How to calculate payments on a calculator

Calculation of income tax is one of the most complex accounting manipulations. For the calculation to be correct, many factors must be taken into account. Therefore, modern accounting specialists resort to various software products that can significantly facilitate the work and reduce the time spent on it. An example of such a software assistant for an accountant is the income tax calculator in 2022 on the website - it provides standard rates with the distribution of payments to the federal and regional budgets.

How much to pay

In 2022, the basic rate is 20%, in the income tax calculator in 2022 it is set as the base rate.

In 2022, the following division by budget is in effect (Article 284 of the Tax Code of the Russian Federation):

- in the federal - 3% (KBK 182 1 0100 110);

- in the regional - 17% (KBK 182 1 0100 110).

In payment orders it is necessary to indicate the correct BCC, otherwise the contribution will be included in an unclear payment.

Use free instructions from ConsultantPlus experts to correctly fill out a payment order for income tax.

to read.

There are tax benefits. Before calculating your income tax using an online calculator, check what percentage your organization should pay. Benefits are provided for by the Tax Code, and they are introduced by local authorities. The part that is allocated to the regional budget also changes - it is reduced to 12.5% and the federal rate - to 0% in special cases (clause 1.2 of Article 284 of the Tax Code of the Russian Federation):

- for organizations - residents of the technology-innovation special economic zone;

- for organizations - residents of tourist and recreational special economic zones, which were united into a cluster by decision of the government of the Russian Federation.

From 01/01/2019, local authorities have the right to establish benefits only for taxpayers who are specified in the Tax Code of the Russian Federation. These include, for example, residents of special economic zones and participants in regional investment projects.

IMPORTANT!

In 2022, changes have occurred, and the number of beneficiaries has decreased! Be sure to study the letter of the Ministry of Finance of the Russian Federation dated October 29, 2018 No. 03-03-10/77793.

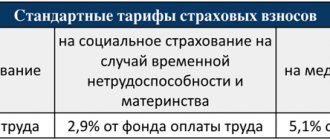

Mandatory payment rate on the calculator

The standard rate is 20%. It is installed by default in the calculator. But there are categories of taxpayers for whom the rate is lower, so if necessary, change the indicator to the one that is relevant for a particular enterprise. You can calculate income tax using an online calculator at preferential rates: 0%, 13% and 15%.

The transferred 20% is distributed between the federal and regional budgets in the ratio of 3% and 17%, respectively. The percentage of contributions to the federal budget never changes, but to the regional budget it changes depending on the benefits introduced by local authorities.

What benefits does using a calculator give and to whom?

From 2022, organizations under the general taxation regime (GTS) can compare their tax burden with the industry average tax burden for their industry and region.

Note that the tax calculator for calculating the tax burden is primarily useful for two taxes:

1. Income tax.

2. VAT.

REFERENCE

The tax burden is one of the key indicators of tax discipline of payers. It is calculated as the ratio of taxes paid (without agency fees) to the organization's income according to the income statement (without income from participation in another business). Keep in mind that the tax burden indicator is calculated for the organization as a whole - that is, taking into account all separate divisions.

Also see “Accounting statements – forms 1 and 2”.

In general, the level of tax burden can be differentiated depending on:

- industry affiliation;

- the scale of the company's activities;

- regional factors influencing business conditions.

Therefore, one of the generally accepted methods for determining the validity of the tax burden is to compare it with average values for sectors of the economy (except for the financial and budgetary spheres due to the specifics of their taxation).

In addition, the new tax burden calculator service on the tax website also displays the following information:

- about profitability of sales;

- level of average salary (the online tax burden calculator calculates it based on 2-NDFL certificates).

Note that the average salary indicator is necessary to assess the risks arising when calculating insurance premiums and personal income tax.

Also see “Deadline for tax agents to submit 2-NDFL certificates for 2022 in 2019.”

Thus, the tax burden calculator service from the Federal Tax Service of Russia allows payers to see themselves through the eyes of the tax authorities. And this will have a positive impact on the ability to assess your own tax risks.

Also see “What are the tax risks?”

Payment due date

The formation of the tax base is completed once a year; tax period - year. Reports are provided quarterly, and advance payments are transferred to:

- quarterly, if the amount of income does not exceed 15 million rubles for the previous four quarters;

- monthly - all other companies.

Depending on the selected transfer method, use the 2021 income tax advance payment calculator to determine the amount of transfer to the budget.

Calculator for Legal Entity

Calculator for Individual Entrepreneur

Calculator for Legal Entity

| Taxes and fees | BASIC | simplified tax system 6% | simplified tax system 15% |

| 1. Insurance premiums | |||

| 1.1 In the Pension Fund of Russia | |||

| 1.2 V FSS | |||

| 1.3 IN MHIF | |||

| 1.4 From accidents | |||

| 2. VAT | — | — | |

| 2.1 VAT accrued | — | — | |

| 2.2 VAT deductible | — | — | |

| 3. Income tax | — | — | |

| 3.1 Taxable income | — | — | |

| 3.2 Taxable expense | — | — | |

| 4. Tax simplified tax system | — | ||

| 4.1 Income accepted for tax purposes | — | ||

| 4.2 Tax accrued (for simplified tax system 6%) | — | — | |

| 4.3 Expenses accepted for tax purposes (for simplified tax system 15%) | — | — | |

