When is it possible and when is it mandatory to send documents to the tax office electronically?

The flow of documents between tax authorities and taxpayers is enormous.

This is not only the submission of regular tax reports, but also various types of responses to requests, notifications, submission of documents, requirements, etc. Gradually becoming a thing of the past, the days when the taxpayer had to run to the inspector with each piece of paper or bring him boxes with confirming documents on a truck documents. Although the legislation does not contain a ban on paper document flow. Controllers will still accept most documents in paper form. Mandatory sending of documents to the tax office in electronic form is provided only in certain cases. For example, filing VAT returns and documents related to this tax (books of purchases and sales, journal of invoices), as well as sending explanations on VAT reporting to tax authorities is possible only in electronic form (with rare exceptions) .

Find out more about this on our website:

- “Rules for writing and submitting explanations to the VAT return”;

- “The journal for recording issued and received invoices - a new format.”

What is the procedure for submitting documents required by the tax authority? Find out the answer to this question in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Tax authorities accept other types of tax reporting both in electronic and paper form. It all depends on the number of employees of the taxpayer who sends the report (clause 3 of Article 80 of the Tax Code of the Russian Federation). At the same time, ordinary citizens can communicate with controllers and submit any documents to them in a wide variety of ways:

- through the taxpayer’s personal account;

- by coming directly to the inspection;

- by sending documents by post.

It is important to remember the basic rule: if you submitted your return electronically, then further interaction with controllers regarding this tax report should occur electronically. This rule follows from the order of the Federal Tax Service dated April 15, 2015 No. ММВ-7-2/ [email protected] Let’s look at this document in more detail.

ConsultantPlus experts explain in detail how to submit requested electronic documents to the Federal Tax Service that are not compiled in established formats. Get trial access to the system and go to the Tax Guide for free.

How to sign photocopies of documents

If documents are submitted in paper form, then a number of rules should be followed.

Photocopies of documents must be certified by the manager or other authorized person. You can also seal them if the organization has one. But this is optional. Tax officials allow not to certify the submitted copies with a seal, even if the company or individual entrepreneur has not abandoned the seal in its activities (letter of the Federal Tax Service of Russia dated 08/05/2015 No. BS-4-17 / [email protected] ).

The authorized person acts on the basis of a power of attorney issued by the manager. The power of attorney must be drawn up in accordance with the requirements of the law (Articles 185-189 of the Civil Code of the Russian Federation and subparagraph 1, paragraph 3, Article 29 of the Tax Code of the Russian Federation).

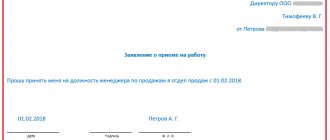

The signature on the photocopies is affixed in accordance with the registration procedure defined in clause 3.26 of GOST R 6.30-2003 (Resolution of the State Standard of Russia dated 03.03.2003 No. 65-st). This standard specifies the order in which the labels should appear. It looks like this:

Right

Position of the certifier Personal signature Initials, surname

date

It is necessary to take into account that the established procedure is advisory in nature, therefore it is considered optional (subclause 4, clause 1 of GOST R 6.30-2003). Thus, inscriptions can be located anywhere in the document.

For example:

Copy is right.

March 20, 2022

Smirnov

General Director of Orion LLC ———— Smirnov A.P.

M.P.

There is no need to notarize copies of documents (Clause 2, Article 93 of the Tax Code of the Russian Federation). But a situation may arise when you cannot do without a notary. Find out about this in the next section.

What is important to remember about deadlines when transferring electronic documents

Typically, taxpayers transfer documents to the tax office electronically at the end of each reporting or tax period. According to the TKS, a significant part of them submit tax and accounting reports to the inspectorate.

But there are other reasons why you need to submit documents to the tax office electronically: tax officials may request documents during an audit (desk, on-site, counter) or offer to clarify the declaration data or make corrections to them. What should you consider when submitting documents electronically to the inspectorate?

First of all, remember the deadlines:

- 10 working days are given to the taxpayer to prepare and submit documents requested during tax audits;

- 5 working days are given to submit clarifications and correct the declaration (clause 3 of article 88, clause 5 of article 93.1 of the Tax Code of the Russian Federation);

The deadlines must be counted from the date of receipt of the requirement from the inspection. Violation of deadlines is fraught: for each document not submitted, a fine of 200 rubles is provided. (Article 126 of the Tax Code of the Russian Federation).

