Liquidation commission

After the decision to terminate the activities of the organization , the founders (participants) appoint a liquidation commission (liquidator) and establish the procedure and timing for carrying out the necessary measures in this regard.

(Clause 3 of Article 62 of the Civil Code of the Russian Federation). From this moment on, the powers to manage the company’s affairs are transferred to the liquidation commission. (clause 4 of article 62 of the Civil Code of the Russian Federation). The next step is the publication of a notice about the liquidation of the company, the procedure and deadline for filing creditor claims in the journal “Bulletin of State Registration”. The period for submitting claims by creditors cannot be less than two months from the date of publication of the notice of liquidation (Clause 1 of Article 63 of the Civil Code of the Russian Federation). After the deadline for submitting claims by creditors, the company's employees must fill out a special form of financial statements - an interim liquidation balance sheet.

Dismissal due to liquidation of the organization: notify the employment service

The employment service must also be notified that layoffs are coming. At the same time, depending on the scale (massiveness) of termination of agreements, deadlines are established within which a message must be sent to the service, and the procedure for such notification. As stated in Decree of the Government of the Russian Federation dated 02/05/1993 No. 99, mass dismissal should be considered the simultaneous termination of employment agreements with 15 or more employees.

If there is a mass dismissal due to the liquidation of an organization, then the employment service must be notified twice:

- 3 months remaining before the start of the dismissal procedure, send Information on the mass release of workers in the form given in Appendix 1 to Resolution No. 99.

- 2 months remaining before the start of the dismissal procedure, submit Information about the dismissed employees in the form given in Appendix 2 to Resolution No. 99. They provide the personal data of each employee, his average earnings, education, profession and qualifications.

The above criteria for mass participation are not dogma. Regional authorities are given the right to determine their own limits for this indicator. However, this must satisfy the main principle: the social security of employees must not be violated (Article 2 of the Regulations under Resolution No. 99).

When there is no widespread dismissal, the employment service can be notified once - up to two months before the start of the dismissal procedure (Clause 2 of Article 25 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” dated April 19, 1991 No. 1032-1).

There is no official form for such notifications. You are allowed to compose a document in any form. It should mention the employee’s personal data, profession, personal working conditions, specialty, etc. From business practice it follows that personnel officers use the form given in Appendix 2 in such cases.

Notifications must be submitted to the employment service on paper - in person or by mail.

Notice of liquidation of a legal entity form P15001

Until July 2013, for each listed action, a separate document had to be filled out and submitted to the registration service of the Federal Tax Service:

- Р15001 (notification of a decision to liquidate a legal entity),

- R15002 (notification of the formation of a liquidation commission, the appointment of a liquidator (bankruptcy trustee)),

- R15003 (on the preparation of an interim liquidation balance sheet).

However, today each of the three actions is accompanied by filling out and submitting to the registration authority only one form P15001 “Notice of liquidation of a legal entity.”

Liquidation balance sheet: sample filling

The liquidation balance sheet does not have a specially approved form. It is filled out on the form adopted by order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66. Its name must be indicated: interim liquidation balance sheet or liquidation balance sheet. Such recommendations were given in the letter of the Federal Tax Service of Russia dated 08/07/2012 No. SA-4-7/13101.

On our website you can download the balance sheet form “Filling out Form 1 of the balance sheet (sample)” .

The liquidation balance sheet is prepared according to the same rules as the regular quarterly and annual balance sheets.

For information on how to fill out a balance sheet, read the article “Procedure for drawing up a balance sheet (example)” .

There are no special rules for drawing up an interim liquidation balance sheet (you can download a sample of filling out a zero balance sheet during liquidation on our website).

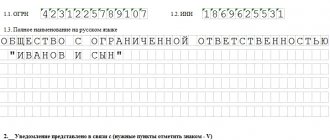

Requirements for filling out form P15001: step-by-step filling

Since forms P15001 and P16001 are the main ones for registering liquidation, we will consider the basic requirements for filling them out, which are established by Order of the Federal Tax Service of Russia N MMV-7-6 / [email protected] General requirements for filling out both forms are contained in Section I of such a document as “ General requirements for the preparation of submitted documents.” In the same appendix to the order of the Federal Tax Service of the Russian Federation there is a sample of filling out forms P15001 and P16001 line by line.

So, when filling out these forms, legal entities must:

- black ink should be used both when filling out manually and when printing on a printer);

- it is necessary to write only in capital letters in Courier New font 18 points high, each of which, as well as quotation marks, dashes, hyphens and numbers are placed in a separate cell;

- do not allow corrections or additions, as they are prohibited;

- do not allow hyphens, the word that does not fit must be continued to be written on the next line (if it ends in the last cell of the first line), the next line begins with an empty cell (space between words);

- do not print or attach blank sheets to notifications;

- When printing an application on a printer, changing the location of fields and sizes of characters is not allowed;

- Do not use double-sided printing of completed forms, as it is prohibited.

