All securities and debt securities on the territory of the Russian Federation are regulated by certain legislative acts. For example, the main law in this niche is the law “On the Securities Market”. But it does not apply to the bill. For this concept, there is a separate federal law - “On promissory notes and bills of exchange”, which was created on the basis of the Geneva Convention, signed already in 1930 (“On a Uniform Law on Bills of Exchange and Promissory Notes”).

But still, for a simple resident, for a simple man in the street and a worker, the concept of a bill, if familiar, is usually extremely vague in the mind. You may have heard the word promissory note along with the names of other debt securities, such as receipt, loan agreement, credit agreement. But what does it mean and what characteristics does it have - this is a question that is sometimes better to understand than to simply ignore. So let's figure it out.

What is a bill of exchange and where did it come from?

A promissory note is a signed document of the debt category. It denotes the right of the one who is the holder of the bill, after a while, to demand the amount of the debt from the person who issued the bill. Moreover, the time after which the right appears, the amount, and even the place of the claim are agreed upon in advance.

But this is not a loan agreement. This is not a receipt. A bill denotes that there is a debt of the writer of the bill to the recipient of the bill. The place that is written in it is usually the bank where the current account of the issuer of this paper is opened. And when the agreed period expires, the person receiving the right under the bill can come to this bank and request the previously determined amount. It is important that the issuer of the bill does not need to be present. The bank itself will pay the debt from the designated account. The main thing is that you have all the necessary documents and data.

The very concept of a bill of exchange has been used for several centuries. It came from Europe. And from that very time, the bill as a debt paper was regarded higher than other options, such as a promissory note. The bills were used to provide loans to the population, pay personal debts, and pay for goods and services. Moreover, when we talk about taking a bill seriously, we really mean complete seriousness. And if the one who was supposed to pay did not have funds at the designated time, then it actually came to the sale of his property. Everything to fulfill the bill of exchange obligation.

But, like any security or debt security, a bill of exchange has its own application features, which cannot be paid less attention to than the concept itself.

How to issue your own bill of exchange at the BU

You can use either a ready-made form from the store or your own as a form.

The main thing is that the bill meets all design requirements. Otherwise it has no legal force. The forms themselves are reflected in the off-balance sheet account. There are standardized forms for promissory notes and bills of exchange.

Capitalization of purchased bill forms – D006.

The costs of purchasing forms (if the banks are not their own) are reflected as follows: D97 K76 (attributable to deferred costs).

By issuing his own bill, the buyer remains, in fact, indebted to the supplier and gives him a paper, which, in layman's terms, can be equated to a promissory note. Accordingly, the buyer's issuance of the bill is reflected in the accounting as a principal debt. To reflect the issuance of money, subaccounts are used to the main settlement accounts.

It would be correct to make a posting to the subaccount “Settlements on issued bills of exchange” to account 60 or 76.

That is, the debt for goods (work, services) D60 / (calculation) K60 (bill) is the debt on the issued bill. The posting amount corresponds to the invoice amount for goods (work, services).

If the bill of exchange was issued by the bill holder as a guarantor of repayment of the loan received, then it is reflected in off-balance sheet account 009. The receipt of borrowed funds must be reflected in posting D51 K66.

A promissory note is not recognized as a security for the drawer.

The issuance and receipt of a bill of exchange must necessarily be accompanied by the transfer of the act in a unified form.

Features of the bill

Who can issue a bill of exchange

The main concept in this matter is bill capacity. That is, absolutely everyone will not be able to issue bills. According to the legislation of the Russian Federation, there are two groups of factors that determine bill capacity:

- The bill can be issued by adult individuals

- Can be issued by a legal entity

State executive authorities do not receive such a right!

That is why promissory notes are most often found in use by private traders, or government organizations that are not related to the authorities.

Features of bill legislation

The use (circulation) of bills of exchange is regulated by relevant legislation and by-laws. The entire set of these normative documents is called bill of exchange legislation.

Each state has its own legal framework governing the circulation of bills. The basic provisions of bill legislation are enshrined in the International Geneva Convention on Bill Trading. On its basis, laws on bill circulation were adopted in the USSR in $1934, $1937 and $1938. In the Russian Federation in 1997, the Federal Law “On Bills of Exchange and Promissory Note” was adopted.

Despite the existence of bill of exchange legislation, courts often apply other laws regulating the economic activities of citizens and enterprises. Therefore, the use of bills in the post-Soviet space has not yet acquired such a wide scale as in other developed countries of the world.

