basic information

Changing the surname of an individual entrepreneur is practically no different from changing the surname of a sole proprietor. The only difference is the need to change not only “physical” but also “legal” documents. Changes must also be entered into the Unified State Register of Individual Entrepreneurs. The entrepreneur will need to change the OGRNIP certificate. The procedure for changing an individual entrepreneur's surname is regulated by Federal Law No. 143 “On Acts of Civil Status” dated November 15, 1997.

Is it necessary to submit a SZV-TD in relation to hired workers if the individual entrepreneur has changed his last name?

The surname changes in several stages. The entrepreneur will have to send relevant applications to various authorities. And this must be done within a certain time frame. It is not enough for an entrepreneur to simply change his passport. If the information in business documents does not correspond to reality, the individual entrepreneur will not be able to carry out activities.

FOR YOUR INFORMATION! If an individual changes his last name, he only needs to change his passport and civil papers. If an individual entrepreneur changes his last name, he needs to change all papers related to entrepreneurial work.

First step

First, an entrepreneur needs to contact the registry office and request a certificate to change his last name. To do this, you need to go to the authority at the place of residence/registration of the individual entrepreneur. An application to change the surname is sent to the registry office. Before submitting an application, a fee is paid, and all the necessary documents are collected.

Question: An individual entrepreneur changed his last name. Is it necessary to make changes to the employment contracts concluded with its employees? View answer

Change of surname is carried out on the basis of an application. The corresponding instruction is in Government Decree No. 1274 of October 30, 1998. The application records this information:

- Basic data (full name, date of birth).

- Children under 14 years old, if any (you must indicate their full name).

- Details of documents (number, date, name of the registry office) about marriage.

- Selected last name.

- Reasons why the surname changes (personal desire, marriage).

- List of attached papers.

Question: The individual entrepreneur changed his last name. In this regard, is it necessary to conclude additional agreements to employment contracts with employees? View answer

The following documents are attached to the application:

- Birth certificate.

- Old passport.

- Marriage or divorce certificate if the surname changes due to these circumstances.

- Authorization of official representation if the surname of minors changes.

The package of documents in question, the application and the receipt for payment of the state fee must be sent to the registry office.

The application is reviewed by the registry office within 30 days. Under exceptional circumstances, it is possible to extend the period to 60 days. As a result, the person receives a certificate. Based on this, you can change your passport. It must be changed within 30 days from the date of receipt of the certificate. A passport with current data will be ready 10 days after it is ordered.

Algorithm for changing the last name of an individual entrepreneur

The process for a sole proprietor consists of several steps.

- Change your passport. To do this, you need an application in form No. 1P, a valid passport, two photos measuring 35x45 mm, a birth certificate, a marriage registration certificate (if the change occurs due to marriage), a receipt for payment of state duty (300 rubles at the bank, if payment through the website of the tax inspectorate or government services - 30% less), military ID if available, birth certificates of children under 14 years of age.

- Pick up an extract from the Unified State Register of Individual Entrepreneurs. Passport office employees themselves send information to the tax authorities. The Tax Inspectorate enters information about changes into the Unified State Register of Individual Entrepreneurs. To ensure that changes have been made, you can order an extract: it is issued free of charge, and by law must be provided within five working days. If the process of changing data in the register is delayed, you can write an application to the tax office so that information about your new name will be entered into the Unified State Register of Individual Entrepreneurs. The document is drawn up in form No. P24001 and submitted to the Federal Tax Service in person or by registered mail with delivery receipt.

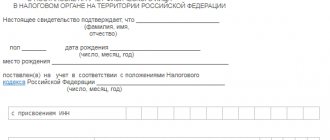

- Change the TIN certificate. This requires contacting the Federal Tax Service, where a corresponding application is submitted in form No. 2-2-Accounting. You can take it during a personal visit, you can also send it by mail or fill out an application on the tax service in the section for submitting applications for individuals to register. The TIN number will not change - it will simply be transferred to a new form with the new surname of the individual entrepreneur. The law gives the tax service five working days to prepare a new certificate.