Requirements for filling out form P15001 are contained in section IX of the Requirements. This form includes a first page consisting of two sections, as well as two separate sheets: sheet A and sheet B.

Requirements for filling out P15016

The requirements for filling out P15016 are identical to those required when filling out other registration forms:

- when filling out by hand, we write capital block letters in black, purple or blue ink;

- on a computer - black Courier New font, font size 18;

- you cannot put hyphens;

- You cannot print the application on both sides;

- You cannot correct mistakes or make additions;

- Write each character in a separate cell - even commas, dashes and spaces.

The form is processed by the program, so all requirements must be met. Otherwise, the system will indicate that the form is filled out incorrectly.

The notice must be accompanied by a decision to liquidate the LLC. The documents must be sent within three days, otherwise the liquidator may be fined 5,000 rubles.

If you are not thinking of closing your business, then start maintaining accounting and tax records in the cloud service Kontur.Accounting. Calculate salaries, control the payment of taxes and contributions in our program. We give all newcomers 14 days of free access.

Fill out section 2 of form P15001

In this sheet, you should put a “tick” (“V” sign) in the relevant points in connection with which a notification is being submitted:

- if a decision has been made to liquidate a legal entity, then put a tick in clause 2.1, this field also indicates the date of its adoption;

- if a commission has been formed and a liquidator has been appointed, then put a tick in clause 2.2.;

- if an interim liquidation balance sheet has been drawn up, then check the box in clause 2.3;

- if a decision is made to cancel a previously made decision to terminate activities, then put a tick in clause 2.4.

The requirements do not contain a ban on filling out several items at the same time. Therefore, you can, for example, check two boxes: about making a decision to terminate work (clause 2.1.) and forming a liquidation commission (clause 2.2.).

If a decision is made to continue the work of the company (clause 2.4.), then the decision to cancel the decision to liquidate the legal entity must be attached to the notification.

The section “For official marks of the registering authority” is not filled out.

Fill out form P15016

An application for liquidation of a legal entity is filled out according to the same requirements as other registration forms. This means that the following features must be taken into account:

- use only printed capital letters;

- When filling out on a computer, only black Courier New font with a height of 18 points is allowed;

- When filling in manually, use black, blue, and purple ink;

- do not attach blank pages to the application;

- number only completed pages;

- There is no need to staple the application; you can only fasten it with a regular paper clip.

Let us remind you that during the liquidation of an LLC, application R15016 is submitted to the tax office three times. And each time it is filled differently.

Stage 1. Notice of liquidation

The first time you must report the liquidation of an LLC to the Federal Tax Service within three working days after such a decision is made. In addition, the company's participants must appoint a liquidator or liquidation commission. It is to them that the powers to manage the society are transferred.

It is also important to set the deadline for the liquidation of the company, because it will need to be indicated in the application P15016 at the first stage. The maximum closure period is established by Article 57 of the LLC Law and is one year from the date of adoption of the relevant decision.

This does not mean that you will not be able to complete your liquidation before the year ends. You just need to take into account that there are deadlines for completing the stages, determined by law, and no matter how much you want to, they cannot be reduced.

If you cannot meet the liquidation deadline specified in the first application P15016, then it will have to be extended in court. That is why we recommend indicating the maximum period in the form. For example, if the decision of the participants was made on 08/05/2022, then the deadline for liquidation is 08/04/2023.

Let's move on to filling out P15016. On the first page, enter the codes of your organization (OGRN and INN). Below you need to select a reason code for filing your application. In this case, this will be the value “3”, which means that the participants decided to liquidate and appointed a liquidator.

On sheet A in paragraph 3, enter information about the liquidator or the chairman of the liquidation commission. These are standard passport data and TIN code, if any. In addition, you must fill out a line about the position: “liquidator” or “chairman of the liquidation commission.”

If access to information about the organization is limited, this must be noted after indicating the position. In this case, sheet B is also filled out, where the grounds for restricting access are indicated. They are listed in Article 6 of Law No. 129-FZ of 08.08.2001:

- companies subject to international sanctions;

- legal entities on the territory of Crimea and Sevastopol;

- credit organizations supporting contracts for defense government orders.

Sheet B is filled in with information about the applicant. This is the liquidator or the head of the liquidation commission, because the director of the LLC no longer has any management powers. On the last page, the applicant must enter an email and telephone number for contact.

Please note that application P15016 is signed only in the presence of a notary or using the liquidator’s digital signature.

Stage 2. Approval of the interim balance

After two months allotted for notifying creditors about the liquidation of the LLC, it is necessary to approve the interim balance sheet and report this to the tax office.

The second time, form P15016 will be simpler. Only the title page and the applicant’s sheet are filled in. Sheet A is not completed for the second and third submission, this is stated in paragraph 104 of the Requirements for filling out (from order No. ED-7-14/ [email protected] ).

