Conducting any business activity is a special type of civil law relationship between individuals and legal entities, regulated by federal legislation. The concept of entrepreneurship means:

- systematic sale of goods of the same direction or systematic provision of the same services;

- regular receipt of profit from the sale of goods or services.

Please note that profit from doing business is calculated in monetary terms. Payment using natural products does not require registration with authorized bodies.

Any business activity must be legalized, that is, be registered with specialized government bodies and have a license allowing this type of business to be conducted on the territory of the Russian Federation. Illegal entrepreneurship entails serious consequences, as a crime in the field of economic activity. Types of illegal entrepreneurship include cases such as:

- production, storage and sale of unlicensed and uncertified products (Article 171.1 of the Criminal Code of the Russian Federation);

- provision of paid services for the repair of large household appliances and electronic equipment without registering activities with authorized bodies;

- provision of paid medical, hairdressing and veterinary services without special permission (license);

- regular rental of residential real estate or vehicles without paying annual income tax for an individual in form 3-NDFL;

- trade in food and industrial goods in spontaneous markets;

- conducting business activities that do not correspond to the declared information in government bodies;

- submission by an individual entrepreneur or legal entity of knowingly false information about himself to the registration authorities.

Who can define illegal business

The responsibility for identifying signs of illegal business activity is assigned to state authorized bodies:

- tax and trade inspection;

- antimonopoly service;

- prosecution authorities;

- Committee for the Protection and Protection of Consumer Rights.

Violations in the activities of companies and individual entrepreneurs can be identified during special inspections. Punishments for offenses are applied after 2 months from the date of their discovery.

Punishment for conducting illegal activities cannot occur after two months after the violation is discovered, unless this fact has been documented and brought to court.

A complaint about illegal business, in particular about the lack of a license or official certificate of state registration of business activity, can be filed by any person with the above-mentioned authorized bodies.

Illegal entrepreneurship: administrative liability

Russian legislation, in particular the Code of Administrative Offenses of the Russian Federation, provides for the following penalties for illegal conduct of business activities:

- for failure to register your activities with government bodies as an individual entrepreneur - a fine in the amount of 500 to 2000 rubles;

- for conducting activities that require licensing without obtaining a special permit - penalties are: for individuals from 2000 to 2500 rubles with the possibility of confiscation of products and production tools;

- for legal entities from 40,000 to 50,000 rubles with or without confiscation;

- for officials from 4,000 to 5,000 rubles with the possibility of confiscation.

- for individuals from 1500 to 2500 rubles;

- for individuals – from 4,000 to 8,000 rubles;

The fact of illegal entrepreneurship is revealed during verification activities in the form of a test purchase, inspection of the premises, etc., upon detection of a violation by state control authorities, a protocol is drawn up. The decision to bring entrepreneurs carrying out illegal activities to administrative responsibility is made by a magistrate at the place of residence of the person who committed the violation, or at the place where the illegal business is conducted. The case of an administrative violation is considered within 2 months from the moment the protocol is drawn up; if this period is exceeded, the court is obliged to make a decision to terminate the proceedings.

Illegal entrepreneurship of the Criminal Code of the Russian Federation

Criminal liability for conducting illegal business activities is an extreme measure of punishment that is imposed on a person who repeatedly violates the law and order of conducting his business. In a number of basic cases, which provide for punishment on the basis of Art. 171 of the Criminal Code:

- systematic violation of the law by one person;

- profit in particularly large amounts as a result of conducting illegal business activities, or received as a result of conducting an unregistered business;

- significant damage caused to clients, organizations and the state during the implementation of illegal business, expressed in payment for goods or services to a company that is not registered with the relevant authorities or does not have official permission to carry out a certain type of activity.

Profit from illegal business activities in the amount of more than 2,250,000 rubles is grounds for bringing the entrepreneur to criminal liability.

The Criminal Code of the Russian Federation provides for the following types of punishments for carrying out illegal business:

- causing damage on a large scale (from 2,250,000 rubles): a fine of up to 300 thousand rubles or in an amount equal to the violator’s earnings for 24 months; performing mandatory work for a period of 180 to 240 hours; imprisonment for a term of 4 to 6 months.

- causing damage on an especially large scale (from 2,250,000 rubles to 9 million rubles) or an act committed by a group of persons: a fine in the amount of 100 thousand to 500 thousand rubles; a fine in an amount equal to the offender’s income for 3 years; imprisonment for up to 5 years with a fine of up to 80 thousand rubles or in an amount equal to the income of the convicted person for 6 months.

The responsibility for identifying the fact of violation and extracting large income or causing damage to third parties on an especially large scale is assigned to the prosecutor's office and the police. Responsibility for illegal business rests entirely with the head of the offending organization. In this case, the following do not bear criminal liability:

- persons who have entered into an employment contract with an illegal entrepreneur;

- owner of premises leased to a person engaged in illegal business activities.

The Criminal Code of the Russian Federation also provides for mitigating circumstances that can be taken into account when making a court decision: the provided positive characteristics of the culprit and the fact that the culprit was initially brought to criminal responsibility. If illegal entrepreneurship is accompanied by other criminal acts in the field of economic crimes (for example, illegal use of a trademark, production and sale of excise goods or counterfeit products, and others), criminal liability measures are assigned in the aggregate of all committed acts.

What punishment is provided by law for illegal business?

For illegal business activities, the violator may face criminal, administrative or tax liability. If the fact of violation has been proven, the tax authorities will collect lost taxes through the court. The payment amount will also include late fees.

