Who signs the invoice?

The issue of who signs invoices should be resolved by the seller in a timely manner.

If this function in the company is not assigned to anyone, the buyer may suffer: an unsigned invoice leaves him without a tax deduction. The same result awaits the buyer if the invoice received from the seller contains the signatures of unauthorized persons. The Tax Code does not strictly establish who signs invoices, and does not prohibit invoices from being signed by other persons in the company (managers, financial specialists, etc.). But the names and positions of the employees authorized to sign invoices must be reflected in the order - then the question of who signs invoices in this company will be resolved.

An invoice can be signed not only by authorized representatives of an organization or individual entrepreneur, but also by a specialist accountant or employees of another company. Typically, this occurs when bookkeeping, including signing invoices, is delegated to these individuals under an accounting services contract. In order for a specialist accountant or employees of an accounting company working under a contract to sign invoices, it is also necessary to either issue a power of attorney for them, or draw up a separate annex to the contract indicating the persons whom the parties authorize to sign the invoices.

ConsultantPlus experts explained by whom and how an electronic invoice is issued and signed. Study the material by getting trial demo access to the K+ system. It's free.

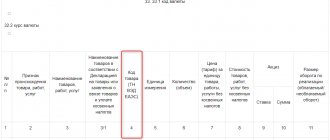

From 07/01/2021 a new invoice form is in effect, incl. adjustment, as amended by the Decree of the Government of the Russian Federation dated 04/02/2021 No. 534. The update of the form was caused by the introduction of a goods traceability system. All taxpayers are required to use the new form, even if the goods are not included in the traceability system. We described in more detail the changes made to the invoice here.

You can download the new invoice form by clicking on the image below:

ConsultantPlus experts have prepared step-by-step instructions for preparing each line of the updated invoice. To do everything correctly, get trial access to the system and go to the Guide. It's free.

Let’s take a closer look at how to properly issue a power of attorney to sign invoices.

The invoice was signed by an unidentified person: tax risks

Home → Articles → Invoice signed by an unidentified person: tax risks

A contract for the supply of goods is concluded between the buyer and seller. Invoices from the seller were signed by an unauthorized (unidentified) person. The director is disqualified in the period after the conclusion of the contract, but before its expiration. In this case, the subject of the supply contract is delivered to the buyer. What tax risks may arise in this situation?

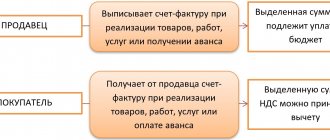

If the requirements established by clauses are met. 5, 5.1 and 6 tbsp. 169 of the Tax Code of the Russian Federation, an invoice is a document that serves as the basis for the buyer to accept the goods (works, services) presented by the seller, property rights of VAT amounts for deduction in the manner prescribed by Chapter 21 of the Tax Code of the Russian Federation (clauses 1, 2 of Article 169, Clause 1 of Article 172 of the Tax Code of the Russian Federation).

At the same time, errors in invoices that do not prevent the tax authorities from identifying the seller, buyer of goods (work, services), property rights, the name of goods (work, services), property rights, their value, as well as the tax rate and amount when conducting a tax audit tax presented to the buyer are not grounds for refusal to accept VAT amounts for deduction (second paragraph of clause 2 of Article 169 of the Tax Code of the Russian Federation).

According to paragraph 6 of Art. 169 of the Tax Code of the Russian Federation, an invoice is signed by the head and chief accountant of the organization or other persons authorized to do so by an order (other administrative document) for the organization or a power of attorney on behalf of the organization (for additional information, see letter of the Ministry of Finance of Russia dated August 27, 2015 No. 03-07-09/49478 ).

Therefore, an invoice issued by an organization must be signed by its head (for example, a director). Instead, another person can do this, but only on condition that he is authorized to perform such actions by the relevant administrative document of the organization or by a power of attorney on behalf of the organization. In the latter case, Chapter 21 of the Tax Code of the Russian Federation does not oblige the seller to transfer to the buyer documents confirming the person’s authority to sign an invoice (letter of the Federal Tax Service of Russia dated 08/09/2010 No. ShS-37-3/8664, in addition see letters of the Ministry of Finance of Russia dated 10/14/2015 No. 03 -07-09/58937, dated 04/10/2013 No. 03-07-09/11863, dated 04/23/2012 No. 03-07-09/39).

Note that the judges proceed from the fact that the mere fact of signing an invoice not by the head of the organization, but by another person, does not mean that the invoice was signed by an unauthorized person; this must be proven by the tax authority (see, for example, the resolution of the Presidium Supreme Arbitration Court of the Russian Federation dated January 16, 2007 No. 11871/06, resolution of the Arbitration Court of the Central District dated December 15, 2016 No. F10-4484/16 in case No. A08-4951/2015).

