Information presentation formats

Tax reporting documentation can be submitted electronically or on paper. This depends both on the tax or fee for which the document is generated, and on the company itself. When choosing a format for presenting data, it is necessary to focus on what exactly is specified in the legislation for a particular situation. However, you need to understand that submitting reports on paper is associated with an impressive amount of labor and time, while filing electronically allows you to reduce them.

As for the reporting method, it could be:

- personal visit to the Federal Tax Service Inspectorate office by the head or other person authorized to transmit reports (based on a power of attorney);

- sending a registered letter by Russian Post with a list of the attachments;

- personal account on the Federal Tax Service website;

- sending via telecommunication channels (TCC).

Important! It is imperative to make sure that one or another transmission method can be used for a particular type of report. If you violate the reporting rules, it will not be accepted by the tax authorities.

Conclusion

For violation of reporting deadlines, the law provides mainly for various penalties. They are imposed both on the organization and on the responsible officials.

Fines can be either fixed or calculated based on the amounts reflected in the declarations or the number of individuals included in the report

In addition, accounts may be blocked for delays in a number of tax reports.

Today, maximum fixed fines (up to 150,000 rubles) are established for violations of deadlines for submitting statistical reports.

But if the bill developed by the Ministry of Finance is adopted, then fines for delays in accounting statements in some cases will amount to up to 700,000 rubles.

Fines for failure to submit reports

If tax reporting is not received on time, tax authorities will issue fines to the company in accordance with Art. 119 Tax Code of the Russian Federation:

- if the tax is transferred in full, but the declaration for it is not submitted, a fine of 1,000 rubles is provided;

- If the tax is not paid in full or at all, a fine of 5% of the amount owed is issued for each month of delay. In this case, the fine cannot be more than 30% of this amount and must not be less than 1,000 rubles;

- if the taxpayer has not submitted a zero return, the fine is 1,000 rubles.

New Code of Administrative Offenses: entrepreneurs imposed high fines

On January 30, 2022, the Ministry of Justice published a new edition of the Code of Administrative Offences, which revises many existing penalties for individual entrepreneurs, organizations and their officials for violations in various areas of regulation. Currently, the draft Code of Administrative Offenses of the Russian Federation is posted on the portal of draft regulatory legal acts for public discussion. A number of future norms have already caused sharp criticism from the public, and there is now serious controversy surrounding the document. At the same time, as practice shows, most bills proposed for adoption by the government nevertheless become laws. We are talking about new fines for businesses that may come into effect as early as January 1, 2021.

Advantages of the new Code of Administrative Offenses of the Russian Federation

The main advantage of the new edition of the Code of Administrative Offenses of the Russian Federation is that the articles have become more specific, detailed and understandable for interpretation compared to the existing ones

. For example, now for violation of labor rights they are fined under Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation without disclosing the specific elements of the violation and their characteristics. The new code makes this provision as specific as possible, establishing 22 separate offenses in the labor sphere.

Thus, non-compliance with working hours, failure to provide personal protective equipment to personnel, non-payment of wages, concealment of accidents, etc. are included in separate articles.

Another advantage of the new code is that it has significantly reduced fines for some offenses

. For example, fines for so-called “wage slavery” and failure to submit reports to Rosstat have been reduced.

In this case, such a type of punishment as a warning will be used much more often. It will be imposed instead of a fine for first-time administrative offenses. Punishment in the form of a fine cannot be replaced by a warning only if this is expressly provided for in the relevant article. The fines themselves are limited to maximum limits that are significantly lower than those currently established.

As a general rule, the maximum fine in the new Code of Administrative Offenses of the Russian Federation will be set in the following amounts:

- for citizens - 5,000 rubles (now - 500,000 rubles);

- for officials - 50,000 rubles (now - 1 million rubles);

- for individual entrepreneurs – 100,000 rubles (now – 1 million rubles);

- for organizations - 500,000 rubles (now - 60 million rubles).

If any article sets the minimum fine in the specified amounts, the court will have the right to reduce the fine even below the minimum established by the Code of Administrative Offences.

Another advantage of the new edition of the Code of Administrative Offenses is the established rule that it is not allowed to simultaneously hold an organization and its officials liable for the same administrative offense

(Article 2.10 of the Code of Administrative Offenses of the Russian Federation). As a general rule, officials of organizations will be punished for violations committed, rather than the organizations themselves.

In particular, for the same “wage slavery” only the heads of organizations will be fined, and not, as at present, the managers and organizations themselves (currently a fine of up to 50,000 rubles is provided for legal entities).

The simultaneous imposition of fines on officials and organizations is provided for only for certain offenses.

Also, the advantages of the new edition include a noticeable softening of the norm on such punishment as administrative suspension of activities

. In the new code, this type of punishment will be called “administrative prohibition of activity,” and the deadline for its imposition will be reduced from 90 to 30 days.

