In the article we will consider the debt for insurance contributions to the Social Insurance Fund, the Pension Fund of the Russian Federation, both organizations and individual entrepreneurs. Insurance premiums are mandatory payments that can be paid both by employers on the income of their employees, and by individuals independently in the case of their individual work.

In relation to insurance contributions, specific payment deadlines are established, violation of which entails a certain liability of payers to extra-budgetary funds.

Employers pay contributions as they accrue on a monthly basis based on calculated wages. Individual insured persons (for example, individual entrepreneurs) - one amount for the past calendar year. It turns out that these payments are not advance payments, and therefore extra-budgetary funds have the right to demand their timely payment.

Failure to comply with the deadlines for transferring payments, errors in calculations (conscious or unconscious) entail the formation of arrears in insurance premiums. In turn, arrears in insurance premiums are grounds for the accrual of penalties and fines. In some cases, the amount of the fine can reach significant amounts (up to 40% of the debt amount). To avoid such unpleasant sanctions, you should regularly monitor your debt and repay it in a timely manner.

Debt on insurance contributions to the Pension Fund

Employers must make monthly pension and health insurance contributions from their employees' salaries. These contributions form the future pension of Russians, and therefore not only the fund, but also the citizens themselves are interested in the absence of debt. Registration of organizations with the Pension Fund of the Russian Federation is carried out automatically when a new legal entity is formed and the necessary documents are submitted to the tax office.

The payment deadlines are established for employers by the fifteenth article of Law No. 212-FZ of July 24, 2009 - no later than the 15th of the previous month. Failure to meet deadlines entails an increase in debt, penalties and, in some cases, fines.

Companies report on payments to individuals and payments to the Pension Fund quarterly using the RSV-1 calculation - until the fifteenth day inclusive of the second month following the quarter (for electronic RSV-1 - until the twentieth day inclusive).

RSV-1 contains lines to reflect the amount of debt to the fund at the beginning and end of the quarter. If these amounts do not coincide with the testimony of the Pension Fund itself, they will be corrected, and the policyholder will receive a letter about the need to clarify the reporting and a demand for repayment of the debt.

Tax arrears

Tax arrears are late payments of taxes, both from citizens and entrepreneurs, to the country's budget.

Arrears may arise due to late payment of tax, which will entail penalties.

Tax arrears also include amounts of payments excessively reimbursed by the tax authority, for example, value added tax.

Overpaid value added tax and excise taxes can be refunded from the budget. The amount of VAT paid can be returned if the amount of this tax is less than the amount of deductions. The amount of excise tax paid can be returned if the deductions are higher than the amount of the tax itself.

Penalties

When you are assessed any tax, a specific deadline for paying it to the budget is set. From the next day after the tax payment deadline, penalty amounts begin to accrue until the payer transfers this tax along with penalties to the budget.

If you received an over-refunded amount of tax, penalties will be charged from the day the amount is transferred to your bank account.

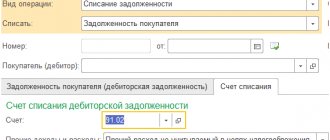

Arrears can and must be paid by a person at his own request and with accrued penalties. If the taxpayer ignores paying taxes, tax authorities can collect them forcibly. If it is impossible to write off this amount from the taxpayer, the tax authorities may recognize it as uncollectible and write it off.

Request for payment of tax

If a fact of non-payment of tax is detected, the tax authority sends a demand to the taxpayer to pay the tax and sets a specific deadline. The taxpayer is obliged to pay the tax within the period specified in the request. Then there will be no unpleasant consequences for the taxpayer.

If the taxpayer has ignored this requirement, the tax authority has the right to write off this amount from his bank accounts without the consent of the debtor. If the debtor does not have bank accounts or they are zero, the tax authority has the right to sue. After the tax authority receives a writ of execution, it has the right to seize the debtor’s property.

The arrears can be written off if the statute of limitations has expired, or if it is recognized by the tax authority as uncollectible.

