Are you an employer with employees? In this case, you have to cooperate with the Pension Fund on a monthly basis. Close communication is also inevitable if you had employees in the year for which you are reporting to government agencies. The Pension Fund accumulates specific information about all employed citizens, and the obligation to update accounting data lies with the employer.

- In what form should this information be submitted?

- How often should this be done?

- Which authority should I provide information to?

In the new year, serious changes in legislation will come into force, which will require entrepreneurs and accountants to change their established habits. What exactly awaits them regarding personalized accounting, we will understand in this material.

Part of mandatory reporting

All employees must obtain registration with the Pension Fund of Russia and become an insured person. It is the employer’s responsibility to formalize and monitor this process, as outlined in the law.

Individual, also known as personalized accounting, is a system for recording information produced by the Pension Fund of the Russian Federation regarding the insurance and funded shares of the future pension of all employees.

It is regulated by the Federal Law “On Individual (Personalized) Accounting in the Compulsory Pension Insurance System”, as well as some other regulations.

The procedure for maintaining and providing personalized accounting information

Currently, the procedure for maintaining personalized records of information about insured persons is established by Federal Law No. 27-FZ and the Instruction approved by Order of the Ministry of Labor and Social Protection of the Russian Federation dated December 21, 2016 No. 766n

The instructions set:

· the procedure for registration in the compulsory pension insurance system;

· the procedure for providing information about insured persons to the territorial bodies of the Pension Fund of the Russian Federation and the procedure for receiving this information by responsible officials of the Fund;

· the procedure for checking and monitoring the accuracy of information provided to the Fund;

· rules for document management, storage and destruction of documents containing personalized accounting information.

Registration with the Pension Fund of the Russian Federation is carried out by a citizen (his representative) personally or through the policyholder by filling out a questionnaire of the insured person. After checking the personal data, the insured person is issued an insurance certificate of compulsory pension insurance.

Policyholders are required to provide the territorial bodies of the Pension Fund with information about employees (insured persons) necessary for maintaining personalized records. In accordance with Federal Law No. 27-FZ, policyholders are all legal entities (including foreign ones), their separate divisions, as well as individual entrepreneurs and citizens operating in the territory of the Russian Federation and hiring under employment contracts or concluding civil contracts for which insurance premiums are charged in accordance with the legislation of the Russian Federation.

According to Article 11 of the Law, the policyholder is obliged to provide information to the Pension Fund of the Russian Federation regarding each insured person working for him (including those receiving remuneration under civil law contracts). This information includes:

- the amount of wages (income) on which contributions to compulsory pension insurance were calculated;

- amounts of accrued insurance premiums.

Information is provided on paper (by the policyholder in person or by mail) or in the form of an electronic document.

The Board of the Pension Fund of the Russian Federation has adopted a number of regulations approving the forms of documents for registration and maintaining personalized records, and also established the procedure for filling them out and sending them to the Fund’s bodies.

The form for providing information about insured persons was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated February 1, 2016 No. 83p (Form SZV-M).

Form SZV-M includes:

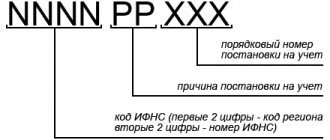

- information about the policyholder (details, registration number in the Pension Fund of the Russian Federation, name, TIN, KPP, reporting period, type of form);

- information of the insured persons - last name, first name, patronymic, insurance number, TIN (if available).

Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 2p approved the forms of documents for registration of citizens in the compulsory pension insurance system and Instructions for filling them out.

In particular, the Resolution approved:

· Questionnaire of the insured person (ADV-1);

· Insurance certificate of state pension (ADI-1) and compulsory pension insurance (ADI-7);

· List of documents submitted by the policyholder to the Pension Fund (ADV-6-1);

· Information about the work experience of the insured person for the period before registration in the compulsory pension insurance system (SZV-K) and others.

The instructions for filling out personalized accounting document forms establish a detailed procedure for filling out and transmitting data to the territorial bodies of the Pension Fund of the Russian Federation and contains more than 80 different tables.

Why is this type of accounting needed?

All employees of an organization who have received insurance from the Pension Fund of Russia have an individual personal account there, the number of which (SNILS) is permanent. The general part of this account contains personal data and information regarding work experience.

Periodic changes are possible in this data: a person moves, improves his qualifications and, accordingly, his salary, and sometimes changes his personal data. Therefore, information must be constantly monitored and, if necessary, updated.

