Why do you need to count payroll numbers?

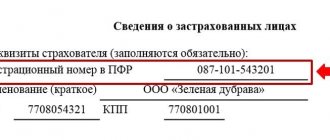

As stated above, the value under consideration implies the total number of employees of the enterprise. If we talk about its practical significance, then the payroll number of employees of an enterprise is a test number that helps in solving analytical problems, such as assessing labor efficiency, calculating average wages and staff turnover rates. In addition, the column of the same name is present in a number of reports submitted to regulatory authorities. For example, information on the payroll number of employees is reflected in form 4-FSS, approved by Order of the Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381. In addition, the specified coefficient is taken as the basis for another value - the average payroll composition of personnel. It, in turn, is necessary when filing tax returns electronically (clause 3 of Article 80 of the Tax Code of the Russian Federation), when calculating income tax at the location of a separate division (clause 2 of Article 288 of the Tax Code of the Russian Federation) or when filling out the DAM form -1 Pension Fund.

Application of average strength

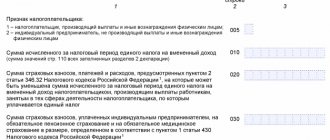

In order for a company to confirm its right to preferential taxation, it is necessary to calculate the average number of employees. Calculation will be required in the following cases:

- When an organization or individual entrepreneur switches to taxation regimes such as the simplified tax system or UTII. In order for a company to do this, the average number of employees per year should not exceed 100 people. If this indicator is exceeded, the use of special modes is impossible;

- When an individual entrepreneur switches to a patent taxation system. In order for an entrepreneur to exercise his right to apply such a regime, the average number of people should not exceed 15 people;

- To receive tax benefits.

How to calculate

Calculation of the corresponding coefficient involves the question of who is included in the payroll number of employees. The answer is contained in the Instructions on statistics of the number and wages of workers and employees at enterprises, institutions and organizations, approved by the State Statistics Committee of the USSR on September 17, 1987. According to clause 2.9 of the specified document, the list of employees of the enterprise includes “all employees hired for permanent, seasonal, and also temporary work for a period of one day or more, from the day they are hired.” It should be understood that the number of employees present and on the payroll are different quantities. The latter includes not only employees present at the workplace, but also some of the personnel who did not show up for reasons such as downtime, being on a business trip, illness, annual leave, etc. The full list is determined by clause 77 of the Instructions, approved by order of Rosstat dated 22.11. .2017 No. 772.

The list of employees is

In the practice of personnel accounting and planning, a distinction is made between attendance, payroll and average payroll.

Attendance is the minimum required number of workers who must come to work every day to complete the task within the established time frame.

Payroll - all permanent and temporary employees registered at the enterprise, both those currently performing work and those on regular vacations, business trips, performing government duties, who did not show up for work due to illness or any other reasons. The number of employees on the payroll can be established on a specific date.

The average payroll is determined by summing the payroll of employees for all calendar days of the period, including weekends and holidays, and dividing the resulting amount by the full calendar number of days of the period.

Personnel requirements are planned separately by groups and categories of workers. The most common methods for calculating labor requirements are:

- According to the labor intensity of the production program;

- According to service standards.

The first method is used to determine the number of workers employed in regulated work. To do this, their turnout and average roster numbers are calculated.

The turnout number of workers per shift (Rav) is the standard number of workers to complete a shift production task.

,

where Tr is the complexity of the production program in the planned transition;

Tcm – shift duration, standard hours;

n – number of work shifts, days;

D – the number of days of operation of the enterprise in the planning period;

k – coefficient of exceeding standards in the planning period.

The average number of workers is calculated either by the average payroll coefficient or by the planned percentage of absenteeism.

The number of workers employed in non-standardized work is determined by the second method - according to service standards, the number of engineering and technical workers and employees - according to the staffing table.

The state of personnel at the enterprise can be determined using the following coefficients.

The staff attrition rate (Q) is determined by the ratio of the number of employees dismissed for all reasons for a given period of time to the average number of employees for the same period:

,

where Ruv is the number of dismissed workers, people;

P – average number of personnel, people.

