Why determine the status of foreign citizens

In order to legally employ a migrant, it is important for the personnel service to determine his status.

It is necessary to clearly know what the differences are between a temporary resident and a temporary resident in the Russian Federation, so that their work occurs legally. The legal source that establishes the differences, the set of rights and obligations of a foreigner in Russia is Federal Law No. 115-FZ of July 25, 2002. Establishing a specific status will help the personnel officer resolve a number of issues:

- what documents to request for border crossing and registration;

- how to legally register foreign workers in a company;

- what medical documents to obtain;

- whether the company has the right to send such citizens on business trips to another subject of the Federation;

- determine the amount of contributions to the Pension Fund and the Compulsory Medical Insurance Fund for each such employee;

- clarify the procedure for notifying government agencies.

IMPORTANT!

It is mandatory to notify inspection authorities about the presence of foreign labor. Otherwise, government agencies have the right to collect a fine from the employer from 400,000 to 1,000,000 rubles or suspend activities for a period of 14 to 90 days (Article 18.15 of the Code of Administrative Offenses of the Russian Federation).

The classification of foreigners in Russia is as follows:

| Category | Document-basis for residence in the Russian Federation |

| Temporary stayer with visa or without visa | Visa or migration card (for employment - work permit or patent) |

| Temporary resident | Temporary residence permit (TRP) |

| Permanent resident | Residence permit (residence permit) |

Each category has different opportunities for employment and entrepreneurial activity in Russia. Citizens with a residence permit have the most opportunities. For the other two categories in the employment procedure there are some limits.

Calculation of insurance premiums for payments to persons granted temporary asylum in the Russian Federation

Temporary asylum means the ability of a foreign citizen or stateless person to temporarily stay on the territory of the Russian Federation in accordance with Art. 12 of the Federal Law of February 19, 1993 No. 4528-1 “On Refugees” (hereinafter referred to as Federal Law No. 4528-1), as well as with other federal laws and other regulatory legal acts of the Russian Federation. The procedure for granting temporary asylum on the territory of the Russian Federation was approved by Decree of the Government of the Russian Federation dated 04/09/2001 No. 274 (hereinafter referred to as the Procedure).

Persons who have received temporary asylum are given the right to temporarily stay on the territory of the Russian Federation (clause 3, clause 1, article 1, clause 3, article 12 of Federal Law No. 4528-1).

In this regard, insurance premiums (except for compulsory health insurance contributions) are calculated for payments to such employees in the same manner as for payments to foreign workers temporarily staying in the Russian Federation.

Contributions for compulsory health insurance from payments to employees who have temporary asylum in the Russian Federation are calculated in accordance with the general procedure and according to the tariffs in force for employees who are citizens of the Russian Federation (clause 1, clause 1, article 420 of the Tax Code of the Russian Federation, article 10 of Federal Law No. 326- Federal Law, paragraph 7, paragraph 1, article 6, paragraph 4, article 12 of Federal Law No. 4528-1, paragraph 13 of the Procedure).

Highly qualified foreign specialist

Here, special conditions for calculating wages are used, namely, the minimum amount is indicated.

- For specialists engaged in the scientific field, as well as teachers, the minimum payment is 83.5 thousand rubles/month. (if living in Sevastopol or the Republic of Crimea);

- For citizens called to work in a specific economic area, the minimum payment is 58.5 thousand rubles/month;

- For specialists in the field of medicine, pedagogy and science, at least 1 million rubles per year;

- For other foreign employees – at least 167 thousand rubles/month.

Regarding contributions, the law provides the following conditions for pension and social protection:

- A qualified specialist temporarily present in the Russian Federation – no insurance premiums;

- Temporary or permanent resident - contributions are identical to the rate for citizens of the Russian Federation.

Contributions for compulsory medical insurance are not charged for all categories of highly qualified foreign specialists, and for accident insurance they are charged according to standard requirements.

Category of foreigners granted temporary asylum

Payments are paid at the same rates and conditions applicable to foreign persons temporarily staying in the territory of the Russian Federation. An exception is contributions to compulsory medical insurance, because they are paid in accordance with the tariffs applicable to citizens of the Russian Federation.

