The patent system (remember the abbreviation PSN) is one of the special regimes for entrepreneurs. Unlike the simplified tax system, it is available only to individual entrepreneurs and has a number of concessions, for example, the lack of reporting. A patent replaces taxes on property, value added and income of individuals.

The patent system has existed since 2013. Before this, entrepreneurs were on the simplified tax system on a patent basis.

The essence of this system is that the individual entrepreneur receives a patent and does not pay part of the taxes. If, for example, you received a patent for the provision of logistics services, then you do not need to pay income tax on this activity. For other types of activities (if any), a different taxation system is applied. PSN is described in detail in Chapter. 26.5 Tax Code of the Russian Federation.

Attention! The patent applies to business only in the territory where the individual entrepreneur is registered. To work on a patent at the place of business, you need to submit an application to the local patent department of the Federal Tax Service.

Who can apply the patent tax system?

Only individual entrepreneurs who bought a patent or several patents in the prescribed manner. The patent system is available for different types of activities.

Who is the patent tax system suitable for:

- software developers;

- to retailers in areas not exceeding 150 m2;

- catering representatives;

- owners of beauty salons and hairdressers;

- landlords;

- workshops for repairing/sewing clothes, shoes or household appliances;

- parking lot owners;

- private tutors who receive official payment;

- language schools and translators, etc.

All types of activities are described in Art. 346.43 Tax Code of the Russian Federation. But constituent entities of the Russian Federation have the right to expand this list, so also read the regional legislation on PSN.

There are also restrictions on the use of a patent. Entrepreneurs who conduct business under a partnership agreement or under a property trust agreement, are engaged in wholesale trade, provide credit and financial services, or make transactions with securities will not be able to switch to the PSN. There are also a number of restrictions on physical indicators:

- for retail trade - the sales floor area should not exceed 150 m² for each facility;

- for catering - the area of the service hall should not be more than 150 m²;

- for cargo and passenger transportation - the individual entrepreneur should not own more than 20 cars.

Regions may introduce additional restrictions on physical indicators. For example, individual entrepreneurs who have 15 vehicles for transporting goods should not be allowed to buy a patent.

Excise goods listed in paragraphs cannot be sold on a patent. 6-10 p. 1 tbsp. 181 of the Tax Code of the Russian Federation, and some types of goods subject to mandatory labeling: medicines, shoes and fur products. Beer and cigarettes can be sold.

This might also be useful:

- KBK to pay for the patent in 2022

- Patent value calculation

- Patent tax system in 2022

- Details for paying insurance premiums in 2022

- Which OKVED code should be indicated in the reporting for 2016?

- Reduced insurance premium rates in 2022

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

How to switch to a patent tax system?

The procedure for switching to a patent is as follows:

- Submit an application to the Federal Tax Service at the place of registration of the individual entrepreneur 10 or more working days before you start using the PSN. You can submit your application by mail or electronically. The application form was approved by order dated December 9, 2020 No. KCh-7-3/ [email protected]

2. Five working days after receiving the application, the Federal Tax Service must issue you a patent or notify you of the refusal against receipt.

Why they may refuse:

- A type of activity is indicated that is not included in the list of eligible patents.

- Incorrect patent expiration date.

- You already lost the right to enforce the patent this year, and this is your re-application.

- You have patent tax debts.

How long does a patent last?

You can be on this tax system from a month to a year, but within one calendar year. That is, you cannot obtain a patent from March 10, 2022 to March 10, 2022, until a maximum of December 31, 2022. Then you need to get a new patent. As you probably guessed, you can get a patent for less than a month.

Answers to questions from the Federal Tax Service for individual entrepreneurs on a patent

Question No. 1: Should I apply for a patent for the month of January, and then from February for 11 months at the new rates?

Answer: In accordance with paragraph 1 of Article 346.45 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), a document certifying the right of an individual entrepreneur to apply the patent taxation system is a patent for carrying out one of the types of business activities in respect of which the law of the constituent entity of the Russian Federation has introduced a patent system taxation.

According to paragraph 5 of Article 346.45 of the Code, a patent is issued at the choice of an individual entrepreneur for a period of one to twelve months inclusive within a calendar year.

The Code does not provide for the possibility of issuing a patent for a period of less than a month.

Paragraph 2 of Article 346.49 of the Code establishes that when a patent is issued for a period of less than a calendar year, the tax period is the period for which the patent was issued.

A period calculated in months expires on the corresponding month and day of the last month of the term (clause 5 of Article 6.1 of the Code).

In connection with this, the validity period of a patent is a period within one calendar year (from January 1 to December 31), starting on any day of the month specified by the individual entrepreneur in the application for a patent, and expiring on the corresponding date of the last month of the period.

Thus, you have the right to take out a patent for any period, but not less than a month. At the end of the tax period, you have the right to reapply for any period within the calendar year.

Question No. 2: I am an individual entrepreneur. From January 1, 2022 I want to switch to a patent. Number of employees: 15 people. But there is an agreement with the self-employed for the provision of services. Do I have the right to use the patent tax system? Thank you.

