Definition of concepts

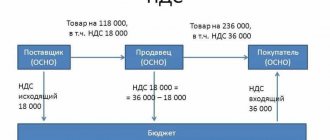

Current accounts are opened by a bank or other financial organization for conducting monetary transactions. The balance of such an account corresponds to the amount of cash balance within which the owner can make payments on his obligations.

This type of account is not used for savings, savings or other passive income. And the amount stored in the current account is available to the owner upon request. This type of account is often also referred to as demand accounts or current accounts .

Current accounts are opened for both entrepreneurs and legal companies, as well as individuals. One client may have several current accounts, for example in different currencies or in different banks. In modern banking practice, in order to distinguish between concepts and avoid confusion, the rule has been adopted that accounts issued to legal entities and individual entrepreneurs are called settlement accounts, and accounts issued to individuals are called current accounts.

However, the division is rather arbitrary and terms are often confused. The concept of “current account of an individual” is most often found in banking service agreements. And also in other legal documentation regulating the relationship between individuals and credit institutions.

Personal accounts in banking practice refer to analytical accounting records. These can be internal bank accounts to reflect the client’s transactions with other individuals or legal entities, or settlements with the bank itself. In addition to financial organizations, personal accounts are opened by:

- Insurance companies;

- pension funds;

- tax inspectorates;

- utilities;

- government departments;

- cellular operators;

- management companies;

- providers.

Personal accounts can be opened by any other institutions that require internal accounting. They are assigned to both individuals and legal companies.

What is a Personal Account

A personal account is a kind of account that is assigned to everyone who enters into an agreement with a financial institution to provide such services. It can contain from 14 to 20 numeric characters (maybe 11). Most often used by ordinary citizens, some entrepreneurs and organizations.

Personal accounts are very convenient to use for transactions involving particularly large sums of money, for example, the sale of real estate.

To open a personal account, you also need to contact the bank, but opening it is somewhat simpler and fewer documents are required. This type of account is never used to conduct business. Its purpose is to move funds when conducting transactions for large amounts or storing and increasing capital.

The term personal account has a fairly broad meaning; it should be understood as:

- Personal accounts are issued for employees to calculate wages;

- This type of account can be issued on demand for one-time or multiple use in order to receive non-cash funds;

- A personal account is issued by tax service specialists to pay tax fees;

- Mobile operators open personal accounts for individuals.

Personal accounts can be registered not only by individuals, but also by legal entities. However, it is not advisable to use them to calculate or receive transfers from counterparties, as this may give rise to inspection by government regulatory authorities.

Appearance of personal and current accounts

The intersection of the concepts of personal and current account and their confusion often occurs for another reason. The 20 digits of the current account, which financial institutions open for all their clients, include 7 digits of the intrabank personal account. This procedure is established by the rules of accounting in financial and credit companies.

The bank account number from the 14th to the 20th digit is called internal personal account . If a financial institution reaches the limit of 20-digit numbers, then it has the right to use 25-digit numbers. In this case, the personal account will consist not of 7, but of 12 digits.

The number of digits in the personal accounts of other companies is established by internal regulations or by order of the ministry or department to which they are subordinate. These can be numbers consisting only of numbers, letters, symbols, or a mixed version.

What is an account for individual entrepreneurs and organizations?

Essentially, this is a client’s bank account, which has an individual number consisting of 20 digits. The numbers are assigned for a reason, it’s a kind of code:

- the first three tell who opened the account. If this is an individual entrepreneur, the number starts from 408, if an organization - from 420 to 422;

- the next two reflect the type of activity of the banking client;

- This is followed by information about the currency - these are the following three numbers: 810 - rubles, 840 - dollars, 978 - euros;

- then the check number is indicated;

- next in line is the number of the bank branch where the agreement is concluded;

- the number ends with 6 digits - this is the client’s personal code (number) in this financial institution.

To perform standard transactions, one account number is not enough. It is included in the general details, which also include the correspondent bank account and its BIC. This data helps to ensure the accuracy of the transaction, in other words, to avoid errors.

Personal account: to whom it is opened and who uses it

Often, to simplify terms, a personal bank account means any current account of an individual that is opened for him in a financial company. But as explained above, every bank account already contains a personal ID. Therefore, both entrepreneurs and law firms have such a part. It is incorrect to say that all personal accounts belong only to individuals.

