dated May 19, 2021 (hereinafter referred to as Order No. 320n). We will tell you what innovations this order brought us in this publication.

You can learn more about the ETC and its advantages on the website of the Pension Fund of the Russian Federation, and also use various services that allow, for example, to generate and receive an extract from the ETC.

For persons who are employed for the first time (starting from 01/01/2021), a BTK should not be started. For such citizens, information about work will be maintained only in electronic form.

Along with the introduction of the new order, such documents as Decree of the Government of the Russian Federation dated April 16, 2003 No. 225, as well as Order of the Ministry of Labor dated October 10, 2003 No. 69, which previously regulated this issue, became invalid.

Let us consider in detail what changes the new document brought us.

Updating the form

With this Order, the Ministry of Labor introduced updated BTK forms and inserts, and also approved the procedure for their maintenance and storage.

First, let's look at what changes have affected the form.

In the updated BTK, the title page remains the same. But at the same time, a clarification appeared on it that the company’s seal is placed on the form only if it is available.

Let us remember that back in 2015. A law has come into force that allows organizations to refuse to use a seal (Federal Law dated 04/06/15 No. 82-FZ).

The number of turns has also changed. The new work information form now has 14 spreads (previously there were only 10), but the names of the columns and sections remain the same.

As for information about awards, there are now 7 spreads. Previously, there were 10 spreads in this section.

Similar changes occurred in the insert for the BTK. In the updated form, the section on work now contains as many as 12 spreads (previously there were 9), and the section on awards only 5 (previously there were 8).

Let us say right away that the form discussed above will begin to be used only in 2023; today, companies are required to continue maintaining BTK on the previous forms. But keep in mind that the filling rules will be new.

Important innovations

Next, we will pay special attention to the most interesting, in our opinion, innovations that directly affected the procedure for maintaining and storing BTK and inserts for them.

The Order we are commenting on partially includes the filling rules that were previously prescribed in Instruction No. 69.

For example, one such rule is the following:

But, unfortunately, Order No. 320n does not indicate how to correct such errors. We believe that in such a situation, it would be correct to correct errors according to the old rules, namely, under the erroneous entry you need to write that such an entry is invalid, and then enter the correct option.

Making entries

One of the most important innovations is the reflection of data in the BTK using stamps.

Now organizations and individual entrepreneurs have the right to enter information into the BTK in two ways:

• manually, using light- and water-resistant ink in violet, black or blue colors;

• using stamps and seals.

Moreover, one recording can easily be made using both methods simultaneously.

In addition, according to the letter of the Ministry of Labor of the Russian Federation dated June 29, 2021 No. 14-6/ОOG-5976, an entry in the BTK can be printed, for example, on a printer.

Dates

As for dates, the commented Order states that dates in sections must be indicated in Arabic numerals, with the day and month written in two-digit numbers, and the year in four-digit numbers. This rule also applies to filling out title pages.

Distancers

The Order also pays attention to “remote” workers. It is clarified that, at the request of such an employee, the organization will be able to reflect information about his work activity in the BTK, provided that the employee presents it. An option for submission may be sending BTK by Russian post.

Deadlines

The next innovation is the deadline for reflecting information in the BTK.

In addition to records of dismissal, which must be reflected on the day of dismissal, all other information, such as: qualifications, transfer to another permanent job, awards, organizations indicate in the BTK no later than 5 working days.

Issuance of BTK

Companies are required to issue BTK to the employee no later than 3 working days for the purpose of his mandatory social security. insurance. An exception is the situation when the employer does not maintain BTK for an employee.

Dismissal

With the entry into force of Order No. 320n, there were no contradictions with the Labor Code of the Russian Federation on this issue. It has now been approved that organizations are required to indicate the clause, part and number of the article of the Labor Code of the Russian Federation, in accordance with which the dismissal occurred.

A sample BTK is presented below:

We draw your attention to the fact that it is no longer necessary to certify such a record with the signature of the dismissed person. This record is certified by the signature of the director of the company (IP) and the seal (if the company has one).

We remind you that entries in the BTK must exactly correspond to the text of the order or order.

Just as before, you cannot use abbreviations:

Part-time job

Before Order 320n came into force, information about part-time work was reflected in the BTK by the organization that was the “main” employer for the employee. Now another approach has appeared: if a person is not currently working, but for some reason he needs to enter data on part-time work in the BTK, then the organization in which he works part-time has the right to make the necessary entry.

