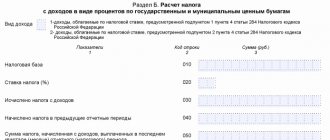

Period code

The reporting period code is indicated on the title page of the income tax return.

This code depends on how the reporting period is defined. If a company pays tax and reports quarterly, then in the annual return you need to put 34. Those who submit reports monthly, put 46.

If you indicate the wrong period code on the title page, the tax authorities will consider that the declaration has not been submitted. If you make such a mistake in your annual declaration, the inspectorate will block your current account. The basis is subparagraph 1 of paragraph 3 of Article 76 of the Tax Code of the Russian Federation.

Read in the berator “Practical Encyclopedia of an Accountant”

Grounds for blocking a current account under the Tax Code

What is the general procedure for filling out an income tax return?

To correctly fill out the income tax return, you should refer to the Procedure from Appendix 2 to Order No. ММВ-7-3 / [email protected] (hereinafter referred to as the Procedure for filling out). It spells out all the basic rules that should be followed:

- To prepare a paper report, blue, violet or black ink is used.

- You cannot correct errors with a barcode corrector.

- The declaration is printed on only one side of the sheet; it is prohibited to staple the pages.

- Data in the report is entered on an accrual basis from the beginning of the year.

- The pages are numbered in order.

- Cost indicators in the report are rounded according to mathematical rules to full rubles.

- A certain indicator has its own field, consisting of a specific number of familiar places.

- The fields are filled in from left to right. Empty fields are crossed out.

You are allowed to fill out the declaration manually, but few people choose this method anymore. You can also fill out the form on your computer using software. Or you can use specialized accounting programs, where report lines are filled out automatically based on the data entered during the reporting period.

New income tax return form

The Federal Tax Service of Russia issued an order dated September 23, 2019 No. ММВ-7-3/ [email protected] “On approval of the tax return form for corporate income tax, the procedure for filling it out, as well as the format for submitting a tax return for corporate income tax in electronic form” .

Thus, the Federal Tax Service approved a new form of income tax return, the procedure for filling it out and the format for submitting it in electronic form.

[email protected] , which approved the “old” tax return form, was declared invalid

It must be said that the update of the tax return form was dictated by the introduction of numerous changes to the legislation on taxes and fees.

Composition of the income tax return

Let us remind our readers that the declaration must include:

- title page (Sheet 01);

- subsection 1.1 “For organizations paying advance payments and corporate income tax” of section 1 “Amount of tax payable to the budget, according to the taxpayer (tax agent)”;

- Sheet 02 “Tax calculation”;

- Appendix No. 1 “Income from sales and non-operating income” to Sheet 02;

- Appendix No. 2 “Expenses associated with production and sales, non-operating expenses and losses equated to non-operating expenses” to Sheet 02.

The remaining sheets of the income tax return need to be included in it only if the organization has the appropriate data and indicators to fill out.

Moreover, even if the data is available, the organization does not include in the income tax return for the calendar year subsection 1.2 “For organizations paying monthly advance payments” of Section 1.

And Appendix No. 4 “Calculation of the amount of loss or part of a loss that reduces the tax base” is included in the declaration only for the 1st quarter and calendar year.

Let's look at examples of what mistakes accounting employees make when filling out income tax returns.

Insurance premiums

Mandatory pension, social and medical contributions of administrative and management personnel must be reflected in line 041 of Appendix No. 2 to sheet 02 of the declaration. Moreover, you need to show the accrued contributions, and not the amount that was transferred to the budget.

This line reflects tax payments that are taken into account as part of other expenses associated with production and sales. In addition to mandatory insurance contributions, these are (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation):

- corporate property tax;;

- transport tax;

- state duty;

- land tax.

In line 041 there is no need to indicate taxes and other mandatory payments that are not taken into account as expenses for income tax purposes. This is VAT presented to the buyer of goods (works, services) and a trade tax (clause 19 of Article 270 of the Tax Code of the Russian Federation). Also, it does not reflect insurance premiums that relate to direct expenses, that is, accrued for remuneration of key production personnel.

As for contributions for injuries, they relate entirely to indirect costs, regardless of the salary of which category of employees they are accrued. Therefore, they are shown completely and once on line 040 “Indirect expenses” of Appendix No. 2 to sheet 02 of the declaration. They are not included in line 041.

What is line 041 of the profit declaration intended for?

Page 041 (included in Appendix 2 of sheet 02 of the report) is intended to generate information on indirect expenses of the enterprise for the reporting or tax period. Here, taxpayers indicate the amounts of taxes/fees, as well as insurance premiums, accrued in accordance with legislative norms. The exception is the amounts of taxes listed under Art. 270 NK.

Earlier, before the entry into force of chapters. 34 of the Tax Code, insurance accruals were not required to be entered in this line. Since 2022, the situation has changed, contributions are included in tax payments, and therefore fall under the requirement to reflect amounts on page 041 in terms of mandatory pension insurance, social insurance contributions for temporary disability and compulsory medical insurance.

Note! “Injuries” remained under the control of the FSS and are not subject to entry into line 041 of the income tax return.