In addition, a personal account can be called a combination of numbers with which an individual or company gains access to an account in the Internet bank or Client Bank. This parameter has nothing to do with the current or current account number at all.

Sometimes a card account is used as a synonym for a personal account, which is opened to an individual when issuing a plastic card. In fact, the concept of a current or current account is much closer to a card account than a personal account. In order not to get completely confused, remember that the card number is the numbers written on it. They do not depend on either the personal number or the current account number. This is a completely different combination of numbers. Find out how to find it and what to use it for.

conclusions

This article covered in detail the issue of the difference between a personal account, current and settlement. We have figured out the definitions of these concepts. In short, a RS is a RS of a legal entity or individual entrepreneur. It is designed for making payments as part of doing business. Using the account, the manager can hand over the proceeds to the bank to ensure its safety. It also accepts non-cash payments for goods or services from partners or intermediaries. Another purpose is to pay wages to employees on cards. Also, with the help of the RS, tax deductions and contributions to the Pension Fund of the Russian Federation are made. Answering the question, what is the difference between a current and personal account, we can say that mainly it is the possibility of using the first one only for conducting activities with the aim of obtaining commercial benefits.

MARINE BANK offers to use trade acquiring services. Accept payments for goods and services by bank cards.

LP is an account that is registered also by individuals. It is used to keep track of expenses. They display data on all monetary and credit transactions with clients of certain companies. These can be not only financial structures, but also social, tax and other government organizations.

This account can be used for several purposes. First of all, this is the repayment of debts and the deduction of interest on them. Another purpose is transactions for companies and individual entrepreneurs. It also stores your own money.

Not everyone knows the difference between a personal account and a bank account. In fact, it's simple. The latter refers to all PCs. In this case, the drug may be of a different type. For example, tax.

One of the main questions is a list of differences between the two terms given in the article. You need to remember it in order to better navigate the topic described. First of all, this is the place of registration. A settlement account can only be opened at a bank. Other organizations, according to current legislation, cannot carry out this procedure. As mentioned earlier, it is impossible for company management to use a current account to conduct business activities. If suspicious activity is detected, significant restrictions will be placed on the account.

It’s also worth remembering how a personal account differs from a current account. Almost every person has the latter nowadays. It is linked to a bank card and used for non-cash transactions.

RKO Account for business Account for LLC Account for individual entrepreneur Current account

For whom current accounts are opened?

As the term implies, current accounts are purposefully drawn up for transactions of cash receipts and expenditures. They are used for deposits from other companies, tax payments, settlements with counterparties and suppliers, cash issuance on a legal basis, receipt of revenue and other operations. Not a single entrepreneur or enterprise in the Russian Federation can do without a current account.

If a company does not open a bank account, it will not be able to carry out economic activities, pay bills or receive payments from other clients. Or the company's activity will be severely limited.

Individuals may not open current or current accounts, but in this case they will not be able to make any non-cash transactions. They will not be able to receive a plastic card, pay wages into their account, or connect to remote banking services. Therefore, if an employee’s salary is transferred non-cash or an individual issues a card on his own initiative, then the bank will first open an account. The employer’s personal payments and other income and expense transactions will go through it.

Can a personal account be used for commercial payments?

Organizations or individual entrepreneurs sometimes open personal accounts for the purpose of carrying out commercial payments on them. The main advantages of such calculations are as follows:

- The cost of servicing a personal account is lower than a settlement account.

- On a personal account, as a rule, there are no restrictions on the monetary limit for settlements within one day. In addition, there are also no restrictions on balances on personal accounts. It can be reduced to zero, and in certain cases this can be very important for the company.

Despite all the advantages, when using a company’s personal account for commercial purposes, the following troubles may arise:

- When a counterparty transfers funds to a personal account, the transaction will be refused (if the counterparty indicates that he is an individual entrepreneur).

- The counterparty may completely refuse to make a payment to a personal account if the company asks not to indicate that he is an individual entrepreneur.

The legislation of the Russian Federation does not allow banking structures to monitor the financial flows of companies on their personal accounts. But bank representatives usually act differently. When drawing up an agreement with a legal entity or entrepreneur to open a personal account with a bank, the bank establishes the rules and procedure for its use. If these rules are violated, the bank declines responsibility and in this case only the account owner bears the penalty.

