Setting up accounting policies

In the 1C program, it is possible to reflect separately issued advances, which were previously indicated on line 1230 “Accounts receivable” of the balance sheet (from release 3.0.88). Advances are shown in the balance sheet by type of asset for the purchase of which they were paid (clauses 45, 46 FSBU 5/2019, clause 23 FSBU 26/2020).

Make the settings in the Main - Accounting Policies section.

Please indicate:

- Apply from - the period from which the new procedure for reflecting advances is applied (if you need to generate reports for 2022 taking into account the new procedure, indicate December 2020 );

- Advances issued to suppliers are reflected in the balance sheet - select the radio button Separate lines by asset type .

Setting up an agreement with a supplier

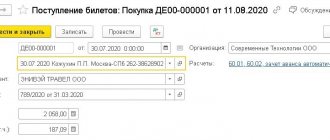

In the agreement cards with suppliers, indicate in the section Reflection in financial statements one of the options (Directories - Purchases and sales - Agreements). The same setting can be made using SALT according to account 60.02.

Advances issued under the agreement are reflected in the balance sheet as:

- Inventories - prepayment under an agreement that provides for the supply of assets classified as inventories (line 1260 “Other current assets”);

- Fixed assets a - prepayment under the contract for the supply of fixed assets (line 1190 “Other non-current assets”);

- Other assets - prepayment under a contract for the supply of other assets not related to inventories and fixed assets (line 1260 “Other current assets”);

- Accounts receivable - prepayment for other agreements (for example, services), set by default (line 1230 “Accounts receivable”).

The setting should be done only for those contracts for which there are outstanding advances at the reporting date. For example, before filling out the balance for 2022, the balance of account 60.02 as of December 31, 2021 is analyzed. There is no need to fill out information on advances that closed within the year.

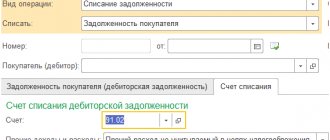

Accounting for receivables from counterparties

Accounts receivable means debt to an organization:

- buyers and customers;

- suppliers and contractors for advances transferred to them;

- employees of the organization;

- budget and extra-budgetary funds;

- other debtors.

Accordingly, persons who have obligations to the organization (including the organization’s counterparties) are considered its debtors. Further we will consider only the receivables of counterparties.

The occurrence (increase) of accounts receivable is always reflected in the debit of the account for settlements with counterparties, for example:

Debit 62.01 Credit 90.01.1 - goods (work, services) were sold to the buyer;

Debit 60.02 Credit 51 - an advance was transferred to the supplier for upcoming deliveries of goods (performance of work, provision of services);

Debit 58.03 Credit 51 - a loan was provided to the borrower counterparty.

The repayment (reduction) of accounts receivable is always reflected in the credit of the settlement account, for example:

Debit 51 Credit 62.01 - payment received from the buyer for goods sold (work, services);

Debit 60.01 Credit 60.02 and Debit 41.01 Credit 60.01 - the supplier's advance payment upon receipt of goods is credited;

Debit 51 Credit 58.03 - loan repaid.

Depending on the accounting tasks, receivables from counterparties can be classified according to various criteria, for example:

- by economic content. The debt may be related to the sale of goods, (work, services) to the buyer (customer) or not. This classification is used when creating reserves for doubtful debts in tax and accounting, as well as for detailing balance sheet indicators (letter of the Ministry of Finance of Russia dated January 27, 2012 No. 07-02-18/01);

- according to the expected maturity of obligations after the reporting date (short-term and long-term debt) - for reflection in the accounting (financial) statements of the organization. We remind you that in the balance sheet assets and liabilities are presented as short-term if their maturity date is:

- no more than 12 months after the reporting date;

- or no more than the duration of the operating cycle if it exceeds 12 months.

- All other assets and liabilities are presented as long-term (clause 19 of PBU 4/99 “Accounting statements of an organization”, approved by order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n);

- according to the actual terms of fulfillment of obligations under the contract - normal (urgent) and overdue debt. Overdue debt, in turn, can be secured, doubtful or hopeless. This classification is used in the formation of reserves for doubtful debts, as well as for reflection in the notes to the balance sheet and the income statement.