Therefore, the employer is obliged to submit relevant information about all its employees to the supervisory and control authorities at the frequency specified in legislative acts.

How it all started

Since the beginning of 2022, all regions of the Russian Federation have switched to direct payments to the Social Insurance Fund.

All of Russia joined the experiment, in which some regions participated for several years. Every year the list of experimental regions gradually expanded, and in 2022 it will include absolutely all territories of the Russian Federation. Direct payments from the Social Insurance Fund have changed the method of transferring benefits for temporary disability, employment and labor and some others. Previously, the employer paid the money to the employee, and then submitted a package of documents to the Social Insurance Fund to reimburse the expenses incurred. The fund verified the documents and, if they were correct, returned the money paid to the employee to the employer’s bank account.

The essence of direct payments is that now the employer does not pay anything to the employee. He accumulates documents confirming the right of the insured person to receive benefits and transfers them to the Social Insurance Fund. And the fund makes the payment to the employee. However, for some benefits the rules remained the same. In this article, we will not dwell in detail on direct payments.

We wrote in detail about the procedure for direct payments to the Social Insurance Fund in 2022 in the article “Direct payments of benefits in 2021: a memo for an accountant .

Changes-2017

In 2022, the Federal Tax Service will take under its jurisdiction all issues related to insurance premiums, and, naturally, to pensions. This change in responsibility initiated significant changes in the filing deadlines and presentation of personalized accounting for employers. Legislative basis – the entry into force on January 1 of the Federal Law of July 3, 2016 No. 250-FZ “On amendments to certain legislative acts of the Russian Federation and the recognition as invalid of certain legislative acts (provisions of legislative acts) of the Russian Federation.”

Forms for submitting reports on individual accounting

Information regarding personalized accounting is reflected in a special calculation of insurance premiums . Previously, a separate form was provided for this in the RSV-1 form. This form records contributions to the Pension Fund made by the employer for each employee from each salary.

In addition to this form, it was necessary to prepare the following documents:

- census of information submitted to the Pension Fund - form ADV-6-2;

- list of documents submitted to the Pension Fund - form ADV-6-3;

- data on insurance premiums during the insurance period - form SZV-6-1;

- register of contributions and information about the length of service of the insured - form SZV-6-2.

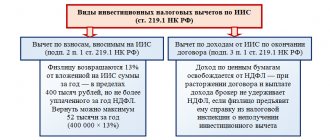

Since 2022, according to the Order of the Federal Tax Service of October 10, 2016 No. ММВ-7-11/551, a single form has been introduced for all insurance premiums, combining its 4 separate predecessors - RSV-1, 4-FSS, RSV-2, RV -3.

What to write in the report

The form for a single calculation provides for the reflection of the following data:

- information about the duties of the contribution payer;

- the corresponding amounts of assessments on contributions;

- social insurance payments in connection with sick leave, maternity and other reasons specified in the law;

- detailed calculation of payments from the federal budget;

- personal data of the insured (full name, SNILS, INN).

IMPORTANT! If during the reporting period the company had less than 25 hired employees on the lists for whom insurance contributions were made to the Pension Fund, then submitting this report in paper form is acceptable. If there are more personnel, the report must be submitted electronically.

Forms SZV-6-1, SZV-6-2, SZV-6-3

In general, information about insured persons is submitted in the form SZV-6-2 “Register of information on accrued and paid insurance contributions for compulsory pension insurance and the insurance period of insured persons.” In this case, the registry cannot contain more than 200 lines. If the number of insured persons exceeds this value, it is necessary to create a second register.

If in 2012 an employee was on leave at his own expense or on sick leave, and also if the employee worked in special (special territorial) working conditions or has the right to an early pension, then for each of such insured persons persons should form the SZV-6-1 form.

Individual information submitted using different types of forms (SZV-6-1 or SZV-6-2) and for different categories of insured persons (NR or CX) is generated in separate batches.

The amounts of accrued and paid insurance premiums in these forms are indicated in rubles and kopecks. In this case, the overpayment amounts are not reflected. At the same time, the legislation is silent on what should be done if the premiums are not paid in full by the policyholder. After all, payment of contributions is made for the organization as a whole, and in personalized accounting forms they are reflected for each insured person separately. You can get out of the situation by determining the contribution payment ratio for the organization as a whole (the ratio of the transferred amount to the accrued amount) and using it to calculate the amounts paid in relation to a specific employee (multiply the amount of accrued contributions by the coefficient).