Below we will consider in more detail the articles of the Code of Administrative Offenses in the new edition, under which individual entrepreneurs, organizations and their officials are most often held accountable. At the same time, we will not consider some fines (for example, for gross violation of accounting requirements or failure to provide information about opening and closing a bank account), which will remain unchanged.

Fines in the new Code of Administrative Offenses for organizations and individual entrepreneurs

Failure to submit SZV-TD (Part 2 of Article 8.1 of the Code of Administrative Offenses of the Russian Federation)

The new Code of Administrative Offenses of the Russian Federation will establish fines for failure to submit reports in the SZV-TD form. Repeated failure to provide or provision of incomplete or unreliable information in the SZV-TD form for the purpose of generating electronic work books will entail a warning or the imposition of an administrative fine on officials of organizations and individual entrepreneurs in the amount of 300 to 500 rubles. Organizations for the same violation will be fined from 1,000 to 5,000 rubles.

Non-payment of wages (Article 8.2 of the Code of Administrative Offenses of the Russian Federation)

Non-payment or incomplete payment of wages or other payments made within the framework of labor relations, as well as payment of wages in an amount below the minimum wage, will entail the imposition of a fine on officials of organizations in the amount of 5,000 to 20,000 rubles (currently from 5,000 to 20,000 rubles) . Fines for individual entrepreneurs will range from 1,000 to 5,000 rubles, and for organizations - from 30,000 to 50,000 rubles. Thus, fines will largely remain at current levels.

At the same time, increased fines will be introduced for non-payment of salaries to two or more employees. Late payment of wages or other payments to two or more employees will entail a fine on officials of organizations in the amount of 20,000 to 30,000 rubles. For individual entrepreneurs, fines will range from 10,000 to 30,000 rubles, and for organizations - from 50,000 to 100,000 rubles.

“Wage slavery” (Part 3 of Article 8.2 of the Code of Administrative Offenses of the Russian Federation)

An employer’s obstruction of an employee’s right to change the bank to which his salary is transferred will be punishable by a warning or a fine for individual entrepreneurs and officials of organizations in the amount of 3,000 to 5,000 rubles. Fines for organizations are abolished.

Let us remind you that now for the same violation the fine for individual entrepreneurs reaches 5,000 rubles, for officials - up to 20,000 rubles, and for organizations - up to 50,000 rubles.

Violation by the employer of the working hours of employees (Article 8.3 of the Code of Administrative Offenses of the Russian Federation)

For this violation, fines will be increased. Violation by the employer of the established working hours for employees or failure to provide them with rest will entail the imposition of an administrative fine on officials and individual entrepreneurs in the amount of 10,000 to 15,000 rubles, and on organizations - from 30,000 to 70,000 rubles.

Now for such a violation they can be charged under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation. This provision provides for fines for officials and individual entrepreneurs in the amount of 1,000 to 5,000 rubles, and for organizations - from 30,000 to 50,000 rubles.

Violation of the deadline for tax registration (Article 29.20 of the Code of Administrative Offenses of the Russian Federation)

Violation of the established deadline for filing an application for registration with the tax authority will entail a warning or the imposition of an administrative fine on officials in the amount of 1,000 to 2,000 rubles.

Now this violation is punishable by a warning or a fine of 500 to 1,000 rubles.

Failure to submit and untimely submission of tax reports (Article 29.21 of the Code of Administrative Offenses of the Russian Federation)

Administrative fines will also increase for violation of deadlines for submitting a tax return or calculating insurance premiums.

According to the new rules, this violation will entail a warning or the imposition of an administrative fine on officials in the amount of 1,000 to 2,000 rubles (currently from 300 to 500 rubles).

Failure to provide documents and information necessary for tax control (Article 29.22 of the Code of Administrative Offenses of the Russian Federation)

Failure to submit or refusal to submit the requested documents and information to the tax authorities, as well as incomplete submission of such information, will entail the imposition of an administrative fine on citizens in the amount of 2,000 to 4,000 rubles (currently from 100 to 300 rubles). For this violation, officials of organizations will be subject to fines in the amount of 4,000 to 8,000 rubles (currently from 300 to 500 rubles).

Failure to submit a payment in accordance with Form 4-FSS (Article 29.27 of the Code of Administrative Offenses of the Russian Federation)

Violation of the deadlines for submitting calculations of accrued and paid insurance premiums to the territorial bodies of the Social Insurance Fund (4-FSS) will threaten officials with an administrative fine in the amount of 2,000 to 4,000 rubles. Let us remind you that now for the same violation, officials bear administrative liability in the form of a fine in the amount of 300 to 500 rubles.

