Purchase of fuel by an accountable person - what about VAT?

The easiest way to purchase gasoline is through an employee of the organization, who pays either in cash received on account or using a bank card. For the purchase amount, the gas station operator issues cash receipts, which the accountable person then attaches to the expense reports and submits them to the accounting department. The accountant receives the received gasoline with the wiring DT 10 KT 71.

If the receipt indicates that the sale is not subject to VAT, then the entire purchase price can be taken into account as material expenses when calculating income tax.

ATTENTION! Write-off of fuel and lubricants as expenses is carried out on the basis of waybills. They are issued daily, or before the start of the voyage if the latter will last several days.

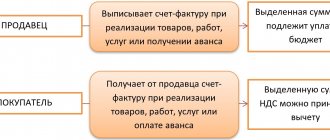

If VAT is highlighted on the check, then an additional entry DT 19 CT 71 is given. Further accounting for the tax will depend on what other documents the seller provides. If there is a power of attorney from the organization, the gas station issues an invoice. On its basis and subject to other conditions being met (acceptance of fuel and lubricants for accounting and its use in activities subject to VAT), the tax is allowed to be deducted: DT 68 CT 19. Note that in practice it is often impossible to receive an invoice when refueling in cash.

If there is no invoice, then the company does not have the right to reflect input VAT on fuel and lubricants as part of deductions. The Ministry of Finance has repeatedly drawn attention to this, see, for example, letter dated March 26, 2019 No. 03-07-09/20252. What to do with the amount of tax not declared for deduction?

Regulatory regulation

Accounting and tax accounting

Like all materials, fuels and lubricants are taken into account in the amount of actual costs for their acquisition (clause 5, clause 6 of PBU 5/01). For profit tax purposes, the actual cost of inventories is determined based on purchase prices (excluding input VAT and excise taxes) and other costs of their acquisition (clause 2 of Article 254 of the Tax Code of the Russian Federation).

The purchase of fuel and lubricants can be carried out either in cash or by bank transfer.

In non-cash form there are:

- direct non-cash payment: by bank card or through a current account;

- indirect non-cash payment: using fuel cards, coupons, statements, and other documents that allow you to receive a certain amount of prepaid fuel.

The receipt of fuel and lubricants and its further accounting is carried out in the accounts (chart of accounts 1C):

- 10.03.1 “Fuel in warehouse”;

- 10.03.2 “Fuel in the tank.”

To control its movement, it is necessary to organize accounting at storage locations and materially responsible persons (MRP) in the context of various types of fuels and lubricants.

VAT

The issue of deducting VAT when purchasing fuel and lubricants is especially acute where there is a large fleet of vehicles and the costs of fuel and lubricants occupy a significant share in the structure of total costs.

When purchasing materials, VAT is deductible if the conditions are met (clause 2 of Article 171 of the Tax Code of the Russian Federation):

- the materials must be used in activities subject to VAT;

- a correctly executed SF (UPD) is available;

- materials were accepted for registration (clause 1 of article 172 of the Tax Code of the Russian Federation).

Moreover, if we talk about non-cash payment, then these three conditions are met when concluding any of the fuel supply contracts: to the buyer’s wholesale warehouse, using fuel cards, coupons, statements. For each of these contracts, the buyer receives a delivery note and an invoice from the supplier.

If you purchase fuel and lubricants for cash, deducting VAT can be problematic.

Is it possible to deduct VAT on cash receipts received at a gas station and attached to the advance report?

If fuels and lubricants were purchased at a gas station for cash without presenting an invoice, then VAT on it cannot be deducted (Letter of the Ministry of Finance of the Russian Federation dated January 24, 2017 N 03-07-11/3094). The cash register receipt reflected in the purchase book will not find a “match” in the general database of invoices for Russia.

More information about VAT in the cash receipt

Fuel cards and coupons for fuel and lubricants - monetary documents or not?