Answer: In accordance with paragraph 5 of Article 346.43 of the Code, when applying PSN, an individual entrepreneur has the right to attract employees, including under civil contracts. At the same time, the average number of employees, determined in the manner established by the federal executive body authorized in the field of statistics, should not exceed 15 people during the tax period for all types of business activities carried out by an individual entrepreneur.

Agreements for the provision of services for a fee are civil contracts and are governed by the provisions of the Civil Code of the Russian Federation.

Thus, if an individual entrepreneur - a PSN taxpayer uses the labor of employees, including individuals applying professional income tax, with whom contracts for the provision of paid services have been concluded, then the individual entrepreneur must take such employees into account when determining the average number of employees.

At the same time, we note that in accordance with subparagraph 2 of paragraph 6 of Article 346.45 of the Code, the taxpayer is considered to have lost the right to use the PSN and switched to the general taxation regime from the beginning of the tax period for which the patent was issued, if during the tax period the taxpayer failed to comply with the requirement , established by paragraph 5 of Article 346.43 of the Code.

Thus, if the number of employees exceeds the number of employees established by paragraph 5 of Article 346.43 of the Code, during the tax period, an individual entrepreneur is considered to have lost the right to use the PSN and switched to the general taxation regime from the beginning of the tax period for which he was issued a patent, and is also required to pay tax in accordance with paragraph 7 of Article 346.45 of the Code.

Question No. 3. Is an individual entrepreneur on NAP exempt from paying insurance premiums?

Answer: Yes. In accordance with paragraph 11 of Art. 2 of the Federal Law of November 27, 2018 No. 422-FZ “On conducting an experiment to establish a special tax regime “Tax on professional income”, individual entrepreneurs who do not make payments and other remuneration to individuals are not recognized as payers of insurance premiums for the period of application of the special tax regime in form of NPD.

Question No. 4: If an application is submitted for 12 months of 2022 and the Federal Tax Service has already calculated the rate, will it change after the adoption of the new law?

Answer: In accordance with paragraph 7 of Article 346.43 of the Code, the laws of the constituent entities of the Russian Federation establish the amount of annual income that an individual entrepreneur can potentially receive by type of business activity in respect of which the patent tax system is applied. The amount of potential annual income established for a calendar year by the law of a constituent entity of the Russian Federation is applied in the next calendar year (following calendar years), unless it is changed by the law of a constituent entity of the Russian Federation (clause 2 of Article 346.48 of the Code).

In addition, the laws of the constituent entities of the Russian Federation may introduce changes that, in accordance with paragraph 8 of Article 346.43 of the Code, differentiate the types of business activities in respect of which the patent tax system is applied, change the amount of potential income, include (exclude) additional types of business activities related to household services.

Paragraph 2 of Article 346.45 of the Code establishes that an individual entrepreneur submits an application for a patent no later than 10 days before the start of application of the patent tax system (in 2022 no later than December 31). The Code does not establish a limitation on the period from which the said application can be submitted.

The tax authority has no right to refuse to issue a patent to an individual entrepreneur due to the fact that the relevant law of the constituent entity of the Russian Federation establishing the amount of potential income for the next calendar year has not been adopted or has not entered into force.

In this regard, in the event that an individual entrepreneur, during 2022, before the adoption of a law of a constituent entity of the Russian Federation establishing the amount of potential annual income for 2022, filed an application for a patent (patents), with a start date in 2022 , the tax authority was obliged to issue him a patent (patents) within five days. If the law of a constituent entity of the Russian Federation for 2021 for certain types of business activity has increased (decreased) the amount of potential annual income received, the tax authority must issue the taxpayer a new patent with an updated tax amount.

Question No. 5: Can those who have applied for a patent for the whole year request a recalculation at the new rates?

Answer: In accordance with the first paragraph of paragraph 1 of Article 5 of the Code, acts of legislation on taxes come into force no earlier than one month from the date of their official publication and no earlier than the 1st day of the next tax period for the relevant tax, with the exception of cases provided for specified by the article of the Code.

Acts of legislation on taxes and fees that abolish taxes, fees and (or) insurance premiums, reduce tax rates, fees and (or) insurance premium rates, eliminating the responsibilities of taxpayers, fee payers, insurance premium payers, tax agents, their representatives or otherwise improving their situation in a way may have a retroactive effect if they directly provide for this (clause 4 of Article 5 of the Code).

Article 346.49 of the Code establishes that for the purposes of applying the patent taxation system, the tax period is recognized as a calendar year, unless otherwise established by this article of the Code (in 2021 - a month). If, on the basis of paragraph 5 of Article 346.45 of the Code, a patent is issued for a period of less than a calendar year, the tax period is the period for which the patent was issued.

In this regard, the law of a constituent entity of the Russian Federation establishing the amount of annual income potentially received by an individual entrepreneur comes into force no earlier than one month from the date of its official publication and no earlier than the 1st day of the next tax period (calendar year).

To carry out the recalculation, you need to contact the inspectorate that issued the patent with a written application to replace this patent with a new one, in which the amount of tax will be reduced.

Question No. 6: During what period will it be possible for an individual entrepreneur without employees to apply for a reduction in the patent for insurance premiums? And is there a sample application?

