Normative base

Federal Law of July 25, 2002 No. 115-FZ “On the Legal Status of Foreign Citizens in the Russian Federation”

Federal Law of July 18, 2006 No. 109-FZ “On Migration Registration of Foreign Citizens and Stateless Persons in the Russian Federation”

Decree of the Government of the Russian Federation of January 15, 2007 No. 9 “On the procedure for carrying out migration registration of foreign citizens and stateless persons in the Russian Federation”

Decree of the Government of the Russian Federation of September 30, 2019 No. 1271 “On establishing for 2022 the permissible share of foreign workers employed by business entities carrying out certain types of economic activities on the territory of the Russian Federation”

Peculiarities of work of foreign citizens in the Russian Federation

The following features of employment of foreign citizens (IG) are identified:

- An IG must be legally located in the Russian Federation and have a work permit or a patent.

- To attract foreign citizens arriving on a visa basis, the employer needs a special permit and quota. Highly qualified specialists are accepted outside the quota.

- The maximum allowable proportion of foreign workers in some industries is regulated by the state.

- It is necessary to notify the labor migration authorities of the Ministry of Internal Affairs of the region about the involvement of IGs

There are categories for which there are some concessions. These include refugees, foreigners permanently residing in Russia, citizens of member countries of the EAEU (Eurasian Economic Union), including Kazakhstan.

The main difference concerns the need to obtain permits to work in the Russian Federation. The provisions of Art. 96 - 98 of the international treaty on the creation of the EAEU established equal labor rights for citizens of the participating countries. Therefore, the answer to the question whether citizens of Kazakhstan need a patent to work is no, Kazakhs have the right to work in the Russian Federation without any restrictions and execution of additional documents.

In turn, employers are allowed to attract such specialists without taking into account measures to protect the national labor market, i.e. they do not need to issue permits, obtain quotas and comply with the maximum share of foreign workers.

What is the essence of simplified employment for citizens of Kazakhstan?

To understand the difference between hiring a citizen from an EEC country and another foreigner, just look at the data in the table:

| Kazakhstan and other treaty countries | Citizens of other countries | |

| Patent or work permit | Not required | Necessarily |

| Invitation to enter | No need. The employer simply notifies the migration department of the Ministry of Internal Affairs about the employment of a foreigner | In most cases it is necessary |

| Confirmation of educational documents | Not necessary, with the exception of such professions as a doctor, pharmacist, lawyer or teacher | Necessary |

Citizens of Kazakhstan who arrived for employment in the Russian Federation can extend their migration card for the entire duration of the employment contract, but not more than 12 months. They also need to register for migration only if the period of their stay in Russia exceeds 30 days.

Nuances in the employment contract

The specifics of concluding employment contracts with foreign workers are listed in Art. Labor Code of the Russian Federation:

- Duration of the contract. Indefinite contracts are concluded with foreigners (including citizens of Kazakhstan) if there are no grounds for their urgency - this rule is directly outlined by the Labor Code of the Russian Federation. In practice, many employers try to enter into contracts with a limited duration on their own initiative or, “at the instigation” of OMV inspectors who are incompetent in labor law, for the duration of the work permit or registration. We remind you that the limited period of validity of permits, as well as registration, is not the basis for the urgency of TD (Article 59 of the Labor Code of the Russian Federation).

- Information about work permit or patent. Often, when employing citizens of the Republic of Kazakhstan, the employer wonders whether citizens of Kazakhstan need a work permit or other similar documents. The answer is contained in the agreement on the EAEU: citizens of the participating countries, which include Kazakhstan, are allowed to work in Russia without additional conditions; they only need to have a passport and a migration card confirming the legality of their stay. It would be useful to point out this norm in the TD.

- Information about the medical policy. Information about the conditions for the provision of medical care must be reflected in the employment contract. These are the details of the VHI policy, the agreement on the provision of medical care to employees between the employing organization and the medical institution. If the details of such documents change or the employee receives a compulsory medical insurance policy, an additional agreement is drawn up, where the changed data is recorded.