Debt on insurance contributions to the Social Insurance Fund

In addition to contributions to health and pension insurance, employers must also pay mandatory social contributions. These deductions are used to pay social benefits and sick leave for employees.

Payment is made monthly to the Social Insurance Fund within the time limits approved by Law No. 212-FZ - no later than the fifteenth day of the next month. The employer reports on the transfers made quarterly by submitting a 4-FSS calculation until the 20th day of the next month inclusive (for electronic 4-FSS - until the 25th day inclusive).

4-FSS also contains fields for reflecting debt on social contributions at the beginning and end of the quarter. These figures are checked against the fund base when submitting the calculation; any discrepancies identified are grounds for sending a letter to the employer with a request to clarify the report data. In addition, a demand for the amount of debt is sent.

If there are no funds in the debtor's account

Arrears on insurance premiums to the Social Insurance Fund are the payments that will be collected from you, even if there is not enough money in your current account.

Law No. 212-FZ allows, if there are insufficient funds in a ruble account, to withdraw unpaid contributions from a foreign currency account (if any). The bank must write off the money no later than 1 business day. If there is no money, it will be debited as it is received into the account. And if there is no income, the arrears can be recovered from other property of the debtor. These could be securities, cars, finished products, etc. Unlike a monetary claim, collection of arrears from other property is given a year for large amounts, and 2 years for an amount of less than 500 rubles. Your debt will be considered paid after the sale of the property seized to account for the arrears (Article 20 of Law No. 212-FZ). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Debt on individual entrepreneur contributions

Individual entrepreneurs are required to transfer insurance payments for each of their employees in the manner established for all employers. In addition, individual entrepreneurs have the obligation to pay contributions for themselves.

Mandatory payments for an entrepreneur are contributions to pension and health insurance. As for the Social Insurance Fund, the decision on the need to pay social contributions remains with the individual entrepreneur. If an entrepreneur wants to receive sick leave, maternity and other social benefits, then he can voluntarily insure himself with the Social Insurance Fund and pay an annual fixed payment.

The amount to be paid depends on the minimum wage. In 2016, the following fixed payment amounts were established:

- RUB 3,796.85 – medical payment;

- 19356.48 + 1% of income over 300,000 rubles. – pension payment.

Entrepreneurs have the right to pay the fee once a year - until December 31 of the current year. 1 percent of income over 300,000 is paid until April 1 inclusive of the next year, since the final amount of income of the individual entrepreneur will be determined precisely at the end of the calendar year.

Individual entrepreneurs transfer the above payments even in the absence of activity. This is an important point, since often arrears in insurance premiums for individual entrepreneurs arise for the reason that activities are not carried out, and individuals forget that they once registered an individual business and now have some responsibilities in connection with this.

If an individual is registered as an individual entrepreneur, then he will have to pay fees and submit RSV-1 even if there is no movement. If contributions are not paid, then a notification will definitely come from the pension fund with a request to repay the arrears of contributions, taking into account the accrued penalties.

If there is no activity, then the best solution is to close the individual entrepreneur, having first repaid the debt to the funds.

Deferment (installment plan) of payment of insurance premiums

The Pension Fund of the Russian Federation and the Social Insurance Fund of Russia have the right to provide deferments (installments) for the payment of insurance contributions (penalties, fines). This is stated in paragraph 11 of part 1 of Article 29 of the Law of July 24, 2009 No. 212-FZ.

The grounds and procedure for granting a deferment or installment payment of insurance premiums (penalties, fines) are established by Articles 18.1–18.5 of the Law of July 24, 2009 No. 212-FZ.

Granting a deferment (installment plan) to the payer is possible if the following grounds exist:

- damage caused as a result of a natural disaster, technological disaster or other force majeure circumstances;

- lack (delay) of budget funding;

- seasonal nature of production and (or) sale of goods (work, services).

This follows from the provisions of Part 3 of Article 18.1 of the Law of July 24, 2009 No. 212-FZ.