- Change your last name in SNILS. The replacement concerns the form itself: the account number remains the same. An application for a replacement is submitted to the branch of the state pension fund at the place of residence, through the MFC or on the government services website or in the personal account of the pension fund. Document form – ADV-2. An existing insurance certificate card is attached to the application. The document should be ready in a maximum of three weeks. And although the personal account number in the pension fund remains anonymous, experts recommend taking care of replacing the SNILS form so that no problems arise in the future, for example, if you want to take out a loan from a bank.

- Change the notice that the individual entrepreneur is registered with the Pension Fund of the Russian Federation. To do this, you need to call the fund office at the place of registration of the entrepreneur to clarify whether changes have been made. You can receive a new notification within two business days on average.

- Change the notification of registration with Rosstat. This requires contacting the statistical service department by telephone to clarify whether updates have been made to the system. If the answer is yes, you can find the document on the statistics department website and print it.

- Renew the license if the type of activity of the entrepreneur is subject to licensing. To do this, you need to submit an application and the corresponding package of documents to the authority that issues a license in the direction where the individual entrepreneur operates.

- Notify the bank where the entrepreneur is serviced. This is necessary to change the IP details. You can inform the bank through the manager - during a personal visit or by email. You will need copies of three passport spreads, which indicate the new surname of the individual entrepreneur, your photo, registration information and information about passports that were issued before. In the case where the change occurs in connection with marriage, it is necessary to provide evidence that it was concluded. You also need an extract from the Unified State Register of Individual Entrepreneurs. If you have a new TIN certificate on hand, you may also be asked to bring or send it. Then the individual entrepreneur will need to sign a new application form and an agreement with the bank.

- Inform business partners: this can be done by registered mail. It is important not to miss this moment so that counterparties are not surprised by your new initials on contracts that you will conclude with them in the future, and also so that they write out the documentation taking into account the new situation.

- Update accounting documentation so that financial statements are filled out correctly in the future. Otherwise, there is a risk of conflicts with the tax office.

- Make changes to personnel documentation if the individual entrepreneur has employees. Amendments must be made to employees’ employment contracts and their work books, where the employer’s full name is indicated. To do this, a local order is issued, which approves the replacement of personnel documents due to a change in the surname of the individual entrepreneur. It must indicate the responsible employees who are responsible for execution, and also describe the procedure for making changes to personnel documents. Thus, it is possible to sign additional agreements to employment contracts, and additional entries can be made in employee work books.

- Report the change of the individual entrepreneur's surname to the Social Insurance Fund if the entrepreneur has employees. To do this, you need to write an application in a free format.

- Obtain a new electronic signature certificate (EDS) required to use the bank’s remote servicing system.

- Re-register the online cash register with the tax office if an individual entrepreneur uses it in his work. If necessary, enter into a new agreement with an organization that is a certification center and provides equipment maintenance services for the online cash register.

- Replace your foreign passport if you had such a valid document. Here the legislation does not dictate any conditions: you simply will not be able to travel around the world until you receive a new passport.

- Change your driver's license, PTS, STS of the car, as well as the MTPL policy if you are a car owner.

- Replace the compulsory medical insurance policy. This is important because such a document is considered valid and accepted in medical institutions only if all the information in it is correct. If your last names in the new passport and the old policy are different, you may simply be denied an appointment with a doctor under the compulsory medical insurance system. The same rule applies to the VHI policy (voluntary health insurance). If you were given such a policy at work, you will have to worry about replacing it with a new name.

Change of passport

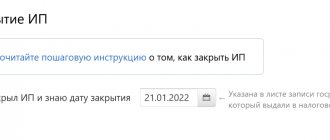

The passport must be changed within 30 days after receiving a certificate of change of surname or after marriage. To obtain an updated document, you can send an application to the Ministry of Internal Affairs, MFC. You can also initiate the process of changing your passport through the government services website.

If the application is submitted at the place of residence of the individual entrepreneur, a new document can be received within 10 days. If the package of documents is submitted to another authority, the passport will be prepared within 30 days. To change you need to prepare these papers:

- Previous passport.