On the title page, again indicate the OGRN and TIN of the organization. However, the reason code for filing the application will not be “3”, but “4”, that is, drawing up an interim balance. There is no need to repeat the liquidation period; there is a corresponding footnote about this.

Sheet B is filled out in the same way as the first application.

Stage 3. Completion of liquidation

After settlements with creditors, the final stage of liquidation begins. To do this, a third application P15016 is submitted to the Federal Tax Service, which differs from the second only in the reason for filing code. Instead of “4” on the title page you should indicate “7”.

In addition, the completed application is accompanied by the liquidation balance itself and a document confirming payment of a fee of 800 rubles. No fee is charged if documents are sent electronically.

Fill out sheet B

The first page and sheet B are filled out if clauses 2.1 (decision on liquidation), 2.3 (interim liquidation balance sheet) or 2.4 are noted in the application. (decision to cancel the liquidation decision). The first page, sheets A and B should be drawn up when appointing a commission (clause 2.2).

What do we fill out in sheet A “Information on the formation of the liquidation commission/appointment of a liquidator”? In section 1, “1” is entered if a commission is appointed, and “2” if a liquidator is appointed. Section 2 indicates the date of formation of the liquidation commission or appointment of a liquidator. Section 3 in Russian indicates the last name, first name and patronymic (if any) of the head of the liquidation commission or the liquidator. If he has a TIN, we indicate it in section 4. Section 5 indicates the date and place of birth of the liquidator, the telephone number by which he can be contacted.

So:

Drawing up a liquidation balance sheet is a mandatory procedure when liquidating a company.

There are two types of liquidation balance sheets: interim and final. Each balance sheet has its own purpose and is signed by the head of the liquidation commission, the appointed liquidator or bankruptcy trustee (in case of bankruptcy of the company). The final liquidation balance sheet must be submitted to the tax office along with an application for state registration of a legal entity in connection with its liquidation. Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Fill out sheet B

In sheet B “Information about the applicant” in section 1, we indicate with a number who the applicant is:

- “1” - for the founder (participant) - an individual;

- “2” - for the founder (participant) - a legal entity;

- “3” - for the body that made the decision on liquidation;

- “4” - for the head of the liquidation commission.

It is important to correctly determine in what cases and which of the entities listed above can act as an applicant. As the Federal Tax Service of Russia explains in a letter dated October 15, 2014 N SA-4-14/ [email protected] , when submitting form P15001 to the registration authority in connection with a decision to liquidate a legal entity, the applicants are the founders (participants) of the legal entity or the body that adopted decision to liquidate the organization. If the document is sent in connection with the decision to liquidate the company and the formation of a liquidation commission (appointment of a liquidator), as well as in connection with the preparation of an interim liquidation balance sheet, then the applicant is the founders (participants) of the organization or the body itself that made the corresponding decision. The head of the liquidation commission (liquidator) can also act as an applicant.

Sections 2-5 should be completed depending on who the applicant is. Section 6 must be completed by hand in the presence of a notary. Next, you should indicate the most acceptable way to obtain a document confirming the fact of making an entry in the Unified State Register of Legal Entities, or a decision to refuse state registration (the document must be delivered personally to the applicant, a person acting on the basis of a power of attorney, or by mail). Section 7 is filled out by the notary, indicating his status and TIN. You can download the free form p15001 2022 at the end of the article.

Applicants

The form provides for several types of applicants: legal entity, individual, liquidator/liquidation commission or the body that made the decision on liquidation. In the first case, you will need to involve a notary who will fill out sections 6 and 7 of sheet B, page 3.

The applicant for liquidation may be a citizen of another country other than the Russian Federation. For this purpose, sheet B, page 3 is provided.

Data about a foreigner, if filled out by citizens of the Russian Federation, remains empty:

Requirements for filling out form P16001

Form P16001 is submitted when the liquidation balance sheet is compiled. Requirements for filling out the P16001 form are contained in section X of the Requirements. This is a simpler form, consisting of one page and sheet A for the applicant (four pages).

On the first page, information about the liquidated organization is entered according to data from the Unified State Register of Legal Entities. Section 2 indicates the date of publication of the notice of the decision on liquidation in the press. In sheet A we put the number corresponding to the applicant. Information about it is filled out according to rules similar to those indicated above for form P15001. Section 3 is completed by hand in black ink and in the presence of a notary.

Correctly filling out notifications P15001 and P16001 will significantly shorten the period for registering the liquidation of an organization. The ability to fill out such forms yourself will naturally reduce the financial costs of the organization. Careful reading of the material presented and the documents linked to it will help resolve both of these difficulties. You can download form P15001 2022 for free and a sample of filling out its lines at the end of this material. This is Appendix No. 20 to the order of the Federal Tax Service of Russia dated January 25, 2012 N ММВ-7-6/ [email protected] “On approval of forms and requirements for the execution of documents submitted to the registration authority for state registration of legal entities, individual entrepreneurs and peasant (farmer) farms" (registered with the Ministry of Justice of Russia on May 14, 2012 N 24139).