Types of bills

There are several varieties, which we will discuss separately in this article:

- Promissory note

- Translated

- Nominal

- Warrant

- Bank

- Promissory note and bill of exchange

The main principle of difference between bills is the form of payment of debt on this paper. Therefore, there are two main types:

Promissory note

The most common type of paper. The debtor in the case of a promissory note is the person who issued the bill.

Bill of exchange

As you can easily guess from the name, this paper translates the debt ratio. And here a third party is already involved, who is the debtor. That is, the debt of this third party is to the one who issues the bill. And the one who receives the bill and will be its holder will demand at the designated time to repay the debt from this third party, and not from the issuer of the bill.

Note: If there is a debt recorded by a receipt or other debt agreement, it can be converted into debt under a bill of exchange. But you need to know all the nuances.

Bill debt, as noted above, is the most serious debt. Accordingly, there is an option that the debtor will not agree to the terms of the bill of exchange. And this is the most important feature of such paper. So always remember:

A bill of exchange will be valid only when it bears agreement to the conditions and obligations (acceptance) of the person who will have to pay this debt.

If there is no such signature, then the bill will also be considered valid, but the obligation to repay the debt will fall on the person who issues the bill. And this will transform the paper into the category of a promissory note.

Personal and order bill

Here we are already talking about the difference in the holder of the bill.

Personal bill. It implies that the paper reflects a specific person who will receive the right to claim the debt.

Order bill. The person who is the holder of the bill is not indicated. Only the person issuing it remains assigned - that is, the one who will pay. Well, and of course all the other data - amount, time, place. And the rights to a bill of exchange can be transferred from one person to another. At the time of the deadline specified for the repayment of the debt, the one who will have the right to the bill and will receive the debt.

A registered bill of exchange can also be transferred to another person in a special way.

To implement this procedure, you need to use the field on the back of the bill of exchange paper. The inscription that is made there is called “endorsement”. Its purpose is to designate the person who next receives the right to the bill. A mandatory condition will be the signature of the previous owner (“endorse”).

If the owner of the order bill changes, endorsement is not required. But it can be done. And if the inscription was nevertheless recorded, all subsequent transfers of this bill must already be accompanied by it. And the bill itself goes into the category of registered papers upon initial entry.

Very important! Responsibility for the bill falls on each person who was its holder. In case of failure to pay the debt of the drawer, the owner of the paper has the right to demand a refund from any of the endorsers.

In simple words: Vanya must pay the debt on the bill, and over a certain period of time the right to the bill passed from Petya to Igor, then to Vova, and then to Dima. And at the moment, Dima is the holder of the bill. Now he demands Vanya to repay the debt. But Vanya has no money. He can't give anything. Then Dima turns to the last (most often) holder of the bill - to Vova. Vova can’t pay either. Therefore, Vova turns to Igor, and he turns to Petya. Before Petya, no one held the bill. This means that he is obliged to repay the debt to Dima.

The more holders of the bill there were, the more force it acquired. When there are many debtors, it is always easier to repay the debt. And the last holder of the bill can demand this from any previous one. Because for him, all the previous ones are also debtors.

This interesting scheme emerged from the peculiarities of the use of bills. The fact is that often these papers were a means of payment in a business environment. They were used to pay both for goods and for their own debts. And the person who accepted the bill for payment in an amicable way must be confident that he will still receive his money back. This is how the obligation of all holders of one bill of exchange to fulfill guarantees to the current owner arose.

If such a system had not been built, fraudulent schemes would have completely destroyed any bill turnover.

Bank bill

In the modern world, banking organizations also sell bills. This is done to attract additional capital. The situation is very similar to the deposit agreement, but there are also some peculiarities.

A bill from a bank does not have support from the state. He is not insured. That is, in the event that a bank becomes bankrupt and loses the ability to pay its obligations, the holder of the bank paper will receive nothing. But! Again, the importance of the bill relative to other securities makes sense. And in our case, after bankruptcy, when the property of the debtor (bank) is sold, first of all, the proceeds will be used to pay off debts on promissory notes. And only then - according to deposit agreements.

But banks don't just sell their bills. They also buy bills from other parties. And accordingly, they have the right to sell bills to everyone else. And as we have already discussed, in these cases, there are more people responsible for paying for the bill, which is good for the holder, who can demand a return, including from the bank itself.

