Question 1. How to fill out the “Government Contract ID” field?

More recently, a new attribute was added to the invoice - government contract identifier. It should be reflected on line 8, and on the adjustment invoice - on line 5.

The need to indicate this parameter in the invoice follows from the new edition of paragraphs 5, 5.1,5.2 of Article 169 of the Tax Code of the Russian Federation. The ID must be reflected on the invoice if available. But not every contract or agreement has it. This property is used in public procurement contracts, but again not in all. The identifier is indicated in government contracts for defense orders and during treasury support.

The issue of availability/assignment of an identifier to a government contract lies outside the competence of the taxpayer, who is its executor. Therefore, it is his job to reflect this detail on the invoice if it is assigned. In other cases, the fields mentioned above, which are intended for the identifier, are left empty. This explanation is contained in the letter of the Ministry of Finance of the Russian Federation dated August 11, 2017 No. 03-07-09/51657.

Note! The ID assigned to defense contracts is a 25-digit numeric code. The length of the identifier code, which is assigned during treasury support of government contracts and agreements, is 20 characters. Which one should be indicated on the invoice? The regulatory authorities did not give any recommendations in this regard. Therefore, just in case, experts recommend specifying both identifiers.

Where is the EAEU Commodity Classification for Foreign Economic Activity indicated in the ESF?

The EAEU HS code is indicated in column 4 “Product code (EAES HS HS)”

Section

G “Data on goods, works, services”.

Healthy

Rules for issuing an invoice in electronic form in the electronic invoice information system and its forms (Order No. 370 dated April 22, 2019)

Question 2. Whose data should the commission agent indicate on the invoice?

Commission agents issue invoices when selling goods of the principal on their own behalf. At the same time, taxpayers sometimes wonder what to indicate in lines 2, 2A and 2B. According to the rules from Resolution No. 1137, the seller’s details should be provided here. But who is considered the seller in this case - the commission agent or the consignor?

Recently, the Ministry of Finance once again confirmed that when carrying out sales on its own behalf, the commission agent must indicate his own data (letter of the Ministry of Finance dated July 19, 2017 No. 03-07-09/45747). Column 2 indicates the name of the commission agent, line 2A - his address, line 2B - his TIN/KPP.

If the commission agent purchases goods for the principal on his own behalf, then the situation is completely different. In this case, the specified lines should reflect the parameters of the seller of goods.

Unit code

In column 2 of the UPD table corresponding to the invoice, indicate the code of the unit of measurement. Column 2a contains its symbol. In column 3 – quantity (volume).

Data on units of measurement are taken from the All-Russian Classifier of Units of Measurement OK 015-94 (MK 002-97) (approved by Gosstandart Resolution No. 366 of December 26, 1994).

For example, code 796 refers to the unit of measurement “piece” (denoted “piece”), 006 – “meter” (“m”), 657 – “product” (“izd”), etc.

But what if the classifier does not contain the designation you need?

Question 4. How to reflect in an electronic invoice that the “primary” is maintained by a third-party organization?

The taxpayer entrusted the maintenance of primary documents to a third-party company. How should this be reflected in the electronic invoice? The Ministry of Finance’s explanations on this issue are given in letter dated May 3, 2022 No. SA-4-15/8461.

Each primary document must contain all mandatory parameters, including the name of the economic entity that compiled the document. The electronic invoice contains the element “NaimEconSubSost”, which is required to be filled out. It should indicate the name of the organization that compiled the invoice exchange file. Also in the electronic form of the document there is an optional element “OsnDoverOrgSost”. It is intended to reflect the basis on which the specified entity generates the invoice. Filling out these fields makes it possible to determine who and why drew up the document on behalf of the seller.

Since 2022, the EAEU HS code has become mandatory

Now it must be indicated in all ESF for goods.

Let us recall that the requirement to indicate the EAEU HS code in invoices was adopted back in 2022, but the implementation of the norm has only come into force now.

Now, according to Article 412 of the Tax Code of the Republic of Kazakhstan, the origin of the goods and the type of transaction do not in any way affect the filling out of the document - the HS code is indicated in all cases.

Where in the ESF should the EAEU HS code be indicated?

The EAEU Commodity Nomenclature for Foreign Economic Activity code is indicated in column 4 “Product Code (EAEU Commodity Nomenclature for Foreign Economic Activity)” of Section G “Data on goods, works, services.”

How to fill out the EAEU HS code in ESF in 1C?

In standard solutions, filling out the EAEU HS code when issuing an ESF depends on working with sources of origin and the version of sources of origin used.

