Numbering on invoices over several years leads to the fact that the numbers on the papers become larger and larger. This is not very convenient when keeping records, since you have to operate with large numbers. For this reason, some enterprises, usually large ones, start numbering from one every month, year or quarter. However, according to Letter of the Ministry of Finance of Russia dated October 16, 2012 N 03-07-11/427, the organization’s policy in this area has some nuances. The same document did not explain exactly how to carry out the numbering. For this reason, this operation still raises a lot of questions.

The legislative framework

Standard details of invoices for shipment, advances and adjustments are set out in paragraphs 5, 5.1 and 5.2 of the Tax Code of the Russian Federation. The serial number is also considered a property. However, there is no numbering order in the law. The features of this operation are spelled out in the Resolution of the Russian Federation dated December 26, 2011, number 1137. In particular, a reference to this normative act is contained in paragraph 8 of Article 169 of the Tax Code of the Russian Federation.

The numbering order has not been edited for many years. Some of the latest innovations were introduced in 2014: the resolution specified a separating symbol that is used when drawing up documentation. This law applies to the following structures:

- Separate divisions.

- Trust managers.

- Persons participating in the partnership.

In particular, you need to use the “/” sign for separation.

What to consider when numbering invoices

The list of mandatory details of shipping, advance and adjustment invoices is contained in paragraphs.

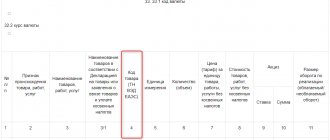

5, 5.1 and 5.2 art. 169 of the Tax Code of the Russian Federation, respectively. One of these details is the serial number. At the same time, the Tax Code itself does not establish the order of numbering of invoices and refers us to the by-law - the resolution of the Government of the Russian Federation (clause 8 of Article 169 of the Tax Code of the Russian Federation). For 2022, this document is the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. ATTENTION! From July 1, 2022, invoices are issued in a new form (see Decree of the Government of the Russian Federation dated April 2, 2021 No. 534). This is due to the end of the experiment on the traceability of goods. At the same time, all VAT taxpayers are required to use the new form, even if the goods are not subject to traceability. Read more about the new invoice form here and about the traceability system here.

You can download the updated invoice form by clicking on the image below:

ConsultantPlus experts have prepared step-by-step instructions for preparing each line of the updated invoice. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

However, nothing has changed regarding the issues of invoice numbering. Thus, since the entry into force of Resolution No. 1137, there have been no fundamental innovations in numbering in its text. Some clarifications took place in the summer of 2014 (Resolution of the Government of the Russian Federation dated July 30, 2014 No. 735), when the type of dividing mark used in invoices of separate divisions, participants in partnerships and trustees was determined. This sign became the slash (fraction, slash) - “/” (previously it was simply a dividing line, but it was not specified whether a slash was meant or a dash).

The main points about the numbering of invoices were given by ConsultantPlus experts. Get trial access to the system and move on to the Ready-made solution. It's free.

Read about the latest changes that significantly changed the form and rules for filling out an invoice here .

Numbering rules

The main rule of numbering is assigning numbers in chronological order: numbers are indicated as they are assigned. Renewal of numbering is permitted. This is inevitable if a company has been in business for a long time. It is imperative to reflect renewal periods in the company's accounting policies. The period may be as follows:

- Month.

- Quarter.

- Year.

However, a government decree limits the resumption of numbering: it cannot be started from the beginning every day. This will be considered a violation.

The frequency of updates depends on the document flow of a particular enterprise. The more papers are filled out, the more often the numbers are renewed.

Ambiguity in numbering

The number is the first detail of the invoice. Subparagraph “a” of paragraph 1 of section 2 of Appendix 2 to Resolution No. 1137 mentioned in the letter states that invoices (both initial and adjustment) must be numbered in general chronological order. If an organization issued an invoice to the buyer with number 1, then sent invoices with numbers 2–9 to other counterparties, and then draws up an adjustment invoice for the first document, then it should be assigned number 10.