The personnel stability coefficient (Kc) is recommended to be used when assessing the level of organization of production management both at the enterprise as a whole and in individual divisions:

,

where Ruv is the number of employees who left the enterprise at their own request and due to violation of labor discipline during the reporting period, people;

P – average number of employees at this enterprise in the period preceding the reporting period, people;

Рп – number of newly hired employees during the reporting period, people.

The staff turnover rate (Kt) is determined by dividing the number of employees of an enterprise (workshop, site) who left or were dismissed during a given period of time by the average number of employees for the same period:

Kt = Ruv / P100%,

where Ruv is the number of retired or dismissed employees, people;

P – average number of personnel, people.

Who is excluded from the calculation

As stated above, the payroll includes employees who have entered into labor relations with the enterprise, regardless of their nature and duration. In accordance with paragraph 79 of the Rosstat Instructions mentioned above, the following employees are not included in the payroll:

- hired externally;

- working under civil contracts;

- enterprises working under special agreements with government services to attract labor (military personnel and persons serving sentences);

- transferred to work in another organization;

- aimed at training without work and without pay;

- those who submitted a letter of resignation and stopped working before the expiration of the warning period or stopped working without warning;

- lawyers;

- military personnel in the performance of military service duties.

Headcount and average headcount: what is the difference between the terms?

Any enterprise exists on the basis of employees who work on it. And each of these terms - headcount and average headcount - speaks about personnel indicators at the company. These are not the only aspects, but they are some of the most significant indicators. After all, it is from them that the scale of production is already based - that is, whether it is a small or a large company.

Moreover, this, in turn, also affects taxation. And most entrepreneurs are trying to save on extraneous deductions, trying to switch to a simplified form. And in general, this affects the management of the entire budget. Therefore, let's talk about visual things in the necessary terminology.

Important: We refer on this issue to Rosstat dated November 20, 2006 N 69. The average value is described in paragraphs 88-89, the average list coefficient is explained in paragraph 90.

Brief Explanation

What is headcount?

We have already touched on a little that this is one of the main indicators of the entire enterprise. But it not only sets, but is also determined by its size, structure, degree of mechanization of processes, volume of production of services or goods. This indicator directly indicates the segment of the enterprise’s activity and the number of specialists employed in it for a specific specified period of time or reporting date. This indicator is used to set the proper percentage of taxes and other static goals.

It consists of the following segments:

- the top cell, which holds very important proprietary information, in the role of administrative staff;

- all employees from working to managed positions on a legislative basis. It also includes service personnel and highly qualified scientific specialists.

- But there may also be such a character: permanent employees. That is, those employees who are registered on the basis of an employment contract on a permanent basis. As a rule, this period starts from a year and has an indefinite period, if no labor incidents arise;

- temporary employees. They are hired for a short period of up to 2 months, and to replace an official - up to 4 months;

- seasonal workers. This is a more common category in the agricultural or heating spectrum. Such employees are hired for various seasonal jobs for up to 6 months.

Important: This criterion includes all employees who have been registered with the company for more than 1 day. And it doesn’t matter - on an open-ended or fixed-term contract.

Terminology

But also take into account as additional indicators:

- workers who were sent to government or public works;

- part-time and part-time workers within the company. By the way, you can read about their differences in our material “What is the difference between part-time and combination?”;

Important: But an employee sent from an external organization on a part-time basis is counted separately!

- those who work part-time. Moreover, keep in mind that they will legally be listed as full-fledged employees if working conditions or the employer’s desire so require;

- remote employees, that is, working from home;

- those who are on probation;

- and all non-staff employees who are hired for one-time special work on the basis of the GPA;

- This indicator also takes into account employees who are on a business trip, as well as persons sent to study outside of work. But they either must retain their wages, or they must take vacation at their own expense;

- truants;

- or employees on any vacation period, sick leave.

Important: The number covers a different time period from 1 day to a year. And in order to see a true reflection of the situation with the attendance of employees at the workplace by day, they use an indicator such as the number of attendance.

At state-owned enterprises, the number of personnel is strictly regulated by law. Private firms also adhere to these standards, however, there is no such strict established control.

