Fixed tangible and intangible assets constantly change their residual value. The majority gradually lose it, transferring it to the products produced with their help - through depreciation. But there are also situations when, as a result of modernization or improvement, a particular asset increases in value. In addition, the enterprise renews its material assets, acquiring new ones to replace worn-out ones, and expands their base. One way or another, the value of an enterprise’s main assets is a parameter that is constantly in dynamics, and therefore requires regular analytical and accounting.

It is important that this parameter is in real accordance with the market characteristics of value in order to reflect the true residual value in accounting documents, and not just expressed in certain figures.

In the article we will highlight the essence of the procedure for revaluing the main property assets of an organization, as it occurs in accordance with the latest legislative innovations, and also show how this is done using a specific example.

The essence of revaluation of fixed assets

The property of an enterprise changes its value over time as a result of wear and tear (physical and/or moral). Market processes occur in parallel, changing the price of various assets at different speeds: real estate, equipment, tools, vehicles, etc. The revaluation is carried out precisely in order to bring these data to a single indicator.

The dynamics of the market value of assets is very uneven, it is difficult to assess from the point of view of certain factors, therefore the value of property at any given moment does not reflect its real price in modern market conditions. Hence, significant distortions in various asset parameters are possible:

- cost;

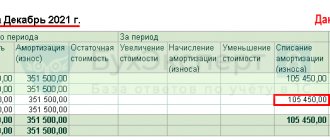

- depreciation charges;

- profitability of funds;

- bases for taxation.

So, revaluation of an organization’s fixed assets is a clarifying measure to bring the residual value of assets to the level of their actual price on the market, that is, establishing the full price that would be needed to restore or renovate them to their original state in modern realities.

FOR EXAMPLE. Two years ago, the company purchased new equipment that cost 50,000 rubles. Over two years, it lost 7 thousand rubles as a result of depreciation. Thus, its residual value according to accounting documents will be 43 thousand rubles. But as a result of certain market processes (the manufacturer released an improved model), the real cost of such equipment of a given level of wear on the market is only 35 thousand rubles. This means that today it can be sold for exactly this amount. It is necessary to carry out a revaluation, as a result of which this equipment will be reflected on the balance sheet at a cost of 35 thousand rubles, which is its real market price, reliable for financial accounting.

Is it necessary to revalue funds?

According to clause 15 of PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, an enterprise has the right, but not the obligation, to revaluate its property. The mandatory nature of this procedure in the Russian Federation was abolished in 1997.

The legislative procedure for the revaluation of property funds is set out in the Tax Code of the Russian Federation in Art. 256 “Depreciable property”, as well as in Art. 257 “The procedure for determining the initial cost of depreciable property.” According to the regulations, the following conditions must be met:

- Having carried out a revaluation once, the company must do this procedure regularly, but not more than once a year (this becomes an obligation);

- the result of the revaluation must be reflected in the documents at the end of the reporting period (before 2011 it was at the beginning);

- objects of revaluation must be owned by the organization;

- the revaluation procedure must be approved in the accounting policy of the organization;

- the beginning of the revaluation process is initiated by an order for the enterprise and the preparation of a list of revalued objects;

- commercial enterprises leave the question of independently conducting revaluation or attracting third-party organizations for this to their own discretion.

Preparatory work before revaluation

In order to carry out a revaluation, the organization must carry out preparatory work - for example, check the presence of the fixed assets themselves that are subject to revaluation.

The decision to conduct a revaluation is formalized in the appropriate administrative document. Its use is mandatory for all services of an economic entity that will be involved in the revaluation.

Revaluation is carried out at current (replacement) cost by indexation or direct recalculation at confirmed market prices.

In order to determine the current (replacement) cost, you must use:

- data on similar products received from manufacturing organizations;

- information on price levels available from statistical bodies, trade inspectorates and organizations;

- information on price levels published in the media and specialized literature;

Important

Revaluation is carried out at current (replacement) cost by indexation or direct recalculation at confirmed market prices (clause 15 of PBU 6/01).