- Contract language. Currently, it is almost impossible to meet a citizen of Kazakhstan who does not speak Russian, but if this happens, you must take care of translating the contract into a language understandable to a foreigner when signing it, or initially draw it up in two languages.

- Employee address. For temporarily staying foreign workers, the address of migration registration is used as the actual place of residence, at which the foreigner must reside. They recognize him from the tear-off part of the arrival notice, which is in the hands of ISIS. For temporary and permanent residents - the address of their permanent or temporary place of residence. Information about it is entered into the passport in the form of a stamp or issued in the form of a certificate. If accommodation is provided by the employer, it also doesn’t hurt to note this.

Otherwise, an employment contract with a citizen of Kazakhstan is no different from that with a citizen of the Russian Federation.

Hiring citizens from Kazakhstan in 2022

The main criteria for hiring a citizen of Kazakhstan on the territory of the Russian Federation:

- when entering the Russian Federation for the purpose of carrying out work activities (i.e. if the purpose of entry is emphasized on the migration card - “work”), registration of patents is NOT REQUIRED. An employment contract is concluded with a person (for this you will need a passport, a migration card, a notice of migration registration (registration)), and the employer is obliged to notify the Main Directorate for Migration of the Ministry of Internal Affairs of Russia about the admission of a foreign citizen, who, in turn, notify the tax service.

- The period of temporary stay of citizens of Kazakhstan who entered to carry out work activities is determined by the duration of the employment contract concluded with the employer in the Russian Federation. The same period applies to members of his family!

- In case of early termination of an employment contract (after the expiration of 90 days from the date of entry into the Russian Federation), a citizen of Kazakhstan has the right, WITHOUT LEAVING, to enter into a new contract within 15 days.

- Citizens of Kazakhstan who entered the Russian Federation for the purpose of carrying out work activities, as well as members of their families, are exempt from the obligation to register for migration - within 30 DAYS from the date of entry. Next, you need to complete migration registration (registration).

- When entering the Russian Federation for a period of UP TO 30 DAYS, citizens of Kazakhstan, if they have a document allowing the affixing of marks from the Border Guard Service of the Russian Federation about crossing the border, are exempt from the obligation to issue a migration card.

- Citizens of Kazakhstan entering the Russian Federation WITHOUT THE PURPOSE OF EMPLOYMENT ACTIVITY have the right to stay in the Russian Federation for no more than 90 days. After their expiration, you must leave the Russian Federation. This rule does not apply to persons studying full-time in educational institutions of the Russian Federation, as well as persons who have submitted documents for a temporary residence permit, or in other cases who have grounds for extending their stay on a general basis, in accordance with Art. 5 Federal Law-115 “On the legal status of foreign citizens in the Russian Federation”

If you are interested in employing foreign citizens of Kazakhstan in a company, in order not to violate Russian legislation, you need to familiarize yourself with the requirements for registration of individuals arriving from neighboring countries.

First, let’s define which category of foreigners Kazakhs belong to. The fact is that citizens of Kazakhstan are equated with Russians. In fact, this means that, according to the current legislation, they are not subject to restrictions regarding the protection of the national labor market.

- You do not need to obtain an official permit to work in Russia.

- Simplifications also apply to the actions of the employer - the employer may not notify government agencies and relevant authorities that Kazakhs are being hired, the same applies to the procedure for dismissing citizens of Kazakhstan.

- To help you better understand the feasibility of employing people living in neighboring states, it will not be superfluous to know that citizens of other states are required to register for migration within 7 days after entering the Russian Federation. For citizens of Kazakhstan, this norm has been extended to 1 calendar month, (30 days) after this period, the individual becomes liable before the law, and these obligations are shared between the Kazakh and the employer.