Answer: To ensure a “seamless” transition from a special tax regime in the form of a single tax on imputed income for certain types of activities to other special tax regimes, including the patent taxation system in accordance with Federal Law dated November 23, 2020 No. 373-FZ “On introducing amendments to Chapters 26.2 and 26.5 of Part Two of the Tax Code of the Russian Federation and Article 2 of the Federal Law “On the use of cash register equipment when making payments in the Russian Federation” (hereinafter referred to as Law No. 373-FZ) from 01/01/2021 the cost of a patent can be reduced by insurance payments (contributions) incurred in relation to employees engaged in activities for which PSN is paid, in particular:

- for contributions paid during the tax period for compulsory health insurance, compulsory medical insurance, VNIM and in case of injury for employees (clause 1, clause 1.2, article 346.51 of the Tax Code of the Russian Federation);

- sick leave benefits paid at the expense of the employer for days paid by the employer (clause 2, clause 1.2, article 346.51 of the Tax Code of the Russian Federation);

- contributions under contracts of voluntary personal insurance of employees in case of their illness for days paid by the employer (clause 3, clause 1.2, article 346.51 of the Tax Code of the Russian Federation).

It will be possible to reduce the tax under PSN on the specified insurance payments (contributions) and benefits by no more than 50%. An individual entrepreneur without employees can reduce the tax on contributions paid for compulsory health insurance and compulsory medical insurance (clause 1.2 of article 346.51, clause 1 of article 430 of the Tax Code of the Russian Federation).

If an individual entrepreneur received several patents in a calendar year, he can reduce the tax on each of them by the listed insurance payments (contributions) and benefits. In this case, the condition for limiting the reduction in the amount of tax for each patent must be met, and the total amount of reductions must not exceed the amount of insurance payments (contributions) and benefits paid this year (clause 1.2 of Article 346.51 of the Tax Code of the Russian Federation).

It is impossible to reduce the tax under PSN on insurance payments (contributions) and benefits that were taken into account when calculating taxes paid in connection with the use of another taxation system.

Law No. 373-FZ provides that the taxpayer sends a notice of reduction in the amount of tax paid in connection with the application of the patent taxation system by the amount of paid insurance payments (contributions) and benefits in written or electronic form using an enhanced qualified electronic signature via telecommunication channels to the tax authority at the place of registration as a taxpayer applying the patent taxation system.

The form, format and procedure for submitting this notification are approved by the federal executive body authorized for control and supervision in the field of taxes and fees (currently not approved).

Question No. 7. Question on 6-NDFL and 2-NDFL. The individual entrepreneur is registered as a UTII payer in the Federal Tax Service Inspectorate 1327, and the Federal Tax Service Inspectorate 5803 is registered. From 01.01.20, UTII is cancelled. Deadline for submitting 6NDFL and 2NDFL to the Federal Tax Service 1327

Answer: In accordance with Article 230 of the Tax Code of the Russian Federation, when deregistering an individual entrepreneur with the Federal Tax Service at the place of activity in connection with the application of the taxation system in the form of UTII (1327), calculations in Form No. 6-NDFL and certificates in Form 2-NDFL should be submitted to the tax authority at the place of his registration as an individual entrepreneur, that is, to the Federal Tax Service Inspectorate 5803. The deadline for submitting the specified reports for 2022 is no later than March 1, 2022. At the same time, filling out the calculation in form No. 6-NDFL, in the “OKTMO code” field » is indicated by OKTMO of the place where activities are carried out under UTII.

Question No. 8: The organization submitted a notification to the simplified tax system on December 17, 2020. How do we know that our application was accepted and registered as a payer of the simplified tax system? Will they contact us?

Answer: If all the conditions for applying the simplified tax system are met, and the notice of transition to the simplified tax system is submitted on time, the company is considered to have switched to the simplified tax system (clause 1 of article 346.13 of the Tax Code of the Russian Federation). The inspection itself will not send you any documents confirming the transition to the simplified tax system.

However, you can at any time contact the Federal Tax Service with a request to issue you written confirmation of the application of the simplified tax system. The inspection will send you form No. 26.2-7, which will indicate the date when you submitted a notification about the transition to the simplified tax system.

Question No. 9: An individual entrepreneur has several patents, how can one properly reduce the cost of patents for insurance premiums?

Answer: To ensure a “seamless” transition from a special tax regime in the form of a single tax on imputed income for certain types of activities to other special tax regimes, including the patent taxation system in accordance with Federal Law dated November 23, 2020 No. 373-FZ “On introducing amendments to Chapters 26.2 and 26.5 of Part Two of the Tax Code of the Russian Federation and Article 2 of the Federal Law “On the use of cash register equipment when making payments in the Russian Federation” (hereinafter referred to as Law No. 373-FZ) from 01/01/2021 the cost of a patent can be reduced by insurance payments (contributions) incurred in relation to employees engaged in activities for which PSN is paid, in particular:

- for contributions paid during the tax period for compulsory health insurance, compulsory medical insurance, VNIM and in case of injury for employees (clause 1, clause 1.2, article 346.51 of the Tax Code of the Russian Federation);

- sick leave benefits paid at the expense of the employer for days paid by the employer (clause 2, clause 1.2, article 346.51 of the Tax Code of the Russian Federation);

- contributions under contracts of voluntary personal insurance of employees in case of their illness for days paid by the employer (clause 3, clause 1.2, article 346.51 of the Tax Code of the Russian Federation).