From January 1, 2011, by order of the Ministry of Finance of Russia dated December 24, 2010 No. 186n, changes were made to paragraph 49 of the Regulations on accounting and financial reporting in the Russian Federation (approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n), paragraphs 43 — 47 Instructions No. 91n. According to these innovations, revaluation of fixed assets should be carried out no more than once a year and at the end of the reporting period. Previously, it had to be carried out at the beginning of the reporting period (clause 49 of the “Regulations on accounting and reporting in the Russian Federation”, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

Goals and objectives

In accounting practice, the revaluation of fixed assets of an enterprise is carried out in order to:

- determine the adequate market value of this fixed asset;

- to attract investment partners (for example, for collateral value when lending);

- with prospects for increasing the authorized capital;

- with plans for restructuring;

- to clarify the cost and price of manufactured products (as part of financial analysis);

- to avoid a fall in the market value of assets below the authorized capital (this threatens the liquidation of the company);

- if you need to provide financial statements according to international standards;

- when insuring property (the insurance base is specified);

- the opportunity to reduce property tax (for companies with low profits), since the value of fixed assets on the balance sheet will decrease;

- a decrease in the income tax base (for profitable organizations) as a result of an increase in depreciation charges if the value of fixed assets increases after revaluation.

Accounting policy

After the revaluation, it is necessary to reflect the data in the accounting records, and everything depends on what activities were carried out - revaluation of fixed assets or revaluation.

If the revaluation led to an increase in the value of the object, then the following entries are recorded:

- Dt 01 Kt 83 – increase in property value as a result of the event;

- Dt 83 Kt 02 - an increase in the level of depreciation as a consequence.

If the revaluation increased the value of previously discounted items, then the amount of the revaluation equal to the previous price is charged to other income with the following entries:

- Dt 01 Kt 91.1 – added value within the limits of the previous markdown;

- Dt 91.2 Kt 02 - increase in depreciation in the appropriate amount.

If the amount of revaluation exceeds the amount of depreciation, then entries are made to additional capital:

- Dt 01 Kt 83 – reflection of the new amount exceeding the markdown;

- Dt 83 Kt 02 – the corresponding depreciation position.

If the initial cost decreases, the following is recorded in other results:

- Dt 91.2 Kt 01 – reduction in price for an object not previously assessed;

- Dt 02 Kt 91.1 – reduction of depreciation.

If the price decrease occurred for previously discounted fixed assets, then the amount of additional capital also decreases:

- Dt 83 Kt 01 – reflection of a decrease in amounts within the previously completed markdown;

- Dt 02 Kt 83 – reflection on reducing depreciation rates.

The excess of the depreciation amount over the revaluation amount is expressed in the following entries:

- Dt 91.2 Kt 02 - reflection of the reduced amount in excess of the previous added value;

- Dt 02 Kt 91.1 - reflection of the corresponding indicators for depreciation.

We recommend reading the article: Accounting and tax accounting for depreciation and revaluation of fixed assets, which provides tables with postings and discusses examples.

Impact on financial results

Financial result is an indicator of the enterprise’s activity for the past period.

It includes:

- profit/loss from ordinary activities;

- income or loss of income from other transactions;

- income/expenses resulting from a decrease in profit.

Therefore, data regarding the revaluation of fixed assets is entered into:

- balance sheet;

- profit/loss statement;

- in other accounting documents, information from which is subject to disclosure and provision to interested parties.

However, due to the fact that the data on the amounts of revaluation are attributed to the additional capital of the enterprise, the information obtained is not related to the financial result or the tax base for income tax.

In addition, the tax liability increases, since changes in depreciation rates are not reflected in tax accounting.

According to the process carried out, several options may arise for entering data into the financial result:

- added value and markdown in previous periods are equal - the data is indicated in the financial result as other expenses and is included in it as other income;

- markdown indicators are included in the financial result as other expenses. Next, figures are entered as a reduction in additional capital formed from amounts received as a result of revaluation in past periods;

- the amount of the depreciation prevails over the revaluation indicators in previous years, then the data is entered into the financial result as other expenses.

What kind of property can be revalued?

Revaluation of fixed assets can be carried out in relation to:

- working equipment;

- real estate – buildings and structures, including unfinished ones;

- devices, machines, tools;

- computer technology;

- Vehicle;

- various equipment;

- equipment that is just prepared for installation;

- any fixed assets that are currently not operational, but have not been written off from the balance sheet (on conservation, in reserve, being prepared for write-off, etc.).

conclusions

Recalculation of the cost of fixed assets is carried out in order to establish their real cost indicators at the current moment.