In order to prevent incorrect execution of the document (without the EAEU HS code), it is necessary to conduct an audit and identify items with unfilled or outdated codes. Let's study in detail the procedure for storing and reflecting information about the HS code in the 1C: Accounting for Kazakhstan configuration, edition 3.0.

Where is the HS code stored?

In the 1C: Accounting for Kazakhstan configuration, edition 3.0, this is a product item card, that is, an element of the Nomenclature

(section Nomenclature and warehouse - Directories and settings).

When goods are accounted for by source of origin, information about the code is also stored in the Sources of Origin

(section Purchase (Sale) - Directories and settings).

The detail HS code in the Source of origin is filled in depending on the operation on the basis of which the individual entrepreneur is formed:

- when reflecting “internal” receipt transactions (production, posting, etc.), the HS code is determined based on the data in the item card;

- when reflecting transactions for the purchase of goods, the HS code is determined based on the data specified in the supplier’s ESF (the code from the card is not taken into account in this case).

If, when creating the source of origin (version 1.0), the HS code was not determined for the product, then the information in the source of origin can be adjusted or added.

When switching to accounting for sources of origin according to version 2.0, i.e. when accounting for goods subject to reflection in the BC module is maintained, information about the HS code is stored in the elements of the Sources of origin directory

(section Nomenclature and warehouse – Virtual warehouse – Directories and settings – Sources of origin of goods).

note

that the basic details of sources of origin (version 2.0) cannot be adjusted manually. You will have to create a new directory element, that is, a “new” source of origin.

Where to get the HS code when filling out the ESF

If the configuration does not keep records of goods by source of origin, then when filling out the tabular part of the Electronic Invoice

The Product code (HS)

field is filled in with data from the item card.

To ensure that there are no empty fields with the Product Code (HS Code), you should revise the elements of the Nomenclature directory, identify the remaining goods with empty HS Codes and fill in the details.

A list of remaining goods without a HS code can be seen in the Material Statement

.

To do this, set the selection according to the item details HS Code with the comparison type Not filled

.

Accounting for goods by source of origin (version 1.0)

If the configuration is configured to account for goods by source of origin (version 1.0), then when auto-filling the Product Code (HS)

information from

the Source of origin

of the goods being sold is reflected.

If the Source of Origin does not contain information about the HS code, the accounting system uses data from the nomenclature card of the specified product.

To exclude empty lines Product code (HS)

, in the tabular part of the ESF, a list of those goods is revealed that do not have a HS code indicated simultaneously

in the Source of Origin and in the item card.

Data on the balances of goods for which the HS code value is not filled in can be viewed in the Source of origin and in the item card

in the following way:

- open the Universal report (section Reports - Standard reports) to generate by data type Accumulation Register according to the Goods register of the accounting organization;

- set the following settings for the report: on the Grouping tab, add a new field Product;

- On the Selection tab, add two new Product fields. HS Code and Source of Origin. HS code, in the Type of comparison column, set the value to Not filled.

The tabular part reflects the balances of those goods for which the accounting system does not indicate the data of the HS code in any of the data sources for auto-filling the ESF.

In this case, you can fill in the information on the HS code directly from this report by opening the item card by double-clicking the left mouse button on the product item in the list.

To view the list of Sources of Origin for the balances of goods for which the HS code is not filled in, add the following parameters in the previously established report settings:

- On the Grouping tab, add a new Source of Origin field.

You can go to Source of Origin to adjust data by HS code from the report list.

Accounting for goods in a virtual warehouse (sources of origin version 2.0)

If the configuration has switched to accounting for goods from a virtual warehouse, then when auto-filling the ESF, information about the HS code is filled in based on the data specified in the source of origin. It is necessary to identify the remains of goods for which such details as the HS code are not filled in the sources of origin.

Props HS code

in

the Source of Origin

(version 2.0) is filled in depending on the operation on the basis of which the source is generated:

- when reflecting “internal” receipt transactions (production, posting, etc.), the HS code is determined based on the data in the item card;

- when reflecting transactions for the purchase of goods, the HS code is determined based on the data specified in the supplier’s ESF (the code from the card is not taken into account in this case);

- when performing the procedure for switching to accounting for aircraft goods from accounting by sources of origin version 1.0, filling out data according to the HS code depends on the method of filling out the document Entering initial balances: According to accounting data - the HS code is determined based on the data in the item card;

- For goods of a BU organization, the HS code is determined in the following order: according to the source of origin (version 1.0), if there is no data on HS in the source, the code is filled in according to the item card data.

- open the Universal report (section Reports – Standard reports) to generate by data type Accumulation register by the Goods in virtual warehouses register;

In the generated report, you can view a list of sources of origin that do not indicate the HS code

, according to the remaining goods of the Goods register

in virtual warehouses

.

note

that when the aircraft goods accounting mechanism is enabled, it is impossible to simply adjust the details of an already created source of origin; when changing the key details, a new source is created.

A new source of origin must be created. To eliminate errors such as the absence of a HS code, it is recommended to check the item details before switching to accounting for aircraft goods (Sources of origin version 2.0).

If you still have questions about where to get the EAEU HS code, how to fill it out in ESF in 1C and how to avoid empty lines, call our specialists.

Contact the specialists of First Bit to set up a Virtual Warehouse in 1C and sources of origin.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Other articles on the topic:

#ESF

All articles

1C Reporting: submit reports directly from 1C Budgeting in 1C

No time to read? We'll send it to you by email!

Order help from a 1C specialist

Log in to leave a comment

Use your social media account to leave a comment or review!

Question 5. How to fill out an invoice if the product is sold by a separate division?

In its letter dated May 18, 2017 No. 03-07-09/30038, the Ministry of Finance responded as follows. VAT payers are organizations and entrepreneurs, as well as persons equivalent to them, moving goods across the border of Russia. Separate divisions do not pay VAT. Therefore, they can only issue invoices on behalf of the main organization.

But in line 2B you should indicate the checkpoint of a separate division, and not the parent organization. But even if the checkpoint is indicated incorrectly, this cannot prevent the deduction. After all, such an error does not interfere with the identification of the main parameters of the transaction - its object and parties, the amount, size and VAT rate.

Question 6. What information about individual entrepreneur registration should be included in the electronic document?

The entrepreneur must indicate information about his state registration in the invoice. For this purpose, special elements were introduced into the electronic form of the document: “SvGosRegIP” and “GosRegIPVydDov”. They should reflect the details of the Certificate of State Registration of the Entrepreneur. However, as of January 1, 2017, tax authorities do not issue such a certificate. Now the fact that the entrepreneur is included in the register is confirmed by the USRIP entry sheet.

Thus, entrepreneurs registered before the beginning of the current year, as before, indicate the parameters of the State Registration Certificate in the invoice. Those who became individual entrepreneurs later than the specified date reflect in the document the data on the Unified State Register of Individual Entrepreneurs: OGRNIP and the date the entry was made in the register.

Question 7. How to fill out an invoice if imported goods are packaged in Russia?

The goods were imported to Russia and underwent secondary packaging here. What to indicate in the invoice in column 11 “Customs declaration number” when selling it?

In accordance with the Tax Code, for imported goods, the customs declaration number must be indicated on the invoice. At the same time, it is determined that Russia will be considered the country of origin of a product if it has undergone sufficient processing (processing) on its territory. If the packaging of goods on the territory of the Russian Federation does not entail a change in the country of origin, then in column 11 of the invoice the data of the import customs declaration should be indicated. This opinion is contained in the letter of the Ministry of Finance dated 04/07/2017 No. 03-07-09/20667.

List of changes in the 2022 invoice

One of the innovations in the invoice is line 5a “Shipment Document”.

Line 5a consists of three fields:

• in the “Item No.” field indicate the serial number of the entry in column 1 of the tabular part of the invoice; • in the “No.” field - the number of the document for the shipment of goods and materials specified in the corresponding line of column 1; • in the “From” field - the date of registration of the document for shipment

The name of the shipping document (invoice, act, etc.) is NOT indicated in line 5a.

The following may be indicated as shipping documents in line 5a:

• when selling goods - a delivery note; • if the product is a fixed asset - an act in the OS-1 form; • for works, services - certificate of delivery and acceptance of results; • Construction and installation work - act in form KS-2; • transport services - depending on the type of transportation, for example, a consignment note for transportation by road, a railway consignment note for railway transportation, etc.; • if services continue without issuing a monthly certificate (for example, for rent, communications) - details of the contract; • in case of gratuitous transfer of property - an act of transfer of property.

Changes in the new form for persons selling traceable goods:

1. In column 11, which has changed its name, the corresponding RNPT for the batch of traceable goods should be reflected. 2. Column 12 has appeared. It is used to reflect the code of the unit of measurement of the traceable product. 3. Column 12a appears. It is used to indicate the corresponding symbol assigned to the unit of measurement of a specific product according to the OKEI system. 4. Column 13 has appeared. It is intended to reflect the quantity of goods calculated in the appropriate unit of change used for traceability purposes.

In addition, in the new form for the above columns 11-13, a certain number of substrings can be formed to one line. This option is useful if the goods that are being tracked have the same name/price/unit of measurement, but different RNPT.