Decree No. 1137 does not say when companies should stop numbering and give the next invoice the first number. It is logical that organizations do this: after all, if you assign numbers to invoices in a general manner for several years, the numbers will turn out to be too large.

For large companies, such numbering is extremely inconvenient. Therefore, some companies begin new numbering quarterly, monthly, or even daily. But in the letter commented on, the Ministry of Finance expressed the position that daily numbering of invoices is not provided for by Resolution No. 1137.

Types of invoice numbers

The numbers can consist of both numbers and letters. Letter designations must be present when document flow is in the following structures:

- Separate units. After the number you need to indicate the index in numbers. Values are separated by slash (/). The index is determined by the company and prescribed under a specific contract.

- People in a partnership or trustee managers. The index separated by a slash must be specified in this case as well.

Compliance with rules is important not only for the implementation of regulations. Correct numbering ensures orderly document flow and prevents confusion.

Mistakes that will not interfere with your tax deduction

What shortcomings in the invoice do not prevent the recognition of a tax deduction:

- Full name of the entrepreneur without indicating “IP”;

- Typos in the name of the buyer or seller: extra characters (commas, dashes), capital letters replaced with lowercase ones;

- incorrect checkpoint with correct TIN;

- incomplete information, shortcomings, technical errors in indicating the addresses of the buyer and seller in comparison with the address in the Unified State Register of Legal Entities (USRIP): abbreviations (“street” instead of “street”, “city” instead of “city”), replacement of capital letters with lowercase ones, other sequence of address details, country indication, etc.;

- in the line “currency code” instead of the name “ruble” its graphic symbol is indicated;

- instead of a national symbol for a unit of measurement, a code letter or entry is given (for example, “thousand”);

- in the invoice when selling, instead of indicating “without excise duty” there is a dash;

- there is no “%” sign in the “tax rate” column;

- for goods produced in Russia, in column 10 “country of origin of the goods”, instead of dashes, the RF code “643” is reflected, and in column 10a - “Russia” is indicated;

- the digital code of the country of origin of the goods (column 10) does not correspond to the name of the country of origin of the goods (in column 10a);

- violation of invoice numbering.

In all controversial cases, it is useful for inspectors to quote paragraph 2 of Article 169: “Errors in invoices and adjustment invoices that do not prevent the tax authorities from identifying the seller, buyer of goods (work, services), property rights, name of goods (work , services), property rights, their value , as well as the tax rate and the amount of tax presented to the buyer, are not grounds for refusal to accept tax amounts for deduction.”

If the error is still significant, do not accept the defective invoice. Let the seller make the corrections.

If you are a seller, do not ignore the buyer’s request. Even if it suddenly seems to you that the error is insignificant. Don't sigh, don't express or refuse. Meet halfway. It's not difficult at all. We're colleagues! In the same boat, on the same waves of storms and shocks...

And don’t forget to reflect it in accounting and reporting: “mirror” for tax control is very important!

Features of putting down letter values

Some enterprises number advance and adjustment documents using different letters and numbers. For example, advance invoices are assigned the letter A, and adjustment invoices are assigned the letter B. This measure allows you to quickly find the necessary documents. However, it is not recommended to use the method in question, since there are no permissions for this in the law.

There is a risk that the buyer, upon discovering the letter designation, will require correction of the papers. A person’s motivation is to prevent problems from arising during a tax audit.

ATTENTION! There is a compromise method. You can assign both an official and an auxiliary number to an invoice. This measure will not be considered a violation. You can indicate the auxiliary number not only in the accounting program, but also in the document itself. However, the additional value does not need to be mentioned in the Number column. It is indicated after all the details in the “For reference” column. Permission to use additional numbers is given in letters from the Ministry of Finance.

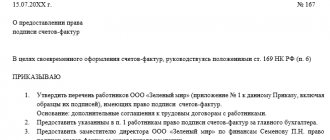

Signatures of persons

Signing of invoices by unidentified or unauthorized persons is grounds for refusal to accept tax deductions.

