Active commercial activities in the Russian Federation with the countries of the EAEU, one of which is Kazakhstan, are carried out on the basis of international and domestic legislative acts that are developed for the convenience of such activities. In general, within the EAEU countries there is a different procedure and amount for VAT, but at the border other rules begin to apply, a tax appears called import VAT, which is controlled by the Federal Tax Service at the place of registration of the organization in the Russian Federation. Tax must be paid by all businesses, regardless of the tax system used.

Let's consider the actions of Russian companies when importing goods from Kazakhstan to pay VAT.

Rules for importing goods into the Russian Federation

The rules that apply when calculating VAT on goods transported to the territory of the Russian Federation are determined by the presence of customs at the state border. Tax is calculated at the time of import of goods.

The procedure for calculating and paying royalties is subject to customs legislation. The tax is paid to the customs service.

Between a number of states that were previously part of the Soviet Union, customs was abolished.

These states were united into the EAEU - the Eurasian Economic Union. Now the import and export of goods across the borders of the countries participating in this treaty follow the same rules of interaction.

These rules were set out in the agreement on the EAEU, which was concluded in Astana in 2014.

You can read the text of the agreement on our website.

When importing from Kazakhstan, as well as when importing goods into Kazakhstan from Russia, the following customs rules are now relevant in relation to VAT:

- taking into account the absence of customs, the importer undertakes to independently calculate VAT and pay it;

- the tax base is calculated taking into account the cost of exported products;

- the price indicated in foreign currency is recalculated at the exchange rate on the date the goods were accepted for accounting;

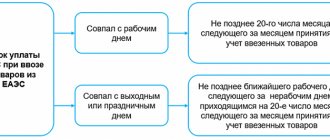

- the optimal period is the 20th day of the month, which follows the month in which the export products were imported. If the end of the period coincides with a weekend or holiday, then for the Russian Federation it is possible to shift to another date that corresponds to the nearest weekday.

More detailed rules can be found by following the link.

It is also recommended that you read Article 6.1 of the Tax Code of the Russian Federation.

Watch the video: registration of goods when importing from EAEU countries.

Read on our website: list of prohibited goods for import into Russia.

How to deduct import VAT

VAT can be deducted after the company receives a tax payment stamp from inspectors on the application for import of goods (see diagram below). The Tax Code of the Russian Federation and the Protocol on the collection of indirect taxes do not contain a clause in this regard. They provide that VAT paid on the import of goods can be deducted if three conditions are met. First, the company purchased goods for taxable transactions. Secondly, the goods have been registered. And thirdly, the organization paid import tax to the budget (clause 11 of article 2 of the Protocol on the collection of indirect taxes, clause 2 of article 171, clause 1 of article 172 of the Tax Code of the Russian Federation). But in the Rules for maintaining a purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137, there is one more condition. In the purchase book, you need to register an application for the import of goods, which contains tax marks (clause 6 of the Rules for maintaining a purchase book).

Procedure for payment of VAT

When goods are imported into Russia, VAT is paid by the importer. This applies to everyone who makes purchases in Russia.

The difference is that when transporting products from countries that do not belong to the member countries of the customs union, the tax is paid when passing customs control.

When importing from the EAEU, money is transferred by the entrepreneur to the budget through the Federal Tax Service.

This applies to goods that were produced on the territory of states that are members of the EAEU and are put into free circulation on the territory of the Eurasian Economic Union.

How to fill in 1C

Formation of the declaration

Form a declaration in 1C in a convenient way of your choice through the section:

- Reports - Regulated reports - Indirect taxes on the import of goods;

- The main thing - Objectives of the organization - Customs Union, declaration for June 2022.

For a reminder to submit a declaration and pay tax to appear in the Organization's Tasks , check the box in the Main section - Taxes and reports - Indirect taxes (import).

Filling out and sending the declaration

The title page is filled with data from the organization’s card.

Check the content:

- adjustment numbers;

- tax period;

- performance venue code.

If there are no excise goods, disable sections 2, 3 via More - Settings - Section Properties.

You can hide sections that are not filled in - uncheck the Show .

The declaration of indirect taxes when importing goods is filled out automatically by clicking the Fill .

Check the report on the CS and the correctness of unloading. And send using the Send (if 1C-Reporting ) / Upload (for sending by another operator).

After uploading the report, set the Passed to protect the report from editing.

The report is monthly, so if there are relevant transactions, fill out the report for the other months of the quarter in the same way.

How is tax calculated?

The price of products that are imported into Russia can be determined under a sales contract. The transaction price reflected in the contract and the one paid to the seller by the buyer are taken into account. The tax base for VAT does not increase due to the presence of expenses for the transportation of goods.

The final tax amount that is paid to the budget can be calculated using the following formula:

price of imported products + excise taxes (relevant for excisable products) x tax rate (10–18%).