From the materials of arbitration practice it follows that the seller’s violation of the established clause 6 of Art. 169 of the Tax Code of the Russian Federation, the procedure for signing an invoice, in particular its signing by an unauthorized (unidentified) person, creates obstacles for the purchasing organization to exercise the right to apply a VAT tax deduction on the basis of such a document (see, for example, the decisions of the Arbitration Court of the Volga District dated April 22, 2016 No. F06-8288/16 in case No. A12-29272/2015, Fourteenth Arbitration Court of Appeal dated June 20, 2017 No. 14AP-2616/17, Seventh Arbitration Court of Appeal dated February 17, 2017 No. 07AP-10134/16, Ninth Arbitration Court of Appeal dated 07/31/2017 No. 09AP-32154/17, dated 10/21/2016 No. 09AP-47339/16).

At the same time, there are examples of court decisions in which judges proceeded from the fact that the mere fact of signing invoices by an unauthorized person in the absence of evidence that the taxpayer received an unjustified tax benefit is not a basis for refusing a VAT refund (see, for example, the resolution of the Supreme Arbitration Court of the Russian Federation dated 05.25.2010 No. 15658/09, decisions of the Twentieth Arbitration Court of Appeal dated 05.17.2017 No. 20AP-1277/17, Nineteenth Arbitration Court of Appeal dated 12.23.2014 No. 19AP-7143/14, dated 05.28.2014 No. 19AP-3049/13) . In the resolution of the Arbitration Court of the Volga-Vyatka District dated September 16, 2015 No. F01-3645/15 in case No. A31-5077/2014, the judges indicated that in order to apply VAT deductions and take into account the corresponding expenses when calculating income tax, it is necessary that transactions be real nature, and the documents confirming the legality of applying tax deductions contained reliable information. Specialists of the Federal Tax Service of Russia, in a letter dated October 4, 2017 No. SD-4-3/ [email protected], also noted that documents confirming the right to VAT deductions must reflect reliable information and confirm the reality of the transaction performed in accordance with its actual economic meaning.

Considering that the supply contract in the situation under consideration was actually executed, the invoice contains reliable data and at the time of concluding this contract the director of the supplier was not disqualified, we see no grounds indicating that the organization received an unjustified tax benefit (resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated 12.10. 2006 No. 53 “On the assessment by arbitration courts of the validity of the taxpayer receiving a tax benefit”).

Along with this, it must be taken into account that on August 19, 2017, Art. 54.1 of the Tax Code of the Russian Federation, which determines the limits of the exercise of rights to calculate the tax base and (or) the amount of taxes, fees, insurance contributions (Federal Law of July 18, 2017 No. 163-FZ). By virtue of clause 1, 2 of this article, actions of taxpayers to reduce the tax base and (or) the amount of tax payable in accordance with the rules of the corresponding chapter of part two of the Tax Code of the Russian Federation are permissible only if the following conditions are simultaneously met (clauses 1, 2 of Article 54.1 of the Tax Code of the Russian Federation) : – information about the facts of economic life (the totality of such facts), about the objects of taxation that are subject to reflection in tax and (or) accounting or tax reporting of the taxpayer is not distorted; – the main purpose of the transaction (operation) was not non-payment (incomplete payment) and (or) offset (refund) of the tax amount; – the obligation under the transaction (operation) is fulfilled by a person who is a party to the agreement concluded with the taxpayer, and (or) a person to whom the obligation to perform the transaction (operation) is transferred under the agreement or law.

As we understand, all the above conditions are met in this case.

At the same time, paragraph 3 of Art. 54.1 of the Tax Code of the Russian Federation establishes that the following circumstances cannot be considered as an independent basis for recognizing a taxpayer’s reduction of the tax base and (or) the amount of tax payable as unlawful: – signing of primary accounting documents by an unidentified or unauthorized person; – violation by the taxpayer’s counterparty of the legislation on taxes and fees; – the possibility of the taxpayer obtaining the same result of economic activity when performing other transactions (operations) not prohibited by law.