Thus, for the most part, compared to the current Code of Administrative Offenses of the Russian Federation, the size of fines for violations committed in the field of taxation, accounting and labor law will be increased. But there are also exceptions.

Failure to submit a mandatory copy of the annual financial statements (Article 29.29 of the Code of Administrative Offenses of the Russian Federation)

Perhaps the most significant increase in fines in the field of taxation and accounting relates to failure to submit a legal copy of annual accounting reports. According to the new rules, violation of the deadlines for submitting annual accounting reports will entail a fine for officials (accountants) in the amount of 50,000 to 70,000 rubles, and for organizations - from 100,000 to 200,000 rubles.

If an organization fails to submit accounting records at all, its officials will be fined in the amount of 80,000 to 100,000 rubles, and the organization itself - in the amount of 200,000 to 300,000 rubles. If an organization does not submit accounting records, which are subject to mandatory audit, fines for its officials will range from 100,000 to 200,000 rubles, and for the organization itself - from 1 million to 1.5 million rubles.

- Thus, fines for accounting will be increased several thousand times

!

Let us remind you that at present the Code of Administrative Offenses of the Russian Federation does not have a separate article providing for liability for failure to submit a legal copy of the annual accounting reports. For failure to submit the balance, officials of the organization are liable under Art. 15.6 of the Code of Administrative Offenses of the Russian Federation in the form of a fine in the amount of 300 to 500 rubles. The organizations themselves are liable in the form of a fine of 400 rubles.

Non-use of cash register equipment (Article 29.31 of the Code of Administrative Offenses of the Russian Federation)

Penalties for non-use of cash registers are increasing. For the first violation, the fines will not change. They will range from ¼ to ½ of the settlement amount, but not less than 10,000 rubles - for officials and individual entrepreneurs and from ¾ to one of the settlement amount, but not less than 30,000 rubles - for organizations.

But for repeated failure to use a cash register, if the amount of settlements made without the use of a cash register amounted, including in total, to 1 million rubles or more, the fines will be increased. Repeated non-use of CCT will entail the imposition of an administrative fine on individual entrepreneurs in the amount of 400,000 to 500,000 rubles, and on organizations - from 3 million to 5 million rubles (currently - suspension of activities for up to 90 days).

Failure to submit SZV-M and SZV-STAZH (Article 29.32 of the Code of Administrative Offenses of the Russian Federation)

Failure to submit to the Pension Fund of Russia information on individual (personalized) registration in the compulsory pension insurance system within the prescribed period will entail the imposition of an administrative fine on officials of organizations in the amount of 3,000 to 5,000 rubles (currently from 300 to 500 rubles).

Failure to submit statistical reports to Rosstat (Article 34.11 of the Code of Administrative Offenses of the Russian Federation)

For this violation, the new edition of the Code of Administrative Offenses provides for a significant reduction in fines. Now, for failure to submit primary statistical data to Rosstat, officials and individual entrepreneurs can be fined in the amount of 10,000 to 20,000 rubles, and organizations - in the amount of 20,000 to 70,000 rubles.

According to the new rules, the same violation will entail a warning or a fine for officials in the amount of 1,000 to 3,000 rubles, for individual entrepreneurs - from 3,000 to 5,000 rubles, for organizations - from 5,000 to 10,000 rubles.

study it

on the portal of draft normative legal acts.

Source:

Penalty for incorrect reporting format

If tax reporting is submitted in an incorrect format, liability is provided for this in accordance with Art. 119.1 Tax Code of the Russian Federation. The fine is 200 rubles. for each case of non-transfer of reporting.

At the same time, there is a possibility that the reporting will not be accepted even if the company complies with all the rules for its presentation. The fact is that due to technical failures in telecommunication data transmission systems, reporting may also not reach the tax office. If declarations are submitted at the very last moment, there is a risk that the company will be fined for being late.

You can challenge such a decision of the tax inspectorate through the court. However, this may take a long time. In addition, it will be necessary to provide evidence that the taxpayer did not submit reports precisely because of a technical failure in the system.

Financial statements

Legal entities must submit financial statements for 2022 to the Federal Tax Service and statistics authorities.

Therefore, if a businessman does not meet the deadline, he will be punished twice. In addition, the guilty officials will be fined separately.

- If the report is not submitted to the Federal Tax Service, the fine will be 200 rubles for each reporting form (clause 1 of Article 126 of the Tax Code of the Russian Federation). In this case, small enterprises will have an “advantage”, because for them the mandatory “set” of financial statements is limited to the balance sheet and form No. 2.

- For failure to submit financial statements to statistics, a larger fine is provided - from 3,000 to 5,000 rubles, regardless of the number of forms (Article 19.7 of the Code of Administrative Offenses of the Russian Federation).

- In both cases, the guilty officials will be fined from 300 to 500 rubles. (Articles 15.6 and 19.7 of the Code of Administrative Offenses of the Russian Federation).