Accounting for fuel cards and coupons is not regulated by accounting regulations. In the Instructions for using the Chart of Accounts, approved. By Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n, fuel coupons and cards are not named as monetary documents, but the list of such documents is open.

Based on the analysis of the Instructions approved by Orders of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n and dated December 1, 2010 N 157n, several features of monetary documents can be identified:

- the document has a fixed cost;

- the product (service) according to the document has been paid for, but not received;

- As a rule, the receipt of an asset is of a one-time nature.

Based on this, we can conclude: quantity-amount and total coupons for fuel and lubricants can be considered monetary documents under contracts where ownership of the fuel passes at the time of refueling. Accounting for monetary documents is organized in 1C on account 50.03 “Cash Documents”.

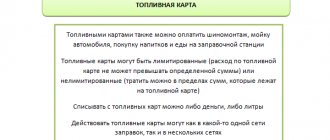

The fuel card has no monetary value and can be used multiple times. In our opinion, it does not meet the characteristics of a monetary document and can be accounted for in an off-balance sheet account, for example, MTs.04 “Inventory and household supplies in operation.”

What to do with VAT on fuel and lubricants in the absence of an invoice

In accounting, tax not accepted for deduction will be charged as expenses: DT 20, 25, 26, 91/2 ... CT 19. With tax accounting, everything is much more complicated.

Let us remind you that VAT amounts can be included in tax accounting expenses in the cases specified in paragraphs 2 and 2.1 of Art. 170 of the Tax Code of the Russian Federation, in particular, when:

- use of purchased fuels and lubricants in activities not subject to VAT,

- application of VAT exemption or special regime,

- purchasing fuel through subsidies or budget investments,

- etc.

The absence of an invoice is not included in the list of cases where tax is included in expenses for tax accounting purposes. Therefore, a VAT payer who has no reason to claim input VAT for deduction will not be able to reduce the profit base using such amounts. Both officials of the Ministry of Finance and judges are unanimous on this issue (see letter of the Ministry of Finance of Russia dated August 13, 2018 N 03-07-11/57127 and resolution of the Thirteenth AAS dated August 27, 2018 No. 13AP).

In what cases can VAT be deducted on a gas station receipt?

The Ministry of Finance of Russia (letter dated June 25, 2020 No. 03-07-09/54634) once again gave a negative answer to the question about the possibility of deducting VAT on goods purchased at retail.

More precisely, the question was asked about the possibility of deducting VAT if there is a gas station receipt received after refueling the organization’s vehicle.

Let us remind you that in retail trade it is enough for the seller to issue the buyer a cash receipt issued in accordance with the current legislation (clause 7 of Article 168 of the Tax Code of the Russian Federation).

The receipt will indicate the quantity and type of fuel purchased (filled in the tank), the price per liter, the cost of the entire refueling, highlighting the amount of value added tax. And it can be considered both a primary accounting document confirming the organization’s expenses for the purchase of fuels and lubricants, and a document confirming the fact of payment of value added tax to the seller (gas station).

But the officials who wrote the above letter come to the conclusion that when refueling at a gas station, having received a check upon payment (with the amount of value added tax highlighted in it), this VAT cannot be deducted anyway.

Arguments, as always, Art. 171 of the Tax Code of the Russian Federation, or more precisely, clauses 3, 6, 7, 8. That is, only in the situations indicated there can VAT be deducted on the basis of other documents, not invoices, and in the rest - in no way.

Clauses 3 (VAT paid by tax agents), 6 (VAT accrued when performing construction and installation works for own consumption), 8 (also related to tax agents) Art. 171 of the Tax Code of the Russian Federation cannot be tied to retail trade in any way.

Only point 7 remains.

And according to it, in the absence of an invoice, but in the presence of other documents indicating the amount of VAT paid, the tax can be deducted when compensating the costs of an employee’s business trip - for travel, for renting living quarters, for other expenses during the business trip made by the employee with the permission or knowledge of the employer.