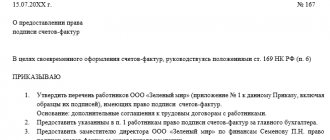

Question 8. Does the chief accountant have the right to sign an invoice for the director?

The manager is away for a few days, but invoices need to be signed. Can the chief accountant do this alone?

The invoice must be signed by the head of the organization and the chief accountant or other authorized persons. In this case, the document can be signed by one person who has the authority to sign both the manager and the chief accountant. The Federal Tax Service agrees with this (letter dated June 18, 2009 No. 3-1-11/ [email protected] ) and the Ministry of Finance (letters dated October 21, 2014 No. 03-07-09/53005, dated July 2, 2013 No. 03-07- 09/25296).

That is, when the manager is on vacation, the chief accountant must sign the document both for himself and for him. However, the chief accountant can sign for the manager only if he is authorized to do so by order or power of attorney on behalf of the organization. This position is adhered to by the Ministry of Finance (letter dated October 21, 2014 No. 03-07-09/53005), referring to the rules from Resolution No. 1137.

Thus, before the manager leaves, you should make sure that the chief accountant has the appropriate powers given to him by order or power of attorney on behalf of the organization.

Question 9. Isn’t it a violation to re-number invoices every month?

The law requires that the invoice indicate the serial number and date of issue. Resolution No. 1137 requires chronological numbering. No other features of putting numbers on the invoice are specified either in the Tax Code or in any other legal act.

This means that the organization can independently determine how exactly it will generate invoice numbers and consolidate this order in its accounting policies. But be that as it may, it is unlawful to take a deduction due to numbering. Such conclusions follow from the letter of the Ministry of Finance dated January 12, 2017 No. 03-07-09/411.

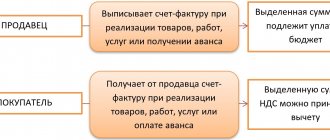

Question 10. Is it possible to claim VAT deduction if the invoice shows an incorrect value?

In accordance with paragraph 2 of Article 169 of the Tax Code of the Russian Federation, not any error in the invoice will entail a refusal to deduct VAT. If it does not interfere with the identification of the seller and the buyer, the name of the object of the transaction, its value, the rate and amount of VAT, then it does not interfere with the deduction.

It follows from this that the error in cost, including arithmetic, is critical. Based on such an invoice, VAT cannot be deducted. The Ministry of Finance once again recalled this in letter dated April 19, 2017 No. 03-07-09/23491.

In addition, it will not be possible to deduct VAT if the invoice incorrectly indicates the name of the object of the transaction (letter of the Ministry of Finance dated November 17, 2016 No. 03-07-09/67406) or data on the currency - code or its name (letter of the Ministry of Finance of the Russian Federation dated 11.03. 2012 No. 03-07-08/68).

What classifiers are used for formation?

Classifier is a grouped list of objects, each of which is assigned a unique unified code. The following classifiers are used to generate invoices:

- OKSM (all-Russian classifier of countries of the world).

- OKEI (All-Russian Classifier of Units of Measurement).

- CPA (All-Russian Classifier of Products by Type of Economic Activities).

This is not yet a complete list of classifiers used in Russia. In total there are just over 31 of them. For current classifiers, see the tax website .

On the Internet, many sites provide information about object classifiers.

Each specific category of classifiers is determined by the corresponding regulatory document:

Goods (OK 034-2014 (CPES 2008). All-Russian classifier of products by type of economic activity" (approved by Order of Rosstandart dated January 31, 2014 No. 14-st) (as amended on September 8, 2017) (with amendments and additions, intro. effective from December 1, 2017).- For operations regulated by the Federal Tax Service of the Russian Federation .

Transaction codes are entered in accordance with the standards established by Order of the Federal Tax Service of the Russian Federation dated March 14, 2016 No. ММВ-7-3/ [email protected] “On approval of the list of codes for types of transactions shown in the purchase book used in calculations of value added tax, additional sheet to it, the sales book used in calculations for value added tax, an additional sheet to it, as well as codes for the types of transactions for value added tax necessary for maintaining a log of received and issued invoices.” - Units of measurement (OK 015-94 (MK 002-97). All-Russian classifier of units of measurement" (approved by Resolution of the State Standard of Russia dated December 26, 1994 No. 366) (as amended on October 13, 2017).

- Country of origin (OKSM (all-Russian classifier of countries of the world) Change No. 21/2016 entered into force on 01/01/2017 with the right of early application in legal relations arising from September 28, 2016).