As a rule, the invoice is signed on behalf of the company by the manager and chief accountant. On behalf of the individual entrepreneur – the individual entrepreneur himself. Others, namely authorized persons, can do so.

It is allowed to sign the invoice by one authorized person with the right to sign: both the manager and the chief accountant. The Ministry of Finance expressed its consent in a letter dated July 24, 2022 No. 03-07-11/55067.

An electronic invoice is signed with an enhanced qualified electronic signature of the first person (company manager, individual entrepreneur) or authorized person.

A facsimile of an invoice will result in a refusal to deduct VAT. This is a significant mistake. The position of the Ministry of Finance is clear. The Tax Code does not provide for the use of invoices signed with a facsimile signature. The position of the Ministry of Finance is set out in letters dated April 10, 2022 No. 03-07-14/25364, dated December 8, 2022 No. 03-03-06/1/81951.

Is it allowed to put separate numbers on different invoices?

Is it permissible to put numbers separately on advance or adjustment invoices? The need for a unified chronology is established by the Decree of the Russian Federation of December 26, 2011, number 1137. Until this year, such a norm did not exist, and therefore accountants often put different numbering on invoices for shipments and prepayments. This procedure was considered the simplest, but is now prohibited. Otherwise, violations may be revealed during verification.

Separate numbering is also clearly prohibited by Letter of the Ministry of Finance of Russia dated October 16, 2012 N 03-07-11/427. If you want to highlight advance invoices, you can use a letter value. The letters must correspond to a single chronology, for example, these could be the values “A”, “AB”.

There are also separate standards for filling out adjustment tax forms. They must be listed in chronological order.

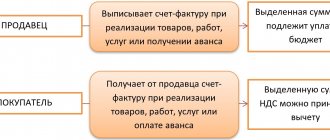

How to enter advance invoices into sales and purchase books

It is the responsibility of the seller/performer to issue an invoice for the advance payment. He records the advance invoice in the sales ledger as usual .

The transaction type code for advance account payment is 02 . It shows the total amount including tax and the tax amount. The column with the indicator “sales cost excluding VAT” is crossed out.

Upon receipt of an advance invoice from a supplier, the taxpayer has the right to deduct VAT and include this advance invoice in the purchase book.

It should be borne in mind that the advance account does not have the right to use the deduction for 3 years . That is, if VAT on a regular account can be deducted within 3 years from the date the account is issued, then VAT on an advance account can be deducted only in the quarter in which it is issued.

When making a shipment for which an advance was paid, the supplier again issues an invoice (already shipping) and registers it in the sales book with the transaction type code - 01 . To avoid double tax, the supplier simultaneously registers an invoice for the advance payment in the purchase book with the transaction type code - 22 .

The buyer accepts the shipping invoice from the supplier and registers it in the usual manner in the purchase book. If the buyer entered the previously accepted invoice for the advance payment into the purchase book and accepted VAT for deduction, then in order for the tax deduction not to be doubled, it is necessary to restore the previously accepted VAT for deduction on the advance payment.

Penalty for incorrect numbering

Errors often occur when assigning invoice numbers. The most common ones are:

- Skipping numbers.

- Ignoring the need for chronology.

- Assigning the same number to the same document.

The last mistake is quite rare, since most accountants use special programs. The software prevents bifurcation.

Violation of the numbering order is the most difficult case. To correct the violation you will have to spend a lot of time and effort. An error in the chronology of one number leads to the fact that other numbers “creep”. It turns out that the invoices already sent to the buyer contain incorrect numbers.

Do the numbering need to be corrected? This measure makes sense if an error was made in the last number of the document, which has not yet been transferred to the buyer. If the error concerns a late number, it is not necessary to correct it. The seller does not bear any penalties for this violation.

ATTENTION! Article 120 of the Tax Code of the Russian Federation states that the absence of invoices for completed transactions entails a fine. These penalties do not apply to incorrect numbers. However, correct numbering is important in any case. This is taken into account during inspections.

