What forms of violations can be appealed?

You can make such a complaint in different situations, for example:

- incorrect assessment of taxes, errors in the amount or illegality of actions in this matter in general;

- imposing various fines without the right to do so;

- delay in tax deduction for more than four months (or more than one, legal disputes are still ongoing in this regard);

- incorrect final results of the tax inspectorate or their absence at all.

You can submit a document at any time. This applies both to the time after the inspection and before it formally begins. You can also submit it altogether in the absence of inspections on your own initiative. For example, when funds due for payment by law are delayed.

How to file a complaint with the Federal Tax Service?

The form and methods of filing documents for citizens to appeal against the actions of third parties, including employees of the Federal Tax Service, are regulated by Article 139.2 of the Tax Code of the Russian Federation. Taxpayers have several ways to file a complaint with the tax authorities:

- fill out a special form for requests on the official website of the Federal Tax Service of Russia nalog.ru;

- send a complaint in writing by fax or via Russian Post;

- contact orally using the hotline number 8-800-222-22-22;

- make an appointment in person (send a legal representative) to the address of the territorial tax office or the central office.

Contacts of the Federal Tax Service

| Official website of the Federal Tax Service of Russia | https://www.nalog.ru/ |

| Hotline number | 8-800-222-2222 |

| Fax | 8 (495) 913-00-06 |

| Anonymous helpline | 8 (495) 913-00-70 |

| Postal address of the central office | 127381, Moscow, st. Neglinnaya, 23 |

| Public reception | Moscow, st. Neglinnaya, 23 (entrance from Petrovskie Lines St.) |

| Schedule | Mon – Fri |

| Opening hours | From 09:00 to 17:00 (Fri – until 16:00) |

| Supervisor | Egorov Daniil Vyacheslavovich |

On this page you can also leave a request to the Federal Tax Service regarding any issue that arose during interaction with the tax authorities.

Contacting the Federal Tax Service through the official website

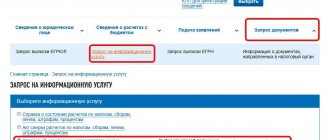

To write a complaint to the tax office via the Internet, fill out the online form on the website:

- Open the official page of the Federal Tax Service www.nalog.ru.

- Scroll down the page and find the “Feedback” button on the bottom panel.

Contacting the tax office via the Internet on the official website of the Federal Tax Service. - In the window that opens, find the “Electronic Services” menu, select the “Contact the Federal Tax Service” section.

- Click “Other requests”, select the appropriate applicant category.

- Complete the required sections of the online form.

Submitting a complaint to the tax office online using the form. - If necessary, upload a file related to the request. Please provide your feedback details.

What should be in the document

The complaint can be drawn up in free form, but all the requirements and nuances listed in Federal Law No. 59-FZ of May 2, 2006 must be taken into account. There are quite a lot of them. If the document is drawn up independently, then there is a possibility of missing one or more mandatory nuances.

Thus, in order to ensure that no data is missed and the complaint is accepted, it is better to use a ready-made application form. This is what the lion's share of those who address this issue do.

In whose name should it be written?

The document is addressed to a specific official who is at the head of the Federal Tax Service, the Subject Directorate or the Federal Tax Service. The complainant can decide which level to choose for his or her purposes. This is clearly stated in Article 138 of the Tax Code of Russia. It is also permissible to draw up a complaint and send it to all three levels of the tax office.

If the reason for the application is an incorrect collection on the account or the return of any debt, then you will have to go straight to the administrative court. Complaints of this type are not considered by the Federal Tax Service, but are sent there.

If there was a blatant abuse of power or deliberate actions of the tax inspector, which led to disastrous consequences (including malicious violations), then the appeal should be written immediately to the prosecutor's office. For these cases, it would be inappropriate to communicate with the authorities of the Federal Tax Service.

Prosecutor's office and court

Fraud, theft or misappropriation of funds is a reason to complain about an individual entrepreneur to the Prosecutor's Office, since administrative and criminal liability is provided for such acts.

Based on the region in which the entrepreneur operates, you must contact the appropriate territorial division of the Prosecutor's Office, using the information from the website genproc.gov.ru/contacts/map/?DISTR=&SUBJ.

If the Prosecutor's Office refused to open proceedings on the facts that were indicated by the applicant, or he wants to obtain monetary compensation or return of previously spent funds (forcibly), he should file a claim with the Magistrate or a court of general jurisdiction. But in view of the fact that for this you need to have a sufficient amount of knowledge in the field of jurisprudence, it is better to use the help of a lawyer who will help prepare documents and represent the plaintiff in court hearings.

In what form is it served?

A complaint can be filed:

- in person, during face-to-face communication;

- via fax;

- by mail or delivery service.

If the paper is printed, filled out in paper form and handed over personally to the recipient, then the receiving party is obliged to give you written confirmation that this document has been received by them, with the seal and signature of the Federal Tax Service.

This rule is very important, since when applying to a court, such information will be valid and will allow you to prove the fact that the complaint was transferred to the employee.

There is also an electronic form for submitting this document. To do this, you need to register on the Federal Tax Service website, enter your data, and fill out the appropriate fields in the drop-down form. Then the official is obliged to promptly consider the complaint and provide a response regarding the incident.

Document form for a complaint against the Federal Tax Service

There was no specific form for a complaint until 2022: it could be issued as a regular written appeal:

- indicating from whom and to whom it is addressed,

- by including in it the mandatory details established by the Tax Code of the Russian Federation,

- by signing and registering the document.