The data is filled in upon the fact of accrual of tax amounts using the accrual method or upon payment of fees under the cash method.

Direct expenses

The amount of direct expenses related to sold goods (works, services) of own production, indicate on line 010 of Appendix No. 2 to sheet 02 of the income tax return.

Lines 020 and 030 must be filled out by those who were engaged in wholesale, small wholesale or retail trade in purchased goods during the reporting (tax) period.

And those who calculate income and expenses using the cash method do not fill out lines 010 - 030 of Appendix No. 2 to sheet 02 of the income tax return.

What taxes are not required to be included on line 041?

To understand the essence, let us turn for clarification to the Tax Code, namely to Art. 270. According to this norm, those expenses that are not taken into account when determining the taxable base are not subject to reflection in line 041.

The following types of taxes are not required to be entered in line 041:

- Excise taxes and VAT presented to buyers.

- Insurance premiums for injuries paid to the Social Insurance Fund.

- Income tax.

- Payments for environmental pollution.

- Amounts of penalties, arrears and fines associated with the payment of tax fees.

According to paragraph 9 of Art. 274 of the Tax Code is also not required to include in p. 041 the amount of taxes regarding the gambling business and UTII, accrued when combining the general and imputed regimes.

Additionally, it should be noted that the following amounts are not included in line 041:

- Accrued dividends.

- Voluntary insurance.

- Sanctions imposed on the company by government authorized bodies.

- Amounts paid to NPFs.

- Guarantee contributions transferred to special funds.

- Trade fee amounts.

- Amounts of taxes previously expensed when writing off accounts payable.

- Amounts of notary fees in excess of tariffs.

- Other amounts under Art. 270 NK.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Expenses and income of previous years

It is often forgotten that there are lines in the income tax return for unaccounted expenses and inflated income of the previous year.

So, if you need to correct a 2022 error, you should fill out lines 400 and 401 of Appendix No. 2 to sheet 02 of the declaration.

Errors in the tax base cannot be shown as losses from previous years. Line 301 of Appendix No. 2 to sheet 02 of the declaration is not used for these cases.

Read in the berator “Practical Encyclopedia of an Accountant”

How to fill out Appendix No. 2 to sheet 02 of the income tax return

Line 041 of the declaration - which taxes to specifically include:

- Transport tax.

- Property.

- MET.

- Insurance premiums in terms of contributions for temporary disability and for employment and labor insurance, compulsory health insurance, compulsory medical insurance.

- Land tax.

- Water tax.

- Fees for the use of various objects of the animal world.

- The amount of input VAT already accepted by the taxpayer for deduction and then restored - subject to use in non-taxable preferential activities or when purchasing at the expense of budgetary funds (Article 170 of the Tax Code).

Often accountants have a question: How to reflect the state duty in line 041 of the new declaration? According to Art. 13 of the Tax Code, the state duty is a federal fee and, according to the general Procedure for filling out the report, is subject to inclusion in the indicators on page 041 on an accrual basis. But, if the fee was paid for registering fixed assets, the accounting algorithm in this case will be special - such amounts are included in the initial cost of the object and are not reflected separately. At the same time, in tax accounting, the state duty is included in other expenses on the actual date of accrual (Article 264 of the Tax Code) - the moment is determined depending on the purpose of the payment.

Transcript page

It must be remembered that the declaration form was established by the Order of the Federal Tax Service of October 2016. The paragraphs contain detailed indicators on the basis of which the tax base of the current reporting period is determined, reflecting information from previous years, thanks to which it is possible to have a significant impact on the reported results of operations.

Line 041 of the income tax return is displayed in the second Appendix of sheet 02. Information must be entered in this field exclusively for the specific reporting period.

Last year, the list of values that must be summed for display on line 041 was adjusted.

The changes in the rules are largely due to changes in the status of insurance premiums itself.

Since last year, their accounting was subject to transfer to the jurisdiction of the tax authority, and the rules for regulating contributions are set out in detail in the tax legislation as a separate assigned tax obligation.

Speaking about what taxes line 041 should display, in this case we can talk about all types of obligations that are recognized as indirect costs.

The list of indirect expenses includes insurance deductions from the income of hired staff, as well as:

- some types of taxes;

- and fees.

In this case, exceptions can be made for amounts specified in tax legislation, in particular in Article 270.

From the list of so-called salary insurance contributions, they are separately taken into account by the Social Insurance Fund directly for injuries. This type of fee was not subject to registration with the tax authority in case of changes.

Indirect costs must be reported in the relevant income tax return using one of several methods:

| Directly linked to the fact of accrual of liabilities | If you use the accrual option |

| Directly linked to the date upon transfer of funds for the entire total amount of fees | If you use the cash method |

The amount of duties transferred by the company is also subject to direct display in line 041. They are taken into account on an accrual basis.

In standard situations, line 041 of income tax includes the amount of transport tax, as well as:

- obligations to pay property tax;

- and mineral extraction tax in particular.

The calculated amount of land tax should be included in the list of indirect costs. A similar rule applies to water tax and input VAT.