Information about the seller and buyer – clearly and unambiguously

Errors in the name of the seller or buyer, TIN and address, due to which auditors will not be able to clearly identify the seller or buyer, are one of the main reasons for refusing a VAT deduction.

The full or abbreviated name of the seller and buyer are indicated in accordance with the constituent documents. Check - you have such data. You check your counterparties with passion, right?

If the TIN is indicated incorrectly, does not correspond to the name of the company, or is not indicated at all, the tax authorities will try to deny the right to a deduction. Better fix it.

The addresses of the seller and buyer must correspond to the data in the Unified State Register of Legal Entities (USRIP). But if they are given with abbreviations, typos and inaccuracies in the form of replacing capital letters with lowercase ones and vice versa; with no quotation marks; indicating extra symbols: dashes, periods, quotation marks, commas - this will not be considered an error due to which the tax office will refuse the deduction. This is confirmed by numerous explanations from the Ministry of Finance.

You can also – quickly and free of charge – check the address on the invoice with an extract from the state register on the Federal Tax Service website at the link https://egrul.nalog.ru.

How does incorrect numbering affect the buyer?

In most cases, incorrect numbering does not have any impact on the buyer. Errors don't bother you:

- identification of the parties to the contract;

- name of GWS, their cost;

- rate and total VAT.

That is, the buyer will not be denied a deduction, as stated in paragraph 2 of Article 169 of the Tax Code of the Russian Federation. If the controller makes his claims, they can be challenged, as evidenced by judicial practice. Based on court decisions, we can conclude that even the complete absence of numbering cannot be a basis for deducting VAT.

Attention! Invoice!

Any accountant knows that the correction procedure itself is tedious and disgusting. Find a supplier: explain – ask – correct. And to be sure to “look through the mirror.” Correctly and promptly make corrections to accounting registers and tax returns. Don't miss it, keep it under control...

And if there is a flood of documents, and the managers of the purchasing department and the sales department refuse to understand these documents, and the suppliers are tedious, and they change accountants, and they are also scattered across the country. Or in general - they don’t listen to requests, they’re in no hurry to correct them - go to court? And yes, you have to fight in the courts for the right to deduction. If the price is worth it, of course.

But in fact - for the most part - errors in invoices are truly insignificant and unimportant. Therefore, if they do not interfere with deductions, you should not add more work to yourself and fool your head with corrections that do not solve anything. Neither to yourself nor to others.

Since 2011, the Federal Tax Service has been trying to distinguish between defects in invoices, highlighting simple flaws in design and critical errors, due to which a tax deduction will be denied. But in practice, during inspections, anything happens. Because rejecting a deduction by recognizing the invoice as defective is easy and simple. What if it goes for a ride? And our task is to stop the persistent impulse of the auditors: not to let their imagination run wild when the legality of the deduction is obvious.

But to do this, you need to understand what to pay attention to when preparing invoices: which errors are serious and critical, and which are not so much. What you can definitely ignore and not waste time on corrections.

Shall we discuss?

The general rule, which has already set teeth on edge, is this: if errors and inaccuracies in the invoice do not interfere with the identification of the seller, the buyer, the name of goods, works, services, property rights, their value, tax rate, the amount of tax presented, it does not threaten VAT deduction. This is from paragraph 2 of Article 169 of the Tax Code.

And again this slippery norm: they interfere / do not interfere - well, it’s very subjective. They won’t interfere with a smart inspector, but they will help someone who comes to cause you problems. To do this, let's look at each of the critical errors in detail.

So, invoice defects due to which the deduction will be denied:

- lack of number and date to identify the document;

- errors or incorrect information that do not allow us to determine who exactly the seller or buyer is: errors in the name, address, TIN of the seller or buyer;

- inaccuracies in determining which product or service is purchased;

- errors that do not allow one to determine the cost of goods (works, services), property rights;

- incorrect VAT rate ;

- lack of signatures of authorized persons.

