About legal entities

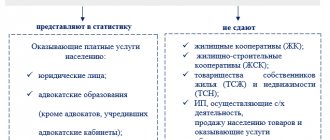

Check the availability of the form in the personal list of Rosstat Form 1 - not all business entities submit it.

How to calculate payments on a calculator Calculating income tax is one of the most difficult

Liquidation commission After the decision to terminate the activities of the organization, the founders (participants) appoint a liquidation commission (liquidator)

Report on form No. 1-T (professional) Rosstat systematically updates reporting forms. Almost none

Manually There are two ways. The first is to print the form and enter the data in the boxes from

Sign in the 2-NDFL certificate The sign in the 2-NDFL certificate shows who (the tax agent or his

The patent system (remember the abbreviation PSN) is one of the special regimes for entrepreneurs. In contrast

Features of the calculation work It is necessary to pay a fee if the enterprise has negative impacts on the surrounding air

Why are fee payer tariff codes needed? The codes in question are recorded in

Tax authorities require full reporting from all business entities, including individual