Conducting a revaluation of fixed assets is not a mandatory action for an enterprise, but it is permissible by law, since a legal entity has the right to obtain data regarding the real value of its property in order to determine information regarding the cost of objects as a whole, which are subject to taxation and depreciation.

All indicators entered into the act by the commission as a result of the process must be taken into account in tax and financial accounting, according to the type of revaluation and its results.

Significance of revaluation of fixed assets

The materiality requirement is set out in clause 44 of the “Methodological guidelines for accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated October 13, 2010 No. 91n. It states that the value of revalued fixed assets reflected on the balance sheet must differ significantly from the original value, otherwise there is no point in carrying out a revaluation. The materiality barrier is conditionally set at 5% (according to the order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n), each organization has the right to independently establish it in its accounting policies, enshrining it in local acts.

FOR EXAMPLE. Brigantina LLC decided to revaluate its fixed assets. According to the balance sheet at the end of the previous reporting year, the cost of fixed assets was 2,000,000 rubles. (let's assume that the OS group is homogeneous). After revaluation, the current (replacement) value of the assets amounted to RUB 2,200,000. The difference is 2,200,000 – 2,000,000 = 200,000 rubles, which is 10% recognized as a significant difference, so these changes should be reflected in the balance sheet.

If the replacement cost was 2,020,000 rubles, then the resulting difference would not be considered significant and the decision on revaluation would not be made.

What is needed for revaluation

Before starting the OS revaluation procedure, you need to carry out a number of preparatory activities, such as:

- Checking the availability of fixed assets subject to revaluation. This stage ends with the preparation of a statement with a list of revalued objects.

- Making a decision on revaluation and documenting it. Issuance of an organization order for all services that will take part in this process. The text of the order should reflect the following features:

- objects subject to revaluation;

- revaluation methodology (method, method of reflection on the balance sheet);

- persons responsible for conducting and processing the revaluation.

- Collection and adoption of the necessary related information:

- information on the level of market prices for similar fixed assets (according to statistical data, information from trade inspections, etc.);

- data on market value from the media and special literary sources;

- information about the cost of products from partners and competitors;

- expert opinions.

Methods of revaluation

The law defines two possible methods for changing the book value of fixed assets:

- indexation – the cost of fixed assets is adjusted based on special statistical deflator indices;

- direct recalculation relative to real market prices is used more often, since currently Rosstat does not regularly publish the statistical indices necessary to apply the first method.

NOTE! If this or that fixed asset has already been revalued, then in the future this procedure requires a recalculation at its replacement cost, taking into account the accrued amount of depreciation during the use of this property.

Revaluation results

The result of the revaluation of assets may be an increase or decrease in value compared to the market value. Thus, one of two procedures provided for by law can be carried out on the balance sheet: revaluation or markdown, after which the replacement cost on the balance sheet will be accepted as the original one.

OS revaluation

If the replacement cost turns out to be greater than the residual value, then this fixed asset must be revalued.

The amount by which the value of an asset or group of assets was increased is credited to the company's additional capital. In previous years, the amounts of depreciation charges that constituted a markdown and were included in the balance sheet as “other expenses” should have been equal to the accrued revaluation and included in “other income.”

Balance entries:

- debit 01, credit 83/91.1 – the amount of the initial cost of the fixed asset has been increased;

- debit 83/91.1, credit 02 – the amount of depreciation charges for this fixed asset has been increased.

OS markdown

Produced if, based on the results of indexation or recalculation, the replacement cost is less than the residual value.

This amount is classified as “other expenses”: it reduces the organization’s additional capital, which was formed by revaluing this fixed asset in other periods. The amount by which the excess is obtained constitutes the markdown. It is included in “other expenses”.

Balance transactions:

- debit 83/91.1, credit 01 – the initial cost of the fixed asset has been reduced;

- debit 02, credit 83/91.1 – accrued depreciation of fixed assets has been reduced.

ATTENTION! If, as a result of revaluation, a fixed asset completely loses value and is subject to write-off, its disposal is recorded and reflected as part of “other expenses”. In this case, the amount of its revaluation must be transferred to the organization’s retained earnings.