A deferment (installment plan) can be obtained for any of three or several types of insurance premiums at once, the payment of which is regulated by Law No. 212-FZ of July 24, 2009:

- in the territorial branch of the Federal Social Insurance Fund of Russia - for contributions to insurance in case of temporary disability and in connection with maternity;

- in the territorial branch of the Pension Fund of the Russian Federation - for pension contributions and for contributions to compulsory health insurance.

Important: deferment (installment plan) for insurance contributions for the funded part of the pension is not provided. Moreover, the presence of debt for this part of pension contributions makes it impossible to obtain a deferment (installment plan) for contributions to the insurance part of the labor pension. In other words, until the organization pays off the arrears in contributions to the funded part of the pension, it will not be provided with a deferment (installment plan) for the payment of pension contributions. The presence of debt on the funded part of pension contributions does not prevent you from receiving a deferment (installment plan) for contributions to compulsory health insurance.

This follows from the provisions of parts 4 and 7 of Article 18.1 of the Law of July 24, 2009 No. 212-FZ.

If a deferment (installment plan) is granted due to the seasonal nature of the organization’s activities, the debt on insurance premiums will have to be repaid with interest. Interest will be calculated based on the amount of debt and half the refinancing rate in effect during the deferment period (installment plan).

In other cases, the funds do not charge interest for providing a deferment (installment plan).

This procedure is provided for by parts 5 and 6 of Article 18.1 and Article 18.3 of the Law of July 24, 2009 No. 212-FZ.

As a rule, a deferment (installment plan) can be granted for a period of no more than one year (Part 1 of Article 18.1 of the Law of July 24, 2009 No. 212-FZ).

There are circumstances that exclude the possibility of obtaining a deferment (installment plan) for the payment of insurance premiums. A deferment (installment plan) will not be provided if in relation to the organization:

- proceedings are underway regarding violation of the legislation on insurance premiums;

- proceedings are underway regarding administrative offenses in the field of insurance;

- there is a decision by the fund to terminate a previously granted deferment (installment plan). Another deferment (installment plan) will be denied if such a decision was made within the previous three years.

This follows from the provisions of parts 1 and 2 of Article 18.1 of the Law of July 24, 2009 No. 212-FZ.

To receive a deferment (installment plan) for the payment of insurance premiums, you need to submit to the territorial office of the fund:

- statement. Each fund has its own application form. Submit an application to the Pension Fund of the Russian Federation in the form approved by Resolution of the Board of the Pension Fund of February 20, 2015 No. 35p. And in the FSS of Russia - in the form approved by order of the FSS of Russia dated May 21, 2015 No. 205;

- act of joint reconciliation of calculations for insurance premiums;

- a certificate from the tax inspectorate about the organization’s open bank accounts;

- bank statements on monthly cash flows for the six months preceding the submission of the application;

- certificates from banks about the organization’s availability of payment documents placed in the file cabinet (about the absence of such documents);

- bank statements about cash balances in all accounts opened by the organization;

- the organization’s obligation to comply with the conditions under which the deferment (installment plan) is granted;

- debt repayment schedule;

- documents confirming the existence of grounds for granting a deferment (installment plan).

This procedure is provided for by Part 9 of Article 18.1, Parts 1 and 6 of Article 18.4 of the Law of July 24, 2009 No. 212-FZ.

The list of documents that will confirm the existence of grounds for granting a deferment (installment plan) depends on the specific basis. For example, to confirm the seasonal nature of an organization’s activities, documents must be submitted to the fund indicating an uneven flow of income (for example, contracts with counterparties with implementation dates in the spring-summer or, conversely, autumn-winter period).

In addition, depending on the reason for applying for a deferment (installment plan), a number of additional documents will have to be submitted to the fund. For example, if the basis for deferment (installment plan) is the seasonal nature of the activity, then a statement of calculation must be attached to the application. This calculation must confirm that the organization’s income from seasonal activities constitutes at least 50 percent of its total income. This follows from the provisions of Part 5 of Article 18.4 of the Law of July 24, 2009 No. 212-FZ and paragraph 5.1 of Article 64 of the Tax Code of the Russian Federation.

