For whom is the transition to Unified Agricultural Tax available?

Tax law provides for the application of a special regime for commercial structures that meet the following parameters:

- legal entities or individual entrepreneurs engaged in the reproduction and sale of products classified as agricultural;

- the share of sales of agricultural products in gross revenue is at least 70% (for all types of products).

Based on their functionality and the organizational and legal form of a business entity, payers of the Unified Agricultural Tax include:

- LLCs and individual entrepreneurs with OKVED codes of agricultural producers;

- agricultural consumer cooperatives (processing, marketing, livestock, horticultural);

- artels engaged in fishing and processing of fish and other aquatic biological resources.

Important: to be classified as an agricultural producer, the complex presence of three factors is necessary - the products must be produced, processed and sold by an applicant for the use of unified agricultural tax. The absence of one component provides grounds for refusing the taxpayer to switch to the agricultural tax.

Fishing farms in Russian single-industry towns and settlements, where this type of activity is a city-forming activity, must meet additional criteria to use the preferential regime:

- the number of employees of fishing enterprises (including family members living with them) must be at least half of the total number of residents of the city/village;

- the number of employees involved in fishing activities is limited - no more than 300 people per year;

- fishing must be carried out using own or leased (chartered) fishing vessels.

Please note: for fishing enterprises (IEs), the requirement to use the Unified Agricultural Tax remains with the volume of sales of agricultural products (fish catch) amounting to 70% of gross income.

Prohibition on the use of the single agricultural tax

In some cases, tax legislation does not allow the application of preferential treatment even if the above conditions are met. Agricultural producers who, in addition to their main activities, perform the following work are not allowed to use the Unified Agricultural Tax:

- produce goods subject to excise duties (tobacco products, alcohol);

- are engaged in gambling business.

In addition, it is prohibited to switch to paying unified agricultural taxes to agricultural organizations that are part of the budget structure.

Procedure for transition to Unified Agricultural Tax

If an organization or individual entrepreneur meets all the criteria corresponding to the status of an agricultural producer, then the taxpayer has the right to declare to the fiscal authorities his intention to use a preferential special regime.

Please note: the transition to the Unified Agricultural Tax is not mandatory and is carried out by taxpayers on a voluntary basis.

When to declare the use of Unified Agricultural Tax

The unified agricultural tax is calculated based on the results of the tax period – the calendar year. For this reason, you can declare the transition to the Unified Agricultural Tax when using other taxation methods before the start of the new reporting period .

The deadlines for filing an application with the tax authority are:

- for existing LLCs/IPs – December 31;

- for new business entities – within 30 days from the date of registration.

Remember: violation of the deadlines for notification of the transition to the Unified Agricultural Tax is grounds for non-recognition of the taxpayer as a subject of the special regime and the accrual of all taxes according to the previous taxation scheme.

How to draw up a notice of application of the Unified Agricultural Tax

FILES

An application-notification on the use of the unified agricultural tax is drawn up by the taxpayer using Form No. 26.1-1 independently.

A separate block is provided for the tax authority’s marks, in which the inspector indicates the date of receipt of the document and the registration number.

At the head of the notification, the applicant indicates the required information:

- name of the subject;

- INN and KPP of the taxpayer notifying about the transition to the Unified Agricultural Tax;

- number (code) of the tax office at the location/registration of the applicant;

- taxpayer sign.

Drawing up a notification does not cause problems for the applicant, but attention should be paid to the following nuances:

- the applicant's attribute is selected depending on the time of submission of the notification;

- if the notification is submitted to the regulatory authority along with the main package of documents for registration, then the number “1” should be indicated;

- when submitting an application within a month (30 days) after registration - number “2”;

- when switching from another tax regime – number “3”.

Newly created individual entrepreneurs and organizations indicating “1” or “2” as the applicant’s attribute sign the notification, certify it with a seal and submit it to the tax office.

For payers who previously applied a different taxation scheme and plan to switch to the Unified Agricultural Tax from January 1 of the next calendar year, it is necessary to provide information on the share of gross revenue related to the sale of agricultural products. The same field indicates the period for which the calculated share is at least 70%.

Notification of the application of the unified agricultural tax can be submitted directly to the fiscal authority (by the head of the organization, entrepreneur or authorized representative), sent by mail or via telecommunication channels.

