Investor's Dictionary

IIS

— individual investment account. A type of brokerage account for long-term investments with tax benefits. The main limitation is that money cannot be withdrawn from the account for three years. If you withdraw money during this period, the account will be closed, and there will be no tax deductions (and those previously received will have to be returned).

Tax deduction type A

— annual benefit on contributions. This is a deduction from the amount contributed to the IIS for the calendar year. This form of deduction has limitations: it is not carried over to other years, and the investor must pay personal income tax. The maximum amount that will be returned in one year is 52 thousand rubles.

Tax deduction type B

- This is a deduction on income. The investor is exempt from paying personal income tax on profits on an individual investment account. Can be obtained upon closing an IIS, but not earlier than three years after its opening.

EP

- electronic signature, formerly called EDS - electronic digital signature. This is a full-fledged replacement for a handwritten signature in electronic form, replacing it in electronic document management.

2-NDFL

— a certificate indicating the amount and source of income, information about taxes withheld.

3-NDFL

— tax return or reporting form. An individual fills out 3-NDFL in order to report to the state or receive a tax deduction. For example, about winning the lottery or renting out real estate.

What are the tax deductions for IIS?

IIS is a brokerage account with additional features and restrictions. Its main advantage is tax benefits: you can receive two types of deductions to choose from - A and B. To do this, you need to meet several basic conditions:

- top up your account for any amount, but up to a million rubles per year;

- do not withdraw money from IIS for three years;

- have only one IRA;

- do not change the type of deduction during the validity period of the IIS.

If you withdraw money from the account earlier, it will lose its IIS status and will be closed, and the deductions already received will have to be returned to the tax office.

Let's take a closer look at the types of deductions.

Type A is an annual benefit on contributions.

With this deduction, the tax office will return 13% of the amount that the investor contributed to the IIS for the year. This will be a return of the investor’s personal income tax, which he paid to the budget earlier, for example, through an employer from his income. Such a deduction cannot be more than 52 thousand per year - this is 13% of 400 thousand rubles.

For example, if you replenished your IIS with 500 thousand or a million, the tax office will still return only 52 thousand. Therefore, it is most profitable to replenish the IIS by 400 thousand per year - this way you can get the maximum deduction.

Type A deduction is suitable for those who pay personal income tax. For example, employees of companies or individual entrepreneurs, if they pay themselves a salary. Self-employed people, investors and retirees pay other types of taxes or no taxes at all, so they are not eligible for the Type A deduction on these incomes.

Another limitation: the state will not be able to return more money than the investor paid to the budget. Therefore, the amount of annual personal income tax must be at least equal to the deduction. Type A deductions cannot be transferred to other years.

The employer transferred personal income tax for the investor in the amount of 35 thousand rubles for 2022. And the investor contributed 400 thousand to the IIS and wants to receive a deduction of 52 thousand. The tax office will return only 35 thousand rubles, despite the fact that 13% of 400 thousand is 52 thousand rubles. You cannot transfer such a deduction to a later date and receive your balance in the future.

Type A deduction can be issued every year or once every few years.

For example, if an investor wants to wait three years and decide which type of deduction is more profitable for him to receive. Type B is an income deduction

. He assumes that after three years the investor will be exempt from income tax on IIS. This format is usually chosen by investors who do not pay personal income tax or if, as a result of their investment, the tax will be more than 52 thousand rubles. For example, if they have an active strategy and replenish their IIS by more than 400 thousand rubles per year.

The most popular tax deduction option is type A. It is beneficial for those who are officially employed and are just starting to invest, because with any financial result you can get some of the money back.

Type A deduction can be issued through the Federal Tax Service website. Moreover, if an investor has applied for such a deduction, it is no longer possible to change the decision and use deduction B. You cannot combine them: get part from one deduction, and part from another.

If you have the right to other types of tax benefits, then it is more profitable to first apply for a deduction under IIS. This will help you get maximum payouts.