Accounting for accounts receivable in “1C: Accounting 8” (rev. 3.0) depends on a set of settings, such as:

- keeping records of contracts;

- setting deadlines for repaying customers' debts;

- the ability to manage the offset of advances and debt repayment;

- formation of reserves for doubtful debts, etc.

Let's take a closer look at these settings.

Note

The procedure for generating accounting (financial) statements is not discussed in this article.

Customer debt repayment terms

If an organization maintains analytical accounting for contracts (in the functionality settings on the Calculations tab, the Accounting for contracts flag is selected), then the deadline for fulfilling the obligation under the contract can be specified directly in the contract card with the counterparty. To do this, in the Payments group of details, set the Payment deadline has been set flag and indicate the payment term in days (Fig. 1).

Rice. 1. Indication of the payment term in the contract card

A single debt repayment period for all buyers can be specified in the Deadline for payment of debt by buyers field in the Deadlines for payment by buyers register (Fig. 2). The register is accessed via the hyperlink of the same name from the Sales section or from the Administration - Accounting Parameters section.

Rice. 2. Payment terms for buyers

The payment terms specified in the program in one way or another are used to automatically identify overdue receivables.

Accounts receivable from counterparties are considered normal (urgent) within the payment period specified in the agreement card, starting from the moment of its occurrence. If the receivable remains outstanding after the payment deadline, it is considered overdue.

If the payment deadline is not specified in the agreement card, then for contracts with customers, receivables that are not repaid within the Customer Payment Deadline specified in the Accounting Parameters settings are considered overdue.

Thus, the payment deadline established for a specific contract takes precedence for qualifying the debt as overdue.

If the payment period is not indicated either in the contract card or in general for customers, then the receivables are considered overdue from the moment they arise.

Overdue receivables identified in the program affect the accounting of expenses and income when forming provisions for doubtful debts, as well as the indicators of accounting (financial) statements.

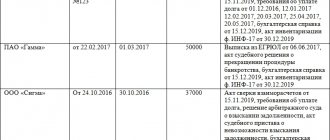

According to paragraph 70 of the Regulations on accounting and financial reporting in the Russian Federation (approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n), the organization must create reserves for doubtful debts if receivables are recognized as doubtful. An organization's receivables are considered doubtful if they are not repaid (with a high degree of probability will not be repaid) within the time limits established by the agreement and are not secured by appropriate guarantees.

For the purposes of forming reserves in tax accounting, doubtful debt is recognized as the receivables of the counterparty in connection with the sale of goods (performance of work, provision of services), if this debt is not repaid within the time limits established by the agreement and is not secured by a pledge, surety, or bank guarantee. The amount of doubtful accounts receivable in relation to each counterparty should be determined minus the accounts payable to this counterparty (clause 1 of Article 266 of the Tax Code of the Russian Federation).

At the same time, the creation of a reserve for doubtful debts for profit tax purposes is a right, and not an obligation, of the taxpayer (clause 3 of Article 266 of the Tax Code of the Russian Federation), therefore the formation of reserves is determined by the accounting policy for tax purposes.

By default, the formation of reserves for doubtful debts in 1C: Accounting 8 is disabled. To enable the automatic formation of provisions for doubtful debts in accounting, in the Accounting Policy form (section Main - Settings - Accounting Policies), you should set the flag Provisions for doubtful debts are formed. If a reserve for doubtful debts is created in tax accounting, then you should set the Create reserves for doubtful debts flag in the Income Tax section of the Taxes and Reports Settings form (section Main - Settings - Taxes and Reports).

In the program, for the purposes of automatic formation of a reserve in both accounting and tax accounting, doubtful debt is considered to be any overdue debt reflected in accounts 62.01 “Settlements with buyers and customers” and 76.06 “Settlements with other buyers and customers”. In other words, provisions for doubtful debts are automatically calculated only for debts accounted for in rubles, and only in relation to contracts with buyers and customers.

In these cases, the calculation of reserves for doubtful debts is performed by the same regulatory operation, which is part of the Month Closing processing. To accrue reserves for doubtful debts in relation to other types of debt (for example, advances issued to a supplier or under contracts with customers in conventional units), you should use the Transaction document.