Revaluation of fixed assets and taxes

Changes in the value of assets of business entities, the accounting of which is one of the tasks of modern accounting, are caused by inflationary processes and other attributes of a market economy. Methods for assessing property, studying theoretical and applied problems related to business assessment as a whole, currently occupy a central place not only in accounting, but also in appraisal activities. However, unlike business valuation, these problems in accounting must be considered in conjunction with the problems of reflecting revaluation transactions in accounting accounts and in financial statements.

The main purpose of the revaluation of fixed assets in accounting is to determine their replacement cost, due to the need to form a source of reproduction of fixed assets, based on the needs and price level for such objects in relation to market conditions at a given time, the reliability of determination of cost indicators, profit and coefficients characterizing efficiency use of fixed assets.

In accordance with the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01 (approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n), a commercial organization can revaluate a group of similar fixed assets no more than once a year (at the beginning of the reporting year). funds at current (replacement) cost by indexation or direct recalculation at documented market prices. When the initial cost of fixed assets changes as a result of their revaluation, the amount of accumulated depreciation and depreciation charges in subsequent reporting periods increases. When deciding on the revaluation of fixed assets of an organization, it should be taken into account that in the future they must be revalued regularly so that the cost of fixed assets at which they are reflected in accounting and reporting does not differ significantly from the current (replacement) cost. The results of the revaluation are taken into account when compiling the balance sheet indicators at the beginning of the reporting year.

In Russian practice until 2002, the current (replacement) cost (taking into account revaluation) of fixed assets for accounting and taxation purposes was assumed to be the same.

With the introduction of Ch. 25 “organizational profit tax” of the Tax Code of the Russian Federation establishes different rules for including revaluation amounts in the value of fixed assets for tax purposes, depending on the date of the revaluation (Article 257 “Procedure for determining the value of depreciable property”):

1) the amount of revaluation of fixed assets, carried out by decision of the taxpayer as of 01/01/2002 and reflected in the accounting records of the taxpayer after 01/01/2002, is accepted for tax purposes in an amount not exceeding 30% of the replacement cost of the corresponding fixed assets items reflected in the accounting records accounting as of 01/01/2001. At the same time, the amount of revaluation as of January 1, 2002, reflected by the taxpayer in 2002, is not recognized as his income (expense) for tax purposes. In a similar manner, a corresponding revaluation of depreciation amounts is accepted;

2) the amounts of revaluations of fixed assets carried out in subsequent reporting (tax) periods are not recognized as income (expense) taken into account for tax purposes and are not accepted when determining the replacement cost of depreciable property and calculating depreciation.

A significant reason for the refusal of many economic entities to carry out revaluation is the fact that the results of revaluation are not taken into account for profit tax purposes. When reflecting the results of revaluation, differences arise in accounting and tax accounting, the accounting methodology of which is a rather complex and labor-intensive process that requires a significant investment of accountants' working time, as well as a certain level of professional knowledge. The differences that arise are reflected in accounting in accordance with the Accounting Regulations “Accounting for Income Tax Calculations” PBU 18/02 (approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n).

If actual expenses according to accounting data exceed expenses recognized in tax accounting, for which restrictions are provided, permanent differences and a permanent tax liability arise.

The amount of permanent tax liability is determined as the product of the permanent difference and the income tax rate (24%). In accounting, a permanent tax liability is reflected in the following entries:

Debit 99 “Profits and losses”, subaccount “Permanent tax liability”

Credit 68 “Calculations with the budget for taxes and fees.”

The experience of recent years has shown that revaluation can be a very effective tool for solving a number of issues, namely:

— taking into account the interests of shareholders (participants) of business companies and the companies themselves as subjects of economic relations;

— formation of increased authorized capital;

— taking into account the interests of business entities in the conditions of state regulation of certain types of prices and tariffs.

The interests of enterprises (as economic entities) and the interests of shareholders (participants) generally do not coincide. Shareholders (participants) are interested in the maximum possible amount of dividends, while the enterprise is interested in the maximum amount of working capital and funds allocated for the modernization of production and for wages, and the general economic indicators of the enterprises’ activities are determined according to accounting data.

In conditions where tax and accounting accounting for depreciation of fixed assets (due to the provisions of Article 257 of the Tax Code of the Russian Federation) do not coincide, shareholders can receive a relatively larger amount of dividends when the tax and accounting values of fixed assets converge, but the enterprises themselves may find themselves financially “bleeded.” It is through revaluation that it is possible to find a balanced solution that satisfies the interests of shareholders (participants) and enterprises as economic entities.

