What is an agency agreement

An agency agreement is a form of intermediary agreement in which the customer entrusts a task to the contractor.

As a rule, this is the sale or purchase of goods, works and services. In an agency agreement, the customer is the principal and the contractor is the agent. The peculiarity of an agency agreement is that tasks are performed both on behalf of the principal and on behalf of the agent, but always at the expense of the principal. Based on the completion of the contract, the agent receives a reward. The customer can specify in the contract a fixed amount, a percentage of the transaction amount, or promise to transfer the profit received from the sale or savings on the purchase as a reward.

The traditional tax scheme for unfair use of a structure looks simplified like this:

The principal on the simplified tax system sells goods through an agent controlled by him on the simplified tax system, thus withdrawing part of the profit received in the form of payment of agency fees at a lower tax rate.

However, an end-to-end analysis of court cases again revealed several unexpected conclusions:

First, it is the taxpayer himself who is increasingly acting as a pseudo-agent. Most likely, out of a desire to control the entire “incoming” revenue flow (sales agent) or key relationships with suppliers (if he is a purchasing agent).

Second, the vast majority of cases involve the use of the much-publicized “reverse agent” model.

To bring a little clarity to the minds of domestic entrepreneurs,

VAT on an agency agreement with the principal

Let's figure out how to work with VAT and invoices when selling and purchasing goods under an agency agreement. The procedure depends on whose name the transaction is executed: the customer or the contractor. There are four possible situations in total.

VAT on the principal when selling goods

If goods are sold on behalf of the customer , then VAT must be charged, invoices issued and registered in the standard manner. Proceed in the same way as when working without intermediaries:

- Charge VAT on the day the agent delivers the goods to the buyer. If there was an advance payment, then VAT is charged twice: on the day of the advance and on the day of transfer.

- Issue an invoice five calendar days from the date of shipment or receipt of advance payment.

- Record the invoice in the sales ledger. At the end of the same quarter, include VAT in your return.

The tax is paid based on the results of the quarter - before the 25th day of the month following the reporting period.

If the product is sold on behalf of an agent , then you will not have to interact with the buyer. The agent himself will issue all the invoices to him, and will give you copies of them or information from them in another convenient form that you agree on. Based on the copies received, charge VAT and re-invoice the agent. There are three steps in total:

- Charge VAT on the day of shipment, and if you receive an advance payment, charge the tax twice - upon receipt of the advance payment and upon shipment.

- Re-invoice the agent within five days. In its lines 2, 2a and 2b, enter your data; in line 1, enter the number that corresponds to your order of invoices. Take the remaining data from the copy received from the agent. Please remember that the date on the reissued document must match the date on the buyer's invoice.

- Register the reissued invoice in the sales ledger in the quarter in which you made the shipment or received the advance. When registering, indicate the buyer’s information in columns 7 and 8, and your agent’s information in columns 9 and 10.

Fix in the agency agreement a condition on the period within which the agent must provide you with information about shipments and advances or invoices issued to buyers. This is necessary so as not to be late in calculating tax and issuing an invoice.

VAT from the principal when purchasing goods

When purchasing items on your behalf, the seller will issue an invoice directly to you. Register it in the purchase ledger in the standard manner and accept the input VAT for deduction.

When purchasing goods on behalf of an agent, he will receive an invoice from the seller in his name and reissue it to you. Register the reissued invoice in the purchase book. Do this in the quarter in which you have met all the conditions for accepting input VAT for deduction, or in the next quarter if you want to transfer the deduction. In columns 9 and 10, indicate the seller’s information, in columns 11 and 12, the agent’s information.

If several invoices are issued or received on the same day, they can be replaced by one consolidated invoice, which summarizes the information from all documents.

How is tax calculated?

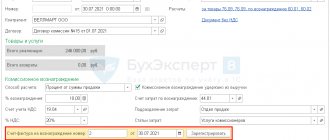

The moment of provision of intermediary services is considered to be the date of endorsement of the act by both parties to the transaction or the day of recognition of the agency’s report by the principal. On this date, the agent has a legal obligation to charge VAT on the amount of remuneration received. He has five days to prepare an invoice and issue it to the counterparty.