Tax liability

For tax evasion, the following types of fines are provided under Art. 116 Tax Code of the Russian Federation:

- 10% of income received but not registered for entrepreneurs who have not registered with the Federal Tax Service. The minimum fine is 20 thousand rubles.

- If an entrepreneur conducts illegal activities for more than three months, the fine will be 20% of income or at least 40 thousand rubles.

- If an entrepreneur submitted an application for registration, but during the audit it was revealed that he had made a profit earlier, the fine will be 5 thousand rubles. If the registration takes longer than three months, the fine will double and amount to 10 thousand rubles.

Administrative responsibility

Illegal business may result in administrative liability. Fines from 500 to 2,000 rubles may be assessed under Art. 14.1 of the Code of Administrative Offenses of the Russian Federation for entrepreneurship without registration of an individual entrepreneur or LLC. If a person decides to engage in a licensed activity without proper registration, the fine will range from two to two and a half thousand rubles. All decisions in cases of violation of the business law are made by the court. Products may be confiscated.

Criminal liability

If other citizens suffered from the actions of the violator or harm was caused to the state, criminal liability may arise. If the fact of illegal receipt of profit in a large (1.5 million rubles) or especially large (6 million rubles) amount has been established, you can fall under articles of the Criminal Code. In such cases, the police and the prosecutor's office take over the case. According to Art. 171 of the Criminal Code of the Russian Federation:

- If the damage was caused on a large scale, then the accused will face a fine of up to 300 thousand rubles or equivalent to the profit received over 2 years. In addition, the offender may face correctional labor (180–240 hours) or even a real sentence of up to six months.

- If the damage caused by an individual as a result of illegal business activity was caused on an especially large scale, then the fine may be 500 thousand rubles. A violator will face imprisonment for up to 5 years.

If, along with the fact of illegal business activity, deception of counterparties or trade in counterfeit goods was revealed, the punishment may include additional sanctions.

Remember: if you are engaged in commercial activities, you must register as an individual entrepreneur, LLC or self-employed. Registration as a self-employed person allows you to register for taxes using a simplified scheme and avoid the process of obtaining a state registration certificate.

Illegal business: tax liability

In addition to administrative and criminal liability, Russian legislation also provides for liability to the tax authorities for conducting illegal business activities. So, in accordance with Art. 116 of the Tax Code of the Russian Federation, the following penalties may be imposed on an entrepreneur:

- a fine of 10 thousand rubles - for late registration of one’s activities with the tax authorities;

- a fine of 10% of the total income for the entire period of illegal business activity (but not less than 40 thousand rubles) - for running your business without registering with the relevant authorities.

Also, it is worth noting that if an entrepreneur operating illegally violates any other legal norms, he will be held jointly responsible for all the offenses committed. For example, a person operating in the field of medicine did not obtain the appropriate permission, and in addition, when hiring employees, did not ensure complete confidentiality of their personal data, allowing information to leak to third parties. Such actions will entail cumulative liability for illegal business and violation of laws on the protection of personal data.

Illegal entrepreneurship: administrative and criminal liability

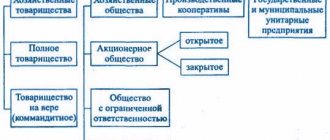

In accordance with Article 2 of the Civil Code of the Russian Federation, entrepreneurial activity is an independent activity carried out at one’s own risk, aimed at systematically obtaining profit from the use of property, the sale of goods, the performance of work or the provision of services. Any citizen has the right to engage in entrepreneurial activity without forming a legal entity from the moment of state registration as an individual entrepreneur with the Federal Tax Service (Article 23 of the Civil Code of the Russian Federation). By evading state registration, these persons hide their profits from being registered with the Federal Tax Service and evade paying taxes. Some types of activities are subject to licensing in accordance with the Federal Law of May 4, 2011 No. 99 “On licensing of certain types of activities” (activities in the field of medicine; transportation of passengers; procurement, storage, processing and sale of scrap ferrous and non-ferrous metals), and the absence of such on Carrying out the types of activities specified by law entails punishment. Thus, Part 1 of Article 14.1 of the Code of Administrative Offenses of the Russian Federation establishes administrative liability for carrying out business activities without state registration as an individual entrepreneur or legal entity in the form of a fine from 500 to 2 thousand rubles. Parts 2, 3, 4 of Article 14.1 of the Code of Administrative Offenses of the Russian Federation provide for administrative liability for carrying out: activities without a special permit (license), when such a permit (license) is required; entrepreneurial activity in violation of the requirements and conditions provided for by a special permit (license); entrepreneurial activity with gross violations of the requirements and conditions provided for by a special permit (license). The commission of these offenses by individual entrepreneurs and legal entities entails the imposition of administrative penalties such as: a fine, confiscation of manufactured products, production tools and raw materials, administrative suspension of activities. When, when carrying out “illegal” activities, major damage is caused to the state, organizations or citizens, or the act is committed by an organized group, or with the extraction of income on a large and especially large scale, the perpetrator faces criminal liability under Article 171 of the Criminal Code of the Russian Federation. Large size, large damage, income or debt on a large scale are recognized as cost, damage, income or debt in an amount exceeding two million two hundred and fifty thousand rubles, and especially large - nine million rubles. Moreover, income in this case is the proceeds from the sale of goods (work, services) during the period of illegal business activity without deducting the expenses incurred by the person related to the implementation of illegal business activity. As punishments, the Criminal Code of the Russian Federation provides for a fine, compulsory labor, arrest, forced labor, and imprisonment for up to 5 years.