General requirements

The numbering for invoices should be:

- continuous;

- sequential in chronological order;

- non-repeating - each document must be assigned its own unique number (Order of the Ministry of Finance of the Russian Federation No. 119n of 2001 and Filling Out Rules).

The chronological order requirements apply to both master and adjustment invoices.

In all other respects, the organization is free to choose a numbering system for primary accounting documents .

Reference. If the numbers increase in chronological order, there should be no reason for claims from the Federal Tax Service of the Russian Federation. The main thing is to correctly fill out the remaining columns of the invoice form.

Regulatory acts allow for the possibility of separate numbering for invoices. But this opportunity, according to the Filling Rules, can only be used:

- for organizations operating through branches or representative offices;

- for participants of the partnership;

- for trustees.

In this case, the serial number is divided into two parts:

- Shared room.

- Through a slash - a digital index of a subdivision or an index of an agreement between comrades.

In general, we can conclude: the organization has the right to adopt its own accounting policy regarding invoices, indicating numbering rules in them. The main thing is that the numbers go in ascending order. At the same time, separate numbering for special types of invoices (for example, only for advance invoices) at the enterprise is not provided for by law - but it is not prohibited either. The main thing is to avoid situations in which the same number can be assigned to different documents relating to different counterparties and different obligations.

Omissions in invoice numbers are not a significant violation, and such documents must be accepted by tax authorities for VAT deduction.

You will learn more about filling out the fields in the invoice in this article.

Which method of registering advance invoices to choose in 1C: Accounting ed. 3.0?

Let's turn to the basics of legislation. According to paragraph 3 of Article 168 of the Tax Code of the Russian Federation, the VAT payer, when receiving an advance from a client for upcoming shipments or provision of services, is obliged to issue an advance invoice. He is given a period of five days from the date of receipt of funds.

At the same time, accountants often do not issue an invoice if, within these five days, a shipment was made that covered the prepayment. There are two points of view on this.

The Federal Tax Service of Russia, in its letters No. KE-4-3/3790 dated March 10, 2011 and No. KE-3-3/ [email protected] dated February 15, 2011, explains that crediting prepayments within five days in one tax period is not is grounds for failure to issue an invoice.

And the Ministry of Finance of Russia has repeatedly expressed a different point of view in letters No. 03-07-08/28182 dated 04/12/2019 and No. 03-07-09/1695 dated 01/18/2017.

It turns out that this decision falls on the shoulders of the taxpayer, who is either ready or not ready to defend his point of view before the tax authorities.

Let's turn to setting up the 1C: Enterprise Accounting 8 edition 3.0 program in terms of issuing invoices for advance payments.

To do this, go to the “Main” section and select the “Taxes and reports” item.

In the window that opens, go to the “VAT” tab and expand the list of options for registering invoices for advance payments.

Let's look at each of them.

As mentioned earlier, invoices must be issued within five days from the date of receipt of the advance payment; accordingly, the second method of their registration completely coincides with the current legislation and the point of view of the Ministry of Finance of the Russian Federation, but not with the point of view of the Federal Tax Service. This item should be selected only by those who are ready to challenge the opinion of the Federal Tax Service.

Also, this setting item is not convenient for those organizations that have a large number of transactions over a period, and because of this, it is difficult for them to track which advances have already been invoiced and which have not.

Based on this, we would recommend selecting the very first item in the drop-down list “Register invoices always when receiving an advance.” With this choice, the program will register invoices for all prepayments, except those that were credited on the same day.

Let's go further: the third and fourth points are contrary to the law, but are convenient for those who always provide services at the end of the period. For example, renting premises. During the month, such companies receive rent for the current month, and on the last day of the month they prepare certificates of completed work. That is, they know in advance that advances will be closed before the end of the period and VAT not calculated on the advance will not affect the final tax amount. These settings items are again recommended only for those who are ready to defend their position.