Revaluation of fixed assets in Russian accounting is carried out taking into account depreciation accrued on the date of revaluation, i.e. both the amounts recorded on account 01 “Fixed assets” and the amounts recorded on account 02 “Depreciation of fixed assets” are revalued. As a result of revaluation, the residual value of fixed assets is actually revalued, which can be revalued (increased) or discounted (decreased) compared to the valuation at the date of revaluation.

The results of the revaluation of fixed assets according to Russian rules are reflected in accounting and reporting, depending on whether the revaluation of the fixed asset was previously carried out or this revaluation is being carried out for the first time.

So, if the first revaluation is carried out, as a result of which the fixed asset is revalued or its value is increased, then the amount of the revaluation is reflected in the debit of account 01 “Fixed assets” to the credit of account 83 “Additional capital”. Additional accrual of depreciation amounts for the revaluation object is recorded in the accounting entry: debit to account 83 “Additional capital” credit to account 02 “Depreciation of fixed assets”. As a result, the increase in the value of fixed assets from revaluation is reflected as the balance of the subaccount of the same name, which is opened to account 83 “Additional capital”. If the result of the first revaluation is a markdown of fixed assets, then the amount of the markdown is shown in correspondence: debit of account 84 “Retained earnings (uncovered loss)” credit of account 01 “Fixed assets” with simultaneous adjustment of the amounts of accrued depreciation on the credit of this account and on the debit of account 02 "Depreciation of fixed assets."

The reflection of the results of subsequent revaluations depends on how the previously made revaluation was reflected. For example, if, as a result of the second revaluation, the value of fixed assets increases, as during the first revaluation, then these operations are reflected in the increase in additional capital with the simultaneous registration of entries for additional depreciation amounts on revalued fixed assets. If, as a result of the second revaluation, a markdown is made, then the following entries are made:

1) Dt sch. 83 “Additional capital” Set of accounts. 01 “Fixed assets” - by the amount of the markdown within the limits of the previous revaluation of fixed assets;

2) Dt sch. 84 “Retained earnings (uncovered loss)” Set of accounts. 01 “Fixed assets” - by the amount of excess of the subsequent markdown over the previous markdown.

If, as a result of the second revaluation, a write-down of fixed assets is made again, then its results are also written off, as in the first case, to the debit of account 84 in correspondence with account 01 - for the amount of the markdown with simultaneous adjustment of the amount of depreciation on the credit of the specified account and the debit of the account 02. If as a result of the second revaluation there is an increase in the value of the revalued object, then first the amounts previously reflected on account 84 are written off, then on account 83 the excess of the subsequent revaluation over the amount of the previous devaluation is shown as an increase in additional capital.

The procedure for recording subsequent revaluations (third, fourth, etc.) is carried out in the same way, depending on how the amounts of previously made revaluations are reflected in the accounting accounts.

Thus, in Russian accounting, there are two possible options for reflecting the results of revaluation of fixed assets in the accounting accounts: in the additional capital account and in the retained earnings account (uncovered loss).

Analysis of the above accounting entries for recording the results of revaluation allows us to conclude that in account 83 “Additional capital” these results are reflected in the following cases:

1) when revaluing fixed assets based on the results of the first revaluation;

2) when revaluing fixed assets based on the results of a subsequent revaluation, but provided that the previous writedown of fixed assets was not reflected in account 84 “Retained earnings (uncovered loss)”;

3) when depreciating fixed assets, but provided that in the previous reporting period additional capital was formed due to the revaluation of fixed assets.

The results of the revaluation are reflected in account 84 “Retained earnings (uncovered loss)”:

1) if fixed assets are discounted during the first revaluation of fixed assets;

2) if fixed assets are discounted, but based on the results of previous revaluations, additional capital has not been formed due to the revaluation of fixed assets;

3) if fixed assets are overvalued, but based on the results of previous revaluations, fixed assets were devalued, which is reflected in account 84 “Retained earnings (uncovered loss).”

Tax consequences of revaluation

Revaluation directly affects only property taxes. Let us remind you that the Tax Code for this tax recognizes accounting indicators. According to Art. 374 of the Tax Code for Russian organizations, the object of taxation is movable and immovable property (including property transferred for temporary possession, use, disposal or trust management contributed to joint activities), accounted for on the balance sheet as fixed assets in accordance with the established accounting procedure . The maintenance procedure refers to PBU 6/01.