As statistics indicate, in 2022 the influx of Kazakh citizens wishing to work in Russia has decreased compared to last year. Despite the economic and political crisis, the Russian Federation is still considered a country where the economy, despite the cataclysms that are shaking the world, continues to move forward. This is especially true in megacities - here it is not difficult to find a job, but, of course, only if foreigners are considering the option of getting a job as unskilled employees.

Individuals who entered Russia from Kazakhstan are automatically perceived as almost “their own”. Such an approach to business can cause the employer to make mistakes, which will subsequently cost his pocket enormous costs.

So, if you have decided to hire citizens of Kazakhstan, ask the individual to prepare a set of necessary documents:

- passport confirming the citizenship of the employee;

- part of the employee’s migration registration certificate, it is torn off from the entire form;

- health insurance agreement (policy);

- migration card, where the column “Purpose of visit” is filled in with the word “Work”;

- the original certificate, which states that Kazakhs speak Russian, confirms knowledge of the history of Russia and the norms of the main legislative acts of the Russian Federation;

- employment history.

If the Kazakh does not have any of these documents, registration will have to wait. The exception is the work book; pay special attention to this document. The work book can be made in several samples:

- if this is a certificate issued since Soviet times, then it is allowed to continue to be filled out, it is valid on the territory of the Russian Federation;

- if a work book is issued and provided for use in Kazakhstan, it is considered invalid in other countries, including Russia;

- a work book will not be needed only if a civil agreement is signed between the employer and the employee.

What else is required from the management of the enterprise? If citizens of Kazakhstan have the status of temporarily or permanently residing individuals in Russia, the employer should register them as payers of contributions to the Pension Fund. You can skip this point only if you already have a certificate of compulsory pension insurance - this is indeed possible if Kazakhs previously officially worked in Russia.

If you are going to hire citizens of Kazakhstan as a highly qualified specialist, it is advisable to familiarize yourself with and take photocopies of diplomas from higher educational institutions, as well as additional documents that can confirm the professional skills of individuals and advanced training.

Hiring Kazakhs is impossible without registering them. As we have already said, the foreigner and the employer are given a period of 30 days after crossing the borders of Russia. Legislative norms for visitors from neighboring countries are such that upon entry, citizens of Kazakhstan in 2022 are not required to obtain a stamp on their ticket, nor do they need to fill out any documents.

Therefore, the employer focuses solely on the ticket provided by the employee. Employees of the department of the Immigration Department of the Ministry of Internal Affairs of the Russian Federation, to which the enterprise belongs, can only focus on the date of signing the employment contract.

There is no need to think that registration for migration can be put aside for a while. If you do not do this within 1 month, as required by the legislation of the Russian Federation, expect notification of penalties, and they are quite large:

- in 2022, the individual entrepreneur will sacrifice 400,000 - 1,000,000 rubles for his irresponsibility;

- management's liability is limited to 35,000 - 70,000 banknotes in national currency.

As you can see, the employer himself is interested in getting Kazakhs registered for migration as quickly as possible. There is no need to shift this responsibility onto the shoulders of hired workers; it is better to do everything yourself or entrust it to the appropriate official whom you completely trust.

Hiring, namely registration, looks like this:

- Using one of the post offices, send a notification from there.

- Find out if there is a center in your region that provides state and municipal services for entrepreneurs in the region. If it exists, consult with the staff and complete the paperwork properly on the spot.

- Adhering to the indicated form, fill out the notification columns and submit it to the department of the Main Department of Migration of the Ministry of Internal Affairs of the Russian Federation, which cooperates directly with your company.

What is needed to fill out the notification correctly? When compiling, you cannot do without a passport of a citizen of Kazakhstan. When the new employee receives the tear-off part of the certificate, ask him to photocopy it and provide you with a photocopy for safekeeping. At this point, hiring a foreigner can be considered complete.