There are other deadlines to keep in mind. For example, to file objections to a tax audit report under the TKS, the taxpayer has 1 month (clause 6 of Article 100 of the Tax Code of the Russian Federation).

If you have not sent a receipt for the electronic request of the Federal Tax Service for the submission of documents, use the advice of ConsultantPlus experts and find out whether it is possible to avoid liability. Get trial access to the system and study the material for free.

What documents may the tax authority require?

The legislation does not provide for a limited list of documents that the tax authority may require.

In fact, the tax authority may request documents:

—

related to tax audits;

—

not related to tax audits.

The tax authority has the right to request:

—

from the counterparty or other persons who have documents (information) relating to the activities of the taxpayer being inspected (fee payer, tax agent), documents (information) (clause 1 of Article 93.1 of the Tax Code of the Russian Federation);

—

information regarding a specific transaction from the participants in this transaction or other persons who have documents (information) about this transaction in the event that, outside the framework of tax audits, the tax authorities have a justified need to obtain such documents (information) (clause 2 of Article 93.1 of the Tax Code of the Russian Federation ).

If, outside the framework of tax audits, the tax authorities have a justified need to obtain documents (information) regarding a specific transaction, a tax official has the right to request from the participants in transactions or other persons who have information about them any documents regarding a specific transaction (letter of the Federal Tax Service No. ED- 4-2/19869 dated 09/30/2014).

How to submit electronic documents

Another important issue that must be addressed when submitting electronic documents to the tax office is the method of presentation. Documents in electronic form can be sent to the TCS inspection through an EDI operator or through personal accounts of taxpayers (clause 2 of Article 93 of the Tax Code of the Russian Federation).

Is it possible to submit paper primary documents in electronic form? Yes, this allows clause 2 of Art. 93 of the Tax Code of the Russian Federation - in the form of electronic images created by scanning with the preservation of their details in established formats. The same article of the code stipulates that if the requested electronic documents are transmitted via TCS, then they must be certified by the enhanced CEP of the person being inspected or his representative.

By order of January 18, 2017 No. ММВ-7-6/ [email protected] the Federal Tax Service approved the format of the list of documents that accompanies the electronic document flow between tax authorities and taxpayers (it came into force on January 15, 2018, clause 1.1 of the Federal Tax Service order dated December 27, 2017 No. MMB-7-6/ [email protected] ).

Individuals not related to business activities can also submit documents electronically. For example, a citizen can attach scanned images of supporting documents to the electronic 3-NDFL declaration when applying for a property or social deduction. The scans signed with an electronic signature along with the declaration will be sent to the inspectorate in electronic form.

In any case, tax officials reserve the right to familiarize themselves with the original documents.

How can you respond to the Federal Tax Service's request to submit documents?

After receiving the documents, the user estimates the time needed to prepare a response, clicks the “Prepare response” button and selects the option:

- “Response to a request for documents (information)” - for a substantive response in a formalized form;

- “Notice of failure to respond on time” - to send a notification to the Federal Tax Service that the subject cannot submit documents or information within the prescribed period. The document is regulated by Order of the Federal Tax Service dated April 24, 2019 No. ММВ-7-2/ [email protected] $

- “Register of documents confirming VAT benefits” - to reduce the list of required documents during a desk audit. Instead of the package of documents for VAT benefits, you can submit a register of these documents in electronic form. This document is regulated by Letter of the Federal Tax Service dated November 12, 2020 No. EA-4-15/18589.

If you select the first option (response to the request), a new form opens - “Response to the request for the submission of documents.”

The selection of documents is carried out in two modes depending on the location of their storage:

- through loading files from disk - click the “Load from disk” button;

- by selecting documents from the 1C database - click the “Select from database” button.

If the answer takes several days to prepare, you can save it by clicking the “Save” button. You can continue working with the document later. It can be opened from the list of requirements form or their IFTS claim card.

What free electronic services are there for interacting with tax authorities?

Among the services for sending electronic documents to the tax office are:

Tax officials provide many other free services to taxpayers. They do not allow you to interact with tax authorities on the exchange of electronic documents, but they help solve other important practical tasks (for example, “Check yourself and your counterparty,” “Online appointment for an inspection,” “Find out about a complaint” and others).

New rules for transferring information and documents to tax authorities through the cash register office

Federal Law No. 54-FZ dated May 22, 2003 “On the use of cash register systems when making payments in the Russian Federation” contains a very important provision that many do not pay due attention to: according to clause 4 of Art. 5 organizations and individual entrepreneurs (IP) carrying out settlements and users are required to provide information and documents in electronic form in accordance with the legislation of the Russian Federation on the application of cash register systems to the tax authorities through the cash register office in the cases, in the manner and within the time limits established by the authorized body .

It turns out that the CCP office is the only channel of communication with the tax authorities for the transmission of legally significant electronic messages in these very “cases that are provided for by the authorized body,” by which we mean the Federal Tax Service of Russia. An exception is established only for those users who make payments in areas remote from communication networks. And this is quite logical.

In this context, the cash register office refers to a service on the official website of the Federal Tax Service, access to which is provided through the information resources of the Federal Tax Service of Russia “Personal Account of a Taxpayer – Legal Entity” and “Personal Account of a Taxpayer – Individual Entrepreneur”.

Regulations

To find out how to correctly correspond with the tax authority through the CCP office, you need to take into account the orders of the Federal Tax Service.

Currently, in this area, there is an order of the Federal Tax Service of Russia dated March 21, 2017 No. ММВ-7-20/ [email protected] “On approval of the Procedure for maintaining a cash register office” and an order of the Federal Tax Service of Russia dated May 29, 2017 No. ММВ-7-20 / [email protected] “On approval of cases, procedures and deadlines for submitting information and documents in electronic form by organizations and individual entrepreneurs making payments and users to tax authorities through the cash register office.”

Both lose force from 03/01/2022, and are replaced by the order of the Federal Tax Service of Russia dated 09/08/2021 No. ED-7-20/ [email protected] “On approval of the Procedure for maintaining the cash register office” and the order of the Federal Tax Service of Russia dated 07/19/2021 No. ED- 7-20/ [email protected] “On approval of cases, procedures and deadlines for submitting information and documents in electronic form by organizations and individual entrepreneurs making payments and users to tax authorities through the cash register account.”

The differences between the old and new orders are not great, but it should be noted that the emergence of new acts is an excellent opportunity to fill gaps in knowledge.

Information transmitted through the cash register account is mandatory

The orders very clearly define what information can be transmitted to the tax authorities only through the cash register office.

Thus, according to the norms of clause 8 of the Procedure for maintaining a cash register office, approved by the annex to the order of the Federal Tax Service of Russia dated 09/08/2021 No. ED-7-20 / [email protected] , and the annex to the order of the Federal Tax Service of Russia dated 07/19/2021 No. ED-7-20 / [email protected] (clause 1) the following are transmitted exclusively through the cash register office:

— a response to a tax authority’s request for information sent through the cash register office as part of the tax authorities’ control and supervision of compliance with the legislation of the Russian Federation on the use of cash registers;

- a statement about the commission of an action (inaction) containing elements of an administrative offense, administrative liability for which is provided for in Parts 2, 4 and 6 of Art. 14.5 Code of Administrative Offenses of the Russian Federation. This refers to such violations as non-use of cash registers, use of cash registers that does not meet the established requirements, or use in violation of the registration procedure established by law, the procedure, terms and conditions for re-registration, the procedure and conditions for the use of online cash registers, as well as failure to issue a cash receipt or strict reporting form to the buyer (client). Why “go and give up” in such cases is probably no secret: by correcting yourself in time (before a decision is made in the case of an administrative offense) and voluntarily reporting the violation, you can avoid a fine. This is provided for in the note to Art. 14.5 Code of Administrative Offenses of the Russian Federation. The main thing is that at the time of the application the tax authority does not have the relevant information and documents about the administrative offense committed, and the data presented are sufficient to establish the event of the administrative offense. Most often we are talking about the user’s comments on the correction check he generated;

- recognition (non-recognition) of the existence of an event of an imputed administrative offense after the automated information system of tax authorities has verified received messages and statements from individuals and legal entities about data indicating that an organization or individual entrepreneur carrying out settlements and users have committed actions (inactions) containing signs of administrative offenses. This case is more exotic, but knowing about this mechanism is very beneficial. For example, a buyer complained of a violation by a cash register user using the mobile application of the Federal Tax Service of Russia “Checking cash receipts.” Such information is processed automatically and the taxpayer receives a request from the tax authority about whether he agrees with the complaint or can justify himself, because complainants can use the mobile service in bad faith. Further events develop as follows: if, with the help of a message through the cash register account, the user admits a violation and voluntarily corrects himself before a decision is made in the case of an administrative offense, a protocol on the administrative offense is not drawn up, and a decision in the case is made without the participation of the violator. The tax authority transfers it to the user through the cash register account within three days from the date of issue. But at the same time, punishment in the form of an administrative fine is imposed in the amount of one third of the minimum amount of the administrative fine provided for in Parts 2, 4 and 6 of Art. 14.5 of the Code of Administrative Offenses of the Russian Federation (Part 3.4 of Article 4.1, Part 4 of Article 28.6 of the Code of Administrative Offenses of the Russian Federation). Thus, a timely and correct response to a request can significantly reduce the size of the fine. If the user denies the violation, the tax authority may decide on the need to carry out control measures.

