Along with a proud title, a person has responsibilities to the state. Let's figure out what taxes an individual entrepreneur (IP) pays, because it is important to comply with the law, otherwise penalties and fines will begin to accrue. At any time, a Federal Tax Service employee can come and check the statements. And if everything that should be paid is not paid, problems may arise.

An inspector can suspend the functioning of an organization for up to three months; for some companies this will be a real disaster. To prevent this, we recommend finding answers to all questions in advance, understanding how and for what to deposit money, and also how the simplified tax system differs from UTII and other words that are still unclear.

What taxes and contributions must individual entrepreneurs pay from employee salaries?

Every individual entrepreneur has the right to hire employees. The main thing is to do this under labor and civil law contracts. It is also allowed to create documents for one-time work and those where it is not necessary to carry out internal regulations.

It is worth remembering that with people come additional responsibilities and costs:

- Calculate and send personal income tax on the income received for each person. Every month, after paying wages, he sends money at a rate of 13% of wages to the tax office.

- Transfer insurance premiums to the Federal Tax Service for everyone who works, depending on the tariff. Moreover, they amount to a fairly large amount. Below we will analyze it in percentage terms.

How they add up:

- pension - 22%;

- social - 2.9%;

- medical - 5.1%.

In addition, additional funds are transferred for insurance against accidents that may occur at work and occupational diseases. Its size depends on the danger of the enterprise itself and varies from 0.2 to 8.5% per year.

Additional costs depending on the type of activity

The following expenses are associated with the conduct of certain types of activities. If they apply to you, plan in advance for the following expenses:

- Installation of the cash register

. From July 2022, almost all individual entrepreneurs accepting cash payments must install an online cash register. And over the next few years, all individual entrepreneurs, with rare exceptions. - Purchasing a patent

. As a rule, a patent is acquired to provide various services - household, repair, hairdressing, etc. Usually, transferring some activity to a patent provides noticeable savings on taxes, but you need to take into account payments for the patent in advance. You can purchase it for a period of 1 to 12 months, the tax rate will be 6% of the estimated profitability. To final calculate the tax amount, you will need an indicator of the basic profitability for your type of activity. This indicator is set by each region separately; you can find it out at the inspection. - Purchasing a license

. If your business requires licensing (alcohol or medicine sales, private security, etc.), you will have to purchase a license and pay a state fee (its amount depends on the type of activity). In some cases, there will be additional costs, which it is better to find out about in advance from the licensing company for your type of activity.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Expenses of an entrepreneur in 1C: Enterprise Accounting 8 - VIDEO

Published 06/13/2017 13:13 If you keep records of an individual entrepreneur, then you are probably faced with the need to reflect in the program for the acquisition of inventory items or services at the expense of the individual entrepreneur’s personal funds. Currently, in 1C: Enterprise Accounting 8 edition 3.0, this operation can be performed with just one document - “Entrepreneur’s Expenses”. It appeared back in 2016, however, I still see that many users do not use it in their work, using expense reports in situations where it is quite possible to do without them. Among other things, the advantage of this document is that it automatically registers entries in KUDiR when applying the simplified tax system with the object “Income minus expenses”. But it is not suitable for all situations; there is a very important limitation. You will learn about these nuances by watching this video tutorial.

Watch more videos on our YouTube channel. Subscribe to channel updates!

Video author: Olga Shulova

Let's be friends on Facebook

Did you like the video tutorial? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Irina 02/07/2022 20:29 I quote Inna:

Good afternoon I registered the purchase of materials with the document “Entrepreneur’s Expenses”, for some reason they were not included in KUDIR. The status of payment of expenses is Not written off. What can be done to ensure that expenses are included in KUDIR?

Good afternoon.

In the “Main” section - “Taxes and reports” - “STS” - “Procedure for recognizing expenses”, check if there are any additional checkboxes. If yes, then remove them. The requirements for expenses when they are included in KUDiR are already established in the program; we are talking about those checkboxes that cannot be unchecked manually. But you can check the boxes if you need additional conditions for expenses to be included in KUDiR. Quote 0 Inna 02/05/2022 02:35 Good afternoon! I registered the purchase of materials with the document “Entrepreneur’s Expenses”, for some reason they were not included in KUDIR. The status of payment of expenses is Not written off. What can be done to ensure that expenses are included in KUDIR?

