Let's start with concepts and meanings

Accounting profit (BP) is a key economic indicator. It characterizes production efficiency, rational use of resources and the overall productivity of the company’s financial and economic activities. The calculated value of accounting profit is determined through income and expenses - their difference shows the real economic situation of the enterprise.

| Bukhpribyl | Meaning |

| Positive | Revenues exceed expenses. The work is going in the right direction, capacity is growing, and the company is benefiting. |

| Zero | Equality of income and expenses. The company has no profit or loss - this is the break-even point. |

| Negative | Profitability is lower than costs. For profitability, such a situation is impossible. |

The result obtained is always either positive or zero. If the difference between income and expenses is negative, the economic situation of the organization is unsatisfactory, and we are talking about accounting losses. Consequently, the company will receive a positive accounting profit if the total revenues from all types of activities exceed the total costs for the same period of time.

After the calculation, analyze the main indicators of financial and economic activity. For each index, profitability per ruble of added material costs is calculated. Here's how to find accounting profit and check your investment's performance:

Step 1. Determine income and expenses.

Step 2. Calculate accounting profit: find the difference between profitability and costs.

Step 3. Select the financial indicator of interest and calculate the coefficient using the formula:

K = P / MZ,

Where:

- P - profit received from core activities;

- MZ is the amount of material costs.

If the index is positive and continues to grow over a given time period, the company's core business is productive. A negative value characterizes the ineffectiveness of investments and an unfavorable economic situation for the enterprise.

Balance sheet profit and specifics of activity

It is obvious that the sources of balance sheet profit will primarily depend on the nature and type of core activity, on the goods, works and services sold and the proceeds for them. For example, trading revenue is nothing more than the gross income from the sale of goods.

Gross income is defined as the difference between the purchase and sale prices of goods sold and represents a markup or discount on the goods.

An enterprise providing services, for example, a repair company, will consider revenue as payment for its services according to tariffs, and a manufacturing company will reflect the money received for its products from customers as revenue.

The specifics of expenses also have an impact. Example: the costs incurred in construction will differ from the costs of an agricultural enterprise or an audit firm.

Briefly

- Balance sheet profit (accounting profit, profit before tax) is calculated using a formula that includes profit from sales of products, profit from the sale of property and other non-operating profits.

- The result obtained with a minus sign means a loss.

- Balance sheet profit is reflected in the financial statements in the income statement on line 2300.

- The composition and amount of balance sheet profit are directly related to the company's core activities.

- Balance sheet profit is one of the most important indicators of financial analysis of a company. It is analyzed both in composition and in dynamics.

- This information is used both within the company itself to make balanced management decisions, and by external users - investors, counterparties.

Types of accounting profit

Experts identify several key types of accounting profits. The classification is:

- Gross - is defined as the arithmetic difference between the gross revenue receipts of the institution and the cost of production costs. Mandatory tax payments, such as VAT, excise duty and other fees, are deducted from the income portion.

- Interim and final - calculated as income minus expenses. The final value is determined based on the results for the year, and the intermediate value is determined for a specific period of time.

- From sales - calculated as the difference between gross profitability and selling expenses. If the company has management costs, they should be deducted.

- Margin is a type of accounting profit, which is calculated as the difference between gross receipts and variable costs. Moreover, fixed costs are not included in the calculation. This indicator allows you to determine profitability for individual areas of activity (categories of goods, types of work, items).

- Balance sheet - an indicator equal to total revenue reduced by the cost of production.

- Net is the balance sheet profitability reduced by the amount of calculated company income tax, which is subject to payment to the relevant budgets. Deferred tax assets should be included in the calculation.

Why are calculations needed?

Accounting records serve as a reliable basis for calculating the indicator and assessing the performance of the company for the period. Both the managers of the company itself and its investors, current and potential, are interested in obtaining data characterizing balance sheet profit.