Let's start with personal income tax, which is one of the most popular types of taxes levied. No one will be able to avoid paying it, but the amounts of contributions vary; accordingly, the final salary paid to the employee also depends on the personal income tax rate.

In 2022, deductions in favor of personal income tax are also carried out in relation to citizens of Kazakhstan who are hired. In order for deductions into funds to be made legally, hiring includes the signing of an employment contract, drawn up for an indefinite period of time; it is also possible to conclude a contract for a period of 6 months, but not less. In this case, the income from professional activities by Kazakhs is subject to personal income tax at a rate of 13%.

- Hiring a person who has received a residence permit on the territory of Russia indicates the same amounts of deductions that other Russian employees pay.

- The permission that a Kazakh has the right to temporarily reside in the Russian Federation ensures that contributions are withheld from insurance wages at a rate of 22%. Other amounts are equal to those charged to Russian employees working under an employment contract.

- When the contract states that it is valid for no more than 6 months, no contributions are collected from citizens of Kazakhstan, thus wages remain without significant changes.

- 22% of the accrued wages will have to be given to individuals who plan to work at this enterprise for more than six months. Foreigners have nothing to do with other contributions.

- The only amount obligatory to pay, regardless of what status a citizen of Kazakhstan has received, is a contribution in the event of injury occurring while a foreign employee is carrying out his professional activities.

According to Russian law, hiring Kazakhs provides for the return of tax deductions. Another important nuance - if by the end of the year a foreigner lives in Russia for less than 183 days, personal income tax is applied at a rate of 30%, and deductions no longer appear here

For citizens of the EEC as well as the Russian Federation, the employer pays taxes, the rates remain the same

| Amount of insurance premium, tax | Name of fees, taxes |

| Personal income tax | 13% |

| OPS, compulsory pension insurance | 22% |

| Health insurance | 5,1% |

| Contributions to the Social Insurance Fund | 2,9% |

| From accidents at work | 0,2% |

So, for example, Ivanov V.G. is a citizen of Kazakhstan who arrived in Russia, he got a job at Astral LLC, with a salary of 30,000 rubles per month, contributions and taxes will be:

- Personal income tax 30000*13%=3900

- OPS 30000*22%=6600

- MS 30,000* 5.1%=1530

- FSS 30,000*2.9% =870

- FSNS 30,000*0.2%=60

The employee’s take-home salary will be 26,100 rubles.

IMPORTANT!! Pension provision for such citizens is under the control of their state.

A compulsory health insurance policy is available free of charge to citizens of Kazakhstan if they have a temporary stay permit or residence permit. In other cases, a voluntary health insurance policy is purchased.

IMPORTANT! Foreign citizens have the full right to receive payments under a certificate of incapacity for work.

As well as all types of maternity benefits, regardless of whether they reside permanently in Russia or temporarily, the employer in any case pays insurance premiums for them upon official employment.

Question No. 1: Our company is a limited liability company, we want to hire a citizen of Kazakhstan, do we need permission to hire a foreigner?

Answer: Permission is not required, it is necessary in the case of receiving a foreigner arriving from a country with a visa regime with Russia

Question No. 2: What taxes will be levied on wages if I am a citizen of the EEC

Answer: For citizens of Kazakhstan, the same procedure is provided for the payment of personal income tax in the amount of 13%, and the employer is also obliged to pay insurance contributions, respectively, to the pension fund, social insurance fund, health insurance and injury.

Question: what if it’s a visa, then before all our actions the employer must first register, issue some kind of permit, and only after that accept visa workers?

Answer: Yes, in this case, the Employer is the receiving party in relation to the foreigner.

Question: in the case of visa-free countries, does this mean that the employer does not register as the host country?

Answer: No, nothing is needed. Accept, notify and that's it.

Question: I should ask her for a voluntary insurance policy, right?