Receivables recognized as uncollectible (uncollectible) are subject to write-off (clause 77 of the Regulations, clause 2, clause 2, article 265 of the Tax Code of the Russian Federation). Bad debts cannot be detected automatically by the program. They are identified by an accountant, guided by the criteria set out in paragraph 2 of Article 266 of the Tax Code of the Russian Federation, and his professional judgment.

| 1C:ITS For more information on accounting for overdue receivables, see the section “Instructions for accounting in 1C programs”: on the formation of reserves for doubtful debts in accounting and tax accounting; on writing off bad receivables. |

Deadlines for payment of invoices

The detail Due date for payment of invoices specified in the Deadlines for payment by buyers register (Fig. 2) does not affect the accounting and tax accounting of receivables and serves solely for making management decisions. In particular, the Invoice Payment Due Date allows you to monitor the status of invoices issued to customers, including partial payments.

We remind you that the Buyer Invoice document is intended for preparing and printing invoices to customers, as well as for monitoring mutual settlements with customers. In the Invoice, the buyer can see not only the full amount of the invoice, but also its paid and unpaid parts.

The payment status of the document Invoice to the buyer attribute can take the following values:

- Not paid;

- Paid;

- Partially paid;

- Canceled.

You can analyze information about unpaid invoices as of the current date using the Invoices not paid by customers report (section for Manager). In addition to invoices with the Unpaid status, the report also includes partially paid invoices. The report reveals the total invoice amount, paid and unpaid parts. Based on the report data, you can send email reminders to counterparties about the need to pay invoices. Sending email messages requires a configured email account.

| How to monitor the status of invoices issued to customers, including partial payments, in “1C: Accounting 8” edition 3.0 |

Planning payments from buyers

In order for the user of “1C:Accounting 8” edition 3.0 to be able to control expected receipts from customers, in the program functionality settings (Main section) on the Calculations tab, the flag Planning payments from customers should be set (Fig. 3). This functionality is used for making management decisions and does not affect accounting and tax accounting.

Rice. 3. Program functionality, “Calculations” tab

When the Planning of payments from buyers functionality is enabled, it becomes possible to specify payment terms in settlement documents with buyers (customers):

- Sales (acts, invoices);

- Provision of production services;

- OS transfer;

- Transfer of intangible assets.

The Payment term detail is indicated in the Settlement form, which opens from the settlement document with the buyer via the appropriate link (Fig. 4) and is filled in automatically based on the payment term specified in the contract card with the buyer, or based on the Due date for payment of debt by buyers detail.

Rice. 4. Payment deadline in the sales document

If the term is not indicated either in the contract card or in general for buyers, then the Payment term attribute will correspond to the date of the settlement document. The payment deadline can be changed manually - this will not affect accounting and tax accounting.

The functionality Planning payments from customers provides the user with access to the assistant (special processing) Expected payment from customers (section Sales - Settlements with counterparties). The assistant form for the selected organization displays both existing customer debts and unpaid invoices issued to customers (Fig. 5).

Rice. 5. Expected payment from buyers

Processing analyzes balances on accounts payable to customers. For each debt (that is, for each settlement document), the planned payment period is indicated. Additionally, processing includes planned payment for issued invoices that have the status Unpaid or Partially Paid. If there is a debt on a settlement document associated with an issued invoice, it is displayed together with the invoice in one line. The entire list is displayed in chronological order.

The Expected Payment from Buyers assistant allows you to change the payment deadline for one or more documents previously selected with the cursor. The Change payment due date command opens a form for entering a new payment due date. You can also change the payment deadline for a document directly in the Payment due date field. By selecting a line in the list, you can send an email to the counterparty with a payment reminder. The letter will be generated automatically by clicking the Remind button.

| How you can schedule payments from customers in the 1C:Accounting 8 version 3.0 program |

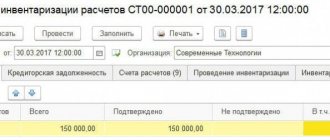

Reflection of advances in the balance sheet

As a result of the settings made, advances issued fall into the corresponding lines of the balance sheet (Reports - 1C - Reporting - Regulated reports).