According to the letter of the Federal Tax Service of Russia dated August 16, 2017 No. SA-4-7 / [email protected] by the legislator in paragraph 3 of Art. 54.1 of the Tax Code of the Russian Federation contains provisions that exclude the formal approach from the practice of tax authorities when identifying circumstances of understatement of the tax base or tax evasion. This means that formal claims against counterparties (violation of the legislation on taxes and fees, signing of documents by an unidentified person, etc.) in the absence of facts disproving the reality of transactions and operations carried out by the declared taxpayer by the counterparty are not an independent basis for refusal to account for expenses and in tax deductions for transactions (operations). In this regard, tax claims are possible only if the tax authority proves the unreality of the transaction (operation) by the taxpayer’s counterparty and the taxpayer’s failure to comply with the provisions established in paragraph 2 of Art. 54.1 of the Tax Code of the Russian Federation conditions.

Thus, we believe that even if the tax authority makes claims regarding the legality of applying a tax deduction due to the signing of an invoice by an unauthorized (unidentified) person, the organization in the situation under consideration has every chance of defending its right to a tax deduction.

We emphasize that the expressed point of view is our expert opinion. For official written clarification on a given issue, an organization has the right to contact the tax authority at the place of registration and (or) directly to the Ministry of Finance of Russia (subparagraphs 1, 2, paragraph 1, Article 21 of the Tax Code of the Russian Federation).

Answer prepared by: Liliya Fedorova, expert of the GARANT Legal Consulting Service, auditor, member of the Russian Union of Auditors Response quality control: Dmitry Ignatiev, reviewer of the GARANT Legal Consulting Service, Candidate of Economic Sciences

Latest news of the digital economy on our Telegram channel

| Need an electronic signature? All you have to do is leave a request. We will help you choose the type of electronic signature certificate you need, tell you how to apply it and provide other additional services. Leave a request >> |

How to draw up a power of attorney to sign invoices: sample

Any employee of the company cannot sign invoices, because in clause 6 of Art. 169 of the Tax Code of the Russian Federation states that this document must contain the signatures of the manager and chief accountant or other authorized persons. As for the individual entrepreneur, he must sign the invoice himself or entrust this work to a trusted person.

In large companies with a complex management structure, the manager may delegate some of the authority to his deputies, full-time employees, or even third parties.

In companies with little document flow, the invoice is signed, as a rule, by the director and chief accountant; an individual entrepreneur often has to fulfill this responsibility alone. But if he decides to save himself from this work, he will need to be given the right to sign invoices by documenting the authority through a power of attorney certified by a notary (letter of the Ministry of Finance of Russia dated April 25, 2017 No. 03-02-08/24718). In this case, the invoice will contain the details of two documents at once - the issued power of attorney and the certificate of state registration. IP registration.

Power of attorney forms do not relate to strictly normative documents, and therefore are not defined by law. But you can draw up a sample power of attorney yourself, focusing on standard forms and thereby determining who signs invoices in the absence of management.

A power of attorney for signing invoices, a sample of which you can view on our website.

On company letterhead

POWER OF ATTORNEY No. _______

mountains ____________________ "___"____________ ___ G.

_______________________________________________________________________

(Company name)

represented by _________________________________, acting on the basis of ____________,

(Full name of the manager, his position)

hereby authorizes _____________________________________________________

(F.I.O. and position held)

passport: series and number ________ issued by ___ ___ ______ by _________________________,

registered at: ______________________

sign invoices for the director (chief accountant).

The power of attorney was issued for a period of ______________ without the right of substitution.

Signature ______________________________ ___________________________ I certify.

(full name of the authorized representative) (signature of the authorized representative)

_______________________________ _________________ _______________

(manager position) (signature) (full name)

M.P.

And from the link below you can download the finished sample:

Transfer of signature rights

Situation: how to correctly transfer the right to sign invoices from the manager and chief accountant to other employees of the organization?

The transfer of the right to sign invoices can be formalized by a power of attorney from the organization or by order (instruction) of the manager (clause 6 of Article 169 of the Tax Code of the Russian Federation).

There are no standard samples for orders (instructions), so these documents can be drawn up in any form. The main thing is that they contain information about to whom the right to sign is transferred, and samples of signatures of these employees. In addition, the order (instruction) can set a period during which an authorized employee has the right to sign invoices. You can also provide for who is given the right to sign instead of an authorized employee during the period of his illness or absence for other reasons.

Authorized employees certify invoices with their signatures. At the same time, when filling out the details “Head of the organization or other authorized person” and “Chief accountant or other authorized person,” they put personal signatures, and indicate their last names and initials in the transcript. You can do it another way: add additional lines to the invoice and indicate in them the real positions of authorized persons and the decoding of their surnames and initials. Both options do not contradict the law and cannot be grounds for refusal to deduct VAT. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated April 10, 2013 No. 03-07-09/11863, dated April 23, 2012 No. 03-07-09/39.

Situation: is it necessary to indicate in the invoice the position of the employee authorized to sign this document instead of the manager (chief accountant)?