The procedure described above is valid for the last time when submitting reports for 2022.

Next, the changes introduced by the law of November 28, 2018 No. 444-FZ will come into effect.

- Accounting statements will need to be submitted only to the Federal Tax Service.

- The “electronic” delivery format will become mandatory. An exception is made only for small enterprises, which can still report for the last time “on paper” for 2022.

The question arises: since there will be no need to submit financial statements to statistics in the future, then for violation of deadlines there will only be a “symbolic” fine in the amount of 200 rubles. for a document?

But everything is not so simple... The bill provides for a sharp tightening of sanctions for late submission of financial statements. Fines imposed on organizations and officials will amount to tens and even hundreds of thousands of rubles.

Sanctions will depend on the length of the delay and whether the unsubmitted reports are subject to mandatory audit.

The maximum fine provided for by the bill will be up to 700,000 rubles. for organizations and up to 50,000 rubles. - for officials.

It is assumed that the new law will come into force on January 1, 2021, i.e. will apply to violations committed upon submission of reports for 2022 and later.

How to pay the fine?

The taxpayer may pay the fine upon notification sent by the tax office. He can also calculate and pay the fine himself. To do this you need:

- generate and submit reports;

- pay tax;

- determine the amount of the fine;

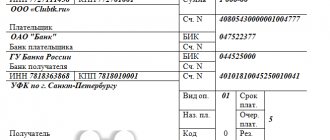

- pay a fine according to the details of the Federal Tax Service for a specific KBK for fines for this tax;

- carry out a reconciliation with the Federal Tax Service.

Important! The Federal Tax Service can hold a taxpayer accountable only within 3 years from the date of violation of reporting rules. This period does not depend on the tax system, specific tax or type of declaration.

The Federal Tax Service may reduce the fine if there are any mitigating circumstances. The taxpayer should submit an application indicating that tax reporting was not submitted on time for valid reasons. Supporting documents must be attached to the application.

Arguments as mitigating circumstances may include the following:

- the tax is transferred on time without delay;

- a reporting violation was committed for the first time;

- the taxpayer has no debts on other taxes;

If the tax office refuses to reduce the fine, the company may go to court to challenge this decision. When considering the case, it is necessary to submit supporting documents that will confirm the plaintiff’s stated claim.

Gross irregularities in accounting

Only those who do not work cannot make mistakes in their work. In the activities of others, errors and omissions are common. But gross mistakes can be seriously punished. So what is considered a gross violation of accounting rules?

An exhaustive list of punishable acts is enshrined in Article 15.11 of the Code of Administrative Offenses of the Russian Federation. A gross violation of accounting requirements is:

- understatement of taxes, contributions and fees by 10% or more, due to distortion of accounting indicators;

- distortion of financial statements (a violation is determined for monetary indicators, the value of which deviates from the fact by 10% or more);

- registration of an imaginary or non-existent operation or object in accounting;

- maintaining accounting accounts outside the established accounting journals and registers;

- preparation and compilation of accounting reports based on data not confirmed by registers and accounting journals;

- lack of primary and accounting documentation within the prescribed periods of safekeeping.

These gross violations will result in a fine. Moreover, the size of the sanction depends on whether the offense was committed for the first time or whether the punishment is imposed again. For example, for a gross violation of accounting committed for the first time, a penalty of 5,000 to 10,000 rubles is provided. Repeated offenses will be punished more seriously - from 10,000 to 20,000 rubles. Or the official may be disqualified for a period of one to two years.

Checking the 1C database for errors with a 50% discount

Remotely in 1 hour 2000 ₽ 4000 ₽ We will provide a written report on errors. We analyze more than 30 parameters

- Incorrect indication of VAT in documents;

- Errors in mutual settlements (“red” and expanded balances according to settlement documents or agreements on accounts 60, 62, 76.);

- Lack of invoices, checking duplicates;

- Incorrect accounting of inventory items (re-grading, incorrect sequence of receipts and expenses);

- Duplication of elements (items, currencies, counterparties, contracts and accounts, etc.);

- Control of filling out details in documents (counterparties, contracts);

- Control (presence, absence) of movements in documents and others;

- Checking the correctness of contracts in transactions.

More details Order

How to avoid penalties?

To protect yourself from financial risks, the taxpayer needs to monitor the deadlines for submitting reports and the formats for submitting them to the Federal Tax Service.

In the first case, you can maintain a special payment calendar, with the help of which you will control the timing of tax transfers, as well as the size of the required amounts of money.

In the second case, it is advisable to use modern accounting programs that will be updated in a timely manner in accordance with legal requirements. In such a situation, 1C company software is suitable, which allows you to automatically solve the problem of updating reporting documentation formats.

Still have questions? Order a free consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter