Russian legislation requires all organizations to maintain accounting records. There was a time when the heads of any company had the opportunity to independently keep records and prepare financial statements, thereby performing the functions of a chief accountant. But now slightly different rules apply. Who keeps the accounting records in the organization? In what cases does a manager have the right to take over accounting? Who is responsible for outsourced accounting? The answers to these and other questions are in our material.

Organizational financial statements

Accounting statements are a unified system of organized data on the financial condition of a company, which is compiled on the basis of accounting records.

Absolutely all organizations are required to present financial statements to internal and external interested users. Let's consider the main accounting regulations that establish the procedure for its preparation by commercial organizations.

The basic rules for the preparation and submission of financial statements are enshrined in the Regulations on Accounting and Reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

This document was developed on the basis of the Law “On Accounting” dated December 6, 2011 No. 402-FZ and consists of 6 sections.

| No. | Section title | Theses |

| 1 | General provisions |

|

| 2 | Basic rules for accounting |

|

| 3 | Basic rules for drawing up and submitting accounting reports |

|

| 4 | Procedure for submitting accounting reports |

|

| 5 | Basic rules for consolidated accounting |

|

| 6 | Storage of accounting documents |

|

The content and list of forms of financial statements are approved in PBU 4/99.

According to clause 5 of section. 3 PBU 4/99 accounting includes:

- Balance sheet (form 1).

- Profit and loss statement of the company (Form 2).

- Appendixes to forms 1 and 2.

- Explanatory note.

- Auditor's report, if the company is subject to mandatory audit in cases established by law.

Also find out whether the tax office can fine you if the audit report is not submitted.

P. 6 section. 3 PBU 4/99 requires accounting records to provide reliable and complete information about the financial position of the company. In order to correctly reflect business transactions on the accounting accounts on the basis of which financial statements are formed, it is necessary to adhere to certain norms and rules that are independently approved by each organization in the main document regulating the procedure for maintaining accounting and tax accounting - the company’s accounting policy. Let's consider the order of its compilation.

Who is responsible for accounting in companies?

The main regulatory act that the director of an organization must follow in all matters related to accounting is the law of December 6, 2011 No. 402-FZ “On Accounting.” In Art. 7 of Law No. 402-FZ states that management is obliged to organize accounting and storage of documentation. In accordance with the law, accounting in an organization can be carried out by:

- Chief Accountant;

- another employee of the company;

- specialized company;

- directly by the manager (subject to existing restrictions).

This law defines a list of entities that:

- completely exempt from accounting;

- have the right to apply a simplified accounting scheme;

- are required to keep accounting records.

The law contains requirements for persons applying for the position of chief accountant or the right to conduct accounting. Qualification requirements for competent specialists are established by the professional standard “Accountant” (Order of the Ministry of Labor of the Russian Federation dated December 22, 2014 No. 1061n).

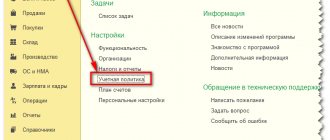

Company accounting policies and accounting regulations

Accounting policy (AP) is a set of methods for maintaining accounting (and tax) accounting for each specific organization. It is approved upon creation of the company and is valid until its liquidation.

A sample accounting policy can be downloaded here.

In this case, the document is applied from year to year, and possible amendments to it are made from January 1 (unless a different date is due to significant reasons) if there are changes (clauses 5, 6, article 8 of Law No. 402-FZ):

- requirements of regulations governing accounting;

- method of accounting;

- operating conditions of the company.

The main accounting document of the company must reflect:

- Working chart of accounts.

- Primary forms used by the company.

- Document flow schedule.

From 01/01/2022, FSB 27/2021 “Documents and document flow” will become mandatory. Let us remind you that the document flow schedule is a mandatory appendix to the accounting policy.

ConsultantPlus experts explained in detail how to organize document flow for accounting purposes under the new FAS 27/2021. Get trial demo access to the K+ system and upgrade to the Ready Solution for free.

- Property accounting procedure.

- Algorithm for conducting audits of the company's liabilities and assets.

- Methods and procedure for determining the company's income and expenses.

- Methods and procedures for assessing property and other assets of an organization.

- Algorithm for monitoring business operations.

- Other important accounting nuances.

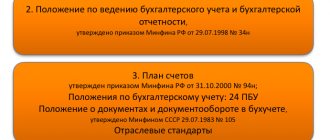

To correctly formulate each section of the accounting policy, companies need to focus on uniform accounting standards approved by the Ministry of Finance of Russia, namely: accounting regulations (PBU) and federal standards (FSBU).

PBU - legislative acts of the 2nd level, following the normative acts of federal significance. They establish the procedure and basic rules for accounting and reporting and are mandatory for all economic entities of the Russian Federation.

For the current list of PBUs, see this article.

The accounting policy of the organization is the accounting regulation PBU 1/2008, which establishes the rules for its formation, approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n. It is compiled by the chief accountant and approved by the head of the company.

You will find the algorithm for generating this document in the article “How to draw up an organization’s accounting policy (2022)?”

Let's consider the main accounting regulations that must be relied upon when drawing up an organization's accounting policies.

Reasons for the need for accounting

The first and most logical reason for carrying out accounting according to a generally accepted procedure is legal requirements. The desire and capabilities of an entrepreneur do not matter when it comes to the legislative framework established by the state.

If accounting is not kept

An organization has no right not to keep accounting records. If business transactions were not recorded properly, and accounting records were never compiled and submitted to the regulatory government authorities, such an entrepreneur is subject to liability:

- for gross neglect of the rules for providing accounting documentation and maintaining appropriate records, as well as the timing and procedure for saving all accounting documents, officials will face a fine of 2-3 thousand rubles. (Article 15.11 of the Code of Administrative Offenses);

- If the tax authorities were not provided with the information required by law about economic activity in due time, citizens will pay a fine of 100-300 rubles. (for each identified case), and officials risk 300-500 rubles. for each delay or failure to provide data (Article 15.6 of the Code of Administrative Offenses).

Inventory accounting: FSBU 5/2019

FSBU 5/2019 must be applied from 2022 instead of PBU 5/01. The new standard regulates the procedure for accounting for inventories of a company.

MPZ include:

- materials, raw materials;

- goods for resale;

- finished products.

Accounting for incoming assets is carried out at their cost, which includes the cost of receipt agreed upon by the buyer and supplier, and all overhead costs associated with the acquisition of these assets. In this case, micro-enterprises can take into account related costs as part of current expenses. Other companies that maintain simplified accounting can include such expenses as current expenses, provided that there are no significant material and production balances.

For information about who is allowed to conduct simplified accounting, read the article “Features of accounting in small enterprises.”

IMPORTANT! Companies that have the right to use a simplified version of accounting may provide in their policies a simple method of accounting, without using double entry (clause 6.1, section 2 of PBU 1/2008).

Disposal of inventories can be carried out:

- at average cost;

- at the cost of each unit;

- FIFO method (the asset that was first registered is written off first).

ConsultantPlus experts explained how to apply FAS 5/2020 in practice and what nuances to take into account when making changes to the accounting policies for 2022. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

How to do accounting

Modern accounting is a rather complex discipline. It is constantly changing under the pressure of legislation. However, the basic principles date back to the 15th century, and the famous double entry was used even during the time of the Incas.

First of all, the accountant must develop an accounting policy, draw up a chart of accounts and prepare forms of primary documents. All of the above is the foundation on which all further activities are built.

An accounting policy is an internal document that defines the principles of accounting in a particular organization. Primary documents mean invoices, acts, invoices and invoices that reflect the facts of the company’s economic activities. In other words, relationships with your customers and suppliers: sales, purchases of goods, provision of services, exchange of material assets, and so on.

Then the accounting magic begins, which is difficult to describe in a couple of general phrases. Balance sheets, postings from debit to credit, the principle of double entry, accounting registers - a quick glance at these terms is enough to fall into depression and lose all desire to do business.

Accounting for fixed assets: FSBU 6/2020 (after 01/01/2022)

Currently, OS accounting is regulated by PBU 6/01. From 01/01/2022 it will no longer be in force and will be replaced by two new FSBUs: 6/2020 for OS and 26/2020 for capital investments.

ConsultantPlus experts explained what will need to be changed in accounting in this regard. You can view comments for free by getting trial access to the system.

According to FSBU 6/2020, the useful life (SPI) of objects depends on:

- from the expected period of operation,

- expected physical wear and tear;

- expected obsolescence,

- plans for the replacement and modernization of fixed assets.

In this case, objects can be taken into account as part of the inventory at a cost set by the taxpayer independently.

The initial cost is the amount of capital investment in the object. These include:

- the contractual value of the asset to be paid to the supplier;

- the cost of assets written off or depreciated in connection with their use in making capital investments;

- salary with deductions for compulsory social insurance accrued to employees participating in capital investments;

- estimated liability, including for future dismantling, disposal of property and environmental restoration.

The cost of fixed assets is repaid monthly by calculating depreciation. Depreciation is calculated:

- in a linear way;

- reducing balance method;

- proportional to the volume of products produced.

ATTENTION! Changes have occurred in the calculation of the base for calculating depreciation; now the latter is calculated not from the original or replacement cost, but from the difference between the book value and liquidation value. The last indicator is another innovation introduced by the standard. According to FAS 6/2020, liquidation value is the estimated value of assets that will remain after the liquidation of an asset, minus the costs of dismantling, disposal and other disposal.

In this case, organizations with simplified accounting and reporting can write off the amount of depreciation either once a year on December 31, or periodically throughout the year within the periods specified in its accounting policies. And the valuation of production and business equipment should be written off as depreciation charges at a time upon acceptance for accounting.

ATTENTION! Since 2022, companies are required to check for impairment of fixed assets in accordance with FAS 6/2020. Thus, assets cannot be accounted for at an inflated value in the financial statements.

Disposal of fixed assets is possible in various ways: through sale, write-off, contribution to the capital of another company, donation, etc. (clause 29 of PBU 6/01). When selling an asset, revenue is recognized as other income, and costs associated with the sale are included in other expenses.

Learn the specifics of using PBU 6/01 in this article.

PBU 18/02 from the middle of the year

Situation: how to start using PBU 18/02 if an organization has lost the right not to apply it in the middle of the year (for example, it has lost its status as a small enterprise)?

PBU 18/02 must be applied from the beginning of the calendar year.

This is explained as follows. The income tax that must be paid to the budget is defined as a tax calculated from the organization’s accounting profit, adjusted to the amounts of permanent tax liability, permanent tax asset, deferred tax asset and deferred tax liability (clauses 20, 21 of PBU 18/02).

Income tax is calculated based on the results of the tax period - the year (clause 1 of Article 285, clause 2 of Article 286 of the Tax Code of the Russian Federation). Therefore, in order to do this correctly based on accounting data and their relationship with tax indicators, PBU 18/02 must be applied from the beginning of the calendar year.

In this case, it will be necessary to identify all the differences between accounting and tax accounting that arose from January 1 to the beginning of the quarter in which the organization lost its status as a small business entity. As of this date, permanent and deferred tax liabilities (assets) must be reflected. That is, an organization that has lost the right not to apply PBU 18/02 in the middle of the year must make additions to its accounting, reflecting all the necessary adjustments for the period when this provision was not applied. Do this in the period in which the obligation to apply PBU 18/02 arose.

An example of how to reflect the differences between accounting and tax accounting. The organization has lost its status as a small business entity

Alpha LLC lost its status as a small business entity in September 2016. The accountant reflected the differences according to PBU 18/02 from January 1, 2016. In the organization’s accounting since January 1, 2016, the accountant identified only one difference between accounting and tax accounting: in the residual value of the fixed asset item. In tax accounting it amounted to 50,000 rubles, and in accounting – 60,000 rubles. The depreciation rate per month in tax accounting is 1,389 rubles, and in accounting – 1,667 rubles. There are 24 months left until the end of the useful life (both in accounting and tax accounting).