To determine the amount of remuneration with tax, the agent must add 18% to the cost of services. This algorithm is enshrined in law and does not change depending on the terms of the contract. If goods and services sold by an intermediary are not subject to VAT, 18% is still charged on the amount of income for transactions in the interests of the principal.

Invoices issued to the principal for agency fees are not recorded in the invoice journal.

Funds received by the agent from the principal to perform the functions specified in the contract (purchase of goods and services, payment of port dues or freight charges, etc.) are not subject to VAT. The intermediary should not include them in the income (expenses) from which the base for calculating income tax is formed.

The amount of VAT calculated on agency fees is subject to payment to the budget as part of the total tax. According to the general rule, it is transferred no later than the 25th day of the month following the reporting quarter.

Invoice with VAT

VAT on an agency agreement with an agent

On the part of the contractor, the procedure for working with VAT and invoices again depends on whose name the transaction is executed: in the name of the agent or in the name of the customer. Let's consider four situations.

VAT at the agent when selling goods

If you are selling goods on behalf of a principal , then you have minimal responsibilities. The principal himself will calculate VAT and issue invoices to buyers. Your responsibility will only be to issue the agency fee.

If you sell goods on your own behalf , you must issue and register an invoice in the name of the buyer in the accounting book. Draw up the document in two copies within 5 days from the date of transfer of goods to the buyer (reception of advance payment). Give one copy to the buyer, the other to the customer under the contract. Based on the received copy, the principal will issue you an invoice with the same indicators. It must be recorded in Part 2 of the invoice journal; nothing needs to be entered in the purchase ledger.

Record the invoice issued to the buyer of the principal's goods in the first part of the invoice journal.

VAT from the agent when purchasing goods

If you are purchasing goods on behalf of a principal , you cannot deduct input VAT since the purchased goods do not become your property. The seller will immediately issue invoices for the goods in the name of the principal, so there will be no need to re-issue anything.

If you buy goods on your own behalf , you cannot deduct input VAT either. But in this case, invoices received from the seller will have to be reissued and recorded in the accounting journal. Proceed in the following order:

- Register the invoices received from the seller in part 2 of the accounting journal for the quarter in which they were compiled.

- Reissue the invoice and transfer it to the principal. In line 1, indicate the serial number of the account according to your numbering, in lines 2, 2a and 2b the seller’s details, in line 5 the payment details, and in lines 6, 6a and 6b the principal’s details. Take all other indicators from the seller's invoice.

- Provide the principal with certified copies of invoices received from the seller.

- Record the invoice reissued to the principal in Part 1 of the accounting journal.

The agent can purchase goods from the seller not only for the principal, but also for himself or other customers. In this case, in the copy of the invoice, the quantity of goods purchased will not match the one that the agent issues to the customer. This is normal, since other people's goods are excluded from the document.

How to calculate VAT on intermediary agreements

Intermediary transactions include:

- under a commission agreement;

- under a contract of agency;

- under an agency agreement.

The procedure for calculating VAT on intermediary agreements depends on:

- who is the participant in the intermediary agreement - the customer (principal, principal or principal) or the intermediary (commission agent, agent or attorney);

- what order the intermediary performs for the customer - sells or buys goods (work, services).

In addition, a special procedure for calculating VAT must be applied:

- upon receipt of advances under intermediary agreements related to the sale of goods;

— when selling goods of foreign organizations that are not tax registered in Russia.

Selling goods through an intermediary

An intermediary agreement related to the sale of goods (works, services) may provide for two options:

— the intermediary participates in the settlements (i.e., the buyer pays the intermediary, and the intermediary transfers the proceeds to the customer minus the intermediary fee);

— the intermediary does not participate in settlements (the buyer pays directly with the customer, and the customer transfers the intermediary fee to the intermediary’s account).

