About legal entities

What part of the year is 1st quarter? October, November, December. 1 year: 1 quarter

Art. 178 of the Labor Code of the Russian Federation guarantees resigning employees financial resources to support them during the period of employment

This year the special assessment of working conditions (SAL) turns 6 years old. She appeared from the beginning

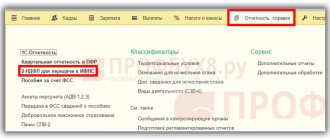

The register of 2-NDFL certificates and a set of certificates on the income of individuals are formed by employers when compiling the annual

Why is a supplementary SZV-M needed? A supplementary SZV-M allows the employer to clarify and supplement previously transmitted

Who grants the right to property tax exemption? Certain categories of taxpayers are given the right

Simply and with examples of why VAT is not a business expense, with

Correspondence 20 accounting accounts Let's consider typical entries: DT20 KT10 - materials written off. DT10

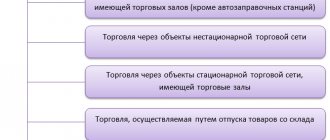

Form TS-2 is used by those who pay the trade tax (TC) if they cease to be his

Drawing up a declaration according to the simplified tax system “income minus expenses” The year-end declaration is submitted by “simplified” students in the spring