Probability of error

The tax amount is billed by the seller according to the documentation, in accordance with current legislation.

Against this background, the person purchasing the goods determines the VAT independently and then makes payments to the Federal Tax Service.

The tax base is necessarily calculated on the date when the goods were accepted for accounting.

It is necessary to proceed from the final price of the product. If it was purchased for foreign currency, then the amount in rubles can be determined by converting it into foreign currency at the Central Bank exchange rate. In this case, the date when the imported products were accepted for accounting is taken into account.

This base is multiplied by the tax rate. Then the amount to be deposited is determined.

What documents should I prepare for the bank?

The import of goods from the countries of the Customs Union, like any other import, is subject to exchange control. Therefore, a company importing goods into Russia from Belarus or Kazakhstan needs to prepare a number of documents for the bank. Alternatively, you can entrust the bank with filling out these documents. To do this, you need to conclude a separate agreement with him or draw up an addition to the current bank account agreement. For these services, the bank will charge a commission, the amount of which depends on the tariff plan in force in a particular bank.

If the company does not submit documents or prepares them later than the established deadlines (they can be seen in the diagram below), a fine of 5,000 to 50,000 rubles is possible. (Article 15.25 of the Code of Administrative Offenses of the Russian Federation).

Transaction passport

A transaction passport is a document that contains general information about the transaction. The company is required to issue a transaction passport from the bank if the value of the contract is equal to or exceeds $50,000. This limit is determined as of the date of conclusion of the contract or amendments and additions to it (clauses 5.1, 5.2 of Bank of Russia Instruction No. 138-I dated June 4, 2012).

Note! The transaction passport must be issued before payment for the goods and no later than 15 working days after the end of the month in which the delivery documents were issued. Fine for delay - up to 50,000 rubles.

A company that imports goods from the Republic of Belarus or Kazakhstan must submit to the bank one copy of the transaction passport in the form given in Appendix No. 4 to Instruction No. 138-I. As well as the contract or an extract from it. Other documents may be required if they contain information that the company provided in the transaction passport. The deadline for submitting documents is before payment for goods and no later than 15 working days after the end of the month in which invoices and transport documents for goods were issued (clause 6.5 of Instruction No. 138-I).

The transaction passport is considered completed after bank specialists assign it a number, date it and sign it. Then the bank must send this document to the company within two working days (clause 6.8 of Instruction No. 138-I). After the supplier transfers the goods and the buyer pays for it, the bank, based on the importer’s application, closes the transaction passport (clause 7.1 of Instruction No. 138-I). This will mean that this foreign economic transaction has been completed and all obligations under it have been fulfilled.

If a company submits documents with a delay, bankers do not have the right to refuse to issue a transaction passport. But they will transmit information about the violation to the Bank of Russia, which will report to Rosfinnadzor. As a result, inspectors can fine the company up to 50,000 rubles. At the same time, this will not affect the company’s VAT obligations, including the right to deduction.

In practice, it happens that a long-term contract is concluded with a supplier, the final amount of which is unknown in advance. If a company sees that the amount of obligations under such an agreement will soon reach $50,000, then a transaction passport can be issued at the bank at any time, but no later than the date when this amount exceeds the limit (clause 1 of the Bank of Russia information letter dated May 7 2014 No. 44).

Certificate of foreign exchange transactions

A certificate of foreign exchange transactions is a document in which a company provides data on payments under an import contract. And if the company transfers an advance to the seller, the certificate must reflect the date when the supplier must ship the goods under the contract.

When making payments in foreign currency, the company importing the goods issues a certificate of foreign exchange transactions in any case. When making payments in Russian rubles, a certificate is submitted to the bank only by companies that have issued a transaction passport. It must be filled out according to the form given in Appendix No. 1 to Instruction No. 138-I. And hand over to the bank simultaneously with the payment slip for transfer to the supplier of money for the goods (clause 2.1 of Instruction No. 138-I).

Certificate of supporting documents

Companies that have issued a transaction passport must submit a certificate of supporting documents to the bank. It provides data on the delivery of goods. The document must be submitted to the bank within 15 working days after the end of the month in which the delivery documents were drawn up (clause 9.2.2 of Instruction No. 138-I). The form for a certificate of supporting documents is contained in Appendix No. 5 to Instruction No. 138-I. Along with the certificate, it is necessary to submit transport (shipping) and commercial documents. As a rule, these are waybills, CMR, specifications, invoices, various certificates and certificates.

Accounting for imported goods from the Republic of Kazakhstan

The order is presented in the table:

| Operation | Debit | Credit |

| Price of goods imported from the Republic of Kazakhstan | 42 | 61 |

| Paid imported products | 61 | 52 |

| Tax accrued for payment | 20 | 69 |

| Return of sales proceeds | 63 | 90-2 |

Example.