In any settlement option, the intermediary - VAT payer must charge tax on the amount of his remuneration and any other income (for example, additional benefits) received during the execution of the intermediary agreement. This is stated in paragraph 1 of Article 156 of the Tax Code of the Russian Federation. The exception is remuneration received for intermediary services for the sale of goods (work, services) specified in paragraph 1, subparagraphs 1 and 8 of paragraph 2 and subparagraph 6 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation. Among them are some medical goods, funeral services, and folk arts and crafts. When selling these goods (works, services), neither their owners nor intermediaries should pay VAT. This procedure is provided for in paragraph 2 of Article 156 of the Tax Code of the Russian Federation.

Intermediary fee

Intermediary fees and other income received during the execution of an intermediary agreement (for example, additional benefits) are subject to VAT at a rate of 18 percent. This follows from the provisions of paragraph 3 of Article 164 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated May 12, 2011 No. 03-07-11/122.

Situation: at what rate should the intermediary pay VAT on the remuneration received during the execution of the contract? The intermediary sells goods subject to VAT at a rate of 10 percent.

Services provided on the basis of intermediary agreements are subject to VAT at a rate of 18 percent (clause 3 of Article 164 and Article 156 of the Tax Code of the Russian Federation).

At the same time, the Tax Code of the Russian Federation does not contain any exceptions that would provide for the application of a 10 percent rate for intermediary transactions. Therefore, there is no connection between the rate at which goods sold by a commission agent (attorney, agent) are taxed and the rate used to calculate VAT for the sale of intermediary services (clause 3 of Article 164 of the Tax Code of the Russian Federation). The Russian Ministry of Finance adheres to the same position (see, for example, letter dated March 21, 2006 No. 03-04-07/04).

An example of reflecting in accounting transactions for calculating VAT on intermediary remuneration. Transactions with an intermediary

ZAO Alfa (committee), under a commission agreement, instructed LLC Torgovaya (commission agent) to sell a batch of milk powder (i.e., 10,000 bags). The selling price of one package (excluding VAT) is 30 rubles/package. Powdered milk (except skim milk) is subject to VAT at a rate of 10 percent (List approved by Decree of the Government of the Russian Federation of December 31, 2004 No. 908).

According to the terms of the agreement, the intermediary's commission (excluding VAT) is 15 percent of the transaction amount (excluding VAT). The intermediary is not involved in the settlements.

Hermes sold the entire batch of goods received on commission at the selling price established by the contract. The amount of commission (excluding VAT) was 45,000 rubles. (30 RUR/package × 10,000 packages × 15%). Despite the fact that the subject of the commission agreement is a product subject to VAT at a rate of 10 percent, the intermediary's remuneration is subject to VAT at a rate of 18 percent. Therefore, the amount of VAT that Hermes presented to Alpha as part of the commission amounted to 8,100 rubles. (RUB 45,000 × 18%). The total amount of commission including VAT was RUB 53,100. (RUB 45,000 + RUB 8,100).

The Hermes accountant made the following entries in the accounting (regarding commission): Debit 76 Credit 90-1 – 53,100 rubles. – commission accrued;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 8100 rubles. – VAT is charged for payment to the budget on the amount of commission;

Debit 51 Credit 76 – 53,100 rub. – money was received from the principal in payment of a commission.

In practice, the intermediary's remuneration may be determined by:

- as a fixed amount fixed in the contract;

— as a percentage of the transaction amount;

- as the difference between the price of goods at which they were sold to customers and the price of goods at which they were transferred to commission.

The intermediary is obliged to charge VAT on the intermediary fee on the day when, according to the terms of the contract, the service is considered completed (clause 1 of Article 167 of the Tax Code of the Russian Federation). For example, on the day when the customer approved the intermediary’s report. The intermediary can independently withhold the accrued amount of remuneration from the customer’s proceeds (Articles 410 and 997 of the Civil Code of the Russian Federation).

An example of reflecting in accounting transactions for calculating VAT when selling goods under a commission agreement. Operations with a commission agent

ZAO Alfa (committee), under a commission agreement, instructed LLC Torgovaya (commission agent) to sell a batch of medical equipment in the amount of 220,000 rubles. (including VAT 10% - 20,000 rubles). According to the agreement, Hermes participates in the settlements. The commission is 35,400 rubles. (including VAT 18% - 5400 rubles).