Documents for opening an account

To open a current account for an individual, it is enough to present a passport of a citizen of the Russian Federation or a document replacing it. Most often, banks issue accounts for free, but some may charge internal fees. A frequent customer's current account can have a debit card linked to it, which the customer will use to make payments. And also connect remote services - online banking and mobile application.

Clients with current accounts are entitled to use any other banking products. For example, credit cards, consumer loans, installment cards, SMS banking, receipt and expense notifications, participation in loyalty programs.

The list of transactions on a current account for individual entrepreneurs and legal entities is strictly regulated. For example, they do not have the right to withdraw cash without supporting documents or take funds for travel expenses without proper documentation. Banks can also connect remote services or corporate cards to the current account of an entrepreneur or LLC for the convenience of non-cash payments by clients.

To open a current account, entrepreneurs and legal entities are required to provide the bank with a certain list of documents:

| Individual entrepreneurs | Legal entities of any form of ownership: enterprises, companies, organizations, institutions |

|

|

Based on the listed documents for individual entrepreneurs and legal entities, banks issue cards for sample signatures and seal impressions. If an entrepreneur or company carries out licensed activities, then when opening a current account they provide bank employees with originals of valid licenses.

Comparison

Where can I open

? There is no commission when opening a personal account. Opening of another type is carried out according to bank tariffs. Also, to open one or another account, a different package of documents is required. This may also make them different.

What documents are required to open a current account:

- statement;

- passport;

- constituent documents;

- extract from the Unified State Register of Legal Entities;

- card with a sample signature and seal.

Additional Information! For a personal account, you only need a passport and an application for opening.

Differences between current and personal accounts

The main differences between personal and current accounts are summarized in the table:

| Description | Calculated | Facial |

| Where is it issued? | At a financial institution. | In any company that requires analytical accounting |

| Purpose of discovery | Carrying out calculations. | For the convenience of recording information and the number of system users. |

| Application area | Banks and other financial institutions. | They are used in banks and many other companies that require accounting for both individuals and legal entities. |

| Uniqueness | A current account is a unique combination of numbers that is never repeated anywhere. Even if one client has accounts opened in different banks, each will have its own current account. | Within one company, each user is assigned a unique personal account. But, for example, data from a cellular operator and a housing and communal services company with the same combination of numbers may belong to different persons in different parts of the country. |

| List of documents | Published on the website of a financial company. You can also find it out from the service specialist when contacting or by calling the hotline number. | Passport or any other procedure established by the company’s internal regulations. |

| Opening Initiative | According to the future account owner. | At the request of the client or without it. For example, when a personal account is assigned to an apartment or subscriber. Automatic registration in the system is possible. |

Opening a current account is a right, not an obligation, for individuals and legal entities. However, legal entities have more restrictions when carrying out activities without a current account.

Payment between an individual entrepreneur and a company within the framework of one agreement can be made in cash if the total amount does not exceed 100 thousand Russian rubles, otherwise a current account is required. In addition, the cash that is allowed to be kept in the organization cannot exceed the established limit. Excess proceeds must be deposited in the bank. An additional reason for opening a current account is tax payments; the Ministry of Finance of the Russian Federation obliges them to be made in non-cash form.

5 / 5 ( 2 voices)

about the author

Klavdiya Treskova is an expert in the field of financial literacy and investment. Higher education in economics. More than 15 years of experience in banking. He regularly improves his qualifications and takes courses in finance and investments, which is confirmed by certificates from the Bank of Russia, the Association for the Development of Financial Literacy, Netology and other educational platforms. Collaborates with Sravni.ru, Tinkoff Investments, GPB Investments and other financial publications. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Bank account opening process

When it became clear what current, personal and current accounts are, what are the differences between them and the common features present, it is necessary to understand the procedure for opening the first one. This process differs depending on the applicant. More details below.

For the company

To open this type of account for an organization or company, you need to collect a complete set of documents and submit them to the bank along with the application. The exact list is in the next section.

For individuals

First of all, a person submits a written application to the institution where the MS will be opened. Opening a personal current account is carried out within the framework of Instruction 153-I of the Bank of Russia dated May 30, 2014.

There is one important limitation that is imposed on this type of account. The only exceptions are transactions for paying taxes and other mandatory transactions.

Comments: 1

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Image

12/03/2021 at 10:21 am Claudia, I fell in love with you at first sight, especially after reading all your articles with an interpretation of what bills are and what they are used with. It's a pity that you are not my wife