Consideration of the indicator in dynamics helps to determine how much the efficiency of the business entity has increased or decreased. By analyzing the components of profit, one can see promising directions for its receipt, factors that prevent an increase in volume, which contributes to making effective economic decisions.

For example, a decrease in profit from sales of core products may indicate:

- about the ineffective work of sales managers;

- about the fall in market prices for products;

- about a drop in demand for certain goods, works, and services.

Note! Based on accounting profit, another important indicator is calculated - net profit, the commercial efficiency of an economic entity. Net profit = book profit – income tax payable.

Let's calculate profit using the formula

Accounting profit is the final financial result for the reporting period - a year (clause 79 of Order No. 34n of the Ministry of Finance of Russia dated July 29, 1998). The general formula for accounting profit is:

BP = D - R,

Where:

- D - income for the period;

- R - consumption.

Only explicit (direct) costs are used for calculations. If necessary, accounting profits are also calculated for one calendar month or quarter, six months, or 9 months. This value is reflected in the financial statements - in Form 2 “Report on Financial Results” (Order of the Ministry of Finance of Russia No. 66n dated July 2, 2010).

The values of formula indicators are in interim and final reports and in balance sheet items. Here's how to determine accounting profit:

- Open balance.

- Find the required values in the balance sheets.

- Substitute the numbers into the formula.

Calculation based on the resulting indicators will give more accurate profitability values. On the balance sheet, the company's accounting profit is calculated using the formula:

BP = revenue (line 2110) + income received from participation in enterprises (line 2310) + amount of % receivable (line 2320) + other income (line 2340) – cost price (line 2120) – commercial expenses (line 2210) – administrative expenses (line 2220) – amount of % payable (line 2330) – other expenses (line 2350).

The essence of balance sheet profit and its calculation

Balance sheet profit can be briefly described as profit from all activities before taxes. A certain period is taken into account, usually a year or a quarter.

How is the balance sheet profit indicator ?

From the above, we can determine the general formula for balance sheet profit (loss):

PB = Pr + Pim + Pvnro, where:

- PB – balance sheet profit (loss);

- Pr – part of the profit received from the sale of products (goods, works, services);

- Pim - part of the profit received from the sale of property;

- Pvnro – part of the profit formed by non-operating operations.

If one of the component indicators is determined to be unprofitable, it is taken with a minus, not a plus.

How is retained earnings (uncovered loss) ?

In the financial statements (“Income Statement”), balance sheet profit is reflected on line 2300. To calculate it, you must:

- sum lines 2200, 2310, 2320, 2340;

- Subtract lines 2330, 2350 from the result obtained.

The financial result from sales, income from participation in other organizations, interest to be received, and other income are summed up. Interest payable and other expenses are deducted. If the result is negative (loss), it is indicated in parentheses.

Let's give an example

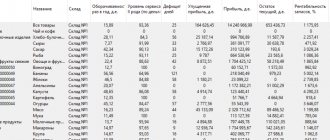

Financial results for 2022 for the organization: income - 15,000,000.00 rubles, expenses - 10,000,000.00 rubles. According to the rules, only explicit costs are taken into account when calculating accounting profit. The items of such costs are presented in the table:

| Expense item | Amount, rub. |

| Wage | 3 500 000,00 |

| Taxes | 2 500 000,00 |

| Communal payments | 500 000,00 |

| Building maintenance costs | 1 500 000,00 |

| Other costs | 2 000 000,00 |

| Total | 10 000 000,00 |

Let's calculate profitability for 2022. BP = 15,000,000.00 - 10,000,000.00 rubles = 5,000,000.00 rubles. This is a positive value, which means production efficiency and productivity of financial and economic activities.

We will reflect it in accounting

For intermediate calculations, data from synthetic accounts is used. To determine what the accounting profit is equal to in the reporting period, the accountant analyzes accounting account 99 (Order of the Ministry of Finance of Russia No. 94n dated October 31, 2000).