It will be possible to reduce the tax under PSN on the specified insurance payments (contributions) and benefits by no more than 50%. An individual entrepreneur without employees can reduce the tax on contributions paid for compulsory health insurance and compulsory medical insurance (clause 1.2 of article 346.51 of the Tax Code of the Russian Federation).

If an individual entrepreneur received several patents in a calendar year, he can reduce the tax on each of them by the listed insurance payments (contributions) and benefits. In this case, the condition for limiting the reduction in the amount of tax for each patent must be met, and the total amount of reductions must not exceed the amount of insurance payments (contributions) and benefits paid this year (clause 1.2 of Article 346.51 of the Tax Code of the Russian Federation).

It is impossible to reduce the tax under PSN on insurance payments (contributions) and benefits that were taken into account when calculating taxes paid in connection with the use of another taxation system.

Law No. 373-FZ provides that the taxpayer sends a notice of reduction in the amount of tax paid in connection with the application of the patent taxation system by the amount of paid insurance payments (contributions) and benefits in written or electronic form using an enhanced qualified electronic signature via telecommunication channels to the tax authority at the place of registration as a taxpayer applying the patent taxation system.

The form, format and procedure for submitting this notification are approved by the federal executive body authorized for control and supervision in the field of taxes and fees (currently not approved).

Question No. 10. We will be deregistered as UTII. How do we submit 6-NDFL?

Answer: In accordance with Article 230 of the Tax Code of the Russian Federation, in the event of deregistration of an individual entrepreneur with the Federal Tax Service at the place of activity in connection with the application of the taxation system in the form of UTII, the calculation in Form No. 6-NDFL for 2020 should be submitted to the tax authority at its place registration as an individual entrepreneur no later than March 1 of the following year. At the same time, when filling out the specified reporting, in the “OKTMO code” field, the OKTMO code of the place of activity under UTII is indicated.

Question No. 11: We rent three retail spaces in the shopping center. Should I buy one patent for all areas or three patents?

Answer: If you plan to transfer everything, in this case three retail spaces, to PSN, then you can indicate three objects in one application. The patent for the right to use PSN (form No. 26.5-P approved by Order of the Federal Tax Service of Russia dated November 26, 2014 No. MMV-7-3 / [email protected] ) indicates the number of indicators characterizing certain types of business activities, in particular for the objects used to carry out retail trade (type of object, location address, name of physical indicator and area of the object), and the amount of tax calculated taking into account such indicators, payable in connection with the application of the PSN. In this case, a separate sheet is filled out for each object.

Question No. 12: Is it necessary to keep a book of income for a patent?

Answer: For the purposes of Chapter 26.5 “Patent taxation system” of the Code, individual entrepreneurs keep records of income from sales received in the implementation of types of business activities for which the patent taxation system is applied, in the income book of an individual entrepreneur applying the patent taxation system, form and procedure the completion of which is approved by the Ministry of Finance of the Russian Federation (clause 1 of Article 346.53 of the Code).

The form of the book of income accounting for individual entrepreneurs using the patent taxation system, and the procedure for filling it out, were approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n “On approval of the forms of the Book of accounting of income and expenses of organizations and individual entrepreneurs using the simplified taxation system, the Book of income of individual entrepreneurs applying the patent taxation system, and the procedures for filling them out.”

Question No. 13: I am registered with the Federal Tax Service Inspectorate 1322, I operate in the city of Saransk on the territory of the Federal Tax Service Inspectorate 1326. Can I apply for a patent to the Federal Tax Service Inspectorate 1322?

Answer: According to paragraph 1 of Article 346.45 of the Code, a document certifying the right to use the patent taxation system is a patent for one of the types of business activities in respect of which the law of the constituent entity of the Russian Federation has introduced a patent taxation system.

A patent is valid throughout the entire territory of a constituent entity of the Russian Federation, except for cases where the law of a constituent entity of the Russian Federation defines the territory of validity of patents in accordance with subclause 1.1 of clause 8 of Article 346.43 of the Code. The patent must contain an indication of the territory of its validity.

In accordance with paragraph 2 of Article 346.45 of the Code, an individual entrepreneur submits personally or through a representative, sends in the form of a postal item with a list of attachments, or transmits in electronic form via telecommunication channels an application for a patent to the tax authority at the place of residence no later than 10 days before the beginning of the application of the patent taxation system by individual entrepreneurs (in 2022 no later than December 31, 2022).

Thus, you submit an application for a patent at your place of residence.

Question No. 14. How to obtain a patent after filing an application?

Answer: In accordance with paragraph 3 of Article 346.45 of the Code, the tax authority is obliged, within five working days from the date of receipt of the application for a patent, to issue or send to an individual entrepreneur a patent or a notice of refusal to issue a patent.

In paragraph 3 of Art. 346.45 of the Tax Code of the Russian Federation states that the tax authority is obliged to issue a patent to an individual entrepreneur within five days from the date of receipt of the application for a patent. Please note: when sending an application for a patent by mail, the day of its submission is considered the date of sending the postal item, and when transmitting the application via telecommunication channels, the date of its sending (Clause 2 of Article 346.45 of the Tax Code of the Russian Federation).