What does temporarily staying mean?

In Art. 2 of Federal Law No. 115 states: foreign citizens temporarily staying in the Russian Federation are persons who are in our country legally with a visa or in a visa-free regime and receive a migration card. But without a residence permit or temporary residence permit. For migrants from foreign countries, the period of stay is determined by a visa, and for neighboring countries with which a visa-free regime has been established - no more than 3 months.

These people require a work permit or patent. Employers hire guest workers based on a special quota for their desired occupations. The exception is highly qualified specialists (with their accompanying families), for whom a quota is not required.

The quota is not taken into account for the following migrants (Article 6 No. 115-FZ):

- if they are married to a Russian;

- if they have children, citizens of the Russian Federation;

- if they have a place of residence in the Russian Federation;

- if they invest in Russia.

The Russian government reviews the permissible share of guest workers every year depending on the economic situation. To obtain work permits for them, the employer must contact the local Employment Center, then apply to the Migration Service for a permit to hire such employees for a period of up to 1 year. To obtain these documents, foreigners will need medical certificates confirming the absence of diseases according to the list specified by the government of the Russian Federation (clause 10, part 9, article 18 No. 115-FZ).

Visa-free migrants have the right to independently come to the migration service to obtain a work permit (without a petition from the employer). The procedure is specified in clause 4.5 of Art. 13 No. 115-FZ.

These citizens do not have the right to carry out labor activities in the following cases (clause 4.2 of Article 13 No. 115-FZ):

- outside the region of the Russian Federation where the permit or patent was issued;

- in a profession not specified in the permit;

- without a voluntary health insurance policy, since its details must be included in the employment contract (Article 327.2 of the Labor Code of the Russian Federation).

Here is the patent form for a foreigner who arrived in Russia in a visa-free regime (approved by order of the Ministry of Internal Affairs of Russia dated June 19, 2017 No. 391):

This category also includes refugees and migrants from the Eurasian Economic Union (EAEU), participants in the state program for the voluntary resettlement of compatriots to the Russian Federation (decrees of the President of the Russian Federation dated June 22, 2006 No. 637 and September 14, 2012 No. 1289). These people have the right to work in Russia without additional permits. They are hired according to the rules in force for Russians (clause 2, clause 4, article 13 No. 115-FZ).

ConsultantPlus experts examined the rights and responsibilities of a foreigner permanently residing in the Russian Federation. Use these instructions for free.

to read.

Some specific situations regarding contributions from the income of foreigners

Art. 420 of the Tax Code of the Russian Federation, defining the object of taxation of insurance premiums, makes an exception regarding payments to foreigners, in which such contributions will not be charged:

- when a foreigner, under an employment or GPC contract, works in a structural unit of a separate nature, located outside the territory of the Russian Federation (clause 5).

The norm specified in paragraph 5 of Art. 420 of the Tax Code of the Russian Federation, allows not to impose contributions on income accrued to foreigners located outside the territory of the Russian Federation and performing work under a civil process agreement remotely (letter of the Federal Tax Service of Russia dated 02/03/2017 No. BS-4-11 / [email protected] ).

However, if income from a foreign company is received by a foreign employee who is temporarily in Russia, working in the representative office of this employer on the territory of the Russian Federation and who is not a highly qualified specialist, then his income must be paid contributions to OPS and OSS for disability and maternity (letter from the Ministry of Finance of Russia dated 02/06/2017 No. 03-15-05/6079).

From the income of a foreigner temporarily staying in the Russian Federation who has received refugee status, unlike other foreigners with a temporary stay, additional deductions will be made for compulsory medical insurance using the usual tariff for the Russian Federation of 5.1% (letter of the Ministry of Labor of Russia dated February 17, 2016 No. 17-3/OOG- 229).

Who is given the status of temporary residents

Sometimes the status is confused, but it is not difficult to understand if you know what documents are issued. Question: if a person has received a temporary residence permit, is this a temporary resident or a permanent foreign citizen by law? The answer is in the abbreviation of the document - this is temporary residence. It allows you to stay in the country for 3 years. Once the period expires, it is not renewed. Such a person is not required to receive any documents for work, but has the right to work only within the region that issued the temporary residence permit.