Р15001 2022 in excel

Form P15001 2022 in .pdf format

Form P16001 2022 in .pdf format

Rules for filling out form P15001

The basic rules for filling out the application for 2022 are:

- in the use of a single form for all legal entities - P15001;

- Data can only be printed in Courier New font, size 18, capital font is used;

- if the form is filled out by hand, only black ink can be used;

- There is no dash in empty fields.

Attention! To fill out P15001, you can use a special Excel form or a developed program. But it is worth monitoring the correctness of their work.

You can download and fill out the form for free using the link below.

Sample design P15001

The application form consists of several sections. An example will help you quickly understand the nuances of the P15001 form:

- The first section is called “Information about a legal entity contained in the Unified State Register of Legal Entities.” This paragraph indicates the exact name of the company, which was registered in the Unified State Register of Legal Entities. In addition, all other fields must be filled in indicating the relevant information: OGRN, TIN, assigned tax number.

- The second section is “Notice submitted in connection with.” This paragraph contains an information list in which the liquidator must tick the appropriate boxes. He must notify:

- on the resolution of the liquidation commission to terminate the company's activities. Here you must indicate the date the decision was made.

- on the creation of a liquidation group and the appointment of a liquidator;

- on ratification of the interim balance sheet;

- resolution on a previous refusal to carry out liquidation. What to do in this case is described in the video:

- In 2022, the new form allows you to claim multiple events on one form by checking the appropriate boxes on the application.

In the columns intended to be filled out by the registration authority, it is prohibited to put dashes or other marks.

A sample of the filling is shown in the photo. You can also download it from the link below.

When submitting a notification, the package of documents may additionally contain a title page and sheet B in case of termination of the enterprise's activities and approval of the interim balance sheet, and sheet A when appointing a commission and liquidator.

Rules for filling out sheet A

According to the law, in 2022, a company can form a liquidation commission and replace one or more candidates more than once. But each time it is necessary to document the changes that have arisen.

Important! Only information about a change of liquidator or chairman of the commission should be submitted to the registration authority.

To do this, fill out sheet A. You must indicate the following data in it:

- approval of the commission;

- date of drawing up the protocol on the decision made;

- Full name, date and place of birth, passport details, place of residence in accordance with KLADR, TIN of the liquidator or chairman of the commission. All information is filled out strictly in accordance with the data specified in the passport. Addresses of objects can be shortened only in accordance with Appendix No. 2 of the Order of the Federal Tax Service.

A sample of filling out sheet A is shown in the photo.

Sheet B data

It states:

- applicant details. If he is one of the founders of the LLC, the number 1 is entered in the column, if a legal entity - 2.

- details of the enterprise subject to liquidation;

- if there is a management company, its details.

If the applicant is the organization itself, in the first section you must indicate the number 3 and fill in the following fields:

- full name of the company;

- details and signature of the applicant.

If the applicant is the chairman of the liquidation commission, only a signature is required.

- in the last paragraph, fill in the details of the notary authority and the notary’s data.

A sample form is shown in the photo.

Post Views: 845

Dismissal

If one of the employees has expressed a desire to resign earlier than two months, he only needs to submit an application. Upon dismissal, such an employee must be paid compensation for the period not worked before liquidation. It is calculated based on average earnings.

As for the dismissal of all others who did not want to terminate the employment contract earlier, the procedure is as follows :

- After two months from the date of notification, a dismissal order . There are two options: draw up one order for everyone or for each employee separately. From a legal point of view, there is no difference. But it is important that each employee is familiar with the order , and this is confirmed by his signature.

- An entry about the termination of the employment relationship is made in the employee’s personal card and work book . Here is an example: “Dismissed due to the liquidation of the organization, paragraph 1 of part 1 of Article 81 of the Labor Code of the Russian Federation.”

- On the last working day, issue the funds due to the employee , work book and other documents, as for a regular dismissal, including a certificate of earnings for 2 years.

As for finances, upon liquidation the dismissed person must receive :

- the salary that is due to him for the period worked;

- if he did not use vacation - compensation;

- severance pay in accordance with Article 178 of the Labor Code of the Russian Federation, equal to the amount of average earnings.

This is a general case, but an employment or collective agreement may provide for increased benefits.

Situation: in a company that is subject to liquidation, an employee is expecting a child. Is she entitled to any special preferences, benefits, payments? No, in this case the general rules apply, that is, a pregnant woman is dismissed in the same way as all other employees. A similar procedure applies to women who are on maternity leave, single parents and other preferential categories.