Hermes sold the goods and independently withheld the commission from the principal's proceeds (35,400 rubles), and transferred the rest of the proceeds to Alpha's bank account.

The Hermes accountant made the following entries in the accounting:

Debit 004 – 220,000 rub. – medical equipment was accepted from the principal under a commission agreement;

Debit 62 Credit 76 – 220,000 rub. – medical equipment accepted for commission was sold;

Loan 004 – 220,000 rub. – the cost of medical equipment sold under a commission agreement has been written off;

Debit 76 Credit 90-1 – 35,400 rub. – commission accrued;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 5400 rubles. – VAT payable to the budget on commission remuneration is accrued;

Debit 51 Credit 62 – 220,000 rub. – payment received from the buyer;

Debit 76 Credit 51 – 184,600 rub. (RUB 220,000 – RUB 35,400) – revenue transferred to the principal (minus commission, including VAT).

The intermediary must issue an invoice to the customer for the amount of his remuneration (clause 3 of Article 168 of the Tax Code of the Russian Federation).

VAT at the customer

Customers determine the tax base for VAT in the same manner as organizations that sell goods (work, services) without resorting to the services of intermediaries.

VAT must be charged to the budget either on the day of shipment (transfer) of goods (work, services) or on the day of payment. It depends on which of these events happened first. This procedure is provided for in paragraph 1 of Article 167 of the Tax Code of the Russian Federation.

To calculate VAT, the customer needs to correctly determine the date of shipment (transfer) of goods (work, services). The customer ships (transfers) the goods (work, services) that need to be sold to the intermediary. Formally, this is the same shipment as when transferring goods (work, services) from the seller to the buyer. However, the customer should not charge VAT on shipment to the intermediary. This is explained by the fact that the seller is obliged to present the amount of VAT to the buyer (clause 1 of Article 168 of the Tax Code of the Russian Federation). But the intermediary is not a buyer in relation to the customer.

Thus, the customer must charge VAT at the moment when the goods (work, services) were shipped (performed, provided) to the buyer by the intermediary. Moreover, the date of shipment is considered to be the date of the first document issued to the buyer (carrier) (letter of the Federal Tax Service of Russia dated January 17, 2007 No. 03-1-03/58). The customer can find out when the goods (work, services) were shipped (performed, provided) from the intermediary’s report. Therefore, if possible, the intermediary should attach to its report copies of primary documents confirming the date of shipment of goods (work, services). The intermediary's report is drawn up in any form; there is no standard template for it.

For information on issuing invoices when selling goods through intermediaries, see How to issue invoices, an invoice journal, a sales ledger, and a purchase ledger during intermediary transactions.

The customer can deduct VAT on the intermediary fee after he receives or approves (depending on the terms of the contract) the commission agent’s report and the corresponding invoice. This procedure is provided for in Articles 171 and 172 of the Tax Code of the Russian Federation.

An example of reflecting in accounting transactions for calculating VAT when selling goods under a commission agreement. Operations with the principal

ZAO Alfa (committee), under a commission agreement, instructed LLC Torgovaya (commission agent) to sell a batch of medical equipment in the amount of 220,000 rubles. (including VAT 10% - 20,000 rubles). The book value of goods is 80,000 rubles. According to the agreement, Hermes participates in the settlements. The commission is 35,400 rubles. (including VAT 18% - 5400 rubles).

Hermes sold the goods and independently withheld the commission from the principal's proceeds (35,400 rubles), and transferred the rest of the proceeds to Alpha's bank account.