An investor bought an apartment for 2 million rubles and can receive a deduction of 260 thousand rubles. In 2022, his employer paid 130 thousand personal income tax from his salary, so he can receive the full amount of the IIS deduction - 52 thousand rubles. If you first apply for a deduction for the purchase of housing, the investor will return 130 thousand rubles, and next year another 130 thousand. But there will be no money left from his taxes to deduct under IIS. If you first apply for a deduction under the IIS, then the investor will receive 52 thousand rubles and another 78 thousand will be left for payments for housing. The tax authorities will pay the remaining 182 thousand rubles in the following years.

When does an investor have the right to an investment deduction?

Investment tax deductions are available to citizens who carry out certain activities in the stock market.

As a rule, these are securities trading operations or depositing money into an individual investment account (IIA). IMPORTANT! An individual investment account is a special account for carrying out transactions in the stock market.

A broker opens an IIS for a citizen. Both an individual and a management company can carry out transactions with securities on it. A special feature of IIS is the availability of tax benefits when using it. It was invented in order to stimulate the population to invest by reducing taxes. The question suggests itself: under what tax does the investment tax deduction apply? Since we are talking about the population, it is obvious that the investment tax deduction is applied under personal income tax.

Please note that not every citizen has the right to an investment tax deduction. Only residents of the Russian Federation can take advantage of the tax deduction for investments, and one of the types of deduction is available only to residents who received income taxed at 13% in a calendar year.

In what case do the designated persons have the right to an investment tax deduction for personal income tax:

- For tax residents of the Russian Federation:

- if there is income from manipulation of securities that the person has owned for more than three years;

- when profits appear on operations carried out on the IIS.

- For residents who received income taxed at a rate of 13% in a calendar year:

- when replenishing an IIS.

We will tell you below how to get an investment tax deduction.

article about how to calculate the tax on bonds in 2022 .

When to apply for deduction

During the current year, you can apply for a deduction for the previous year. You can collect documents and upload them to the tax website at any time; there is no clear reference to dates. The main thing is to meet three years from the date of the first reporting year, because this is the official deadline for filing an income tax return.

For example, already at the beginning of 2022 you can submit documents for a deduction under the IIS for 2022, at the beginning of 2022 - for 2022, and so on. The deadline for filing a return for 2022 is December 31, 2023. If you decide to file a deduction for three years at once, you will need to file a separate return for each year.

Form for obtaining an investor deduction from the tax office

Find out how to fill out 3-NDFL when selling shares not through a tax agent in the ready-made solution “ConsultantPlus”. Sign up for a free trial and find out the filling algorithm.

Let us dwell on the procedure for filling out and submitting a declaration in Form 3-NDFL to receive an investment deduction.

Let us repeat that you can submit it for tax purposes and documents confirming the right to deduction within three years from the year in which you received the right to deduct.

Methods for sending a declaration:

- by mail by letter with a list of the contents and notification of receipt;

- personally take it to the tax authority;

- send your representative to the tax office, providing him with a power of attorney;

- through the tax website if you are registered on it.

- through the State Services portal

The declaration form for 2022 is presented in our article .

Download a sample of how to fill out an investment deduction of type A in 3-NDFL following the example from our article at the beginning of this material in the “Documents and Forms” section.

To claim deductions in the form of financial results from transactions with securities, fill out all the same sections of the declaration, except Appendix 5. Instead, fill out Appendix 8.

What documents to prepare

To apply for a Type A deduction online, you will need to scan and upload to the Federal Tax Service website:

- Notification of the opening of an IIS. It can be downloaded from your Gazprombank Investments personal account.

- Certificate of income and tax amounts of an individual - 2-NDFL. A certificate must be provided for each year for which the deduction is issued. If the employer has reported to the tax office for the required period, the data is already in the tax service system. You will see them in your personal account. If not, you need to request a certificate from the accounting department at your place of work.

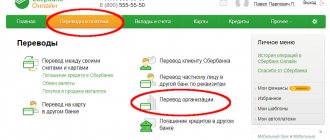

- Confirmation of deposit of funds to the account. You need to confirm with the tax authorities that you contributed money to an IIS. Payment orders from the bank, where the transfer to the account is reflected, or confirmation of account replenishment from the broker are suitable for this.