In order to ensure a “seamless” transition from a special tax regime in the form of a single tax on imputed income for certain types of activities to a patent taxation system for applications for a patent sent before March 31, 2021, the tax authority must ensure the issuance (direction) of a patent to an individual entrepreneur or notification of refusal to issue a patent no later than the day following the day of receipt of the application via the TKS and through the Individual Entrepreneur’s Personal Account. If the application is submitted in person or by mail, the inspectorate will consider it in the general manner, within five working days.

A patent is issued to an individual entrepreneur against a receipt or transferred in another way indicating the date of its receipt (clause 3 of Article 346.45 of the Tax Code of the Russian Federation).

Question No. 15. An individual entrepreneur rents a retail space on the market when switching to the simplified tax system, income minus expenses, is the amount of rent for the retail space taken for deduction?

Answer: When determining the tax base for the tax paid in connection with the application of the simplified taxation system, the taxpayer has the right to take into account the expenses provided for in paragraph 1 of Article 346.16 of the Code, in particular, expenses for renting premises.

According to paragraph 2 of Article 346.16 of the Code, the above-mentioned expenses are accepted subject to their compliance with the criteria specified in paragraph 1 of Article 252 of the Code, namely, expenses are recognized as justified and documented expenses incurred to carry out activities aimed at generating income.

In accordance with paragraph 2 of Article 346.17 of the Code, expenses of a taxpayer are recognized as expenses after they are actually paid.

Thus, if expenses are incurred for business purposes and aimed at generating income, and are also justified, documented and paid, then the taxpayer has the right to take into account these expenses when determining the tax base for the tax paid in connection with the application of the simplified taxation system.

Question No. 16. The patent application was sent via TKS. The application does not provide a method of receipt. Obtain a patent electronically or in person?

Answer: In accordance with paragraph 3 of Article 346.45 of the Code, the tax authority is obliged, within five working days from the date of receipt of the application for a patent, to issue or send to an individual entrepreneur a patent or a notice of refusal to issue a patent.

In paragraph 3 of Art. 346.45 of the Tax Code of the Russian Federation states that the tax authority is obliged to issue a patent to an individual entrepreneur within five days from the date of receipt of the application for a patent. Please note: when sending an application for a patent by mail, the day of its submission is considered the date of sending the postal item, and when transmitting the application via telecommunication channels, the date of its sending (Clause 2 of Article 346.45 of the Tax Code of the Russian Federation).

In order to ensure a “seamless” transition from a special tax regime in the form of a single tax on imputed income for certain types of activities to a patent taxation system for applications for a patent sent before March 31, 2021, the tax authority must ensure the issuance (direction) of a patent to an individual entrepreneur or notification of refusal to issue a patent no later than the day following the day of receipt of the application via the TKS and through the Individual Entrepreneur’s Personal Account. If the application is submitted in person or by mail, the inspectorate will consider it in the general manner, within five working days.

A patent is issued to an individual entrepreneur against a receipt or transferred in another way indicating the date of its receipt (clause 3 of Article 346.45 of the Tax Code of the Russian Federation).

Question No. 17. The taxpayer carries out retail trade in several markets on different days of the week and in different regions of the republic, for example: 1 day a week in Krasnoslobodsk (Sunday), 1 day a week in Torbeevo, etc. Will there be new conditions for the patent? such activities, with UTII it was possible to calculate K2

Answer: Currently, neither the Tax Code of the Russian Federation nor the Law of the Republic of Moldova dated November 20, 2012 No. 78-Z “On the patent taxation system in the territory of the Republic of Mordovia” when calculating the cost of a patent does not provide for adjustment factors depending on the operating mode.

Question No. 18. A receipt indicating that the inspectorate received the patent application was received electronically. The patent itself did not come under the TCS.

Answer: In accordance with paragraph 3 of Article 346.45 of the Code, the tax authority is obliged, within five working days from the date of receipt of the application for a patent, to issue or send to an individual entrepreneur a patent or a notice of refusal to issue a patent.

In paragraph 3 of Art. 346.45 of the Tax Code of the Russian Federation states that the tax authority is obliged to issue a patent to an individual entrepreneur within five days from the date of receipt of the application for a patent. Please note: when sending an application for a patent by mail, the day of its submission is considered the date of sending the postal item, and when transmitting the application via telecommunication channels, the date of its sending (Clause 2 of Article 346.45 of the Tax Code of the Russian Federation).

In order to ensure a “seamless” transition from a special tax regime in the form of a single tax on imputed income for certain types of activities to a patent taxation system for applications for a patent sent before March 31, 2021, the tax authority must ensure the issuance (direction) of a patent to an individual entrepreneur or notification of refusal to issue a patent no later than the day following the day of receipt of the application via the TKS and through the Individual Entrepreneur’s Personal Account. If the application is submitted in person or by mail, the inspectorate will consider it in the general manner, within five working days.

A patent is issued to an individual entrepreneur against a receipt or transferred in another way indicating the date of its receipt (clause 3 of Article 346.45 of the Tax Code of the Russian Federation).

Question No. 19. Cargo transportation is carried out throughout Russia. It is not practical to buy a patent in every region, what should you do?