Clause 15 of PBU 6/01 establishes that a commercial organization may, no more than once a year (at the beginning of the reporting year), revalue groups of similar fixed assets at current (replacement) cost by indexation or direct recalculation at documented market prices. Revaluation of an object of fixed assets is carried out by recalculating its original cost or current (replacement) cost, if this object was revalued earlier, and the amount of depreciation accrued for the entire period of use of the object. Separately, it should be noted that the results of the revaluation of fixed assets carried out as of the 1st day of the reporting year are subject to reflection in accounting separately, are not included in the financial statements of the previous accounting year and are accepted when compiling the balance sheet data at the beginning of the reporting year.

In the Tax Code, paragraph 4 of Art. 376 establishes that the average annual (average) value of property recognized as an object of taxation for the tax (reporting) period is determined as the quotient of dividing the amount obtained by adding the values of the residual value of the property on the 1st day of each month of the tax (reporting) period and 1 -th day of the month following the tax (reporting) period, by the number of months in the tax (reporting) period, increased by one.

This provision of the Tax Code has given rise to a number of conflicts:

1) if an enterprise has revalued fixed assets, then the results of the revaluation are “not visible” in the annual reporting, i.e. accounting statements (for the tax period) as the only source of information for monitoring the accrual of property taxes cannot contain the results of revaluation;

2) if you follow the norms of the already mentioned Art. 376 in its relationship with the provisions of paragraph 1 of Art. 374 and paragraph 1 of Art. 375 of the Tax Code, then when determining the average annual value of property for a tax period, the residual value of property on the 1st day of the month following the tax period should be taken into account in the value in which it was formed in accordance with the established accounting procedure for the corresponding date (i.e. e. on January 1 of the calendar year following the tax period).

Thus, a direct reading of the norms of Ch. 30 of the Tax Code obliges an enterprise, for the purposes of calculating the tax base for the past tax period, to use indicators that will be included in accounting only in the next period. This is exactly how the Russian Ministry of Finance interprets the situation in its Letter dated March 22, 2006 N 03-06-01-04/69.

However, in our opinion, this position is more than controversial. As we have already indicated, revaluations have been made before. The government adopted a procedure for calculating the tax base for the corporate property tax, according to which the results of the revaluation of fixed assets as of January 1 of the tax period for this tax were not taken into account when calculating the corporate property tax for the previous tax period. It is interesting that the Ministry of Finance in the already mentioned Letter dated March 22, 2006 N 03-06-01-04/69 states that the rules for accounting for revaluation were regulated, in particular, by Resolutions of the Government of the Russian Federation dated November 25, 1995 N 1148 “On the revaluation of fixed assets” ( clause 7), dated December 7, 1996 N 1442 “On the revaluation of fixed assets in 1997” (clause 5), were applied until the Law “On Enterprise Property Tax” was declared invalid. However, this statement is not supported by anything. All these Decrees are considered to be in full force today.

Moreover, in other clarifications regarding the taxation of property (fixed assets that have been revalued), the Ministry of Finance takes the opposite point of view (see, for example, Letter dated May 19, 2004 N 04-05-06/57).

Credit organizations occupy a separate position. Let us remind you that the accounting rules for them are established by the Central Bank of the Russian Federation. In particular, Appendix No. 10 to the Rules for maintaining accounting records in credit institutions located on the territory of the Russian Federation dated December 5, 2002 No. 205-P stipulates that the results of the revaluation of fixed assets as of January 1 of the reporting year are subject to reflection in accounting as turnover for January. If it is impossible to reflect within this period due to certain reasons, the deadline for reflecting the revaluation is the last working day of March of the reporting year. In this case, depreciation accrual from January 1 of the reporting year should be based on the replacement cost of fixed assets, taking into account the revaluation (clause 2.8.5).

This means that banks that have revalued their fixed assets, unlike business companies, include the results of the revaluation in the turnover of the next year and are freed from the need to pay property tax for the past tax period taking into account the revaluation.