In addition, the cash register office is the main communication channel in a number of cases. But there is already an alternative provided for by law:

— registration (re-registration) of cash registers;

— deregistration of cash registers, including in cases of theft or loss of cash registers.

You can also register the cash register, re-register and deregister it by submitting a paper application to any tax authority (Clause 1, Article 4.2 of Federal Law No. 54-FZ). The provisions of the order only mean that the relevant statements should be submitted in electronic form through the CCP office on the website of the Federal Tax Service of Russia. The only acceptable alternative to carrying out registration actions with a cash register online is to use the appropriate OFD service;

— generation of reports on registration, changes in registration parameters, and closure of the fiscal drive.

Reports on registration and changes in registration parameters are allowed to be submitted to the tax authority not only through the cash register office, but also on paper or through the OFD. The report on the closure of the fiscal drive is submitted together with the application for registration (re-registration, deregistration) of the cash register, and therefore in the same way as the application itself (clause 3, clause 4, clause 8 of Article 4.2 of Federal Law No. 54- Federal Law).

Important!

The new order of the Federal Tax Service of Russia dated July 19, 2021 No. ED-7-20 / [email protected], unlike its predecessor, does not mention that documents related to registration, re-registration or deregistration of cash registers can be submitted to any tax authority on paper carrier. But this does not mean at all that such an opportunity has been cancelled. It is enshrined in Law No. 54-FZ (see links above). The exclusion of this paragraph from the order is motivated only by the fact that these rules are not subject to regulation by the order - it is dedicated specifically to the use of the cash register cabinet and nothing more.

Deadlines for transfer of information and documents

The Appendix to the Order of the Federal Tax Service of Russia dated July 19, 2021 No. ED-7-20/ [email protected] (clause 6-17) establishes specific deadlines for submitting information and documents to the tax authority through the cash register office:

| Type of information, documents | Submission deadline |

| necessary for registration of cash registers | simultaneously with the application for registration |

| necessary for re-registration of cash registers | no later than one business day following the day the information contained in the cash register registration card is changed |

| necessary for deregistration of cash registers | simultaneously with the application for deregistration of the cash register, and in case of theft or loss of the cash register - no later than one business day from the date of discovery of the theft or loss |

| CCP registration report | no later than the working day following the day of receipt of the registration number from the tax authority |

| report on changes in cash register registration parameters | together with an application for re-registration of the cash register in connection with the installation of a new fiscal drive |

| report on closing the fiscal drive | together with an application for re-registration of a cash register in connection with the replacement of a fiscal drive or with an application for deregistration of a cash register |

| submitted at the request of the tax authority | no later than three working days from the date the tax authority places the request in the cash register account |

| statement from an organization or individual entrepreneur about committing an administrative violation under Parts 2, 4, 6 of Art. 14.5 Code of Administrative Offenses of the Russian Federation | no later than three working days following the day of voluntary correction of the error |

| recognition (non-recognition) by an organization or individual entrepreneur of an event of an imputed administrative offense after an automated information system of tax authorities has verified received reports of administrative violations in the field of application of cash register systems | within one working day from the moment the tax authority places such data in the cash register office, but no later than the day the decision is made in the case of an administrative offense |

When transmitting data through the cash register office, all messages and documents are signed with an enhanced qualified electronic signature of the head of the organization, individual entrepreneur, user (clause 3 of the appendix to the order of the Federal Tax Service of Russia dated July 19, 2021 No. ED-7-20 / [email protected] ).

The date of provision of information and documents in electronic form is considered the date of their placement in the cash register office if there is a receipt for their receipt (clause 5 of the appendix to the order of the Federal Tax Service of Russia dated July 19, 2021 No. ED-7-20 / [email protected] ).