Answer: If an individual entrepreneur carries out entrepreneurial activities in the field of providing motor transport services for the transportation of goods on the territory of several constituent entities of the Russian Federation, but he received a patent for this type of activity only in the territory of one of the constituent entities, he is obliged to pay taxes on income received in other constituent entities from the specified type of activity, in accordance with other taxation regimes, or must obtain a patent in each constituent entity of the Russian Federation on the territory of which the specified business activity is carried out. However, if contracts for the provision of motor transport services for the transportation of goods are concluded in one subject of the Russian Federation, and in another subject of the Russian Federation there is only the destination (departure) of the cargo within the framework of these contracts, the individual entrepreneur has the right not to apply for a patent in another subject of the Russian Federation and , accordingly, has the right to carry out the specified type of activity within the framework of one patent obtained at the place of registration with the tax authorities (basis - Clause 1 of Article 346.45 of the Tax Code of the Russian Federation).

How to calculate the value of a patent?

There is a certain formula for calculation. 346.51 Tax Code of the Russian Federation:

Patent cost = potential income (PI) per year / 365 (366) × number of days for which the patent was obtained × 6%.

6% is the tax rate for a patent, according to Art. 346.50 Tax Code of the Russian Federation. In Crimea and Sevastopol, the patent rate cannot be higher than 4% until 2022. And the constituent entities of the Russian Federation can establish a tax rate of 0% for newly registered individual entrepreneurs working in the fields of production, science, social and consumer services.

Potential income is determined by the subject of the Russian Federation. There are currently no restrictions on its amounts, so in different regions the potential income may differ significantly. The period for which potential income is established is 1 year. If there have been no changes, then the previous year's limit applies by default. Previously, the Tax Code of the Russian Federation limited potential income to 1 million rubles, and regions could increase it, but now this rule has been removed - there are no restrictions.

The cost of a patent can be calculated on the tax service website.

Example . Pyshka LLC is a cafe in Yekaterinburg. Its area is 50 m². Regional authorities have established the potential income per 1 m² of the visitor service hall in the amount of 29,137 rubles per year. To calculate the cost of a patent for March-December 2022, we use the formula given above:

Potential income for the year = 29,137 rubles × 50 m² = 1,456,850 rubles.

The cost of a patent per year = 1,456,850 / 365 × 306 × 6% = 73,282 rubles.

From 2022, the cost of a patent can be reduced by a deduction similar to that existing on the simplified tax system “income” and UTII. Entrepreneurs will be able to reduce the cost of a patent by:

- the amount of insurance premiums for yourself and your employees,

- the amount of sick leave for the first three days of employee illness;

- the amount of contributions for voluntary personal insurance of employees.

At the same time, there is a limitation for individual entrepreneurs with employees - they reduce the patent by a maximum of 50%, even if the amount of the deduction exceeds the cost of the patent. Entrepreneurs without employees can reduce the cost of a patent down to zero if the deduction amount is sufficient for this.

Book of accounting of income and expenses (KUDiR)

KUDiR is a reporting document of a private businessman. Under the patent regime, the ledger takes the form of a journal in which only the receipt of funds must be recorded. Keeping a journal is a must.

The document is intended to record the income of businessmen, which in the future will be taken into account to calculate potential income for the entire business area. However, these books do not directly affect the amount of tax payments of a particular entrepreneur.

The book has a form approved by the Ministry of Finance of the Russian Federation. The absence of a document is punishable by law: for this you will have to pay a fine of 200 rubles. It’s not much, but you shouldn’t risk it, because it could harm your reputation.

Keeping a book is simple: your task is to enter official income in chronological order. Please note that only those transactions that are confirmed in the form of an accounting document are entered into the report.

The book must be filled out within one tax period (the period for which the patent was purchased). After the expiration of the period, a new accounting journal is started.

KUDiR is presented in two formats: paper and virtual. You can buy a paper version at a printing house and fill it out manually. The electronic version is presented in the form of a program and online services for accounting.

If you chose a virtual form, then at the end of the reporting period, the completed document must be printed, certified by the regulatory authority and stored in the organization for the next 4 years.

Structure:

- Title page . The personal data of the business owner is displayed here: first name, last name, patronymic, place of registration, current account, identification number and start date of the tax period;

- The first section is “Income and Expenses” . This part of KUDiR contains four tables, one for each quarter. Each table is divided into four columns: date of entry, name of the document, its number and date, income and expenses. Patent owners do not need the “Expenses” column, so we will not analyze it. The income column is divided into five more columns: record contents, sales income, non-operating income, other income, notes. The lines must be completed in chronological order.

- The second, third and fourth sections are not needed by entrepreneurs operating under the patent regime . They are intended to calculate the amount of future tax. We won't dwell on them.

Rules for filling out the journal:

- Pages must be numbered;

- The pages must be bound;

- Transactions are recorded in chronological order;

- The last page of the journal must contain the stamp and a numerical value of the number of pages that make up the document.

How to reduce the patent on contributions

To reduce the tax on contributions under the simplified tax system, we submit a tax return, but the patent does not provide for declarations. To enable patent holders to reduce their tax, the Federal Tax Service has developed a special notification form - Federal Tax Service letter dated January 26, 2021 No. SD-4-3/ [email protected] The notification consists of a title page and two sections. Submit one notification at once for all patents from one inspection whose value you want to reduce.