And the last point - it is chosen only by those organizations whose production process lasts more than 6 months. This position is set out in paragraph 13 of Article 167 of the Tax Code of the Russian Federation.

Let's move on directly to registering invoices for advance payments. This is done in two ways: manual and automatic.

You can manually enter an invoice by clicking on the prepayment registration document, for example, on “Receipt to current account”, and clicking on the “Create based on” button - “Invoice issued”.

But this method is extremely inconvenient and time consuming. The second method is much more attractive. On the “Bank and cash desk” tab there is an item “Advance invoices”.

When you select this item, processing opens, in the header of which you need to set the period, and then successively click on the “Fill” buttons - and the program will fill in the list of prepayments for the selected period and “Run” - to register all invoices from the specified advances.

At the same time, the program has two options for assigning numbers to advance invoices - this is either a single numbering with invoices for shipment, or indicating the prefix A. That is, when shipping invoices will have numbers 1, 2, 3, and on advance payment - A1, A2, A3. This way they will be easy to distinguish.

An important point when registering an advance invoice is the name of the service or product for which the advance payment was received. The program automatically indicates the name - “Advance payment”, but often a different general name is indicated in the agreement with the client, for example, “Rent”. You can change the content of the operation in the advance invoice itself:

So it is in an agreement with a counterparty. In the “Directories” section, select the “Counterparties” item, go to the one we need and on the “Agreements” tab, “fail” into the agreement.

Let’s expand the green section “VAT” and in the column “Generalized name of goods for an advance invoice” we enter what we need.

Let's look at a specific example where we receive an advance payment from a buyer, issue an invoice for it, and then make a shipment, and see how these transactions will be reflected in the books of purchases and sales, as well as the VAT return.

Let's assume that in the 3rd quarter we received an advance from the customer, and in the fourth quarter we made a sale. To reflect the receipt of an advance payment, go to the “Bank and cash desk” section and select the “Bank statements” item. In the window that opens, click on the “Receipt” button and enter the details of the incoming payment order.

After completing this document, we will open the transactions and check whether this is indeed an advance payment. The loan score for the advance must be 62.02, 62.22 or 62.32.

Then we will go to the section “Bank and cash desk” - “Invoices for advance payments” and register invoices for the 3rd quarter.

We can see registered invoices in the “Invoices issued” journal in the “Sales” section:

The result of their implementation is the receipt of posting Dt 76.AB Kt 68.02 and an entry in the sales book.

Let's go to the "Reports" section and select the "Sales Book" item. In the window that opens, enter the period and click on the “Generate” button.

In this report we will see a line generated by the previously issued invoice for advance payment. The transaction type code is 02; in the column number and date of the document confirming payment, the incoming details of the payment order will be indicated.

Let’s create a VAT return; to do this, go to the “Reports” - “Regulated reports” section.

In the window that opens, click on the “Create” button and select the declaration we need from the list of reports. The amounts of advance payments received for future shipments will be reflected in line 070 of Section 3.

Let's move on to Q4 and shipping. To register sales, go to the “Sales” section and select “Sales (acts, invoices)”. Then click on the “Implementation” button and select the corresponding item, in our example it will be “Services (Act)”.

After filling out and posting the document, you must analyze the transactions. An important posting in our case will be the offset of the advance payment, because if it does not happen, the program will not understand that payment of 100,000 rubles and shipment of 200,000 are the same transaction.

Based on this sale in the footer of the document, we also issue an invoice for sales with code 01. Please note that if you register an invoice for a sale for which there were previously payments, then these payments are filled in in the invoice.

The sales invoice, like the advance invoice, goes into the sales book.

Thus, it turns out that we have increased the VAT payable first at the time of receipt of funds, and then at the time of sale.

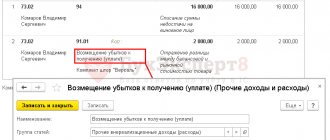

Accordingly, in order not to pay twice, we need to reflect the amount of the offset advance in the purchase book. To do this, in the “Reports” section, in the “VAT reporting” item, you must fill out the document “Creating purchase ledger entries”.