Quote

0 Irina Plotnikova 03/25/2020 06:08 I quote Raisa:

Good afternoon, goods purchased for cash are included in the entrepreneur's expenses document, written off in the retail sales report document, but these goods are not included in the income and expenses book. And in the document there is an analysis of accounting according to the simplified tax system, when you open it and fall into the goods and materials they are not there. Please tell me what's wrong?

Raisa, hello.

We reproduced a similar situation on the latest release of the 1C program - everything worked out. Check whether these 2 operations take place in the same reporting period? Also check the warehouses, the range of these goods, has there been any duplication? Quote 0 Raisa 03/08/2020 22:41 Good afternoon, goods purchased for cash are included in the entrepreneur’s expenses document, written off in the retail sales report document, but these goods are not included in the income and expenses book. And in the document there is an analysis of accounting according to the simplified tax system, when you open it and fall into the goods and materials they are not there. Please tell me what's wrong?

Quote

Update list of comments

JComments

What taxes are levied on individual entrepreneurs depending on the chosen taxation system?

There are as many as 6 mode options that an individual can use. Here it is proposed to independently choose the most convenient one, provided that it meets the requirements of the law and does not go beyond the established limits.

Let's take a closer look, because what the payer chooses may change the amount of his debt to the state.

What happens to individual entrepreneurs on the simplified tax system

This is the easiest way to work legally. Usually, an entrepreneur goes to it immediately after registering a business. Here, instead of VAT, 1 fee is paid on profits and property.

Count in two ways:

- From income. The estimated amount is from 1% to 6%, this is precisely determined by the region of location.

- From the difference between the profit received and expenses. The rate also varies from 5 to 15%.

What to choose depends on how much you plan to earn. If the owner thinks that his costs will be 60% or more, then it is more profitable to take the second method. If this is less than half, then it is better to stop at the first example.

What payments does an individual entrepreneur pay on PSN?

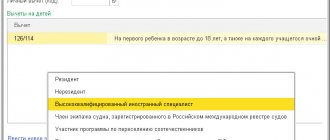

This is a relatively new regime that is actively used in certain areas. You can get several of them in different areas of the country. Its validity period is from a month to a year, then it needs to be renewed. The rate is from 0 to 6%, depending on what the company does. You will not have to submit reports.

But there are also limitations:

- employees - no more than 15, including the business owner;

- the area where clients are served does not exceed 50 m²;

- income no more than 60 million rubles annually.

When UTII was abolished, the state allowed PSN participants to reduce the tax on the volume of insurance premiums.

What deductions does an individual entrepreneur make and what does he pay on UTII?

The main thing is that this regime ceased to exist on January 1, 2021. Here everything also depended on the region and varied from 7 to 15%. But it was allowed to deduct insurance from what was prepared for payment.

What's happening at the Unified Agricultural Service

This is almost a simplification, but for agricultural producers. All enterprises that work on this system must send VAT and Unified Agricultural Tax to the state. The maximum rate is 6%, but almost all cities are trying to reduce it; for example, in the Moscow region it is zero. You can deduct the amount of insurance premiums already paid from the percentage that should be transferred.

What do you need to pay for OSNO?

This is the only tax on profit and income of an individual entrepreneur (IP), within which it is possible to receive property and social payments. But it is also considered the most difficult to use.

Everyone needs to independently calculate and send to the budget:

- Personal income tax - 13%;

- VAT - 20%;

- for property - 2.2%.

You must also pay transport and environmental fees, as well as insurance premiums for yourself. If there are employees, then you also need to pay for them. Usually it is taken by those who constantly work with large businesses. They can reduce the VAT payable due to the input, but they should remember that it is advisable to collect all the paperwork themselves, including all primary documentation.

What happens to self-employed entrepreneurs

This is one of the most profitable and simple taxes on business activities. From mid-2022, it operates throughout the country and for some friendly states that have clients in Russia.