Alpha's accountant made the following entries in the accounting records:

Debit 45 Credit 41 – 80,000 rub. – goods were transferred for commission;

Debit 62 Credit 90-1 – 220,000 rubles. – revenue from the sale of goods is reflected based on the commission agent’s report;

Debit 76 Credit 62 – 220,000 rub. – reflects the commission agent’s debt, repaid at the expense of buyers’ funds;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 20,000 rubles. – VAT is charged for payment to the budget on proceeds from the sale of goods;

Debit 90-2 Credit 45 – 80,000 rub. – the cost of goods sold under a commission agreement is written off;

Debit 44 Credit 76 – 30,000 rub. (RUB 35,400 – RUB 5,400) – commission accrued (excluding VAT);

Debit 19 Credit 76 – 5400 rub. – VAT on commission fees is taken into account (based on the commission agent’s invoice);

Debit 68 subaccount “Calculations for VAT” Credit 19 – 5400 rub. – accepted for deduction of VAT on commission fees (based on the invoice and the commission agent’s report);

Debit 51 Credit 76 – 184,600 rub. (RUB 220,000 – RUB 35,400) – revenue received from the commission agent (less commission).

Situation: is it necessary to charge VAT on revenue additionally received by the commission agent (agent)? According to the terms of the agreement, the remuneration increases by the entire amount of additional funds received.

Answer: yes, it is necessary.

As a rule, the intermediary agreement determines in advance the price at which the commission agent (agent) must sell the goods (perform work, provide services) of the principal (principal). However, the intermediary can sell goods (perform work, provide services) at a higher price. In such a situation, the parties to the transaction receive additional revenue from sales. By default, it is divided equally between the customer and the intermediary. But the contract may also provide for other conditions. This follows from the provisions of Articles 992 and 1011 of the Civil Code of the Russian Federation.

Additional revenue received by the commission agent (agent) is subject to VAT from the principal (principal). This is explained by the fact that everything received by the intermediary at the expense of the customer (including money) is the property of the latter (clause 1 of Article 996, Article 1011 of the Civil Code of the Russian Federation). This means that additional revenue as part of the income from the sale of goods (performance of work, provision of services) belongs to the customer. This was stated, in particular, in the letter of the Department of Tax Administration of Russia for Moscow dated March 6, 2003 No. 24-11/13281.

Thus, the customer must charge VAT on the amount of additional revenue. But since this entire amount is included in the intermediary fee, after the intermediary’s report is approved, the customer will be able to deduct the amount of VAT on additional revenue. To do this, the intermediary (if he applies the general taxation system) must issue an invoice to the customer for the amount of his remuneration, increased by the amount of additional revenue (clause 1 of Article 156 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 12, 2011 No. 03-07 -11/122).

An example of calculating VAT on additional revenue received by a commission agent. According to the terms of the agreement, the amount of additional revenue is part of the commission

CJSC Alfa (committent) instructed LLC Torgovaya (commission agent) to sell a consignment of goods for 94,400 rubles. (including VAT – 14,400 rubles). The contract states that the commission is 5 percent of the sale price of the goods indicated by the principal, as well as the entire amount that the commission agent will receive by selling the goods at a higher price.

Hermes sold goods for 118,000 rubles. (including VAT – 18,000 rubles).

The additional benefit of Hermes is 23,600 rubles. (RUB 118,000 – RUB 94,400). Thus, the total amount of commission including VAT is equal to: RUB 94,400. × 5% + 23,600 rub. = 28,320 rub.

VAT on the commission amount is RUB 4,320. (RUB 28,320 × 18/118). This amount was presented to Alpha on the commission invoice issued by Hermes.

VAT accrued by Alfa for payment to the budget after the sale of goods amounted to 18,000 rubles. The principal accepted for deduction VAT on the commission amount in the amount of 4,320 rubles.

When calculating income tax, Alpha’s accountant took into account:

- income from the sale of goods in the amount of 100,000 rubles. (RUB 118,000 – RUB 18,000); — expense in the form of commissions (including additional income of the commission agent) in the amount of 24,000 rubles. (RUB 28,320 – RUB 4,320).

Purchasing goods through an intermediary

If the intermediary purchasing goods for the customer acts on his own behalf, the customer is not mentioned in the contracts concluded by him. Consequently, invoices, acts and invoices for purchased goods, works or services will be issued in the name of the intermediary. The intermediary records the invoice received from the seller only in the journal of received invoices.