All this taken together shows that the wording of Ch. 30 of the Tax Code contain elements of uncertainty. And the Ministry of Finance itself, in the above-mentioned Letter dated March 22, 2006 N 03-06-01-04/69, essentially agrees with this. Experts note, given that the tax period for corporate property tax is a calendar year, and in accordance with the established accounting procedure, the results of the revaluation of fixed assets carried out as of the 1st day of the reporting year are subject to reflection in accounting separately and are not included in the data financial statements of the previous accounting year, but are taken when compiling the balance sheet data at the beginning of the reporting year, the issue of clarifying the procedure for determining the average annual value of property deserves attention and requires legislative regulation.

It is worth noting that paragraph 46 of Art. 1 of Federal Law No. 216-FZ in paragraph 4 of Art. 376 of Part Two of the Tax Code of the Russian Federation (hereinafter referred to as the Code), amendments have been made according to which the average annual value of property recognized as an object of taxation for the tax period is determined as the quotient of dividing the amount obtained by adding the residual value of the property on the 1st day of each month tax period and the last date of the tax period, by the number of months in the tax period, increased by one.

Provided for in paragraph 4 of Art. 376 of the Code, a new procedure for calculating the average annual value of property is established to determine the tax base for the tax period.

The provisions of paragraph 46 of Art. 1 of Federal Law No. 216-FZ, published in Rossiyskaya Gazeta on August 1, 2007, come into force on January 1, 2008 and, therefore, apply to the tax period following 2007, i.e. for 2008 and subsequent tax periods.

In conclusion, let's make a few conclusions:

1. The current legislation contains uncertainty regarding the results of accounting for the revaluation of fixed assets for the purposes of calculating property tax. From 01/01/08 this uncertainty in the legislation has been eliminated.

2. Taxpayers (business entities, credit organizations and budgetary organizations) are actually placed in unequal conditions for taxation of property taxes based on the results of revaluation.

3. As a result of revaluation, differences are formed between accounting and tax accounting indicators. The differences that arise are reflected in accounting in accordance with the Accounting Regulations “Accounting for Income Tax Calculations” PBU 18/02 (approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n). These differences must be taken into account as permanent with the formation of PNO or PNA.

Author: Auditor of the General Audit and Consulting Department of Audit MSK LLC

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Impact on tax accounting

From a tax point of view, neither revaluation nor depreciation of fixed assets affects the amount of income or expenses of the organization, since the funds were not actually spent or acquired. Therefore, the income tax on the results of the revaluation will not change. This is reflected in the Tax Code of the Russian Federation and in letters of the Ministry of Finance of Russia dated July 8, 2011 No. 03-03-06/1/412, dated September 8, 2011 No. 03-03-06/1/544.

ATTENTION! The Tax Code provides for changes in the value of fixed assets only in cases clearly defined by law, such as reconstruction, modernization, liquidation, etc. (Part 2 of Article 257 of the Tax Code of the Russian Federation). Revaluation is not included in this list.

However, the revaluation will affect the tax base calculated for paying property taxes.

Therefore, in accounting and tax accounting, the amount of depreciation for a given fixed asset or homogeneous group will be reflected differently. Such a permanent difference causes the appearance of a permanent tax asset (clause 7 of PBU 18/02).

Reflection in financial statements

When forming the Balance Sheet indicators for the reporting year, reflect fixed assets taking into account the results of the revaluation of fixed assets on line 1130 “Fixed Assets”. In addition, the results of the revaluation are reflected in the balance sheet on line 1340 “Revaluation of non-current assets”. In this case, the amount of additional capital is reflected in the balance sheet without taking into account revaluation on line 1350 “Additional capital (without revaluation)”.

The results of the revaluation must also be reflected in the following forms of financial statements:

- according to the lines “Increase in capital” and “Decrease in capital” (columns 4 and 6) of the Statement of Changes in Capital;

- in the Notes to the Balance Sheet and the Statement of Financial Results.

Situation: is it possible to write off losses from previous years using additional capital formed as a result of the revaluation of fixed assets?

No you can not.

This is due to the fact that due to the additional capital formed during the revaluation of a fixed asset, the amounts of its subsequent markdowns are written off (paragraph 6 of clause 15 of PBU 6/01, Instructions for the chart of accounts (account 83)). If the additional capital is written off to pay off losses from previous years, then the methodology for reflecting the results of revaluation of fixed assets in accounting will be violated. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated July 21, 2000 No. 04-02-05/2.