But as always in the case of bank actions, no one will exchange an awl for soap. And in fact, the bank will pay a smaller amount to the person to whom it sells the bill. This is due to the interest rate of the organization and the period specified in the bill. Let's figure it out.

The price of the bill that the bank sells to you is calculated using the following formula:

The amount of debt of the issuer of the bill minus the same amount multiplied by the time until the end of the payment period multiplied by the lending rate assigned by the bank.

Example: the cost of a bill of exchange for the right to receive one hundred thousand rubles in a year and a half is as follows:

100,000 - 100,000 * 1.5 (time) * 0.25 (annual rate - 25%) = 62,500 rubles.

It turns out that the more time remains until the end of the payment period on the bill, the less the bill is worth. The maximum price can be obtained on the last day before payment of the bill. The bank's rate is set individually. And if the bill is issued by a large company or a wealthy individual, then the bank may reduce the interest.

The price is also affected by the total number of note holders. But it will never rise above the initially indicated amount of debt.

Rules for filling out a bill of exchange

Proper execution is the key to the validity of a debt document. The absence of at least one basic detail makes the bill invalid. In practice, not all fields of the form are allowed to be filled in, that is, they should be there, but may remain empty.

Nuances and subtleties

The “Payment due date” column is not always filled in. In this case, payment must be made upon presentation.

When indicating the moment of presentation in the form, the clause can be supplemented with the accrual of interest on the amount of the bill, and the interest rate is prescribed. For other terms, interest accrual is not allowed.

Places of payment and filling may not be indicated. Then they are equal to the address of the drawer, recorded next to his name.

The most common mistakes when filling out

When writing amounts in numbers and words, the values may differ. In this case, priority belongs to what is written in words. If the amount of debt is indicated several times, the smallest value is considered correct.

If, when it is necessary to accrue interest, their rate is not indicated, then the condition is invalid.

Where are bills used?

Essentially, a promissory note is a written confirmation of a debt. It is not affected in any way by the circumstances under which it is issued and the characteristics of the transaction. If you need to specify additional conditions - for example, the sale of goods, the provision of a loan, and so on, then an additional agreement is concluded between the parties.

Basically, bills of exchange are used in:

- In lending. Any person can act as a lender or borrower. This could be a private owner, a credit organization, any legal entity - everything except the state! As we said at the beginning of the article, authorities do not have the right to issue such papers. Moreover, as before, a loan on a bill of exchange will be regarded as more reliable for the one who issues it. In fact, they pay off their own debts using bills of exchange and sell the debts to others.

- Entrepreneurship. Basically, sellers thus give the client the opportunity to defer payment. Typically, such transactions are carried out without interest.

- Raising capital. This is mainly done by banking organizations. But, unlike the first option, we are not talking about lending. Because in this case, bill obligations are similar to bank deposits. In addition to banks, large companies and investors can also increase turnover in this way.

- Monetary sphere. In other words, sometimes bills act as a substitute for money. These papers are used to pay off the debt. And this can be done in front of almost anyone. First of all, we are talking about business niches. You are unlikely to see bills of exchange in everyday life of ordinary citizens.

Classification of bills

According to their purpose, design and types of security for debt obligations, bills of exchange come in different types:

Finished works on a similar topic

Coursework Promissory note of an individual 490 ₽ Abstract Promissory note of an individual 260 ₽ Test work Promissory note of an individual 220 ₽

Receive completed work or specialist advice on your educational project Find out the cost

- simple and transferable,

- external and internal,

- commodity and financial.

In addition, bills of exchange are distinguished:

- credit,

- borrowed,

- deposit,

- etc.

Some economists believe that the main thing in a bill is the debt obligation it contains. And everything else is just partial manifestations of various forms of credit and financial operations.

Differences between a bill of exchange and a promissory note

- Decor. The bill cannot be drawn up in free form. It must contain all the necessary details of the parties. Most often it is issued on special paper, which is protected against counterfeiting. But if drawn up on a standard sheet, it will also be valid.

- A bill of exchange, as has been said more than once, imposes the strictest liability. And a receipt cannot compare with it.

- One bill of exchange can be used in completely different situations and areas of activity, because it is not tied to the terms of the transaction. He is the guarantor of the debt.

- A bill of exchange as a security has an international level and is regulated by a separate law, the same in all countries that signed that very convention of the thirtieth year.