Keep in mind: if application No. 26.1-1 is submitted by an authorized person, then a power of attorney certified by a notary office is required.

Who has the right to switch to paying unified agricultural taxes?

The Federal Tax Service in Letter dated March 11, 2020 No. AB-4-19/ [email protected] invites UTII payers to choose the optimal tax regime for use from 2022 instead of imputation:

- For individual entrepreneurs, you can choose from 4 options: simplified tax system, unified agricultural tax, PSN and NPD. Some modes are even allowed to be combined.

- There are fewer options for organizations: only the simplified tax system and the unified agricultural tax. We have already talked about the transition to the simplified tax system here.

The Unified Agricultural Tax regime has the right to apply to agricultural producers, i.e. enterprises and individual entrepreneurs whose 70% of total revenue is income:

- from the sale of agricultural products of own production;

- from the provision of services to agricultural producers.

In order not to violate this restriction, Unified Agricultural Tax payers have to refuse to sell expensive fixed assets. Clause 2.1 art. 346.26 of the Tax Code of the Russian Federation indicates the types of activities common to UTII and Unified Agricultural Tax:

| Retail | Provision of catering services |

|

|

In relation to these types of activities, the Tax Code of the Russian Federation requires choosing one of two taxation systems.

How could it happen that an agricultural producer ended up being imputed instead of the Unified Agricultural Tax? Possible reasons:

- UTII was cheaper than Unified Agricultural Tax;

- from January 1, 2022, Unified Agricultural Tax payers were required to pay VAT, and the timely transition to UTII freed them from such obligation;

- the agricultural producer was not sure that the revenue from the products he produced would be at least 70% of his income.

By the way, payers whose average number of employees does not exceed 300 people have the right to switch to the Unified Agricultural Tax, in contrast to imputation - no more than 100 people. Therefore, after the transition to the unified agricultural tax, it is possible to increase the number of employees.

If you have questions about the transition from UTII to other regimes from 2021, you can find the answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

Start of work on Unified Agricultural Tax

Individual entrepreneurs and firms operating under a general or simplified taxation system switch to the Unified Agricultural Tax starting on January 1 of the year following the year in which the notification was submitted. Those who received the status of an individual entrepreneur or a legal entity and immediately declared their intention to apply the Unified Agricultural Tax, use this regime from the beginning of production activities.

When the right to use the unified agricultural tax is lost

Loss of the status of an agricultural producer and, accordingly, the right to apply a preferential agricultural special regime is possible in the following cases:

- reducing the mandatory 70% barrier to the share of sold agricultural products in gross income;

- violation of requirements for agricultural producers entitled to apply a special regime;

- termination of activities that give the right to apply the Unified Agricultural Tax;

- transition to another form of taxation.

Since the tax period for agricultural tax is a calendar year, all decisions regarding the loss of the right to use the Unified Agricultural Tax are made after December 31. If you refuse to further apply the special regime (regardless of the circumstances), the business entity is obliged to notify the fiscal service about this as follows:

- in case of violation of the criteria of the Unified Agricultural Tax payer - by submitting an application for loss of the right to a special tax in form No. 26.1-2;

- if you wish to use a general or simplified taxation system - according to form No. 26.1-3;

- when interrupting activities related to agriculture - according to form No. 26.1-7.

Information on the given forms must be submitted to the tax authority for a limited period - from January 1 to January 15 of the new calendar year.

Notifications and messages under the Unified Agricultural Tax

Unified Agricultural Tax (USAT)

is a special tax regime that was developed and introduced specifically to support agricultural producers.

The taxation system in the form of a single agricultural tax is regulated by Chapter 26.1 of the Tax Code of the Russian Federation.

The approved rules also apply to peasant farms (peasant farms)

.

The use of the Unified Agricultural Tax significantly reduces the tax obligations of payers.

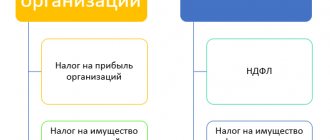

Taxpayers who use the unified agricultural tax are exempt from paying the following taxes:

- Organizations

- Individual entrepreneurs

- Corporate income tax

- Organizational property tax

- Value added tax (with the exception of VAT when importing goods into the territory of the Russian Federation and other territories under its jurisdiction)

- Personal income tax (in relation to income from business activities)

- Property tax for individuals (in relation to property used for business activities)

- Value added tax (with the exception of VAT when importing goods into the territory of the Russian Federation and other territories under its jurisdiction)

Attention!