The main condition is that there should be no hired employees. A self-employed person must do everything himself.

For the provision of services to individuals, he will transfer 4% to the budget, and for projects with legal entities - 6% of the money received. This is much less than the income tax of individual entrepreneurs in other regimes.

They can operate without a cash register and issue receipts from a mobile application. There are no social or health insurance contributions.

The main limitation is that income should not exceed 2.4 million rubles in a year. You cannot sell excisable goods and those with mandatory markings. Resale is also prohibited.

It will not be possible to transfer less than 4 and 6%, since these citizens do not pay any contributions. But they cannot count on retirement either.

Costs of maintaining individual entrepreneurs for dummies

How much will an individual entrepreneur cost in 2022 and what amounts will you have to pay for your own peace of mind. Let's figure it out.

What does an individual entrepreneur without employees, working under a simplified system, pay:

· insurance premiums - a fixed amount of 36,238 rubles per year + 1% of the amount of income over 300 thousand rubles;

· simplified tax system - 6% of income (this is the most suitable option for a freelance copywriter)

Moreover, the tax amount can be reduced by the amount of insurance premiums paid by 100%, that is, you will pay the simplified tax system less by the amount of insurance premiums. But only if you pay insurance premiums quarterly, and also submit advance reports according to the simplified tax system on time - once a quarter.

In fact, everything is simple - when you open a bank account (for example, Tinkoff, Modulbank, Tochka - they are the most convenient for online work), there will be prompts in your personal account with a calendar of mandatory payments. The bank will warn you in advance that it is time to pay contributions or submit an advance report using the simplified tax system.

According to the law, it is necessary to open an individual entrepreneur if you receive regular income from your activities and it is considered regular if transactions are concluded more than 2 times during the year. But now we are not talking about the legality of the activity, but about the benefits and expediency.

There is a confusing and complex calculator with detailed explanations - https://ipipip.ru/platej-ip/, and here is a very simple online calculation of insurance premiums - https://www.malyi-biznes.ru/servisy/platezh-ip/ and tax - https://www.malyi-biznes.ru/servisy/raschet-usn/.

But I'm better at examples.

Income is 20,000 rubles per month, per year - 240,000 rubles.

Income is less than 300 thousand rubles per year, so you only need to pay a fixed fee - 27,990 rubles per year.

STS 6% * 240,000 rubles = 14,400 rubles, but since it can be reduced by the amount of insurance premiums, you won’t have to pay it - it is less than the deduction and will be 0 rubles per year.

In total, you will have to pay the tax office 27,990 rubles per year or 2,325 rubles per month.

You receive an income of 30,000 rubles per month, per year - 360,000 rubles.

As a self-employed individual entrepreneur, you are required to pay insurance premiums - a fixed contribution + 1% of annual income that exceeds 300 thousand rubles = 27,990 + 1%*(360,000–300,000) = 27,990 + 600 = 28,590 rubles per year.

The simplified tax system is 6% of income, that is, 6% * 360,000 rubles = 21,600 rubles. But you have already paid more insurance premiums than this amount (28,590 rubles), so the simplified tax system for payment is 0 rubles, you will not need to pay anything else. Sleep well.

In total, an individual entrepreneur will cost 28,590 rubles per year.

Income per month - 50,000 rubles, per year - 600,000 rubles.

Insurance premiums - 27,990 + 1%*(600,000–300,000) = 27,990 + 3,000 = 30,990 rubles.

STS - 6% * 600,000 rubles = 36,000 rubles. We subtract the paid insurance premiums 36,000–30,990 = 5,010 rubles.

In total, the individual entrepreneur will pay 36,000 rubles for the year, and 3,000 rubles per month.

Monthly income - 100,000 rubles, annual income - 1.2 million rubles. Insurance premiums - 27,990 + 1% * (1,200,000–300,000) = 27,990 + 9,000 = 36,990 rubles per year.

STS - 6% * 1,200,000 rubles = 72,000 rubles. We reduce the amount of insurance premiums by 72,000–36,990 = 35,010 rubles.