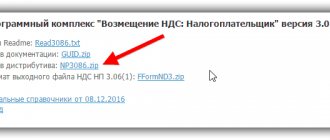

However, in 2022 (from April 30, 2020), Order of the Federal Tax Service of Russia dated December 20, 2019 No. ММВ-7-9/ [email protected] , which approved:

- paper complaint form (form according to KND 1110121);

- format for complaint filed electronically;

- format for an electronic decision made on a complaint;

- the procedure for electronic exchange of documents related to the complaint;

- procedure for filling out the complaint form.

approved by Order No. ММВ-7-9/ [email protected] apply only to the document flow that is carried out through TCS.

For individuals filing a complaint through their personal account, the procedure introduced by the Order of the Federal Tax Service dated August 22, 2017 No. ММВ-7-17/ [email protected] . But the form for both orders becomes the same from April 30, 2020.

Including complaints in electronic document flow carried out through TCS allows you to:

- certify this document with an enhanced qualified electronic signature of the submitter;

- send electronically not only the complaint itself, but also the documents attached to it or information about them (for example, information about the power of attorney issued to the representative)

- receive (within 1 business day) an electronic receipt indicating that a complaint has been received by the Federal Tax Service or a refusal to accept it;

- Receive electronically a decision made on a complaint.

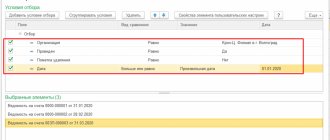

The paper complaint form is a structured set of information required for this document, some of which is displayed in the form of digital codes selected when filling it out.

Those coded include:

- type of document being appealed;

- the method of obtaining a decision on the complaint;

- type of complaint;

- type of person making the complaint.

Other information is entered into the form by hand or typewritten in the fields provided to reflect each detail.

Complaint form to the higher Federal Tax Service, 2022 model

Components of a complaint

In the upper right corner two main points are indicated:

- Contact details and exact name of the receiving authority, including location. Federal Tax Service, Inspectorate of the Federal Tax Service or the Administration of the subject.

- The name of the person or organization that filed the complaint. This could be an individual entrepreneur, an organization or an individual. If desired, it is possible to indicate the address, contact phone number, fax and other information.

After the contacts, in the middle of the sheet, is the name of the document itself, “Complaint against.” The text that follows should explain the situation briefly and clearly.

Let's sum it up

- Illegal actions or inaction of the Federal Tax Service may be appealed by the taxpayer (tax agent) to a higher tax authority.

- A complaint is a document that must be drawn up in writing and include legally defined information in the text. If necessary, the list of information can be expanded.

- The complaint is sent to the Federal Tax Service about which the complainant is complaining. The Federal Tax Service must attach its materials to this document and transfer the entire set to the higher authority to which the complaint is addressed.

- To submit a complaint, the usual methods of interaction with the tax authority are used (in person, by mail, via TKS, through your personal account). New for 2022 is the appearance of an electronic complaint format for interaction with the Federal Tax Service via TKS and the introduction of a form for this document (begins to be effective from 04/30/2020). The form should be used for any type of contact (including through your personal account).

Recommendations for filling out the descriptive part

You can describe either any actions of employees or the inaction of the tax authority as a whole. For example, there are often situations when an application for a tax deduction was submitted in accordance with all the rules, but funds were not credited to the account. This is exactly the case when a complaint is required. It is also advisable to mention when contacting:

- number and date of the act or other document, the appeal of which is being discussed;

- arguments in your defense;

- references to relevant laws;

- papers with legal force that confirm the described circumstances.

The most important requirement is to avoid subjectivity and unfoundedness.

The form contains two parts of the document. One describes the current situation, the second suggests a way out of it. Moreover, the information is supplied in the form of a request. It can be formulated as:

- find a solution;

- cancel any decision made;

- accrue funds;

- change part of the accepted document;

- make a new decision on the appealed case, etc.

The paper is completed with a list of attachments (copies of them must accompany the complaint), a signature with a transcript and the date of filing.

Procedure for filing tax complaints in 2020

Despite the fact that the complaint is addressed to a higher tax authority, it should be submitted to the Federal Tax Service, which generated the document being appealed (clause 1 of Article 139, clause 1 of Article 139.1 of the Tax Code of the Russian Federation). The Federal Tax Service, which is being complained about, must supplement it with the materials it has and no later than after 3 working days send it to a higher authority.

The method of filing a complaint can be (clause 1 of Article 139.2 of the Tax Code of the Russian Federation):

- submitting a document in person or through a representative;

- sending it by post:

- sending via TKS or transfer through the personal account of the tax payer.

The period during which a complaint is filed against the actions (inaction) of the Federal Tax Service is 12 months from the day on which the taxpayer learned of a violation of his rights (clause 2 of Article 139 of the Tax Code of the Russian Federation).

The complaint will not be considered if (clause 1 of Article 139.3 of the Tax Code of the Russian Federation):

- the order of its submission is violated;

- it does not indicate the details of the disputed document;

- the deadline for applying for it has expired and there are no grounds for its restoration;

- before a decision on it is made, the complaint is withdrawn by the taxpayer or the Federal Tax Service has eliminated the violations;

- in relation to the document being appealed, there is already a complaint accepted for consideration.

Refusal to consider does not serve as an obstacle to re-submitting a complaint if it is not related to its withdrawal or to the existence of a previously filed complaint on the same grounds.