No no need.

The composition of the mandatory invoice details is established by Article 169 of the Tax Code of the Russian Federation, therefore changing them is unacceptable. This also applies to such invoice details as “Head of the organization or other authorized person” and “Chief accountant or other authorized person.” Thus, if the invoice is signed by an authorized employee, then his position should not be indicated in this document. But to identify the person who actually signed the invoice, his last name and initials must be indicated after the signature. This procedure for issuing an invoice signed by an employee authorized to do so by an order (instruction) of the manager or a power of attorney on behalf of the organization is recommended by the Ministry of Finance of Russia in letters dated April 23, 2012 No. 03-07-09/39, dated February 6, 2009. No. 03-07-09/04, Federal Tax Service of Russia in letter dated June 18, 2009 No. 3-1-11/425.

At the same time, if the employee authorized to sign invoices indicated his position in it, such a document is not drawn up in violation of the established procedure. Neither the Tax Code of the Russian Federation nor the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 prohibits indicating additional details (information) in invoices, including the names of positions of persons authorized to sign these documents. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated April 23, 2012 No. 03-07-09/39 and dated February 6, 2009 No. 03-07-09/04.

Situation: should the seller (executor) provide the buyer (customer) with copies of documents indicating the authority of employees (who are not the manager or chief accountant) to sign invoices?

No, you shouldn't.

The law does not assign such an obligation to sellers. However, when checking the legality of the application of VAT deductions by the buyer (customer), the tax office may request from the seller (executor) documents about his employees authorized to sign invoices (clause 8 of Article 88, clause 12 of Article 89, Article 93.1 Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated August 9, 2010 No. ШС-37-3/8664). If it turns out that these documents are missing, the inspection will recognize invoices signed by unauthorized persons as having been drawn up in violation of the established procedure. For such invoices, the buyer will not be able to deduct VAT (clause 2 of Article 169 of the Tax Code of the Russian Federation). Therefore, it is better to provide copies of documents confirming the right of employees to sign invoices to counterparties.

The impossibility of deducting input VAT due to the lack of documents confirming the authority of employees to sign invoices is recognized by most arbitration courts (see, for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 11, 2008 No. 9299/08, determinations of the Supreme Arbitration Court of the Russian Federation dated January 16, 2009 No. VAS-17445/08, dated January 15, 2009 No. VAS-17093/08, dated October 16, 2008 No. 13259/08, resolution of the Federal Antimonopoly Service of the Moscow District dated April 28, 2008 No. KA-A40/2274- 08, dated February 26, 2009 No. KA-A40/13170-08-P, West Siberian District dated September 24, 2008 No. F04-5092/2008(10144-A46-42), Far Eastern District dated September 4, 2008 No. F03-A73/08-2/3591, Volga-Vyatka District dated February 24, 2009 No. A28-5306/2008-148/23, dated November 21, 2008 No. A28-8965/2007-384/11, dated July 25, 2008 No. A43-13960/2007-40-532, East Siberian District dated December 3, 2008 No. A19-2109/08-50-52-F02-5812/08, dated November 5, 2008 No. A19-4298/08-56-F02-5273/08, North Caucasus District dated December 16, 2008 No. F08-7618/2008, dated December 15, 2008 No. F08-7582/2008).

At the same time, in some cases, when tax inspectorates were unable to provide sufficient evidence, the courts made decisions in favor of organizations (see, for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 16, 2007 No. 11871/06, determination of the Supreme Arbitration Court of the Russian Federation dated October 8 2008 No. 12951/08, resolution of the Federal Antimonopoly Service of the North-Western District dated January 20, 2009 No. A56-5037/2008, dated June 16, 2008 No. A42-167/2007, dated November 11, 2008 No. A52-664 /2008).

Transfer of authority to other persons, sample order for the right to sign invoices

Let's look at an example. The director of Green World LLC, R. A. Patrikeev, often goes on business trips abroad due to official needs. The company's chief accountant is responsible for overseeing accounting in regional divisions, so she is also often away. As a result, the question arose: who signs invoices in their absence?

To resolve the issue, the company issued an order “On granting the right to sign invoices” dated September 21, 2017 No. 167, after which the question “Who signs invoices?” didn't get up again. Thus, the company complied with the requirements of the law and saved itself and its customers from potential claims from controllers.

For more information about what inaccuracies are permissible in an invoice, read the material “What errors in filling out an invoice are not critical for VAT deduction?” .

IMPORTANT! Before writing an order about who has the right to sign invoices, it is better to open GOST R 6.30-2003 and familiarize yourself with the requirements for the preparation of organizational and administrative documentation.