In total, you will have to pay 72,000 rubles per year.

If you spread this out monthly, you will get only 6 thousand rubles, but with an income of 100 thousand rubles, paying this is quite realistic.

Do you think it's crazy how much? Nope, that's only 6% of your income. Remember how much commission you paid on the exchange (5–10–20% of earnings, and you also paid extra for withdrawals), and how much did you lose when working directly when the customer left without payment? If there is an individual entrepreneur, problems with “discounts” are solved simply by concluding an agreement. There is no need for an intermediary in the form of an exchange, and the money goes directly to your bank account without commissions.

_______

Let's see if you can avoid paying the simplified tax system if you just registered a company yesterday.

Tax holidays are given for the first two years of work of an entrepreneur, but only if he is included in the list of beneficiaries.

Each region has its own list of “lucky ones” and includes a list of priority activities. Any business cannot be exempt from taxes; concessions apply only to those engaged in scientific or production activities or providing socially significant services.

Check the relevant regional law to make sure that copywriting or advertising is not included in the list of preferential activities.

For self-employed workers who are engaged in the necessary business, there is a zero rate under the simplified tax system, but this benefit does not exempt them from paying insurance premiums.

__________

- Servicing a bank account - there are discounts, promotions, special bonuses for those who bring a friend, you can save money on this.

At Tinkoff, for the first three months I did not pay a commission to the bank for services, now I pay 490 rubles a month plus 99 rubles for SMS information. It works out to about 5,300 rubles per year, if you take into account the welcome gift of three months of free service, the second year will cost 7,000 rubles.

2. Some people connect to the accounting services Elba or My Business (there are also promotions and discounts, you can use the donated months and receive them by bringing your affiliate friends).

I still have enough built-in features in the bank, but if I hire employees, I will definitely turn to accounting specialists for help.

3. Electronic document management service, for example, (3 thousand for a qualified electronic signature for a year) - needed for the exchange of documents with an electronic signature with the tax office and clients.

But I can manage without it for now. Through the bank I send advance reports according to the simplified tax system, and at the end of the year they will help me fill out a declaration automatically and also submit it without a personal visit to the inspectorate. For now, I resolve issues with customers by sending paper acts and contracts with a signature, and I issue an invoice again in the bank’s personal account and send it to the customer’s accounting department by email.

It turns out that of the additional expenses, only the first point is required, the second and third are optional.

Something like this. Later I will write an educational program for those who do not know what to do with customers and their money - how an individual entrepreneur can organize work and document flow according to all the rules.

What do you have to pay extra?

Not all types of activities are easy. Some of them imply that the individual entrepreneur will have to acquire permissions to perform a number of actions.

For example, if he is doing:

- the creation or sale of excisable products - everything related to alcohol, cigarettes and some types of medicines will have to be reported;

- mining - it will not be possible to silently pump oil, you should transfer funds for this;

- use of water bodies - if a company uses water from a pond, sea, or reservoir, then it is obliged to the state.

And in order to shoot or breed animals of some wild breeds, you must have a special license and transfer money to a fee for use.

Benefits for paying insurance premiums

Since 2013, it has become possible not to pay if there is a serious reason for it. Persons who:

- serve by conscription - does not apply on a contract basis to those for whom the country has decided;

- on maternity leave for up to 1.5 years - for those caring for a baby up to 1.5 years old;

- caring for a disabled person or a person over 80 years of age - officially registered caregivers;

- the spouse of someone who serves, including under a contract, lives with him and cannot find a job.

You won’t be able to simply get an indulgence; you will have to contact the tax office with a corresponding application.

While the organization is functioning and does not close, the individual entrepreneur is obliged to transfer funds for himself. If he hasn't worked all year or hasn't made a profit. The Federal Tax Service will stop accruing debt when the entrepreneur is excluded from the state register.

Another nuance - if the company was not registered on January 1, then you have to pay for the number of days from which it opened.

Changes for individual entrepreneurs in special modes

In pilot mode, a new simplified system is being introduced in four regions (Moscow, Moscow Region, Tatarstan and Kaluga Region) - the automated simplified taxation system (AUST).