Account 99 reflects profitability or losses from the main and other activities of the enterprise every month. It also forms the final accounting records. Here are the main wiring:

| Wiring | Operation description |

| Dt 90.9 Kt 99 | Accounting profit from main activities is taken into account |

| Dt 99 Kt 90.9 | Loss from core activities |

| Dt 91.9 Kt 99 | Profitability from other income and expenses |

| Dt 99 Kt 91.9 | Loss from other income and expenses |

| Dt 99 Kt 84 | Total accounting profit for the year |

| Dt 84 Kt 99 | Total loss for the year |

Profitability for the selected period (as of the date of report generation) is calculated as follows: BP = balance of account 99 + balance of account 84.

How to calculate net profit

Net profit - in fact, this is the main indicator for the sake of which the whole business is started! It is this component that is extremely important not only to the owners of the company, but also to investors. And it is precisely this result that every accountant should formulate and present to management at the end of the year.

Formation of net profit

it's not easy.

I propose to calculate the amount of net profit and reflect it in accounting using a practical example. It is necessary to calculate and reflect in the accounting records the net profit of Sigma LLC if: 1. Income from the sale of goods amounted to

2,950,000 rubles .

incl. VAT 18% RUB 450,000

.

2. The cost of goods amounted to 750,000 rubles. excluding VAT 3. Administrative expenses RUB 200,000. excluding VAT 4. Selling expenses

RUB 250,000 .

In addition, Sigma LLC received a percentage of the loan provided in the amount of 80,000 excluding VAT. Expenses for banking transactions amounted to

15,000 excluding VAT. Our initial task is to calculate

the financial result

of business transactions for the period.

The next stage is to accurately distribute the company’s income and expenses among the accounting accounts.

Let's get acquainted with the structure of accounts established by accounting rules:

Wherein,

With the opposite inequality

Calculation of non-operating profit

or loss on

account 91

is carried out in a similar way.

At the end of each month, both accounts are closed, that is, the balances on these accounts are written off to Account 99 “Profit and Loss”.

And now our example comes into play! Let's compile SALT for each account and determine the financial result.

Based on the sales results, Sigma LLC made a profit, which means that at the end of the month the following entry will be generated:

Using exactly the same technique, we compile the SALT according to Section 91

The financial result for non-operating operations showed profit.

And here’s what will happen according to account 99

To a reasonable question about the amount for Dt 99.2

- this is nothing more than

a tax on profits received

, which companies are obliged to independently calculate and pay to the budget.

Find out how to calculate your income tax. And we come to the climax - on December 31 we carry out an operation called balance sheet reformation

, which involves closing

account 99

.

The balance of account 99

is written off with final turnover to

account 84 “Retained earnings (uncovered loss).”

In the problem being analyzed, this is

Dt 99 Kt 84

– 1,092,000.00.

It is this indicator that is subject to distribution among the participants of the company and is a characteristic of the profitability and solvency of the enterprise! And personally, you have a unique opportunity to simultaneously gain deep theoretical knowledge and invaluable practical experience not only in accounting and tax calculation, but also in preparing reports, analyzing the company’s business activities, checking and identifying errors.

Author of the article:

Matasova Tatyana Valerievna - expert on tax and accounting issues

RECOMMENDED COURSES:

•

ATTENTION!

In connection with the entry into force of the law on professional standards on July 1, 2016, we recommend taking a professional retraining course “

Accounting and taxation using the 1C: Accounting program.

Audit and analysis of enterprise activities » in person / dist

• Audit and analysis of the activities of a dist enterprise

• Taxation. Preparation of tax and accounting reports 2016 + 1C 8.3 full-time / remote

• Payroll and personnel accounting 2016 + 1C ZUP 8.2 full-time / remote

• Accounting of foreign exchange transactions (FEA) + 1C 8.3 full-time / remote

ALL COURSES

face-to-face / dist