The territorial branch of the Pension Fund of the Russian Federation will make a decision on granting a deferment (installment plan) or refusing to change the deadlines for payment of insurance premiums (penalties, fines) within 30 working days from the date of receipt of the organization’s application. At the request of the organization for this period, the fund may decide to temporarily suspend the payment of insurance premiums (Parts 7, 8, Article 18.4 of the Law of July 24, 2009 No. 212-FZ, Resolution of the Pension Fund of the Russian Federation Board of February 20, 2015 No. 35p).

The territorial branch of the FSS of Russia will also make a decision on granting a deferment (installment plan) or refusing to change the deadlines for payment of insurance premiums (penalties, fines) within 30 working days from the date of receipt of the organization’s application. At the request of the organization for this period, the fund may decide to temporarily suspend the payment of insurance premiums (Parts 7, 8, Article 18.4 of the Law of July 24, 2009 No. 212-FZ, order of the FSS of Russia of May 21, 2015 No. 205).

The territorial branch of the fund is obliged to notify the organization of its decision within three days after its adoption (Part 13, Article 18.4 of the Law of July 24, 2009 No. 212-FZ).

The decision to refuse a deferment (installment plan) can be appealed both to a higher department of the fund and in court. Unlike decisions of tax inspectorates, complaints can be filed simultaneously: to go to court, you do not need to wait for the conclusion of a higher department of the fund (Part 12, Article 18.4, Article 54 of the Law of July 24, 2009 No. 212-FZ). The period for appeal is three months from the date of the decision (part 4 of article 198 of the Arbitration Procedure Code of the Russian Federation, paragraph 2 of article 55 of the Law of July 24, 2009 No. 212-FZ).

How to find out the debt on insurance premiums?

Depending on who wants to receive information about the presence of debt to extra-budgetary funds, there are several methods for obtaining information.

| A person who wants to know the debt | Method of obtaining information |

| Employer's contributions for employees | Submitting a written request to the Pension Fund or Social Insurance Fund indicating where the response should be sent. The fund will provide a written response within up to five working days. You can get it at the fund itself, or at the post office. |

| Submitting an electronic request to the Pension Fund or Social Insurance Fund - for those who submit electronic reports. An email response will be given within 1-2 days. | |

| Tracking current data in your personal account (on pension contributions). | |

| When submitting quarterly reports. If there is a discrepancy in debt data at the end or beginning of the quarter, the fund will notify you of this. | |

| Individual entrepreneur with contributions for himself | Submitting a written request to the Pension Fund. The response is provided in writing within five days to the address specified in the request. |

| Through your personal account (registered on the Pension Fund website). | |

| Individuals on pension contributions | Submitting a request in person (you need to have your passport and SNILS with you). |

| In your personal account on the Pension Fund website. | |

| In your personal account on the government services website. |

What to do to write off debts

The amnesty is offered on the basis of official orders of the Government, and to write off debt, entrepreneurs do not need to make any applications, prepare documents or contact Federal Tax Service employees.

Attention! The regulations do not contain information about the timing of write-offs, and there is also no information about the duration of the amnesty.

The fiscal authorities of each region independently form a special schedule, on the basis of which the debts of individual entrepreneurs are written off. Errors and misunderstandings often arise, so the individual entrepreneur’s debts are simply not written off.

Therefore, entrepreneurs perform the following actions:

- Initially, your personal account is checked on the Federal Tax Service website, which reflects current and written-off debts;

- if you have any doubts about the existence of an outstanding debt, you can clarify this issue by telephone or during a personal visit to a Federal Tax Service office;

- if necessary, a special appeal is drawn up to representatives of the Federal Tax Service, which contains a request to reconcile debts and write them off as part of the ongoing amnesty.

Such actions help reduce the risk that debts that can be written off by law will have to be repaid yourself.

Amnesty is a measure of support that is offered to entrepreneurs who, when faced with crisis situations, were unable to pay taxes and insurance premiums . But this does not apply to unscrupulous businessmen who hid income or are trying to write off recently incurred debts.

It is also useful to read: Refund of overpaid insurance premiums

Collection of debt on contributions. Algorithm

When unpaid contributions are detected, extra-budgetary funds carry out certain procedures aimed at stimulating payers to transfer the due amount.