- Brokerage report. Provided in addition to payment orders for replenishing IIS from the bank. The report can be requested in your Gazprombank Investments personal account.

Which deduction should an investment account owner choose?

Tax legislation allows IIS owners to choose the type of investment deduction.

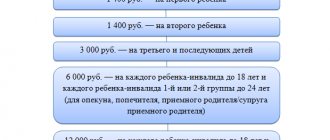

The types of investment deductions for IIS and their brief description are presented in the figure:

Both types of investment deductions have nuances:

- Tax deduction for contributions to IIS

You can return your personal income tax as early as the next year after placing funds in an individual investment account, but if the account is closed early (before three years from the date of conclusion of the agreement), the entire refunded personal income tax must be returned (plus penalties are paid). After closing the IIS, you are required to pay personal income tax on the amount of income generated.

This is the most suitable option for people who have official income (taxable with personal income tax at a rate of 13%) and do not plan to invest funds for a long time and receive solid income from it.

- Tax deduction on income from IIS

The basis for the deduction is income (positive financial result) for the period of validity of the IIS, determined according to the norms of Art. 214.9 Tax Code of the Russian Federation. To receive the deduction, at least three years must pass by the closing date of the contract. A deduction for income is available if during the period of validity of the contract the deduction for IIS contributions was not used.

The deduction is suitable for situations where an individual plans to make long-term investments, replenish an individual investment account in an amount exceeding 400 thousand rubles and receive large incomes.

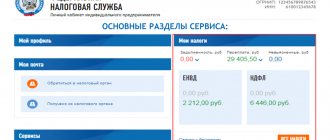

How to register in your personal taxpayer account

To apply for a Type A deduction online, you need to go to the taxpayer’s personal account on the Federal Tax Service website. If you haven’t registered on the resource yet, you can register by choosing a convenient option:

- Log in using your State Services portal account.

- Get a login and password from the Federal Tax Service. To do this, you need to come to any branch in person with a passport of a citizen of the Russian Federation.

Make an electronic signature at any certified department of the Ministry of Communications.

You can log into your personal account in three ways: through your State Services account, with your tax office login and password, or using an electronic signature.

The easiest way is to use a State Services account. Now you can create and verify it online without going to government agencies.

If you select the login method through the Unified Identification and Login Account, the user will be redirected to the State Services page

After authorization, the main page of the taxpayer’s personal account will open. Here you need to create an electronic signature.

Registration of a non-qualified electronic signature

When filing a return, the taxpayer puts his signature on the documents. In the case of electronic registration of deductions using IIS, an electronic signature (ES) is required. This is an encrypted key that is stored on the user’s computer or other media - for example, on a flash drive. This electronic signature can only be used to send documents to the tax authorities.

To create an electronic signature you need:

- Click on your name at the top of the page and go to your personal profile.

2. Scroll to the right in the top menu, select the “Receive electronic signature” item, and then select the option for storing an electronic signature.

The electronic signature can be stored on the tax server or on your device: for example, a computer or flash drive. Choose the option that seems most convenient and safe.

3. Fill out the form data and send a request.

4. The electronic signature will be officially registered in a few days. After this, you can proceed to filling out form 3-NDFL. The signature is valid for more than a year, so you won’t have to repeat this step next time.

Filling out form 3-NDFL

Having received the electronic signature, you can fill out form 3-NDFL. In your personal account there is a simplified version - “Application for tax deduction”. It can be used if you need to issue only one deduction for the previous year and do not need to report additional income. In fact, this is the same form of 3-NDFL only without additional features. Therefore, investors fill out a complete declaration. To do this, you need to open the main screen of the taxpayer’s account.

- Go to the “Life Situations” section.

2. Select the item “Submit 3-NDFL declaration”. 3. Click “Fill out online” if there is no ready-made declaration.

4. Fill in the fields with data from the 2-NDFL certificate. There are hints next to the question marks that will help with correct formatting.

5. On the next screen you need to

6. On the page that appears, in the top field, you need to enter the amount contributed to the IIS for the last year. The bottom field must be left blank - the next screen will display the amount of the tax deduction refund.

7. The last stage is to attach documents, enter the password for the digital signature and send the declaration to the tax service.