In this document, you should click on the “Fill out the document” button, and then check the completion of the “Advances received” tab. There should be amounts of advances credited in this period.

The posted document will create the posting Dt 68.02 Kt 76.AB, so account 76.AB will be closed, which means that it will not have a balance at the end of the period.

Let's create a “Purchase Book” in the “Reports” section.

Please note that when receiving a deduction for a previously issued advance invoice, the name of our organization, and not the organization that made the advance payment, is reflected in the purchase book in the “Name of the Seller” column. The transaction type code is indicated as 22.

Let's look at the VAT return for the 4th quarter.

The amount of VAT on the advance payment, which was previously declared in the sales book, is now reflected in the purchase book and in the declaration on line 170 of Section 3.

And finally, the main points:

1. It is best to always register advance invoices upon receipt of an advance if you are a VAT payer and the place of sale is the territory of the Russian Federation.

2. For the absence of advance invoices, inspectors may fine you under Article 120 of the Tax Code of the Russian Federation, as a gross violation of accounting rules. The fine will range from 10,000 to 40,000 rubles.

3. If the absence of advance invoices resulted in late payment of VAT, then in addition to penalties, a fine under Article 122 of the Tax Code of the Russian Federation in the amount of 20 to 40 percent of the payment amount is also possible.

4. An example of how additional VAT is charged to you will be the Decision of the Arbitration Court of the Moscow Region dated November 28, 2022. in case No. A41-77939/2016.

Let's also immediately look at which mistakes are made more often than others and what they lead to.

Error 1. Those who believe that issuing advance invoices is advisable only for uncredited prepayments at the end of the period, since these amounts affect the amount of tax payable, select the “Do not register invoices” option in the “Taxes and reports” setting -invoices not counted until the end of the tax period.” At the same time, as stated at the beginning of the article, the Federal Tax Service has repeatedly explained that invoices are subject to issuance for all advances received. And if your prepayment and shipment were made in the same quarter, then the invoice for the advance payment still needs to be registered.

Let's assume you didn't do this and it turned out during the check. Of course, this error did not result in late payment of tax, but there is still a violation in the document flow. In this case, you will receive a fine of 10 to 40 thousand rubles. The amount in this case will be affected by the number of periods in which this violation was detected.

Error 2 . We have repeatedly heard the opinions of accountants: “Why do we need advance invoices? Our customers don’t require them.” In this case, they select the “Do not register advance invoices” setting option.

What does this lead to? Returning to the example described above, when in the 3rd quarter we received an advance payment in the amount of 100,000 rubles, we did not issue an advance invoice and did not charge VAT payable in the amount of 20,000 rubles. And this amount will only appear in the declaration for payment in the 4th quarter.

In total, we have penalties for the period from October 25 of the current year to January 25 of the next year in the amount of 4,000 rubles and a fine of 10,000 rubles if this violation is committed by you for the first time. Or a penalty of 8,000 rubles and a fine of 40,000 rubles if several facts of such errors are found.

Error 3 . In the settings, you selected the option “Do not register invoices settled within 5 calendar days”, but did not track one or more transactions that did not fit into the specified period. In this case, the errors will be one-time, but in any case, penalties will be imposed on you.

The choice is yours!

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Legislative support

In the case when it comes to regulations regarding the numbering of invoices, you need to be guided by:

- Tax Code of the Russian Federation - articles are given above.

- Filling rules approved by Decree of the Government of the Russian Federation No. 1137 of 2011 (hereinafter referred to as the Filling Rules).

- Letter of the Ministry of Finance of the Russian Federation No. 03-07-09/411 of 2022, which confirms that the VAT deduction is not related to the numbering of invoices.

These are just the basic regulations. In specific cases, it is necessary to be guided by others. In addition, the provisions are regularly revised - and therefore you need to focus on current legislation.

Read more about registration requirements here.