Let us recall that failure by an organization or individual entrepreneur to provide information and documents at the request of tax authorities or to provide such information and documents in violation of the established deadlines shall entail a warning or the imposition of an administrative fine provided for in Part 5 of Art. 14.5 of the Code of Administrative Offenses of the Russian Federation, the amount of which for officials and individual entrepreneurs (taking into account the note to Article 2.4 of the Code of Administrative Offenses of the Russian Federation) will range from 1.5 thousand to 3 thousand rubles; for legal entities – from 5 to 10 thousand rubles.

In our opinion, the transfer of information and documents in an unacceptable way is equivalent to failure to provide the necessary data, since it does not create appropriate legal consequences.

It is worth keeping in mind that tax authorities practice a risk-based approach to control, and it is important for them that their information resources accumulate significant information about the cash register user, both about his violations and about his voluntary correction of errors. The latter is also important for the user himself. Perhaps the good people at the tax office will agree to accept information (documents) directly, bypassing the cash register office, but this action will not leave a proper trace in the Federal Tax Service databases, which may have undesirable consequences for the organization or individual entrepreneur.

In conclusion, we note that through the cash register office it is possible to transmit to the tax authorities other information and documents in electronic form used by organizations and individual entrepreneurs to exercise their rights and obligations established by the legislation of the Russian Federation on the application of cash register systems (clause 10 of the appendix to the order of the Federal Tax Service of Russia dated 05/29/2017 No. ММВ-7-20/ [email protected] (until 03/01/2022), clause 2 of the appendix to the order of the Federal Tax Service of Russia dated 07/19/2021 No. ED-7-20/ [email protected] (starting from 01.03. 2022)).

✅ Taxi

is one of the largest developers of business services in Russia. The company is the first operator of electronic reporting and the founder of electronic document exchange in the country.

For more than 20 years, the company has been developing and implementing electronic document management services. Nowadays, Taxkom’s ecosystem of business products includes modern electronic reporting services, solutions for EDI, marking, traceability, CRF, counterparty verification service, as well as electronic signatures for individuals and legal entities.

CCT cash register equipment application CCT

Send

Stammer

Tweet

Share

Share

Results

Electronic submission of documents to the tax office is carried out by taxpayers regularly in the form of tax and accounting reports. When sending electronic documents to the inspectorate, it is necessary to certify them with an electronic signature and comply with legally established deadlines (when submitting documents at the request of inspectors). A special free tax service allows you to remotely submit documents for registering companies and individual entrepreneurs.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to make copies of documents

If the legislation does not provide for a copy of documents certified by a notary, then tax inspectors do not have the right to demand certified copies (subparagraph 2, paragraph 2, article 93 of the Tax Code of the Russian Federation, additionally letter of the Ministry of Finance of Russia dated December 7, 2009 No. 03-04-05-01/886 ).

Therefore, tax inspectors are provided with copies of documents certified by the manager.

A multi-page copy of the document must be bound and a single certification inscription must be placed on the firmware. The sheets are numbered and the total quantity is indicated on the certification inscription. It is necessary to stitch the sheets in such a way that subsequently there is no embroidering of the bundle, and there is free access for photocopying any sheet. All dates and signatures must be clearly visible on the copy of the document (letter from the Ministry of Finance of Russia dated 08/07/2014 No. 03-02-RZ/39142, Federal Tax Service of Russia dated 09/13/2012 No. AS-4-2 / [email protected] (clause 21) ).

If there are several documents, then the copies are certified separately and a certification inscription is placed on each one. The financial department reports this in its letters dated May 11, 2012 No. 03-02-07/1-122, dated October 24, 2011 No. 03-02-07/1-374, dated November 30, 2010 No. 03-02-07/1 -549 <1>, as well as the tax department in a letter dated 10/02/2012 No. AS-4-2/16459. The judicial authorities adhere to the same position (resolution of the Federal Antimonopoly Service of the Moscow District dated November 5, 2009 No. KA-A41/11390-09).

—————

<1> These letters refer to counter checks. Since the conditions for submitting documents at the request of the tax authorities are the same, they can also be applied to desk audits (clause 2 of Article 93, subclause 3 of clause 5 of Article 93.1 of the Tax Code of the Russian Federation).

You should not use used sheets to copy documents. On the reverse side there is information about the executor of the document - last name, initials and telephone number (letter dated 02/01/2010 No. 03-02-07/1-35).

ConsultantPlus expert M.A. Klimova answers about the specifics of preparing responses to the requirements of the Federal Tax Service. Get free trial access to the system and go to the video lecture.