Immediately after submitting the declaration, the service will offer to submit an application for a refund of the deduction and indicate the details to which the money will be received. This step does not have to be completed right away. You can wait for the notification about the consideration of the declaration and click the “Dispose of overpayment” button. The declaration will be checked within three months, and money will be transferred within another month.

The online format for filing a declaration and processing a deduction is convenient because you do not need to go to the tax office to complete it. The deduction can be issued on weekends or holidays and at any time of the day.

The longest stage is preparation: collecting documents, registering in your personal account and creating an electronic signature. Making a deduction next time will be faster and will take 5-10 minutes.

How to get 52,000 rubles for investing money in an individual investment account (IIA)

If you invest money in securities in a brokerage account, you receive a certain income. And if you invest money in an individual investment account, you will immediately increase your income by 13%. Let's figure out how to do this.

What you need to know about IIS in 2022

An individual investment account (IIA) is opened with a stock broker or trustee. The difference is in the method of managing the account: in the first case - independent management, in the second - trust. Investing through a broker is more profitable - the commission percentage is lower.

There are two types of IIS:

- type A - deduction for contributions;

- type B - income deduction.

We will discuss each type of IIS in detail and the features of obtaining a deduction for it below. But you can only choose one account type.

Important to remember:

- The minimum period of existence of the IIS is 3 years;

- You can open an IIS with only one broker;

- The maximum contribution to an IIS is 1 million rubles per year.

- withdrawal of money from an IIS - closing the IIS.

Example 1:

In 2022, you opened an IIS and deposited 400 thousand rubles. In 2022, they filed a declaration and returned the tax - 52 thousand rubles (13% * 400 thousand rubles). In the same year, they decided to withdraw 452 thousand rubles from the IIS. In this case, you will have to return to the tax office the previously received tax - 52 thousand rubles.

Example 2:

You opened an individual investment account in a management company in 2022. And in 2022, we learned that you can open an individual account with a broker and not pay expensive commissions for account management. But you won’t be able to open a second IIS until you close the first one or transfer the securities from the management company to the broker.

Who can receive a deduction under IIS

Only tax residents of the Russian Federation can open an IIS. By law, these are persons who are actually in the Russian Federation from 90 to 182 calendar days inclusive during the period from January 1 to December 31, 2022 (Federal Law No. 265-FZ dated July 31, 2020). IIS is provided for both individuals and individual entrepreneurs under the general taxation regime. The main condition is the presence of official income, taxed at a rate of 13% (personal income tax).

You will receive a deduction under IIS if:

- you do not receive an official salary, but during the year you paid personal income tax on renting out an apartment;

- are engaged in active trading on the stock market (the broker pays personal income tax on transactions for the purchase and sale of securities). But remember that you will not receive a tax deduction on dividends.

Type A deduction - for contributions

The maximum contribution to an IIS, from which the state will return 13% of personal income tax, is 400 thousand rubles per year. You will receive no more than 52 thousand rubles into your account (400 thousand rubles * 13%). If your employer paid personal income tax for you more than 52 thousand rubles per year, then you will return the tax in the maximum amount. You can return personal income tax for the past three years. If your income allows, then return 52 thousand rubles at least every year and reinvest the money further. Here's how it works.

Example 1:

You opened an IIS and deposited money in 2022. The tax return must be submitted by 2022. If you submit later, you will not receive a deduction. In 2022 - receive a deduction for 2022, in 2022 - a deduction for 2022, in 2022 - a deduction for 2022.

Example 2:

You opened an IIS in 2022. In December 2022, 400 thousand rubles were added to the account. In January 2023, they declared a deduction from the maximum contribution amount - 400 thousand rubles, and closed the IIS in order to withdraw the money back. Within three months (the period of the desk audit), the tax will be returned to your account - 52 thousand rubles. In this case, you will not have to wait 3 years to withdraw your money.

Example 3:

In 2022, they contributed 500 thousand rubles to the IIS and bought securities with it. For 2022, the employer paid personal income tax for you - 60 thousand rubles. In 2022, you submit a return for deduction. The maximum deduction amount is 400 thousand rubles. The amount of personal income tax paid (60 thousand rubles) allows you to return the tax to your account - 52 thousand rubles (400 thousand rubles * 13%).