Answer: Yes, when concluding an employment contract with a foreign citizen, along with the documents listed in Article 65 of the Labor Code of the Russian Federation, you also need a voluntary health insurance (VHI) policy. In order to avoid claims from inspectors when hiring citizens of Kazakhstan, it makes sense to request a VHI agreement (policy) from them. If a foreign person does not have this agreement (policy), the employer has the right to enter into an agreement with a medical organization to provide paid medical services to the individual.

Question: her registration expires on August 20, 2020; she will renew it for the third year before this date (how long can she do this or should she leave this time)?

Answer: In accordance with Part 5 of Art. 97. Treaty on the EAEU. The period of temporary stay (residence) of a worker of a Member State and family members on the territory of the state of employment is determined by the duration of the labor or civil contract concluded by a worker of a Member State with the employer or customer of the work (services).

Question: when applying for a job, the immigration officer should only indicate “work”, otherwise I don’t apply for them, right?

Answer: YES, her migration card says Work

Question: It is also indicated on your page that it must have a certificate of proficiency in Russian. (she has some kind of paper that says that she is a native speaker of Russian - is this the same thing?)

Answer: No, not necessary. In accordance with Part 5 of Art. 15.1 Federal Law of July 25, 2002 N 115-FZ (as amended on August 2, 2019) “On the legal status of foreign citizens in the Russian Federation”

Taxation

Before employing a citizen of Kazakhstan in 2022, it is important to understand the issues of taxation of his income.

Taxation of foreign citizens depends on their status. The income of non-residents (staying in the Russian Federation for less than 183 days) is taxed at a rate of 30%, residents - 13%. An exception is made for citizens working on the basis of a patent and citizens of countries participating in the Treaty on the EAEU. Their income is subject to income tax at the rate of 13%, like citizens of the Russian Federation. This norm is reflected in Art. 73 Treaties. But this does not mean that all resident rules automatically apply. Standard tax deductions are not provided to the employee, and personal income tax is not considered as an accrual total, but for each payment separately until confirmation of his resident status is received.

In addition, the Ministry of Finance believes (letters dated July 14, 2016 No. 03-04-06/41639 and dated June 10, 2016 No. 03-04-06/34256). that it is necessary to control the status of the employee as of December 31, and if he turns out to be a non-resident, recalculate personal income tax at a rate of 30%, as happens with Russians. At the same time, the Federal Tax Service in a letter dated November 28, 2016 No. BS-4-11/ explains that the provisions of Art. 73 of the Agreement does not provide for tax recalculation. It is up to the employer to decide what to do in this situation.

Do you need a medical insurance?

As for the health insurance policy, according to Art. 327.3 of the Labor Code of the Russian Federation, labor migrants are required to purchase a VHI policy, which provides them with the opportunity to receive primary medical care and emergency care in Russia. However, different rules are established for EurAsEC citizens.

According to paragraph 2 of Art. 98 of the EAEU Treaty between the member countries of the economic union, a citizen of Kazakhstan with a temporary residence permit (temporary residence permit) and members of his family have the right to receive emergency medical care in Russia free of charge, without issuing a VHI policy.

But to receive health care they will still need a VHI policy.

After signing an employment contract, the current employee has the right to contact the insurance company with documents to apply for a compulsory medical insurance policy. It is issued for one calendar year or until the termination of the employment relationship.

After issuing a medical policy, its details must be specified in the employment contract. To do this, an appropriate additional agreement must be signed between the employee and the employer.

Social insurance and sick leave

Art. 98 of the Treaty on the EAEU regulates the procedure for social security of citizens of the participating countries. It is produced in exactly the same way as the Russians. Pension insurance for foreigners is carried out in the manner prescribed by Law No. 167-FZ of December 15, 2001 on compulsory pension insurance in the Russian Federation. This means that concluding an employment contract with a citizen of Kazakhstan entails the employer’s obligation to pay insurance premiums for compulsory medical insurance, compulsory social insurance in case of disability and in connection with maternity, and compulsory pension insurance in relation to these persons.