- Statement.

- Marriage/divorce certificate.

- A receipt confirming payment of the duty.

- Photo 35 by 45 mm.

- Papers needed to put marks in the passport: military ID, marriage certificate.

The fee is 300 rubles. When paying through government services, you can get a 30% discount.

Obtaining an extract from the Unified State Register of Individual Entrepreneurs (USRIP)

An entrepreneur does not need to contact an individual entrepreneur to change information. The passport office itself will send all the necessary information on the basis of which changes are made. An entrepreneur can receive an extract from the Unified State Register of Entrepreneurs about the change of data. Providing an extract is a free service. The document will be ready within 5 days.

Sometimes information in the Unified State Register of Individual Entrepreneurs does not change in a timely manner. The entrepreneur can speed up the procedure. To do this, you need to send a corresponding application formed according to form P24001. The application is sent to the tax office. This can be done either in person or by mail. There is no need to pay a fee.

Do I need to change the OGRNIP certificate?

The Federal Tax Service of Russia, in its Order No. ММВ-7-14/ [email protected] dated September 12, 2016, canceled the issuance of registration certificates for individual entrepreneurs and legal entities from January 1, 2017. They were replaced by a Record Sheet, which is issued to new individual entrepreneurs and to those who applied for a replacement Certificate due to its loss or for other reasons.

The new document is externally similar to an extract from the Unified State Register of Individual Entrepreneurs, but it contains information about the separate registration of the changes made. That is, for each entry in the register, the businessman receives a separate Entry Sheet.

To obtain a document, an entrepreneur, as in the case of an extract, must contact the tax office and provide an application, as well as a document confirming payment of the state duty (receipt).

Sending notifications to partners

The first step is to send the changed information to the servicing bank. The client's current account will remain the same, but the name of the individual entrepreneur will be updated. A notification must be sent to the bank before the next payment from the counterparty so that the money goes through the correct details.

It is also recommended to contact counterparties. Free-form letters are sent to partners. They must indicate that the details of the individual entrepreneur, and in particular the last name, have changed.

If the entrepreneur has a seal, it also changes. This is due to the fact that the surname of the individual entrepreneur usually appears in it. If you do not update anything, the seal will no longer be relevant.

An entrepreneur may have loans. In this case, you need to contact the credit institution.

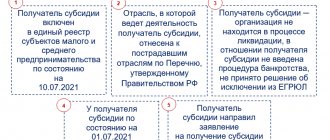

Scheme for contacting government agencies

Changing the last name of an entrepreneur is a lengthy process that involves contacting various authorities. Moreover, the process is complicated by the fact that the individual entrepreneur needs to meet the deadlines. Let's consider all the authorities where you need to go, with current deadlines:

| Government agency | Action | Deadlines |

| Passport Office | Change of passport | Submitting an application within 30 days from the date of wedding/divorce or issuance of a certificate for changing a passport |

| Federal Tax Service | Change of TIN | The application must be submitted immediately after the new passport is issued |

| Pension Fund | Change SNILS | Within 2 weeks from the date of issue of the new passport |

| Bank | Change of details | After receiving an extract from the Unified State Register of Individual Entrepreneurs |

| Federal Tax Service | Extract from the Unified State Register of Individual Entrepreneurs. Requested as needed | Issued within 5 days |

| Insurance | Change of compulsory medical insurance | Within 30 days from the date of receipt of a new passport |

The process of amending documents due to a change of surname can take up to 2 months.

Required documents

To receive a Unified State Register of Individual Entrepreneurs with new data, a businessman must submit the following documents to the tax office:

- an application indicating the full name of the individual entrepreneur, OGRN and INN, registration, telephone number and email address;

- paid receipt of state duty.

The fee for receiving the Sheet is 200 rubles for receiving the document in the usual way or 400 rubles for the expedited one. The document is issued only in electronic form, but the application is submitted in person to the tax organization. The sheet is endowed with legal force, since it is confirmed by a special digital signature of the inspectorate.