It is valid for those individual entrepreneurs who simultaneously meet the following conditions:

- annual income no more than 60 million rubles;

- no more than 5 people on staff;

- Employees' salaries are paid to the card.

Such individual entrepreneurs are exempt from mandatory social contributions for themselves and their employees. But at the same time, the income tax will be increased and will amount to 8% for the simplified tax system “income”, and 20% for the simplified tax system “income minus expenses”.

Also, in this mode you can not keep records and not submit declarations.

If the experiment gives a positive result, it will spread throughout the country from 01/01/2024.

For taxpayers, the standard simplified tax system also provides for three changes:

- a new declaration form (including the declaration for 2022 will need to be submitted using a new form);

- the list of expenses for the simplified tax system includes the costs of ensuring safety measures in connection with Covid-19;

- It is allowed to include employee salaries for non-working days as expenses (letter of the Ministry of Finance dated June 16, 2021 No. 03-11-06/2/47346).

For individual entrepreneurs on a patent, the list of types of activities has been expanded since 01/01/2022 (Law No. 8-FZ of 02/06/2020).

Voluntary payments for social insurance

What must be paid guarantees a person a pension and free medical care.

If he wants to receive sick leave and maternity leave, like any other hired employee, he will have to insure himself against temporary disability with the Social Insurance Fund.

The amount is small - 2.9% of the minimum wage per month. It is also possible to pay them once per year.

Please note that the Social Insurance Fund takes last year's accruals. To receive payment in 2022, it was necessary to conclude an agreement and transfer funds back in 2022.

How the amounts payable to the budget in 2022 and the payment procedure have changed

Some of the changes that came into force on January 1, 2022 relate to an increase in the amount payable that entrepreneurs are required to transfer to the budget and various funds.

Thus, from 01/01/2022, the amount of mandatory insurance premiums that individual entrepreneurs are obliged to pay for themselves will increase.

Contributions to the Pension Fund of Russia will amount to 34,445 rubles in 2022. If income exceeds RUB 300,000, you will additionally need to pay 1% of the excess amount.

The amount of medical contributions will be 8,766 rubles.

Corresponding amendments have been made to Art. 430 Tax Code of the Russian Federation.

Individual entrepreneurs should take into account that from 2022 the minimum wage has been increased (to 13,890 rubles), and the list of policyholders who have the right to apply reduced premium rates has been expanded (clause 2 of article 2, subclause “b” of clause 88 of art. , subparagraph “a”, paragraph 1, article 3 of Law No. 305-FZ of 07/02/2021).

Another innovation for 2022 is the introduction of a single tax payment for individual entrepreneurs and legal entities. The payment has been introduced since 01/01/2022 and allows all tax payments to be paid with one payment document. There is no need to specify which payment is being paid. The Federal Tax Service itself will distribute the transferred money to one or another CBK.

Please note that a single tax payment is not mandatory. If an individual entrepreneur is more accustomed to paying each tax separately, he will retain this right in 2022. Thus, two systems for calculating the budget operate in parallel.

Please note that the procedure for filling out payment orders for the transfer of taxes, fees, insurance premiums and other payments to the budget has also changed.

Previously, when filling out payment orders for settlements with the budget, individual entrepreneurs, lawyers, notaries, heads of peasant farms and individuals indicated different codes in field 101. Now one code is indicated in this field - 13. This practice has been applied since September 2022.

NOTE! When transferring personal income tax from employee salaries, individual entrepreneurs, lawyers, notaries and heads of peasant farms indicate their standard code 02 in field 01.

Tax reduction

Every entrepreneur has the opportunity to pay less. Sometimes these calculations completely cover the debt to the Federal Tax Service. In addition, employee contributions also reduce this number. The order in which everything happens depends on the system you choose.

How this is done with OSNO and simplified tax system

Everything that needs to be transferred to the state is included in expenses and this makes the individual entrepreneur’s tax base smaller.

For example, if in 2022 you managed to receive 850,000 rubles. At the same time, his expenses include 300,000 rubles, and he also transferred 40,874 rubles for himself. In total, 340,874 ₽ were spent. He must pay from 850,000 - 340,874 = 509,126 rubles.