Attention: writing off losses from previous years using additional capital formed as a result of the revaluation of fixed assets may entail administrative liability.

In practice, in order to make the Balance Sheet more attractive, the founders of the organization decide to allocate additional capital generated through revaluations of fixed assets to pay off losses of previous years. However, this may lead to a gross violation of the rules for presenting financial statements. A gross violation of the rules for presenting financial statements is a distortion of any line of the financial statements by at least 10 percent. Therefore, if the value of additional capital in the financial statements is distorted by at least 10 percent, the court may fine the head of the organization or the chief accountant in the amount of 2,000 to 3,000 rubles. (Article 15.11, Part 1 of Article 23.1 of the Code of Administrative Offenses of the Russian Federation).

The procedure for reflecting the results of revaluation of a fixed asset in tax accounting depends on the taxation system that the organization applies.

Revaluation factor

This indicator represents the ratio of the real (replacement) cost of the operating system to the original one.

Sometimes the revaluation coefficient is called a deflator index developed by Rosstat to carry out revaluation using the indexation method. As part of this method, the initial cost of fixed assets had to be multiplied by the coefficient established by Rosstat for this group, valid for the required period. These coefficients were regularly published by Rosstat specifically for the needs of revaluation. Rosstat developed them based on the prices of manufacturing companies, and for real estate - on the basis of prices for construction and installation work in various regions.

Today, the indexation method has not been officially canceled, but in fact it has lost force, since Rosstat has stopped publishing the regular dynamics of statistical deflator indices. An enterprise is not prohibited from using indexation during revaluation, but it must establish the index either independently or by contacting Rosstat for a fee. Therefore, in practice, in modern revaluation of fixed assets, the direct recalculation method is almost universally used.

IMPORTANT INFORMATION! Since, from the point of view of the law, there is a choice between the method of indexation and direct recalculation when revaluing fixed assets, it must be reflected in the accounting policies of a particular organization.

How to recalculate the cost of an operating system - procedure

The revaluation process must be carefully prepared:

- First of all, this is the study of information about fixed assets - what initial cost is subject to adjustment.

- The commission is assembled on the basis of the order of the head.

- The range of fixed assets subject to revaluation is determined.

- The process itself is carried out according to the chosen method.

- The results obtained are then reflected in the company's accounting.

Methods

Today, due to changes in legislation, only one recount option is used - direct recalculation.

In this case, information is used as a base from the following sources:

- data from the database of manufacturers of similar objects;

- data regarding price levels from government or statistical sources;

- expert assessment of independent specialists.

The abolition of the index deflator established by Decree No. 315 of 1996 occurred as a result of the adoption of Decree of the Government of the Russian Federation No. 121 of 2002, which abolished the previous version.

But new indices were not installed, so the index method has lost its relevance, although it is used in some companies.

Documenting

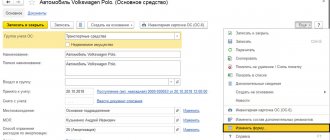

According to the algorithm, the revaluation of fixed assets should be carried out on the basis of an order from the manager, and a list of objects with a brief description should also be generated - the date of acquisition, the date of acceptance for accounting and an indication of the current price.

In addition, other documents on this object are being studied. An accounting certificate for the revaluation is generated, which indicates the relevance of the event.

Based on the results of the inspection, a report on the work done is drawn up, indicating the price indicated by the commission.

New data is also recorded in the OS-6 inventory card for the facility.

Sample order

The manager's order is formed taking into account the requirements for the preparation of such documentation and its sample is fixed in the accounting policy of the organization.

The structure of the document is as follows:

- Name of the organization;

- title of the document with justification, for example, “On the revaluation of fixed assets”;

- date and document number;

- then the main part of the manager’s order is indicated, where the reason for the recalculation is initially indicated - “Due to a significant change in prices, I order a revaluation of fixed assets for real estate”;

- after which the list can be indicated in a tabular version - the name of the objects, inventory number and cost during the period of acceptance for production;

- Next, you should indicate what cost should be taken for the initial, for example, cadastral value;

- after this, responsible persons are appointed, and responsibility for each stage may be assigned to different employees.

At the end of the document there must be signatures of the manager and persons related to the revaluation process.

order for revaluation of fixed assets – word.