Finally, let us once again recall the features of a bill of exchange - it can be used in various areas - from paying one’s own debts to selling to banking organizations. And the value of this paper becomes higher as the designated debt payment deadline approaches.

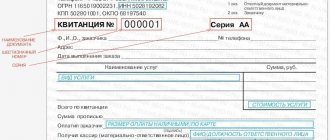

Procedure for issuing a bill of exchange

The release should be considered carefully. The bill of exchange requires strict adherence to the statutory form. Otherwise, it will be a promissory note - the unconditionality of fulfillment of the specified obligation will be lost.

There is a developed form in Russian legislation. Its use is discretionary (free) in nature. There are also no additional requirements for payment of duties and registration of this security.

On the one hand, this is undoubtedly another advantage; on the other hand, it forces drafters to be more attentive to the procedure for issuing an obligation. Many people try to work on printed forms that correspond to the form developed by the legislator and are protected. This form is sold in banks and treasury organizations.

Published on paper, the content is written in or printed.

The following details are required for entry:

- Name

- obligation

- payment details

- amount of payment

- payment term

- place of fulfillment of the obligation

- date and place of creation of the paper

- drawer's signature.

Bills of exchange in accounting as financial investments

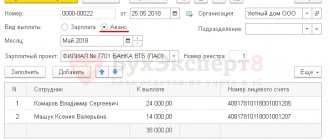

If an enterprise, having free money, invests it in the purchase of bills issued by banks and capable of generating income, then we are talking about financial investments. Such bills are the object of purchase and sale, they are recorded in subaccount 58/2 “Debt securities”. Let's figure out how bills of exchange are accounted for in accounting. Postings:

| Operation | D/t | K/t |

| Purchase of a bill of exchange | 76 (60) | |

| Acceptance for registration | 76 (60) | |

| The difference between the purchase price and the face value is reflected |

Example 2

On January 25, 2018, the company acquired a bank bill with a face value of RUB 2,000,000, issued on January 25, 2018, with a payment due date at sight, but not earlier than May 5, 2018. Interest accrual is 8% per annum. On 04/05/2018, the company executed a compensation agreement with the condition of transferring the bill of exchange to the counterparty who performed the work worth RUB 2,000,000. without VAT. It was accepted as payment for the work. The transaction was formalized by an agreement for the transfer of a promissory note.

Accounting entries:

| Operation | D/t | K/t | Sum |

| Bill paid | 2 000 000 | ||

| The bill is included in financial investments | 2 000 000 | ||

| Accrual of interest on the bill for January 2,000,000 x 8% / 365 x 6 days. | |||

| Interest accrued for February (2,000,000 x 8% / 365 x 28) | 12 274 | ||

| Interest accrued for March (2,000,000 x 8% / 365 x 31) | 13 589 | ||

| The work performed was accepted for accounting | 2 000 000 | ||

| Interest accrued for April (2,000,000 x 8% / 365 x 5) | |||

| The contractor was given a bill of exchange to repay the mortgage | 2 000 000 | ||

| The nominal value of the bill has been written off | 2 000 000 | ||

What does endorsement of a bill mean?

The holder of a bill, as a participant in commodity-money relations, can use someone else's debt obligation as a payment document for his own calculations. In this case, on the form of the bill, or on an additional sheet attached to the form, an inscription about the endorsement of the document is affixed. This is a special inscription that indicates that the rights of claim under the security are completely transferred to another person. The promissory note literally should say “pay to favor.”

The person transferring the bill is called the endorser. The organization receiving the right of claim is called the endorser.

The endorsement on a bill of exchange can be of two types:

- Personal endorsement, in which the endorser writes the name of the new owner of the security: pay to the order the name of the endorser organization or the last name, first name, patronymic of an individual.

- A blank endorsement may consist only of the signature of the previous holder of the bill without indicating the acquirer's right to demand repayment of the bill. The legal entity supplements the signature with a seal. The blank endorsement may also include the phrase “pay to bearer.”

The transfer inscription must not contain errors or blots. Incorrect inscriptions are crossed out, and the correct wording is indicated below.

There can be any number of such endorsements by the time the promissory note is repaid. In this case, the debt obligation is fulfilled to the actual owner of the security at the time of its payment.

If the endorser does not wish to subsequently transfer the rights to claim the fulfillment of the debt obligation, then when making the endorsement he must put the inscription “without negotiability”. This will prohibit the transfer of the bill of exchange to another person in the future.