Under the terms of the contract, goods purchased for the customer can be delivered to the intermediary’s warehouse. Since their owner is the customer, the intermediary records the goods on the balance sheet in account 002 “Inventory assets accepted for safekeeping.”

The intermediary is obliged to charge VAT on the intermediary fee on the day when, according to the terms of the contract, the service is considered completed (clause 1 of Article 167 of the Tax Code of the Russian Federation). For example, on the day when the customer approved the intermediary’s report.

An example of reflecting in accounting transactions for calculating VAT when purchasing goods under a commission agreement. Operations with a commission agent

LLC "Torgovaya" (principal), under a commission agreement, instructed CJSC "Alfa" (commission agent) to purchase household goods in the amount of 118,000 rubles. The commission is 11,800 rubles. (including VAT - 1800 rubles).

The principal transferred the amount under the contract to the commission agent. The commission agent, in turn, bought the necessary goods worth 118,000 rubles. (including VAT - 18,000 rubles) and notified the committent about this.

The Alpha accountant made the following entries in the accounting: Debit 51 Credit 76 - 118,000 rubles. – money was received from the principal for the purchase of goods;

Debit 76 Credit 60 – 118,000 rub. – the debt to the supplier, repaid at the expense of the principal’s funds, is taken into account;

Debit 002 – 118,000 rub. – purchased goods are accepted for safekeeping;

Debit 60 Credit 51 – 118,000 rub. – money was transferred to the supplier of goods on behalf of the principal;

Debit 76 Credit 90-1 – 11,800 rub. – commission accrued;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 1800 rubles. – VAT is charged on commission fees;

Loan 002 – 118,000 rub. – the goods were transferred to the consignor;

Debit 51 Credit 76 – 11,800 rub. – remuneration has been received from the principal.

The customer can deduct VAT on purchased goods no earlier than he fulfills all the conditions specified in Articles 171 and 172 of the Tax Code of the Russian Federation. Namely, he will receive the goods and receive the corresponding invoice.

An example of reflecting in accounting transactions for calculating VAT when purchasing goods under a commission agreement. Operations with the principal

LLC "Torgovaya" (principal), under a commission agreement, instructed CJSC "Alfa" (commission agent) to purchase household goods in the amount of 118,000 rubles. The commission is 11,800 rubles. (including VAT - 1800 rubles).

The principal transferred the amount under the contract to the commission agent. The commission agent, in turn, bought the necessary goods worth 118,000 rubles. (including VAT - 18,000 rubles) and notified the committent about this.

The Hermes accountant made the following entries in the accounting:

Debit 76 Credit 51 – 118,000 rub. – money is transferred to the commission agent for the purchase of goods;

Debit 41 Credit 76 – 100,000 rub. (RUB 118,000 – RUB 18,000) – the acquisition of goods is reflected at cost excluding commission (based on the commission agent’s notice);

Debit 19 Credit 76 – 18,000 rub. – input VAT on purchased goods is taken into account (based on the invoice received from the commission agent);

Debit 41 Credit 76 – 10,000 rub. (RUB 11,800 – RUB 1,800) – commission included in the price of goods (excluding VAT);

Debit 19 Credit 76 – 1800 rub. – VAT on commission fees is taken into account;

Debit 76 Credit 51 – 11,800 rub. – remuneration was transferred to the commission agent;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 19,800 rub. (RUB 18,000 + RUB 1,800) – accepted for deduction of VAT on purchased goods and commissions.

Continued >>

Which agent services are not subject to VAT?

For intermediary services, the VAT exemption rules prescribed in Article 149 of the Tax Code of the Russian Federation do not apply. Cases in which a company does not have to pay tax are specified in Article 156. These include:

- Renting premises to foreigners or resident companies of other states accredited in Russia.

- Sales of medical products and medicines recognized by law as vital.

- Sale of prosthetic and orthopedic products and components for them.

- Sales of lenses and frames for them.

- Sale of products used exclusively for the rehabilitation of people with disabilities and the prevention of disability (the list of such goods is given in the government List).

- Funeral services and sale of handicrafts.

If an agent is engaged in transactions subject to and not subject to VAT, the law obliges him to maintain separate accounting records.