Who is required to report on insurance premiums and how?

Calculation of insurance premiums is submitted to the tax authorities by all organizations, without exception, and individual entrepreneurs who have concluded at least one employment contract or civil servants' agreement with individuals.

It shows the amounts of contributions accrued for wages and other payments in favor of employees. Reporting for the periods from the 1st quarter of 2022 to reporting for 9 months had to be on the form put into effect by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11 / [email protected] The same order also establishes the Procedure for filling out the calculation. For periods up to and including 2022, the form from the Federal Tax Service order dated October 10, 2016 No. ММВ-7-11/551 was used.

From the reporting campaign for 2022, a form is used, approved. by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] It must also be used when drawing up a report for 2022.

If you need a sample of the ERSV for 2022, use the sample from ConsultantPlus experts. This can be done for free by getting trial online access to the system.

The due date falls on the 30th day of the month following the reporting period. These include: first quarter, half year, 9 months, year. The ERSV for 2022 must be sent no later than 01/31/2022 (since 01/30/2022 is a Sunday).

You can send the report to the tax authorities on paper (in person, through an authorized representative, by mail) or electronically via TKS.

IMPORTANT! The choice of delivery method depends on the average number of employees of the policyholder. If it does not exceed 10 people, then you can choose any form of delivery. If the SSC is more than 10 people, then there is no choice - you need to submit the calculation electronically. This number limit is valid from 01/01/2020. Previously there were 25 people.

When is the zero calculation for insurance premiums due?

As already noted, the calculation is filled in with data on insurance premiums accrued from wages and other payments. However, it happens that salaries are not paid, for example, due to the suspension of activities. What to do in such a situation?

- Organizations must submit calculations in any case - whether they have payroll accruals or do not have them. It is believed that the company always has one insured person - the director. When the salary is not accrued or paid even to him, the report is filled in with zero indicators and sent to the tax authorities.

- Individual entrepreneurs working alone are not required to submit a zero calculation. However, if they have at least one unterminated employment contract, then they will have to report on contributions. At the same time, the entrepreneur’s employees may be on unpaid leave.

Based on all of the above, there may be several options for submitting zero settlements. Next, let's look at how to correctly draw up zero payments for contributions.

Features of filling out Appendix 2 to Section 1 of the Calculation

In Appendix 2 to Section 1 of the Calculations, the amount of insurance premiums in case of temporary disability and in connection with maternity is indicated.

When filling out the Calculation of contributions for the first quarter of 2022, you must take into account that:

- line 070 “Expenses incurred for payment of insurance coverage” does not need to be filled in;

- line 080 “Reimbursed by the FSS for expenses for payment of insurance coverage” is filled out only if the organization received reimbursement of expenses from the FSS for periods that expired before January 1, 2021;

- in line 090 “Amount of insurance premiums payable (the amount of excess of expenses incurred over calculated insurance premiums)”, sign “2” is not indicated.

Sign “2” means the excess of incurred expenses over calculated insurance premiums.

This might be interesting:

Direct FSS payments: new procedure for assigning benefits in 2021

How to calculate sick leave opened in December 2022 and closed in January 2022?

What sections should be included in the zero contribution sheet?

In the absence of payments in favor of individuals under employment contracts, civil process agreements, copyright, etc. and, accordingly, in the absence of digital indicators for insurance premiums, policyholders must include the following sections in the calculation:

- title page;

- Section 1 indicating code 2 in the “Payer Type” field - without any attachments to it;

- section 3 with zeros and dashes.

This is directly indicated in the order of filling out the calculation (clause 4.2) and is confirmed by the Ministry of Finance (see letter dated 10/09/2019 No. 03-15-05/77364).

Until 2022, there were more mandatory sheets. Subsections 1.1 and 1.2 of Appendix 1 to Section 1 and Appendix 2 to Section 1 were also required (letters of the Ministry of Finance dated April 16, 2019 No. 03-15-05/27074, dated February 13, 2019 No. 03-15-06/10549, Federal Tax Service dated November 16. 2018 No. BS-4-21/ [email protected] ). Now you can do without them.

The title page contains the details of the policyholder (TIN, KPP, name/full name, OKVED code, telephone numbers), and the tax authority accepting the settlement (code). It also reflects whether the original form or the corrective one is submitted (if necessary, the adjustment number), the reporting period and the year to which it relates.

All data is certified by the signature of an authorized person indicating the date of preparation or submission of the report.

Section 1 with all the subsections and appendices we have indicated will contain zeros on all lines with summative and quantitative indicators and dashes on the remaining familiarities. It is best to register the BCC in the fields provided for this in order to avoid problems with the generation of electronic reporting.

For a sample of filling out the zero ERSV, see ConsultantPlus, having received a free trial demo access to the reference and legal system using the link below:

We will tell you what information needs to be entered into section 3 of the zero calculation in the next section.