The use of the Unified Agricultural Tax does not exempt you from performing the duties of a tax agent, for example, calculating, withholding and transferring personal income tax from employee salaries, as well as from paying other taxes in accordance with the law.

Agricultural producers must take into account many factors when making a decision to switch to the Unified Agricultural Tax. The advantages and disadvantages of using unified agricultural tax are shown in the table.

| Advantages | Flaws |

|

|

Agricultural producers producing agricultural products and switching to paying the Unified Agricultural Tax.

For tax purposes, the unified agricultural tax recognizes agricultural producers and agricultural products as:

- Agricultural producers

- Agricultural products

Agricultural producers

are:

- organizations and individual entrepreneurs producing agricultural products, carrying out their primary and subsequent (industrial) processing and selling these products, for which the share of income from the sale of agricultural products produced by them in the total income is at least 70%

; - agricultural consumer cooperatives, in which the share of income from the sale of agricultural products produced by them in their total income is at least 70%

; - city- and village-forming Russian fishery organizations (including agricultural production cooperatives) with a total income from sales of at least 70%

and with the number of employees (including family members living with them) is

at least half the population of the locality

; - fishery organizations and individual entrepreneurs, if:

- the average number of employees for the tax period does not exceed 300 people

; - in the total income, the share of income from the sale of their catches of aquatic biological resources or fish and other products from aquatic biological resources produced on their own from them is at least 70%

; - fishing is carried out on vessels of the fishing fleet owned by them ,

or they use them on the basis of charter agreements (bareboat charter and time charter).

To agricultural products

relate:

- crop products

- agriculture and forestry

- livestock products (including those obtained as a result of growing and growing fish and other aquatic biological resources),

- catches of aquatic biological resources,

- fish and other products from aquatic biological resources

- catches of aquatic biological resources obtained (caught) outside the exclusive economic zone of the Russian Federation in accordance with international treaties of the Russian Federation in the field of fishing and conservation of aquatic biological resources,

- fish and other products produced on vessels of the fishing fleet from aquatic biological resources obtained (caught) outside the exclusive economic zone of the Russian Federation in accordance with international treaties of the Russian Federation in the field of fishing and conservation of aquatic biological resources.

Attention!

Organizations and individual entrepreneurs that do not produce agricultural products, but only carry out their primary or subsequent (industrial) processing,

are not entitled to apply the Unified Agricultural Tax

.

For organizations - accounting, for individual entrepreneurs - a book of income and expenses.

Organizations

are required to keep records of their performance indicators necessary for calculating the tax base and the amount of the Unified Agricultural Tax, based on

accounting

.

Individual entrepreneurs

keep records of income and expenses for the purpose of calculating the tax base for the unified agricultural tax in

the ledger for accounting income and expenses

.

Agricultural producers subject to certain rules.

Agricultural producers have the right to switch to paying the unified agricultural tax if, based on the results of work for the calendar year preceding the calendar year in which the notification of the transition to paying the Unified Agricultural Tax is submitted, the share of income from the sale of agricultural products produced by them in the total income from the sale of goods (work, services) products (including primary processed products produced by them from agricultural raw materials of their own production) is at least 70%

.

For fisheries

organizations have additional conditions.

Can not

switch to paying agricultural tax:

- organizations and individual entrepreneurs engaged in the production of excisable goods

; - organizations engaged in organizing and conducting gambling

; - state-owned, budgetary

and autonomous institutions.

Attention!

Organizations and individual entrepreneurs who pay UTII for one or more types of business activities have the right to switch to paying the Unified Agricultural Tax for other types of business activities they carry out. At the same time, restrictions on the amount of income from the sale of agricultural products produced by them will be determined based on all types of activities they carry out.

The transition to the Unified Agricultural Tax is carried out voluntarily.

To switch to a single agricultural tax, it is necessary to submit a corresponding notification in form No. 26.1-1 to the tax authority at the location of the organization or at the place of residence of the entrepreneur.

Deadline for submitting notification of transition to unified agricultural tax:

- within 30 days

from the date of registration of the newly created organization or individual entrepreneur; - until December 31

of the year for existing organizations and individual entrepreneurs (for the transition to the Unified Agricultural Tax from the next calendar year).