You can view and download a sample order on our website using the link below:

Additional details

Failure to comply with the requirements for an invoice not provided for in paragraphs 5 and 6 of Article 169 of the Tax Code of the Russian Federation cannot be grounds for refusal to accept for deduction the amounts of tax presented by the seller (clause 2 of Article 169 of the Tax Code of the Russian Federation). Thus, tax legislation does not prohibit taking the initiative and entering some details into the invoice “on your own.”

The main thing is that such creativity does not violate the sequence of arrangement of the mandatory invoice indicators given in Resolution No. 914. This is stated in the letter of the Ministry of Finance of Russia dated April 23, 2010 No. 03-07-09/26.

Representatives of the judiciary do not consider the inclusion of additional information in the invoice to be a violation of the procedure for drawing up the invoice. In particular, the judges of the Federal Antimonopoly Service of the Volga District (resolution of June 7, 2008 in case No. A55-14265/2007) are convinced that additional details in the invoice are not a reason to refuse to receive a tax deduction on its basis. The judges of the Federal Antimonopoly Service of the East Siberian District agree with this position (resolution of November 9, 2005 No. A19-5000/05-24-F02-5522/05-S1).

Having analyzed the explanations of officials and the decisions of the servants of Themis, we can note the following details, the presence of which in the invoice does not threaten the buyer with the inability to reduce the tax payable by the amount of “input” VAT. In particular, we are talking about the following information

- position of a person who is not the manager or chief accountant of the company, but who legally (based on administrative documents or a power of attorney issued on behalf of the organization) signed the invoice (see letters of the Ministry of Finance of Russia dated February 6, 2009 No. 03-07-09/04 and dated January 21, 2008 No. 03-07-09/06, letter of the Federal Tax Service of Russia dated May 20, 2005 No. 03-1-03/838/8);

- the invoice number in the line “to the payment and settlement document” of the invoice (resolution of the Federal Antimonopoly Service of the Central District dated December 10, 2007 in case No. A48-1165/07-18);

- details “Issued” and, accordingly, the position and full name of the person who issued the invoice (letter of the Ministry of Finance of Russia dated July 26, 2006 No. 03-04-11/127).

Do I need to sign the invoice on both sides?

Given the large amount of information that needs to be reflected in this document, it may happen that one page is not enough. The Tax Code of the Russian Federation does not contain a prohibition on issuing an invoice on several sheets.

So that the recipient does not have concerns about the reliability of the data, we recommend transferring part of the tabular form to another sheet so that it looks like a continuation of the previous one. In addition, the document originator may be required to endorse each page of the invoice.

For clarity, all information is reflected on separate sheets, stapled and numbered. You can also display the data on the back, but this is inconvenient for accountants processing documents bound for archiving. Details that determine who signs invoices in the organization (“Head of the organization” and “Chief accountant”) are indicated on the last sheet. This arrangement of signatures is not a violation if the continuous numbering is not broken.

Invoice for individual entrepreneurs on the Unified Agricultural Tax

Until the end of 2022, entrepreneurs using the Unified Agricultural Tax were not considered VAT payers, except for the cases listed in clause 3 of Art. 346.1 Tax Code of the Russian Federation:

- when importing goods into the Russian Federation;

- when carrying out operations listed in Art. 161 (when performing the duties of a tax agent for VAT) and in Art. 174.1 of the Tax Code of the Russian Federation (see the figure above).

But as of January 1, 2019, the situation has changed—those using the special agricultural regime will also have to pay VAT. Such amendments were made to paragraph 12 of Art. 9 of the Law “On Amendments to the Tax Code of the Russian Federation” dated November 27, 2017 No. 335-FZ.

Companies and individual entrepreneurs on the Unified Agricultural Tax will need to issue invoices to their customers and customers, maintain tax registers for VAT (sales books and purchase books), and also submit quarterly declarations for this tax to the inspectorate.

How an individual entrepreneur fill out a VAT return is described in this material .

Legislators have provided a benefit for Unified Agricultural Tax payers—from 2019, individual companies and individual entrepreneurs can maintain their VAT non-payer status. We will tell you what is needed for this in the next section.

Results

The issue of who signs invoices must be resolved in a timely manner. If this is done by the manager (IP) or the chief accountant, no additional actions are needed, but if other persons sign, then it is necessary to consolidate their powers by issuing the corresponding local act (order, instruction) or issuing a power of attorney.

These documents will officially identify who signs the invoices, and your counterparty will not have to argue with inspectors and defend a deduction if the invoice is signed by unauthorized persons.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.