The collection procedure is prescribed in Law No. 212-FZ and provides for:

- Submitting a demand to the debtor for repayment of the debt.

- Forced withdrawal of the required amount from a bank account.

- Recovery through court.

The first step is to send a demand to the debtor with the amount of money owed for contributions, penalties and fines specified in it. In addition to the amounts, the requirement specifies specific dates for their transfer.

It is better for a conscientious policyholder or insured person to voluntarily repay the debt on the basis of the received demand, otherwise the next step may follow on the part of the Pension Fund and the Social Insurance Fund, aimed at collecting the debt.

The second step is the forced withdrawal of the required amount from the debtor's bank account ; this procedure is called uncontested. This step can be completed if there is no payment within two months from the date reflected in the request. If the two-month period is missed, then it will no longer be possible to use forced debt collection; the issue will have to be resolved through the court.

There are special standard forms sent to the bank by extra-budgetary funds to withdraw the required amount from the client’s account. These forms were approved by Order No. 698n dated November 27, 2013; form 1-PFR is provided for the Pension Fund; form 1-FSS is provided for the Social Insurance Fund. If there is money in the debtor's account, the bank is obliged to withhold the required amount and transfer it to the fund.

The fund must notify the debtor himself of the decision to collect the debt on contributions from his account in writing by sending a registered letter, after which the necessary documents can be sent to the bank.

The third step is filing a claim in court . This step is performed if the two-month deadline for forced collection of the debt from the bank account is missed, but no later than six months from the payment date specified in the request. If the fund misses this deadline, the court will refuse to file a later application unless there are good reasons.

This procedure for collecting debt on insurance premiums is legal in relation to employer companies, as well as individual entrepreneurs. If an individual is not an individual entrepreneur, then the debt can only be collected from him through the judicial authorities.

Who will have their debts written off in 2022?

This year, an amnesty is offered for debt on insurance premiums, both for individual entrepreneurs and individuals.

Individuals write off debts for transport, property and land taxes, but this only applies to debt that was incurred before 2015. Reference! Former entrepreneurs who had debts before 2015 are exempt from mandatory repayment.

For 2022, several relaxations are proposed for individual entrepreneurs, so different types of debts are subject to write-off, which includes debt on insurance premiums. Not only immediate debts are subject to write-off, but also fines and penalties accrued on them.

Based on the amnesty, all legal proceedings regarding the collection of funds from entrepreneurs are terminated. The debt cancellation procedure is initiated by representatives of the Federal Tax Service, so businessmen do not have to prepare any statements on their own.

In 2022, amnesty is offered to the following persons:

- debts on contributions to social funds are forgiven for legal entities;

- persons engaged in private practice receive exemption from repayment of debt on insurance premiums;

- transport, income and property debts are forgiven for individuals and individual entrepreneurs;

- For individual entrepreneurs, an amnesty is additionally offered for contributions to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance.

Write-offs are made exclusively for debts that were incurred before 2022, if this applies to insurance premiums. Taxes are written off for debts incurred before 2015.

Information about the presence of outstanding debt can be obtained directly from employees of the Federal Tax Service or through the official website of this service. The verification can be performed through the State Services portal if you have an identified account.

It is recommended to contact the bailiffs to find out about the availability of open proceedings in which FSSP specialists have the right to write off funds from the current or personal accounts of entrepreneurs.

It is also useful to read: Mandatory insurance contributions of individual entrepreneurs to the Pension Fund of Russia

Repayment of debt on insurance premiums

If a debt is identified, it must be repaid within the period reflected in the fund’s requirement. It is better to do this voluntarily within the allotted time; you will still have to pay, only the amount of penalties and fines may increase significantly. The request indicates the already calculated amount to be paid, taking into account all penalties. The fine can range from 20 to 40% of the debt amount. Maximum sanctions are provided for deliberate underestimation of the amount payable.

If in the reporting the amount of contributions is calculated correctly, but the contribution itself is not listed, then you will not have to pay a fine, but penalties on the amount of the debt will be charged for each day of delay.