Officials do not object to the fact that the list of travel expenses for tax purposes is open (letter of the Ministry of Finance of Russia dated June 29, 2020 No. 03-03-06/1/55801). This letter noted that the validity of expenses taken into account when calculating the tax base (for income tax) should be assessed taking into account circumstances indicating the taxpayer’s intentions to obtain an economic effect as a result of real business or other economic activity.

Consequently, guided by the opinion of officials expressed in these two letters above, we can come to the conclusion that the organization has the right to deduct VAT indicated in cash receipts if they confirm the expenses of an employee of the organization while he is on a business trip and are recognized as expenses that reduce taxable profit .

And consider the following situation.

An employee of an organization goes on a business trip in a car (car or truck, it doesn’t matter).

In this case (clause 7 of the Regulations on the peculiarities of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749), documents confirming the use of the vehicle for travel to the place of business trip and back (as well as travel costs) will serve as travel documents sheet, invoices, receipts, cash receipts and other documents confirming the transport route.

Thus, receipts from roadside gas stations where fuel was purchased will be attached to the advance report, indicating the cost of refueling and the amount of VAT paid.

Does accounting have the right to accept it for deduction? The cost of fuel and lubricants purchased along the route is recognized as travel expenses and reduces income tax. Consequently, according to paragraph 8 of Art. 171 of the Tax Code of the Russian Federation, it turns out that it is possible.

But how will the tax authorities react to this? It has not yet been possible to find arbitration practice on this issue.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

How to take into account input VAT when purchasing fuel using fuel cards

In order not to lose the right to claim VAT for deduction, general regime residents enter into an agreement to purchase fuel and lubricants by bank transfer using fuel cards. At the end of the month, the supplier will issue a certificate for the cost of the supplied fuel and issue an invoice for this amount, which will solve the problem with the deduction.

To work with fuel cards, you need to pay their cost and capitalize them in accounting. After which the advance payment DT 60/2 KT 51 is transferred to it.

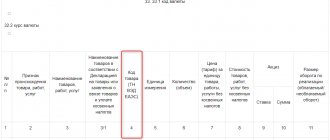

The purchase of fuel and lubricants using fuel cards will be reflected in the following entries:

- DT 10 KT 60/1 – for the cost of fuel and lubricants. In this case, the date of creation of the record will be influenced by the conditions for the transfer of ownership (upon payment or upon release to the consumer). If the transfer of ownership is carried out upon payment, then additional sub-accounts must be opened for account 10 and gasoline accounting will be carried out through them;

- DT 19 CT 60/1 – for the amount of VAT.

At the end of the month after receiving the set of documents:

- according to the act, the advance is credited - DT 60/1 CT 60/2;

- According to the invoice, VAT is accepted for deduction - DT 68 CT 19.

Purchasing fuel and lubricants using coupons - is a deduction possible?

Another option for receiving an invoice is to purchase fuel using coupons. The accounting procedure will depend on the type of coupons (liter or cash) and the terms of the agreement concluded with the fuel supplier.

If it is determined that ownership of fuel and lubricants is transferred upon sale of coupons, then according to the received invoice, input VAT on fuel can be deducted immediately in the full amount. However, if the organization receives less fuel during the period than indicated in the coupons, then the condition for the capitalization of material assets for VAT deduction will not be met. Therefore, to avoid tax authorities finding fault with an inflated deduction, it is better to declare it in proportion to the amount of fuel actually purchased.

If it is agreed that ownership passes at the time of refueling, VAT is deducted as the fuel filled at the gas station is posted. The postings will be like this:

- DT 60 KT 51 – coupons paid to the fuel supplier

- DT 50/3 KT 60 – coupons received from the supplier

- DT 71 KT 50/3 – coupons issued to the accountable person

- DT 10 KT 71 – fuel was capitalized on the basis of gas station receipts and coupon stubs

- DT 19 KT 71 – input VAT on fuel and lubricants is taken into account

- DT 68 CT 19 – VAT is accepted for deduction.