There is another important innovation: now data on part-time work can be reflected in two ways:

1. In chronological order.

For HR specialists, this method is well known, because it was the method that was used until 09/01/21. Below is a sample of such a reflection of records;

2. In blocks, that is, data on part-time work can be made regardless of the time of entries at the main place of work. A sample of this option for filling out the BTK is presented below.

Translation

In a situation where an employee was temporarily transferred to another position, but such a position subsequently became permanent for him, the employer organization needs to enter 2 orders into the BTK. In column 2 we enter the date of transfer of the employee to a temporary position, and in column 4 it is necessary to enter the details of the orders:

1. About temporary transfer.

2. About permanent transfer.

More detailed information can be found in paragraph 10 of Order No. 320н.

Below is a sample BTK in the situation described above:

Liner

Now let's talk a little about how, according to Order 320n, the insert should be drawn up.

The first thing to note is that an insert without BTK is not valid.

Every time a company issues an insert to an employee, the BTC must be stamped with the “Insert Issued” stamp, indicating its series and “No.” This entry is stamped on the title page of the BTK. If there is not enough space there, then such a stamp is affixed to the title page of the first insert issued to the employee.

BTK accounting

Now there is no longer a need to maintain a receipt and expenditure book for accounting for BTK, as well as a book for accounting for the movement of BTK.

At the moment, the employer, in accordance with paragraph 39 of Order 320n, must maintain two forms of accounting for BTK. One of them will reflect the accounting of blank forms. In the other, there is the BTK movement. The forms of such forms and the name of the organization will have to be developed independently and approved by order. Such forms can be developed using the previous ones as a basis.

These documents must be numbered, laced and certified by the signature of the director (IP), as well as a seal, if the organization has one. From this requirement we can conclude that these books must be in paper form. At the same time, there is no need to fasten them with sealing wax or a seal. These rules are a thing of the past.

If the organization is currently keeping old-style accounting books, and they have not yet run out, then there is no need to change them to new ones.

Due to the fact that, according to the updated rules, employees will need to be temporarily issued BTK in their hands, we strongly recommend that the new form of accounting books include a column “Reason for issuing the work book in hand.” This will help you easily track situations in which an employee is required to return BTK to the organization. After all, there are quite a few reasons why an employee can take the form in hand, for example, dismissal or transfer to the ETC, as well as for recalculating a pension or receiving benefits, and a personnel employee may simply not keep track.

In addition, let us remind you that the organization must always have the required number of BTK forms and inserts available.

If the BTK or insert is filled out incorrectly or the form was damaged through no fault of the employee, then the cost of the damaged form is paid by the company.

Refusal from BTK

In conclusion, we will tell you what to do if an employee refuses BTK in favor of ETC. In this case, special attention should be paid to columns 3 and 4, filling them out according to the rules prescribed in paragraph 35 of Order No. 320n.

The record must be certified by the organization by affixing a signature and seal, if available.

Let us remind you that in this case the company is obliged to issue the BTK to the employee no later than 3 working days from the date of receipt of the corresponding application from the employee.

Below is an example of how to fill out the BTK in the situation discussed above:

Conclusion

To summarize, it should be said that, starting from 09/01/2021, the main document for working with BTK is Order of the Ministry of Labor No. 320n dated 05/19/2021.

If you encounter any difficulties in working with BTK, we strongly recommend that you refer to this document. Because it has answers to all the questions that HR specialists may have.

Author of the article: Marina Alenina

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

JComments

Results

Accounting for work records is a mandatory procedure for organizations. The choice of accounts for its management is a very controversial issue and is interpreted ambiguously by officials. We propose to use a scheme in which work books are accepted for accounting as BSO.

You can learn more about the features of accounting for work records in the articles:

- ;

- “How to properly certify a work book - sample”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Let's sum it up

- Since 2022, the work book has 2 forms - electronic (mandatory for everyone who works under an employment contract) and paper (which continues to be maintained in parallel with the electronic version at the request of the employee).

- An electronic work book does not require the use of a special form. And maintaining a paper document is carried out according to the same rules that were in force until 2022.

- Accounting entries for recording work books and inserts in them depend on 3 features of these documents - their classification as strict reporting forms, the material form of existence and the need to charge the employee compensation for the cost of the form issued to him.