Thus, temporarily residing foreign citizens are people with an official position that was granted to them by a temporary residence permit. They have a strong reason to live and work in the country. A quota is allocated for migrants wishing to obtain a temporary residence permit. It is distributed across all regions. To receive the document you will have to sign up for a queue.

The holder of a temporary residence permit is obliged to notify the migration authorities of registration within a couple of months after the end of each year and provide a certificate of income for the year (clauses 8 and 14, part 1, article 7). By submitting an application for this status, a foreigner indicates the place of registration, but later he has the right to register at any address and change it if necessary. The only condition is that he must register in the region where the document was issued.

Obtaining a temporary residence permit is the first step to obtain Russian citizenship in the future. After a year of being in the country in this status, foreign citizens temporarily residing in the territory of the Russian Federation have the right to submit a request for a residence permit, and after some time for citizenship.

Recruitment

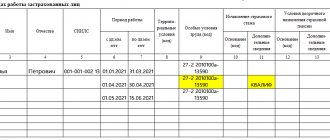

Go to the “Personnel” section, open the “Employees” directory, create a new employee. In the employee’s card, follow the “Insurance” link, where we indicate the status of the insured person, as well as the period from which information about the insurance status is valid, the month of registration of changes.

Next, in the employee’s card, follow the “Personal Data” link, indicate in the “Citizenship” section the country of the foreign employee or switch the attribute to “Stateless person”. This data will be included in the insurance premium report.

Please note: if an individual has already been registered in 1C, then when creating a new employee, the system will issue a warning that a similar person has been found and will offer to determine whether this is the same individual or a namesake.

After creating an employee and collecting documents for hiring the employee, go to the “Personnel” section, open the register of documents for admissions, transfers, dismissals and create a new document “Hiring”, where we enter the date of admission, employee, work schedule, position, information on wages, employment contract data.

For foreign employees, the “Additional” tab appears in the reception, in which we display the following data:

- Work permit.

- Residence permit.

- Conditions for providing medical care.

Thus, the employee is hired.

Who are permanent resident foreign citizens?

The holder of a residence permit has more opportunities than others. This document allows you to permanently live and work in the Russian Federation. In accordance with paragraphs. 1 clause 4 art. 13 Federal Law No. 115-FZ, it is established what it means to permanently reside on the territory of the Russian Federation - this is a foreign citizen who has the right to freely move throughout the Russian Federation, travel outside its borders and enter back. He has the right to work on an equal basis with Russians in any place in Russia of his choice. No additional permissions are required for this. The ability to travel for work to another subject of the Russian Federation for a person permanently residing in the territory of the Russian Federation is not limited in any way. For such foreigners, both permanent registration and a compulsory health insurance policy are available.

Results

Foreigners can be in the Russian Federation in the status of residents (temporarily or permanently) or temporarily staying. For the first group, insurance premiums will be calculated in the same manner as for citizens of the Russian Federation. That is, at generally established, additional or reduced tariffs, if the foreigner is registered under a contract (labor or civil process agreement). An exception will be highly qualified specialists, from whose income they will not have to make contributions to compulsory medical insurance.

No accruals will be made on the income of highly qualified specialists temporarily located in the Russian Federation and working under a contract (labor or civil employment contract), except for contributions for injuries. And the income of other foreign workers temporarily staying in the Russian Federation and working under a contract must be subject to contributions to compulsory health insurance and compulsory social insurance, applying a special rate for compulsory social security for disability and maternity.

Contributions from the income of foreign individual entrepreneurs will be calculated according to the algorithm for calculating payments for individual entrepreneurs in force in the Russian Federation, regardless of their status.

Sources:

- Federal Law of July 25, 2002 N 115-FZ “On the legal status of foreign citizens in the Russian Federation”

- Federal Law of December 15, 2001 N 167-FZ “On Compulsory Pension Insurance in the Russian Federation”

- Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

- Federal Law of November 29, 2010 N 326-FZ “On Compulsory Health Insurance in the Russian Federation”

- Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.