In July, Slon LLC imported products from Kazakhstan to Russia for further resale. The cost under the supply agreement is 500.0 thousand rubles.

The amount of VAT that was paid by the company to the budget of the Russian Federation amounted to 90.0 thousand rubles. (at a tax rate of 18%).

VAT reporting

The company submits a declaration.

The following documents are attached to it:

- application (4 copies, paper and electronic versions);

- Bank statement;

- shipping documentation;

- invoice;

- agreement for the purchase of products;

- intermediary agreement (upon its conclusion).

All documentation is provided in the form of photocopies, which are notarized. The exception is the application - it is submitted in the original.

The same requirements are relevant when exporting to Kazakhstan.

A desk audit is required. If during the process no discrepancies are identified, then the inspection undertakes to put a VAT payment stamp on all copies of the application. Duration – 10 days.

The tax office returns three copies of the application with a mark to the applicant. The applicant gives two copies to the exporter, one remains with him.

When is it safest to deduct VAT on goods imported from the Customs Union?

A company can deduct VAT paid when importing goods if the following conditions are simultaneously met:

- imported goods are registered;

- import VAT is transferred to the budget;

- On the application for the import of goods, tax officials put a mark on the payment of VAT.

For example, a company imported goods and paid tax in December. Inspectors marked the application for indirect taxes in January. Then VAT can be deducted in the first quarter (letter of the Ministry of Finance of Russia dated August 17, 2011 No. 03-07-13/01–36).

Note! To deduct import VAT in the purchase book, be sure to register an application for the import of goods with marks from inspectors regarding the payment of tax, and also provide the payment details for the transfer of tax.

It can be proven in court that the company has the right to claim a deduction in the period in which the tax is transferred to the budget. That is, without waiting for the Federal Tax Service's mark on the application for the import of goods (Resolution of the Federal Antimonopoly Service of the Moscow District dated July 25, 2011 No. KA-A41/7408–11). But if the company wants to avoid a dispute, it is safer to wait for the mark. And after that, register the application in the purchase book. The date and number of the application are given in column 3 of the purchase book. And the payment details for transferring VAT to the budget are in column 7.

At the same time, the import application, unlike ordinary incoming invoices, does not need to be registered in the invoice journal (clause 15 of the Rules for maintaining the invoice journal, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

Please note: payment of import tax is reflected in a special declaration, but the deduction can only be declared in a regular one. To do this, fill out line 190 of section 3 (letter of the Federal Tax Service of Russia dated October 20, 2010 No. ШС-37-3/ [email protected] ).

What documents and within what time frame need to be submitted to the tax authorities at the bank and customs?

Changes in EAEU legislation

TCEAES came into force on 01/01/2018. The new document calls for ensuring unified customs regulation on the territory of the EAEU, creating acceptable conditions for participants in foreign economic activity, as well as simplifying customs formalities.

Main changes:

- providing participants with the opportunity to take advantage of a deferred payment of import customs duties (period - no more than 30 days);

- presentation of a product declaration without documentation that confirms the declared information;

- improvement of the institution of authorized economic operator;

- providing the opportunity to make additions to the product declaration.

More details about the changes can be found at the link.

Documents for customs clearance

List of documents for customs clearance:

- passports of the director and chief accountant;

- constituent documentation, as well as documents on the organization;

- balance sheet of the foreign trade entity for the last reporting period;

- company charter;

- order on the appointment of a chief accountant;

- memorandum of association + amendments;

- decision of the meeting on the appointment of a director;

- tax registration certificate;

- certificates from banks.

For a list of additional documents, see the link.

We recommend watching the video: the procedure for registering customs duties on goods imported from the EAEU countries.

What documents to submit to customs

The statistical form for recording the movement of goods must be submitted to the customs of the region in which the company is registered for tax purposes. The deadline is no later than the 10th day of the month following the month in which the company imported the goods. The document must be drawn up according to the form given in Appendix No. 1 to the Rules, approved by Decree of the Government of the Russian Federation of January 29, 2011 No. 40.

You can fill out the statistical form on paper. The easiest way to fill it out is on the website edata.customs.ru. Certify the completed document with your signature and seal, then submit it to customs or send it by registered mail. If you choose to submit the form electronically, it will need to be electronically signed.

In addition, the statistical form must be submitted to the bank along with a certificate of supporting documents. If a company submits a certificate of supporting documents to the bank, but has not yet submitted the statistical form to customs, then this document can be submitted to the bank later (clause 6 of the Bank of Russia information letter dated January 21, 2014 No. 43). The main thing is that at the time of closing the transaction passport, the bank has all the statistical accounting forms that contain information about the goods received under the contract.