In December 2022, add money to your IIS again - 252 thousand rubles (52 thousand rubles - tax refund and 200 thousand rubles - your own funds). For 2022, the employer paid personal income tax for you - 50 thousand rubles. In January 2022, you submit a return for deduction. The amount of personal income tax paid (50 thousand rubles) allows you to return 32,760 rubles (252 thousand rubles * 13%). In the future, you can further reinvest the received amount into an IIS and receive tax deductions.

Type B deduction - for income

At the end of the year, the broker (tax agent) pays 13% personal income tax on your transactions. This percentage significantly reduces the profitability of the investment portfolio.

You can receive a Type B deduction only when you close your IIS - when 3 years have passed. If by the end of the IIS term your portfolio shows a positive financial result (profits from sales of securities exceed losses), then you do not have to pay 13% personal income tax (clause 4 of article 219.1 of the Tax Code of the Russian Federation).

Keep in mind that not all income is exempt from personal income tax. Income from the sale of securities, currency revaluation and coupons are exempt from tax. Dividends and corporate bonds issued after January 1, 2022 (if the coupon income exceeds the Central Bank refinancing rate increased by five points) are not exempt from taxes (letter of the Ministry of Finance of Russia dated June 23, 2017 No. 03-04-06/39694).

Example:

In 2022, you bought securities for 500 thousand rubles, in 2018 - for 700 thousand rubles, in 2022 - 800 thousand rubles. In 2020 (over 3 years), profitable transactions worth 700 thousand rubles were recorded, and unprofitable positions amounted to 40 thousand rubles. Financial result for 3 years - 660 thousand rubles (700 thousand rubles - 40 thousand rubles). In 2020, the broker withheld and paid 85,800 rubles from you (660 thousand rubles * 13%). In December, you applied a type B deduction. Thus, you will receive income from securities - 574,200 thousand rubles0) and a tax refund - 85,800 rubles.

Which type of IIS to choose: type A or type B

Type A deduction is suitable for you if:

- there is taxable income at a rate of 13%;

- you are a conservative investor (invest money in government and corporate bonds);

- Do you want to receive a tax deduction every year?

Type B deduction is suitable for you if:

- there is no taxable income at a rate of 13%;

- actively trading on the stock market.

The most popular deduction is Type A. Even inexperienced investors can increase the profitability of their portfolio by 13%.

Documents for registration of deductions under IIS

Documents for tax deduction for contribution (type A):

- certificate 2-NDFL for the year (in which the right to deduction appeared);

- a copy of the agreement on maintaining an individual investment account or an agreement on brokerage services (take from a broker or management company);

- brokerage report on the flow of funds to the individual investment account or payment orders from the bank (copy);

- return application (indicate your bank account details)

Documents for income tax deduction (type B):

If you receive a deduction through a broker or management company, then:

- a certificate from the tax office confirming that you have not previously used the right to receive a deduction for contributions (type A).

If you receive a deduction through the tax office:

- declaration 3-NDFL;

- 2-NDFL certificate from a broker or management company;

- return application (indicate your bank account details).

How to quickly and inexpensively issue a deduction

In the process of collecting documents for the tax office, you will more than once regret taking on this matter. What will definitely plunge you into deep despair is filling out a tax return. And in this difficult situation, the specialists of the Return.tax company will help you get your money back as soon as possible.

In less than 24 hours, you will be advised on deductions, filled out a declaration, prepared and submitted documents to the tax office. Minimal participation is required from you. The cost of filing a deduction for one calendar year under the “Standard” package is 1,690 rubles.

During the audit, the tax office may make a mistake in the amount of the deduction. We take full responsibility for communicating with the tax inspectorate: we will monitor timely payments, call, file complaints and protect your rights in accordance with the Tax Code of the Russian Federation. The Premium package offers full verification support from the moment of submission until the money is received in your account. The cost of filing a deduction for one calendar year under the Premium package is 3,190 rubles.