The addresses of insured persons for sending information about the status of an individual personal account in each form should be filled out only in the case of their first submission or when this detail is changed.

In addition, at the end of the year it is necessary to submit information in the form SZV-6-3. This information indicates payments and other remuneration for each insured person accrued for the entire reporting calendar year with a monthly breakdown in rubles and kopecks. Information is generated by categories of insured persons and types of contracts concluded with employees (separately for employment and civil law contracts). For each category and type of contract, a separate packet of information is generated, which is also accompanied by a separate inventory in the ADV-6-4 form.

How often to take it

Reporting on this type of accounting has so far been submitted to the Pension Fund of Russia every three months. It was necessary to submit 4 such reports per year, each no later than the middle of the month following the quarter.

This has been the case until now, however, changes are expected in the coming year. The last annual report must be submitted, as expected, before February 20 of the next year, and then legislative changes in deadlines should be taken into account. The quarterly reporting period remains in force, and entrepreneurs are given until the 30th of the month following the reporting period to submit reports.

- The first calculation for 2022 will need to be submitted based on the results of the first quarter - before May 2, 2022, since the calculation date of April 30 falls on a Sunday, and the next day, May 1, is a public holiday.

- for the half-year no later than July 1, since June 30 is a Sunday.

- For the 3rd quarter, the report will be required until October 30.

- For the annual report, documents will need to be prepared by January 30, 2022.

If the information about an individual is filled in incorrectly

Paragraph 7 of Article 431 of the Tax Code of the Russian Federation stipulates that if the submitted calculation contains unreliable personal data identifying the insured individuals, such calculation is considered not submitted.

A corresponding notification is sent to the payer about this no later than the day following the day of receipt of the calculation in electronic form (10 days following the day of receiving the calculation on paper).

However, earlier the Federal Tax Service of Russia, in a letter dated January 16, 2018 No. GD-4-11/574, reported that the indication of irrelevant personal data in the submitted calculation for insurance premiums does not prevent its acceptance by the tax authority. The Federal Tax Service has the opportunity to identify an individual using information that has lost its relevance on the date of submission of the calculation.

Who should I take it to?

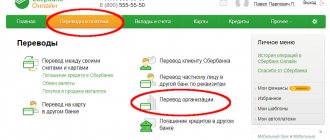

If previously personalized accounting was provided exclusively to the Pension Fund of Russia, then from 2022 the Federal Tax Service has taken over some of the functions of control and administration. Therefore, now it will be necessary to submit calculations to both of these bodies:

- to the Pension Fund of the Russian Federation - quarterly form SZV-M (information about the insured) - until the middle of the month following the reporting month;

- in INFS - quarterly Unified calculation (new unified form) - until the 30th day after each quarter.

NOTE! From 2022, an annual re-registration of personalized accounting information will be required; for the first time it will need to be submitted for the whole of 2022. The deadline for submission is limited to the entrepreneur on March 1 of the next year, so the first such report will be received by the Pension Fund only in 2022. The form for it has not yet been developed.

Features of personalized reporting in 2021

From 2022, reporting on the calculation of insurance premiums (including those intended for the Pension Fund of Russia) is submitted to the tax authorities. The calculation of contributions, which combines information on all types of contributions transferred under the control of the Federal Tax Service, contains a section devoted to personalized data. However, these data only include information on accrued income for the period and related contributions. There is no information about experience in them.

Read about reporting on contributions in the article “ERSV - calculation of insurance premiums for 2022 in 2022.”

Reporting on length of service is submitted at the end of the year directly to the Pension Fund of the Russian Federation before March 1 (clause 2 of Article 11 of Law No. 27-FZ of April 1, 1996). For it, by resolution of the Board of the Pension Fund of December 6, 2018 No. 507p, a new form SZV-STAZH was approved, in which for information about length of service a table is provided, similar to that included in the expired form RSV-1.

By the way, before the end of the year, the liquidating organization and the individual entrepreneur deregistering must submit the SZV-STAZH.

Whether it is necessary to take the SZV-STAZH upon dismissal and how to fill it out, find out in ConsultantPlus. Get trial access to the system for free and go to the Typical situation.

Resolution No. 507p approved the rules for filling out reports and the formats for submitting them to the Pension Fund. The text of the rules contains a reference to the same codes that were used when filling out personalized information in the RSV-1.