| 4.4 Deduction of insurance premiums (for simplified tax system 6%) | — | — | |

| 4.5 Minimum tax (for simplified tax system 15%) | — | — | |

| 5. Total payable | |||

| The tax burden | |||

| Financial result (profit (+)/loss (-)) |

Calculator for Individual Entrepreneur

| Taxes and fees | BASIC | simplified tax system 6% | simplified tax system 15% |

| 1. Insurance premiums | |||

| 1.1 To the Pension Fund for employees | |||

| 1.2 To the Pension Fund for oneself (fixed) | |||

| 1.3 To the Pension Fund for oneself (additionally) | |||

| 1.4 In the Social Insurance Fund for employees | |||

| 1.5 In the Compulsory Medical Insurance Fund for employees | |||

| 1.6 In the MHIF for yourself | |||

| 1.7 From accidents | |||

| 2. VAT | — | — | |

| 2.1 VAT accrued | — | — | |

| 2.2 VAT To be deducted | — | — | |

| 3. Personal income tax | — | — | |

| 3.1 Taxable income | — | — | |

| 3.2 Taxable expense | — | — | |

| 4. Tax simplified tax system | — | ||

| 4.1 Income accepted for tax purposes | — | ||

| 4.2 Tax accrued (for simplified tax system 6%) | — | — | |

| 4.3 Expenses accepted for tax purposes (for simplified tax system 15%) | — | — | |

| 4.4 Deduction of insurance premiums (for simplified tax system 6%) | — | — | |

| 4.5 Minimum tax (for simplified tax system 15%) | — | — | |

| 5. Total payable | |||

| The tax burden | |||

| 6. Financial result (profit (+)/loss (-)) |

Notes.

1) The main criteria for the applicability of the simplified taxation system: - revenue for the year is not more than 150 million rubles. ; — the average number of employees is no more than 100 people; — the cost of fixed assets is no more than 150 million rubles; — the organization should not have branches or representative offices.

2) When calculating for individual entrepreneurs, enter annual figures, since fixed insurance premiums are calculated for a full calendar year. The amount of the simplified tax system is calculated taking into account the deduction of fixed insurance contributions, which implies their mandatory payment in the reporting (tax) period.

3) The calculation does not take into account cases of sales at different VAT rates, as well as combinations with UTII and PSN.

4) The service is in the testing stage. If you find errors or have suggestions for improving functionality, please report this using the button below.

Leave a comment on online calculation of tax burden

- Tweet

- Like

How to make an online payment

Regardless of how income tax is calculated, it is carried out in accordance with the following formula:

Amount = tax base × tax rate.

From this formula it becomes clear that the most difficult step is calculating the tax base. To do this, it is necessary to correctly take into account all the income and expenses of the organization, since the profit of the enterprise serves as the base, that is, the difference between income and expenses.

Let's present a simplified accounting model and give an example of calculation.

The manufacturing enterprise received an income of 1,000,000 rubles for the month. Of this, 250,000 rubles were spent on expenses related directly to production. Another 250,000 rubles were allocated to pay salaries to employees, and the same amount was allocated to the purchase of raw materials. The total profit of the enterprise is 250,000 rubles. From this it follows that the amount of deductions will be:

250,000 rubles × 20% = 50,000 rubles.

When to pay

The tax period is a calendar year, but each organization submits reports and makes advance payments in its own way. If her income does not exceed 15 million rubles. for the previous 4 quarters, then she is allowed to report and transfer money to the budget quarterly. In other cases, declarations and advance reports must be submitted monthly.

IMPORTANT!

An organization has the right to submit an application to the Federal Tax Service that it intends to switch to monthly payment of advances based on actual profits. In this case, she will have to report 12 times a year.

Read more: How to fill out an income tax return

Why is it necessary?

From July 25, 2022, new regulations for the work of commissions on the legalization of the tax base and the base for insurance premiums are in effect. It is recorded in the letter of the Federal Tax Service of Russia dated July 25, 2017 No. ED-4-15/14490.

For more information, see “New regulations for the work of commissions on the legalization of the tax base from 2017.”

Among other things, the updated regulations provide the procedure for calculating the tax burden in 2022, as well as its analysis. Why do taxpayers, insurance premiums, and tax agents need this? There are 2 main reasons:

- So as not to be called to the legalization commission;

- So that they are not included in the plan for on-site inspections.

Also see “Inspection Plan for Legal Entities and Individual Entrepreneurs for 2022: What you need to know.”

Accountant's impressions

The first form seems very simple. I like that you don’t have to search for the type of activity, but simply write your OKVED ID in the appropriate field. How much time could I spend searching for the right type of activity?

Most accountants remember their organization's code. It's a small thing, but nice. The first impression is that it is a very convenient calculator. Without going into details, I would like to note the undeniable advantage of this particular service in the information that the tax office itself discloses. I'm talking about the "Industry Average Load" column of numbers. With the technical equipment of the controllers, I think these indicators can be confidently trusted. The service can be used as another tool for communicating with the director.

Nowadays, company managers have begun to have a different attitude towards record keeping and risk assessments, but still, it is this data that can become an additional argument in defense of proper record keeping. Although, on the other hand, you need to remember that these are still industry averages and they vary greatly depending on how the company conducts its activities. One year can be a success for a business and another a failure. And then the ratio of indicators will be different. Anything can happen, this is a business, an increased risk area.

Separately, I would like to draw your attention to the data that the service shows via the “average salary” link. I’m wondering how the tax service determined this level of employee income? There are no similar salaries in our industry and region, and I know this for sure. It would be great to earn as much as the auditors think, but so far, alas, our income is much lower.