Amounts can be checked in a standard report. For example, in the balance sheet for account 60.02 (Reports - Standard reports - Account balance sheet). From SALT according to 60.02, you can also go to the agreement card and make settings for reflecting advances in financial statements. To do this, click on the Contract : for example, Supply Contract No. 154 dated 03/01/2021 .

Advances for services do not belong to inventories, since the services themselves do not form inventories (only as part of work in progress or if they are deferred expenses).

Advances for services that do not form inventories but are immediately recognized as expenses are accounts receivable (line 1230 of the balance sheet).

To decipher advances issued in the balance sheet for earlier periods, we recommend making similar settings for contracts, for example, from 2022:

- enter information into contracts with advances at the end of the reporting period according to the algorithm above;

- indicators of previous periods will be filled in the balance automatically in accordance with the settings.

We recommend performing such operations on a copy of the database using the following algorithm:

- enter information into contracts with advances at the end of the reporting period (according to the algorithm above) in copies of the database;

- fill out the balance sheet for 2022 (2020) in a copy of the database;

- amounts from line 1230 “Accounts receivable” will be automatically transferred to other lines in accordance with the settings in the agreement with the supplier. Transfer this data manually to the appropriate columns of the BFO for 2022. Please leave a note about the changes you made in the comments.

You can change the UE regarding advances issued for previous periods and in the working database. Then fill in the required information on the contract card. There will be no need to transfer documents for previous periods due to a change in UE in 1C. Advances in the balance sheet for previous years will be decrypted automatically.

If this option is chosen, it is important not to refill the original accounting reports submitted to the Federal Tax Service over the last 3 years, so that the amount for advances issued is not lost.

For more detail, you can manually highlight the amount of advances in the total value of assets by line, among other things.

If advances issued include VAT, then the following is shown separately in the balance sheet:

- on lines 1190, 1260 - the amount of the advance minus VAT, recorded in account 76.VA;

- on line 1230 - VAT reflected in account 76.VA.

In order for the issued advance to be included in the balance sheet “cleared” of VAT, the document Invoice received for the advance . It forms wiring Dt 68.02 Kt 76.VA. At the end of the reporting period, it is necessary to monitor the receipt of all SF for advances issued (if they include VAT) and register them in 1C.

Calculation of VAT on advance payment

The advance payment system provides for the transfer of a certain part of the total cost of goods, works and services against their future delivery or performance.

It is necessary to calculate and pay VAT on advance tranches (AT). The buyer accepts the tax amount as a deduction or refuses it. This is his full right. Each situation has its own nuances.

| Input tax from the vehicle is accepted for deduction by the buyer | The settlement option allows the purchaser of goods to reduce the tax payable to the budget before the actual shipment. To receive a deduction, all three conditions must be met:

Check whether the seller has calculated the tax correctly. After the actual delivery of the goods, the buyer has the opportunity to deduct the entire purchase price. Consequently, the tax on vehicles declared earlier will have to be restored. Report advance invoices on your VAT return in the quarter in which they were paid. Include the amounts in section 3 of the report. |

| The input tax from the vehicle is not accepted for deduction by the buyer | The buyer is not required to deduct the input tax from the AT. It is allowed to reduce the obligation to pay to the budget once - at the time of actual delivery of goods or performance of work or services. The company declares the entire amount of the input fee in the sale without any recovery. This means that the offset of advances issued in the VAT return will not have to be reflected. An application for a benefit is allowed only if three conditions are met: an issued invoice, a supply agreement, and payment documentation for payment. |

How is VAT calculated on an advance payment?

The buyer does not need to calculate the input tax on the advance payment. The seller will do this for him. The tax amount is allocated in the advance invoice. But the buyer should check whether there has been an error in the calculations.

To check, use the formula:

| VAT on advance | = | the amount of AT reflected in the invoice under the supply agreement, contract | × | settlement rate, in accordance with the rate at which the transaction is taxed: 20/120 or 10/110 |

If you find an error in the calculation, contact the seller and clarify the details. An arithmetic error needs to be corrected. Liabilities calculated incorrectly cannot be accepted for deduction.

In accounting, reflect AT in special account 76. For additional analytics, provide subaccounts 76 AB - for tranches received and 76 VA - for amounts issued. Fix the procedure for reflecting accounting transactions in the accounting policy. According to 76 VA, in the VAT return, reflect the amounts of advances issued.