Reduced payment for the amount of insurance

This is real - due to these transfers from individual entrepreneurs, a reduction in payments is allowed. Sometimes they are able to completely block it, then you won’t have to pay anything extra. But the order in which this happens depends on the system chosen.

What can be done with the simplified tax system “Income” and UTII

Here, all payments are calculated from the tax itself, but you should take into account whether there is hired staff. When it is not there, it is allowed to reduce it to very zero. If you have employees, this can be minimized by 50%, that is, half of the contributions must be transferred.

What's happening on PSN

Everyone who uses this system has nothing to brag about. They should count and send all payments in full, including the price of the patent itself.

General expenses for all types of individual entrepreneur activities

The first expense that awaits you when registering an individual entrepreneur in 2022 is paying the state fee for registration with the Federal Tax Service, the amount is 800 rubles. You can pay it in cash in banks, online through Internet banking, as well as on the Federal Tax Service website or the State Services portal.

Since 2022, it has become possible to register individual entrepreneurs without paying state duty

: This can be done if you submit registration documents electronically. You can send information to the tax office in this way when opening an individual entrepreneur online with Tinkoff, through a notary, and also through some MFCs. Please note that not all multifunctional centers can send electronic documents to the inspection. If they are sent in paper form through a courier service, a fee will have to be paid. If registration is refused, you will not be refunded the fee paid, but within three months you can resubmit the documents without paying it.

You can prepare and submit documents for free

. With automated application preparation, you can prepare everything you need yourself in 15 minutes and at no additional cost. However, if you entrust the preparation and submission of documents to a representative or third-party organization, then be prepared for expenses.

Post-registration costs

After registration, the amount of expenses largely depends on the chosen type of activity. In addition, there are a number of costs associated with setting up a business. According to the law, they are not mandatory, but sometimes you cannot do without them:

- Order a print

(from 500 RUR). Entrepreneurs are not required to have it. A seal will definitely be needed if you hire workers - without it it is impossible to certify work books. Printing is also required for the preparation of strict reporting forms if you work without a cash register. - Opening a bank account

. According to the law, individual entrepreneurs can work exclusively with cash payments, but in this case, the amount of payments under one agreement cannot exceed 100,000 rubles. If you expect to make large payments, you can open an account at any time after registration. Opening an account at many banks is free, but there are monthly or annual account maintenance fees to consider. Tinkoff offers quick opening and profitable servicing of a current account for individual entrepreneurs.

Open an individual entrepreneur online with Tinkoff - it's free!

Or download documents for submission to the Federal Tax Service

The service will prepare all the documents, and a bank employee will help you submit them online. Tinkoff will also open a current account for you. If online filing is not suitable for you, our online service will prepare all the documents for individual entrepreneur registration. Just fill out the form according to the prompts, and then print the finished documents. Any option is free!

Open an individual entrepreneur onlineGet documents

Open an individual entrepreneur onlineGet documents

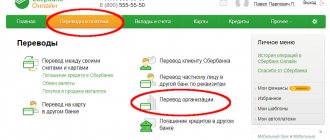

How to automate the transfer of taxes paid by individual entrepreneurs in the required amount

If you use the special services and tariffs that most banks offer along with a current account, they greatly simplify the work of a business owner. They themselves can calculate and prepare a report on which funds will be deposited. All that remains is to double-check the amounts and details.

If an entrepreneur pays fixed payments, then they can also be set as a template in any bank and a convenient amount and period of transfers to the Federal Tax Service can be set.

Some document management programs can also perform such calculations and set deadlines that must be met.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Reporting: what to submit and where

We have looked at what taxes and mandatory payments must be paid when opening an individual entrepreneur and conducting business. Now let's figure out how to report for work.

Here's what you should submit:

| Mode | What to take |

| simplified tax system | Declaration |

| Unified agricultural tax | |

| PSN | not served |

| BASIC | 3-NDFL, according to VAT |

It is worth noting that when combining different types, you will have to submit documents for each separately.