Hence the conclusion: sick leave is provided and paid to Kazakh employees in the usual manner.

What documents does a citizen of Kazakhstan need for employment?

To get a job officially, a foreigner from the EEC must provide the following set of documents:

- passport;

- work book (if previously opened);

- SNILS (except for highly qualified specialists);

- a certificate of no criminal record (if required by the employer);

- diplomas, certificates, certificates and other documents to confirm education;

- migration card (for employment for a period of more than 30 days).

An employment contract with a citizen of Kazakhstan can be concluded for an indefinite period, as with citizens of Russia. The exception is cases when a fixed-term agreement is drawn up (Article 59 of the Labor Code of the Russian Federation) - then it is limited to five years.

see → How to conclude an employment contract with a foreign citizen + sample

Upon expiration of the employment contract, the foreigner must leave the Russian Federation, because the term of this document determines the time period of his stay in Russia, if a temporary residence permit has not been previously issued . If a citizen was dismissed early, he is given the opportunity to re-employ himself within 15 days.

Migration registration

After the latest changes to Law No. 109-FZ “On Migration Registration”, the obligation to register and remove employees from migration registration remains only for those employers who provide accommodation for employees. In this case, the employer is also required to control the timing of migration registration and the presence of a foreigner at this address.

Thus, before employing a citizen of Kazakhstan, it is necessary to decide whether the organization has the opportunity to provide him with housing or not, and based on this, determine whether he will become the receiving party and whether to apply to the OVM for the so-called registration (correctly: “placement on registration at the place of stay") of a foreigner or not.

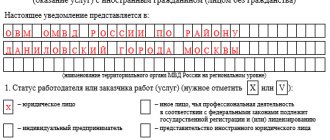

To assign an employee to the MU, the receiving party must contact the territorial body of the Department of Internal Affairs of the Ministry of Internal Affairs at the location and provide:

- constituent documents;

- documents confirming the legality of ownership or use of residential premises;

- employment contract with IG;

- IG documents: passport, migration card, residence permit (if available);

- completed arrival notice. Today, the form approved by Order of the Ministry of Internal Affairs No. 180 dated March 24, 2020 is in force.

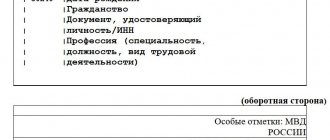

OVM employees check the completeness and correctness of filling out the documents, enter information into the database (PPO “Territory”) and return the detachable part of the notification, in which they put the registration period, stamp and signature of the official. This document is given to the foreigner.

The deregistration of a foreigner occurs in a similar manner. The form was approved by order of the Ministry of Internal Affairs No. 142 of March 18, 2019.

Registration and deregistration is not prohibited in other ways: through the MFC or mail, and in some regions - through State Services or using specialized software that ensures secure document flow between the OVM and the receiving party.

It is necessary to register and deregister within 7 working days from the date of arrival (departure) of the foreigner.

Citizens of Kazakhstan are a special workforce

Despite the fact that not everything is so simple in Russia economically, despite crises and some tensions in business, many citizens of nearby countries come here in search of work and a better life.

In most cases, such foreigners come to Russia in search of work that does not require qualifications. Basically, such work involves physical labor, and the wage level is low.

However, there are a large number of Kazakhs who are highly qualified and have extensive work experience, for example in manufacturing, and come to work in Russia in their specialty.

Kazakhstan is our closest neighbor. However, this is a foreign country, and therefore the employment of such foreign workers has its own characteristics. On May 29, 2014, an agreement on cooperation in the economic sphere was signed in Astana, which secured, among other things, employment opportunities for citizens of Kazakhstan in a simplified manner . This makes it possible to attract foreign workers to work in Russia without any special obstacles, thereby filling gaps in some vacancies. In May 2015, amendments were made to the agreement.

Along with the Agreement, the labor of foreigners is partially regulated by Chapter 50.1 of the Labor Code of the Russian Federation.