The accountant of Alpha LLC made the following entries in 2016:

Debit 68 subaccount “Calculations for income tax” Credit 77 – 2000 rubles. ((RUB 60,000 – RUB 50,000) × 20%) – deferred tax liability is reflected;

Debit 44 subaccount Credit 02 – 1667 rub. – depreciation has been calculated;

Debit 77 Credit 68 subaccount “Calculations for income tax” – 56 rubles. ((RUB 1,667 – RUB 1,389) × 20%) – reflects the decrease in deferred tax liability.

Over the course of 24 months, the accountant will charge depreciation and write off the deferred tax liability.

Make additional entries based on supporting documents (Part 1, Article 9 of Law No. 402-FZ of December 6, 2011). For example, these could be:

- primary documents indicating the emergence of differences between accounting and tax accounting;

- accounting certificate justifying the entries made.

If necessary, make a change to the organization's accounting policy for the current year: specify the obligation to use PBU 18/02 and the procedure for its application (clause 10 of PBU 1/2008).

Accounting for an organization's income: PBU 9/99

Income is an improvement in the economic indicators of an enterprise due to the receipt of assets (cash, inventories, etc.), as well as a decrease in its liabilities, leading to an increase in the capital of this entity. In this case, contributions of its participants to the authorized capital are not taken into account.

According to PBU 9/99, income is divided:

- Those that arose from ordinary activities. This is, as a rule, revenue (clause 5 of PBU 9/99).

- Other: proceeds from rent, sale of fixed assets, receipt of interest, penalties, donated assets, exchange rate differences, etc. (clause 7 of PBU 9/99).

Revenue is recognized subject to the following conditions:

- The company has the right to receive income according to the contract (or on another basis).

- The amount of revenue is clearly defined.

- There is confidence that as a result of the transaction there will be an increase in the economic benefits of the company.

- Ownership of the asset passes to the buyer.

- The amount of expenses associated with generating income is determined.

IMPORTANT! If at least one of the listed conditions is not met, the assets received in fulfillment of obligations are recognized in accounting as accounts payable.

Companies that maintain simplified accounting have the right to recognize revenue using the cash method.

A sample accounting policy for enterprises using the simplified tax system was prepared by K+ experts. If you do not have access to the K+ system, get a trial online access for free.

Accounting for organizational expenses: PBU 10/99

Expenses according to PBU 10/99 include a decrease in economic benefits due to the disposal of funds or assets, as well as the occurrence of liabilities leading to a decrease in the company’s capital. This does not take into account the reduction of the authorized capital agreed upon by the founders.

Expenses fall into two categories:

- For ordinary activities: expenses directly related to production or sales (clause 5 of PBU 10/99).

- Other: expenses for renting premises, services of credit institutions, penalties and interest payable, etc. (clause 11 of PBU 10/99).

Expenses for ordinary activities are divided into the following cost items (clause 8 of PBU 10/99):

- material costs;

- depreciation;

- social expenses needs;

- wage;

- other costs.

At the same time, for the purposes of management accounting, the company has the right to create additional cost items at its discretion.

An expense is recognized if the following conditions are met:

- the expense is made in accordance with a specific agreement (or as required by law), as well as in accordance with business turnover;

- the amount of expenses is clearly defined;

- there is confidence that there will be a reduction in economic benefits.

IMPORTANT! If at least 1 of the listed points is not met, the company is obliged to take such expenses into account as accounts receivable.

Results

PBUs are regulations that establish the procedure for maintaining accounting records in commercial organizations and are mandatory for execution by all economic entities of the Russian Federation. They contain general requirements for company accounting and are explained by methodological recommendations and letters from the Ministry of Finance and the Federal Tax Service of Russia.

All information about the procedure for maintaining accounting (and tax) records must be recorded in the accounting policy of the organization - accounting provisions form the legal basis of this document.

For information on the procedure for drawing up a company’s tax policy, read the article “How to draw up an organization’s tax policy?”

The article “The difference between accounting and tax accounting” will tell you how accounting differs from tax accounting.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting services for customer consulting

This type of service includes both one-time consultation and ongoing operational support on current tax issues, organization of accounting and reporting, and possible tax risks arising from various administrative and economic actions.

Specialists provide tax planning services for transactions, calculate and assess the tax burden for certain types of transactions or proposed transactions.

Important!

Our client's problems are our problems, and therefore it is in our interests to solve them in the best possible way.