The submission deadline has not been confirmed. If you have already paid for the patent and did not take into account the deduction, the overpayment of tax will be returned or counted against future payments. Send the notification to the tax office where you are registered as a patent payer and to which you pay this tax.

Why will we become your reliable partner?

- We understand your needs and adapt to you

- All documents are systematized, finding the necessary information is not difficult

- We handle any requirements from the tax office ourselves, guaranteeing a reduction in the number and quality of claims

- We optimize the tax burden within the framework of legislation

- We advise and provide clarifications without restrictions on time, volume or business direction

- Let us make your accounting clear to you

- We will warn you about changes in legislation and help you prepare for them.

- We control the deadlines for submitting reports, paying taxes, and compliance of the tax burden with the requirements of the law

How can I pay for a patent?

To pay, you need to know the details of the tax office that issued your patent. The payment method depends on the patent term:

- Less than six months. If you have received a patent and it will be valid from 1 to 6 months, then you need to pay for it in full before its expiration date.

- From six months to a year. If you are allowed to remain on a patent for 6–12 months, then you can pay for it in two tranches: you pay a third within up to 90 days, and the rest until the end of the patent.

When does the right to use PSN lose in 2021?

An individual entrepreneur will lose the right to be in the patent tax system when he:

- will increase the average number of employees engaged in patent activities to 16 people;

- will receive an income of more than 60 million rubles - this is the maximum permissible income for applying PSN. If for other types of activity you are on the simplified tax system or, for example, on OSNO, then the total income for all types should not be more than 60 million rubles;

- will sell excisable goods, furs, shoes or medicines;

- will violate the patent payment deadlines established by Art. 346.51 Tax Code of the Russian Federation.

If you lose the right to be on the PSN within one calendar year, you can switch to the PSN again only in the next year. After you have lost the right to PSN, you need to write a corresponding application to the Federal Tax Service in the patent department. Deadline: no later than 10 calendar days. Rights to a patent cease from the moment the tax period begins, that is, from the beginning of the patent.

If you lose your right to PSN, you do not automatically switch to the general system. That is, if you had an Unified Agricultural Tax or simplified tax system before the PSN, then you will apply it in the future, and you need to calculate the tax for the period of the patent according to the rules of the Unified Agricultural Tax or simplified tax system.

Reviews from our clients

Our company has been working in the field of production and installation of building structures for more than 11 years. And cooperation with Olga Mikhailovna began from the moment the first LLC was opened. And every day we can be absolutely sure that the accounting and all tax reporting of our organization is in absolute order. Over the years, together with Olga Mikhailovna, we have gone through several tax audits, expanded our staff, acquired liquid assets, real estate, and leasing equipment. Support for every step in the development of our company was supported by clear registration, accounting and reporting to all government bodies thanks to the high professionalism, experience and expert view on accounting issues that we receive in cooperation with Olga Mikhailovna. Website: www.fplus.ru

General Director of Ferolit LLC, Natalia Boyarinova

Olga Vlasova's Center for Accounting Services has been our partner for 5 years. During this time, the company has shown its ability to approach assigned tasks with full responsibility and complete work with high quality and on time. A distinctive feature of the work of the Olga Vlasova Center for Accounting Services is the high professionalism, organization of the company’s employees and a strong team spirit.

We recommend the company as a reliable and stable business partner.

Website: drillmarket.ru Original review

General Director of Bur Prof LLC, Ekaterina Specht

OJSC Elion has been cooperating with Olga Vlasova's Central Budgetary Institution on an outsourcing basis since 2016. The results in the field of accounting are the most positive: reporting is prepared with high quality and submitted on time, all issues related to the tax authorities are resolved promptly and completely, audits are completed quickly and without comments. I would like to note the readiness of the employees and personally of O.M. Vlasova. for assistance in resolving issues not related to accounting - financial planning, optimization of organizational structure, etc.

With high competence, the conditions for cooperation with Olga Vlasova’s Central Bank are very acceptable in comparison with similar companies, which is also important in modern economic conditions.

Website: elion.ru

General Director of OJSC Elion, Sergey Dyachenkov

All accounting of our construction company SMU-5 LLC is carried out by the Olga Vlasova Accounting Services Center. I am very pleased with the work of the Center, since I have little understanding of these issues, and besides, I don’t have enough time. He is very well oriented and understands various production issues, and is attentive to his work. Thanks to Olga Vlasova’s Center for Accounting Services, I have enough time to pay attention directly to production processes.

With the Center I am not afraid of any tax audit. I always know that the accounting cell of my construction company is always in perfect order: it’s like payroll; full accounting of raw materials; control of settlements with partners; submission of reports, and other issues!

General Director of SMU LLC, Andrey Yarovoy

On behalf of the construction and installation team, I express my gratitude to Olga Mikhailovna Vlasova and her team for their professional and well-coordinated work in supporting the accounting activities of our organization.

In our long-term cooperation, Olga Mikhailovna and her colleagues are always extremely competent, promptly respond to assigned tasks, advise on changes in current tax and labor legislation, and always treat their work conscientiously.