Penalties = amount of debt * number of days of delay * refinancing rate.

The transfer is made to the local branch of the fund where the policyholder or insured person is registered. Details for payment are indicated in the fund’s request; you can clarify them at the Pension Fund branch where the money is transferred.

Request for payment

Within three months from the date of discovery of the arrears, the fund department is obliged to send the organization a request for payment of insurance premiums (fines, penalties). The dates of detection of arrears are recorded in special certificates. This is stated in Part 2 of Article 22 of the Law of July 24, 2009 No. 212-FZ. The forms of requirements and certificates were approved by orders of the Ministry of Labor of Russia dated November 27, 2013 No. 698n and dated June 23, 2014 No. 400n.

The requirement can be submitted to the head of the organization (its legal or authorized representative):

- personally against signature;

- by registered mail. In this case, the request is considered received after six working days from the date of sending the registered letter;

- in electronic form via telecommunication channels. The formats, procedure and conditions for sending claims for payment of arrears via telecommunication channels must be established by the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia.

This procedure is provided for by Part 7 of Article 22, Part 6 of Article 4 of the Law of July 24, 2009 No. 212-FZ.

If a demand for payment of insurance premiums (fines, penalties) is drawn up based on the results of an inspection, it must be sent within 10 working days from the date of entry into force of the decision on the inspection report (Part 3 of Article 22, Part 6 of Article 4 of the Law of 24 July 2009 No. 212-FZ). The forms of decisions were approved by orders of the Ministry of Labor of Russia dated November 27, 2013 No. 698n, dated June 23, 2014 No. 400n. They come into force after 10 working days after delivery to the representative of the organization (Part 12, Article 39, Part 6, Article 4 of the Law of July 24, 2009 No. 212-FZ).

The repayment of arrears in compulsory social insurance contributions, which arose due to an overestimation of the amount of expenses accepted for deduction when calculating the monthly payment to the Social Insurance Fund of Russia, has some specific features. Having discovered such a violation, the territorial branch of the fund will make a decision not to take into account the costs of paying out insurance coverage and, within three days, will send the organization a demand for their compensation, indicating the amount and repayment period of the arrears (Parts 4 and 5 of Article 4.7 of the Law of December 29, 2006 No. 255-FZ). Based on this requirement, the organization is obliged to transfer the specified amount to the budget of the Social Insurance Fund of Russia, adjust the accounting data, and, if necessary, tax accounting, make changes to the reporting (clause 5, part 2, article 4.1 of the Law of December 29, 2006 No. 255-FZ , clauses 5–10 PBU 22/2010 and paragraph 2, clause 1, article 54, clause 1, article 81 of the Tax Code of the Russian Federation).

Situation: is the organization obliged to comply with the requirement to pay mandatory insurance contributions if it is incorrectly completed?

No, I don't have to.

The procedure for filing claims for payment of insurance premiums is provided for in Part 4 of Article 22 of Law No. 212-FZ of July 24, 2009. The requirement, in particular, must indicate:

- amount of debt on insurance premiums;

- the amount of penalties and fines accrued by the time the claim was made;

- deadline for payment of insurance premiums for which arrears arose;

- measures that will be taken by the extra-budgetary fund if the organization does not pay off the arrears;

- the grounds on which insurance premiums are collected, with references to specific provisions of the Law of July 24, 2009 No. 212-FZ.

If the request for payment of insurance premiums received by the organization does not contain any data from the above list, it is considered to have been drawn up with violations. The organization should not comply with such a requirement. This follows from the provisions of paragraph 9 of part 1 of article 28 of the Law of July 24, 2009 No. 212-FZ.

In arbitration practice there are examples of court decisions confirming the legality of this approach. For example, by resolution of February 20, 2012 No. A46-5496/2011, the Federal Antimonopoly Service of the West Siberian District invalidated the requirement to pay penalties on insurance premiums, since it did not indicate how much debt was owed and for what period the territorial branch of the Pension Fund of the Russian Federation charged the organization a penalty.