Table - composition of the lines under consideration in the mandatory sections of KND 1151111

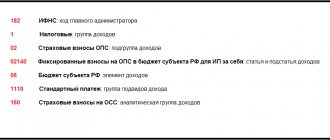

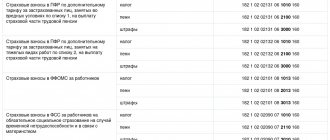

| Mandatory classified parts of the calculation of SV | Information to fill out (according to the lines being studied) | Instruction on registration |

| Sec. 1 | “060” - KBK for crediting generally obligatory fees (OPS at an additional rate) | Procedure, part 5, clause 5.10 if there are several codes, then the required number of sheets of this section is drawn up with the corresponding indicators in lines “060-073”; if there is no code, dashes are added |

| Adj. 1 to Section 1 (1.1) | · “060” - the total amount of calculated OPS fees (indicator line “061” + indicator line “062”); · “061” (cells 3-5) - the amount of mandatory pension fees from a base not exceeding the maximum; · “062” (cells 3-5) - the amount of mandatory pension fees from a base exceeding the maximum, which is equivalent to the value: indicator page "051" cells 3-5 * 10/100 (for payers with tariff codes “01”, “02”, “03”) | Procedure, part 7, clauses 7.1 and 7.9, as well as clause 7.10. and 7.11 |

| Adj. 1 to Section 1 (1.2) | “060” (cells 3-5) - the total amount of calculated compulsory medical insurance fees | Procedure, part 8, clauses 8.1 and 8.7; the indicator of the row in question is equal to the value: indicator page "050" i. 3—5 * tariff (according to the payer's tariff code) |

| Adj. 2 to Section 1 | “060” (cells 1-5) - the amount of calculated OSS fees (VN and M) | Procedure, part 11, clause 11.2 and 11.12 |

| Section 3 (3.1) | “060” - INN (12 digits) assigned to the insured employee of the Federal Tax Service upon registration (if any); You can find out your personal tax identification number: in the certificate of registration with the Federal Tax Service, on page 18 of the passport if there is a proper TIN mark there, on the Federal Tax Service website through the “Find out your TIN” service | Procedure, part 22, clauses 22.8 and 22.9; |

What should be reflected in section 3 of the zero calculation of contributions?

Section 3 contains information on each person insured in the compulsory health insurance system. In this case, it does not matter whether there were accruals in his favor during the reporting period or not (clause 21.1 of the Filling Out Procedure). Thus, the zero calculation for insurance premiums in Section 3 may include either employees who do not receive remuneration from their employer, for example due to being on unpaid leave, or a director - the only founder who also does not receive wages.

Subsection 3.1 contains information about whether the form is initial or corrective, the reporting period code, year, serial number and date of submission of information. Next comes the indication of all the data of the individual: TIN, SNILS, full name, date of birth, gender, code and details of the identity document, sign of the insured person in the OPS and Compulsory Medical Insurance systems.

Subsection 3.2 contains information about the amounts:

- remuneration in favor of individuals;

- accrued contributions to compulsory pension insurance.

According to clause 21.2 of the above Procedure, when submitting a zero calculation, dashes are placed in the lines of subsection 3.2.

If during the reporting period there were accruals to employees, as well as to individuals who performed services (work) under civil contracts, the employer will have to fill out a report in accordance with all the rules. ConsultantPlus experts explained in detail how to fill out the calculation correctly. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

What to consider when filling out the Calculation of Contributions in connection with the transition to direct payments of benefits from the Social Insurance Fund

When filling out the Calculation of Contributions for the first quarter of 2022, you must remember that the employer pays sickness benefits at its own expense only for the first 3 days of temporary disability of the employee.

Most benefits are paid by the Social Insurance Fund from its own funds under the “direct” payment mechanism.

At the same time, the organization pays contributions in full and does not have the right to reduce them by the amount of expenses for benefits.

Therefore, the employer must take these changes into account when filling out:

- Appendix 2 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity” to section 1 of the Calculation;

- Appendix 3 “Expenses for compulsory social insurance in case of temporary disability and in connection with maternity and expenses incurred in accordance with the legislation of the Russian Federation” to Section 1 of the Calculation;

- Appendix 4 “Payments made from funds financed from the federal budget” to section 1 of the Calculation.

Also on topic:

How to indicate the number of “separate” employees when calculating contributions?

What is the liability for failure to submit a zero report on insurance premiums?

In general cases, failure to submit or delay in sending a contribution calculation may result in the imposition of various sanctions by the tax authorities. But what happens if you don’t submit a zero calculation on time? Will a person be able to do without a fine in this case, since there are no charges involved? Answer: no, he can’t. The fine will be mandatory, the tax authorities will simply impose it in the minimum amount - 1000 rubles, as provided for in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation.

Taking into account the above, an organization that does not pay any remuneration to individuals, like all others, must report to controllers on time. In addition, if you are more than 10 days late in submitting your report, the tax authorities will block the organization’s account—they have the right to do so.

Results

All organizations must submit a zero calculation for insurance premiums, including those who do not pay wages to employees during the reporting period, and individual entrepreneurs who have at least one employment contract, but for some reason also do not make payments under such contracts.

The zero sheet will contain only the required sheets; all others are not subject to inclusion in the calculation.

In section 3, you will have to fill in all the data about the individual with whom the organization or individual entrepreneur has concluded an agreement, but to whom the salary is not paid. In companies, this person can be the director - the only founder. His data must be included in section 3 even in the absence of an employment contract.

Failure to submit a zero calculation threatens economic entities with a minimum fine of 1,000 rubles, and in some cases, blocking of the current account.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.