Attention!

Taxpayers who do not submit a notification within the established time frame are not entitled to apply the Unified Agricultural Tax.

Taxpayers have the right to continue to apply the Unified Agricultural Tax in the next tax period if:

- a newly created organization or a newly registered individual entrepreneur who switched to paying the Unified Agricultural Tax in the first tax period had no income taken into account when determining the tax base;

- in the current tax period, the taxpayer did not violate the restrictions and (or) fail to comply with the requirements established for the application of the Unified Agricultural Tax.

In case of violation of the restrictions that are established when applying the unified agricultural tax.

If, at the end of the period, the taxpayer does not comply with the mandatory conditions for the application of the Unified Agricultural Tax, then he is considered to have lost the right to apply the unified agricultural tax from the beginning of the year in which this violation was committed or detected. In this case, it is necessary to inform the tax authority within 15 days after the expiration of the reporting (tax) period about the loss of the right to use the Unified Agricultural Tax system in form No. 26.1-2.

A taxpayer who has lost the right to use the Unified Agricultural Tax, within one month after the expiration of the tax period in which this occurred, must recalculate tax liabilities for the entire tax period in the manner prescribed by the Tax Code of the Russian Federation for newly created organizations or newly registered individual entrepreneurs.

You can refuse to use the Unified Agricultural Tax on a voluntary basis.

to other taxation regimes before the end of the tax period (year).

.

When switching to a different taxation regime,

you must notify the tax authority in Form No. 26.1-3 no later than

January 15 of the year

in which they intend to switch to a different taxation regime. Taxpayers who have switched to a different taxation regime have the right to switch again to paying the Unified Agricultural Tax no earlier than after a year.

In case of termination

a taxpayer

of entrepreneurial activity

in respect of which the Unified Agricultural Tax was applied, he is obliged,

no later than 15 days

from the date of termination of such activity, to notify the tax authority (at the location of the organization or place of residence of the individual entrepreneur) in Form No. 26.1-7, indicating the date of termination of the activity.

Do not forget to submit a declaration under the Unified Agricultural Tax to the tax authority at the location of the organization or at the place of residence of the entrepreneur.

- Based on the results of the tax period, no later than March 31 of the year following the expired tax period.

- In case of termination of business activity no later than the 25th day of the month following the month in which this activity was terminated in accordance with the notification submitted by the taxpayer to the tax authority.

Notice may be given in person, by mail, or electronically.

To send reports via the Internet, you can purchase them at the CBU Certification Center

electronic digital signature and use it for one year to submit reports to the Tax Authorities, Pension Fund (PFR), Social Insurance Fund (FSS), etc.

Recalculation of taxes upon loss of the right to a special regime

After the end of the reporting year, a taxpayer who has violated the requirements for agricultural producers is obliged to recalculate tax payments.

Instead of the unified agricultural tax paid during the year, an organization or individual entrepreneur will have to calculate and pay the main types of taxes to the budget:

- property tax (if there are fixed assets);

- VAT;

- income tax (NDFL);

- income tax.

All additional tax returns must be filed by January 31, and all budget obligations must be paid during this period.

Simultaneously with the formation and submission of declarations to the Federal Tax Service under the general taxation system, the former agricultural producer is obliged to draw up an updated calculation for the Unified Agricultural Tax (advance payments) for the 1st half of the year. The amounts paid will be considered an overpayment of agricultural tax.

You can return to the use of the Unified Agricultural Tax after one year has passed after the loss of the right to use it (or voluntary refusal).

What taxes does the Unified Agricultural Tax exempt from?

The Unified Agricultural Tax exempts (clause 3 of Article 346.1 of the Tax Code of the Russian Federation):

- organization - from paying income tax and property tax of organizations;

- Individual entrepreneur - from paying personal income tax and property tax for individuals.

In this case, the property for which tax exemption is granted must be used in the production, processing and sale of agricultural products, or in the provision of services to agricultural producers.

Payers of the Unified Agricultural Tax have the right to receive an exemption from VAT in accordance with clause 1 of Art. 145 of the Tax Code of the Russian Federation, provided that their annual income excluding VAT does not exceed:

- in 2022 - 80 million rubles;

- in 2022 - 70 million rubles;

- in 2022 and beyond - 60 million rubles.