What is the aval of a promissory note

The document form can be marked with the inscription Aval. This is security for payment of a bill of exchange. In other words, it is a guarantee from a third party that the security will be repaid on time. The one who guarantees the bill is called an avalist. This can be any business entity other than the drawer.

An avalized bill is a security that becomes more reliable when it has collateral. Banks often put an aval on the form of a legal entity’s debt obligation. In this case, the bill becomes secured by a bank payment, and the bank receives a commission.

To affix an aval, a simple signature of the avalist on the form of the bill, or on an additional attached sheet called an allonge, is sufficient.

Features of the use of bills of exchange by enterprises

Enterprises and firms can issue bills of exchange to pay for products. In this case, the bill serves as a means of payment. The use of a bill of exchange leads to the fact that the enterprise’s monetary obligations under the contract for the supply of goods are considered repaid, and the obligations under the bill of exchange come into force. The completed bill of exchange form must be signed by the head of the enterprise and the chief accountant, and then handed over to the creditor.

If bills of exchange are issued to pay for goods or services, such transaction is not subject to tax. Payment by “someone else’s” bill of exchange is equated to barter and is subject to value added tax.

Note 1

It should, however, be taken into account that the company's issuance of bills and their transfer into the hands of creditors can significantly worsen the financial position of the enterprise. After all, a bill of exchange is not money, but a debt obligation. And it must be paid within a strictly established period. After all, in case of late payment, penalties will follow.

What bill of exchange is called a bill of exchange?

The main difference between a bill of exchange, also called a draft, and a simple one is that it is not the drawer himself who must make the payment on the bill, but the business entity that is the debtor to him. In other words, when making payments using an ordinary bill of exchange, initially, when issuing a security, only two entities are participants in the inventory turnover: the debtor and the creditor. When using a bill of exchange for settlements in business activities, three business entities become parties to the transaction:

- The organization receiving the right to demand payment under a draft.

- A person who transfers his debt to the recipient to his debtor.

- Actually, the payer of the bill himself, who has outstanding financial obligations to the drawer.

The issuer of a bill of exchange is called the drawer, the payer of the bill is called the drawee, and the beneficiary is called the remitee.

Thus, the draft allows you to shift your obligations to your debtor. In this case, the creditor of the business entity and its debtor pay directly, bypassing intermediate settlements. To be paid, a bill of exchange must undergo an acceptance procedure.

Accounting for bills of exchange: postings

Often, a promissory note in a buyer-seller relationship plays the role of a promissory note, since it arises in a situation where the buyer cannot pay for the goods with available funds, and the seller agrees to accept the bill. Such a commodity bill is not considered a security until it is transferred to a third party. To account for such bills, the buyer has an account. 60 open a subaccount 60/3 “Bills issued”, and the seller opens a subaccount 62/3 “Bills received”.

Transactions with it are recorded on both sides in the settlement accounts by postings:

| Operation | D/t | K/t |

| Accounting entries for bills issued | ||

| Reflected delivery debt | ||

| Security for future payment issued (behind balance) | ||

| If the bill is interest-bearing, then the buyer’s debt will increase by the amount of accrued interest | ||

| Repayment of a debt | ||

| Writing off the bill after payment | ||

| Accounting entries for bills received | ||

| The debt on the shipped goods is reflected | 62/ 3 | |

| Payment security received | ||

| Interest income from the bill | ||

| Received payment for goods secured by a bill of exchange | ||

| Writing off a bill after receiving payment | ||

Example 1

Blitz LLC, to secure payment obligations under the supply agreement, Atrium LLC issued a promissory note in the amount of RUB 236,000. including VAT RUB 36,000. The accounting records of both organizations will reflect:

| Operation | D/t | K/t | Sum |

| At Blitz LLC | |||

| Debt to supplier for goods | 200 000 | ||

| VAT | 36 000 | ||

| A bill of exchange was issued | 236 000 | ||

| The bill is included in the balance sheet | 236 000 | ||

| Amortization | 236 000 | ||

| Writing off a bill | 236 000 | ||

| At Atrium LLC | |||

| Revenue reflected | 236 000 | ||

| VAT charged | 36 000 | ||

| The cost of goods is written off | 100 000 | ||

| Bill received | 236 000 | ||

| The bill is included in the balance sheet | |||

| Payment for goods and materials received | 236 000 | ||

| Writing off a bill | 236 000 | ||