Thank you for your good work and wish your team professional growth!

Website: himpromstroi.ru Original review

General Director of Khimpromstroy LLC, Butorin P.B.

I would like to say a big thank you for your responsible work and serious approach! We contacted him in 2010 regarding accounting issues and since then have never regretted his decision. Always the optimal tariff that matches our volume of work with excellent quality of services provided.

For all this time, not a single serious comment from the tax office. We are very pleased with the work!

Website: www.ag02.ru

General Director of Perspektiva LLC, Andrey Vikulov

LLC Sudokhodnaya has been using Olga Vlasova’s range of services for 5 years. The result of our cooperation is a fully streamlined process of accounting and tax accounting, taking into account all the features and specifics of our Company’s activities.

On behalf of the entire team of SK Vector LLC, I express my gratitude to Olga Mikhailovna and her team for the quality work performed at a high professional level.

I wish you further professional success and achievement of your goals!

Website: www.fleet-vector.ru

General Director of SK Vector LLC, E.V. Koroleva

Our company has been cooperating with Olga Vlasova’s Central Budgetary Institution for many years. Throughout our cooperation, we have repeatedly been convinced of the correctness of our choice. Olga has established herself as a reliable partner, always ready to provide comprehensive assistance in various situations. We would like to especially note the efficiency of solving problems, the professionalism and friendly attitude of the employees.

Founder of Router LLC, Igor Krasnobaev

We have been working with Olga since 2005. In 14 years of work, we have never had any problems with accounting. Olga and her team have proven themselves to be high-level professionals. I am very glad that in our difficult times there are people who do their work so clearly, quickly and professionally.

President of the Zelenograd Karate Federation, Executive Director of the Change the World Charitable Foundation, Vadim Sizonenko

I know Olga Mikhailovna as a professional, extremely responsible and friendly person. We have known each other for several years. Olga Vlasova’s CBU team needed a contractor to create a website. As fate would have it, this contractor turned out to be our company. The collaboration and the process of developing the site itself brought great pleasure to our entire team involved in the project. Timely approvals, wishes and comments - everything happened quickly, this is what any IT company can dream of. This approach is only possible in cooperation with a serious, professional and responsible person.

We have now delegated our accounting and tax issues to the CBU team.

It’s extremely rare to recommend someone, but I’ll make an exception for Olga Vlasova’s CBU. Are you planning to work with Olga Vlasova’s CBU? Rest assured that your accounting department will be in good hands. I am very glad to meet you and cooperate.

Head of the company Inaltech.ru - website development and promotion, Inal Vedzizhev

How to keep tax records and submit reports to PSN?

Entrepreneurs on PSN keep records using the income book of individual entrepreneurs on PSN. For each individual patent, you will have to keep your own separate book. Income accounting method: cash. All accounting rules are described in Art. 346.53 Tax Code of the Russian Federation.

Important! If you conduct business only on a patent, then you do not need to submit a declaration. But if you have other taxation systems for other types of business activities, you will have to submit even zero returns for them.

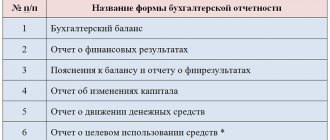

There is no need to keep accounting records for a patent, since all entrepreneurs are exempt from it. Preparation of a balance sheet, financial results report, development of accounting policies, etc. is not required. But without accounting it will be difficult if you combine a patent with the simplified tax system or another regime.

For hired employees, reporting will need to be submitted in the standard manner: DAM, 6-NDFL, 4-FSS, SZV-M and other papers.

Do you need convenient and simple accounting?

The cloud web service Kontur.Accounting allows you to conduct all necessary operations via the Internet. Get acquainted with the capabilities of the service for free for 14 days, keep records, calculate salaries, report online and work in the service together with colleagues. Try for free

Comments

Olga 04/09/2017 at 01:15 pm # Reply

Declaration of individual entrepreneurs on the simplified tax system and patent for 2016

Please tell me what kind of declaration should be filed by an individual entrepreneur who uses the simplified tax system and works on a patent? Zero? Thank you.

Natalia 04/09/2017 at 01:29 pm # Reply

Olga, good afternoon. If you receive all your income from activities on the patent tax system, then you need to submit a zero declaration to the simplified tax system.

08/02/2017 at 00:11 # Reply

Sergey

If the patent has employees, but it so happens that I work without. What reports do I need to submit, or do I not need to submit anything?

08/07/2017 at 15:16 # Reply

Good afternoon. If you have registered with the Pension Fund of Russia and the Social Insurance Fund as an employer, you are required to submit zero reports until you deregister as an employer with the Pension Fund of the Russian Federation and the Social Insurance Fund. You must submit Form 4-FSS to the Social Insurance Fund by the 20th day of the month following the reporting quarter. To the Federal Tax Service, the RSV form, by the 30th day of the month following the reporting quarter.

07/26/2018 at 12:16 pm # Reply

Filling out insurance calculations for individual entrepreneurs on a patent

Tell me how to correctly fill out in 1C Calculation of insurance claims for individual entrepreneurs on a patent? There, benefits apply to employee contributions. How can this be reflected correctly in the report?