Structure

Who is not included in the average population:

- Let us repeat that these are external part-time workers;

- specialists who are involved on a civil law basis;

Important: Employees who have entered into this agreement with the organization are counted only at their main location.

- persons who were sent from state spectrums;

- lawyers and military personnel;

- when transferring abroad;

- persons who are undergoing training, but at the same time receive a scholarship from this institution;

- owners of the organization, if they do not receive payment for their work;

- as well as those who have already submitted their resignation, or whose contract has expired. Moreover, the exception occurs from the first day of absence from work.

Exceptions

What is the average number of employees?

But the tax service requires a more precise criterion, namely the SSC or average headcount.

Important: Regarding employees who work reduced hours or part-time. When calculating the SSC, the whole unit of a full-time worker is not taken into account, but the time worked is taken into account proportionally!

- The first and significant difference is the list of employees included. For the average headcount, only those workers who are officially registered at a given enterprise are taken into account. That is, unofficially arranged jobs are immediately eliminated.

- But employees who are on paid leave, business trips or undergoing treatment must be taken into account. But again, this must necessarily have documentary evidence.

But there are exceptions for full-time employees:

- a woman’s leave for pregnancy or child care is excluded from the calculation;

- as well as new parents in adoption;

- students or qualified persons who study at the expense of the company. At the same time, they receive a stipend or do not have a fixed salary;

- The list is also supplemented by employees who are absent to take entrance exams.

Important: But the average headcount includes employees based on special contracts with government organizations. Namely, military personnel and persons who are in prison! Moreover, they are equal to a full unit for each revealed day.

Accounting for the average indicator

It is also worth considering important points:

- if a company has 5 working days, then to determine the man-hour indicator, 40 total hours per week should be divided by 8. But with a six-day week, it is 6.67;

- The total number of 36 hours is calculated in a similar way. That is, with 5 days we divide by 7.2, and with 6 – by 6;

- We divide the 24 total hours by 4.8 for a five-day period and by 4 for a six-day period.

What are the differences from the average

As we previously found out, the number of employees on the payroll is the number of people who have entered into an employment relationship with the organization in the form of an employment contract. This value is calculated for each day in whole units and corresponds to the number of people declared on the working time sheet. The resulting indicator is taken as the basis for calculating the average headcount, a significant value for statistics and taxation. Its calculation for a month is carried out as a calculation of the average value: the average value for each calendar day is summed up, the resulting amount is divided by the number of calendar days. The quarterly coefficient is calculated in a similar way. However, in order to obtain correct data when calculating both quantities, it is necessary to take into account a number of nuances.

Step-by-step instructions for calculating the average number of employees

The average headcount is calculated for a quarter, half a year, 9 months and a year. The principle is this: count the number of employees for each month of the period and divide by the number of months in this period. For example, if 6 people worked for you in the first quarter, and 4 in the second, the average number of employees for the six months is 5 employees

If nothing changed during the calculation period - the employees did not quit or come back, they worked full time, just count them on their heads.

There are more complicated situations. New employees appear and old ones leave, some take maternity leave, and some work part-time. To calculate everything correctly, use step-by-step instructions.

Step 1. Calculate the NAV of full-time employees

Add up the employees for each day of the month—even those who were sick or on vacation—and divide by the total number of days in the month.

In the same way, count employees for the remaining months.

Step 2. Calculate the SCN of part-time employees

If you don't have part-time employees, move on to the next step.

First, calculate how many hours all part-time employees worked each month.

Divide the hours worked by employees by the daily working hours multiplied by the number of working days in the month.

Step 3. Calculate the average value of all employees

- Add up the NAV of full-time and part-time employees for each month. Round the result to a whole number.

- Divide the number of full-time and part-time employees by the number of months in the period. Round again to a whole number.

The number is calculated for the periods:

- quarter – calculate the employees’ average balance from January to March and divide by 3;

- half a year - calculate the employees’ average balance from January to June and divide by 6;

- 9 months – calculate the employees’ average balance from January to September and divide by 9;

- year – calculate the employees’ average balance from January to December and divide by 12.

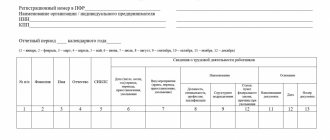

The final result of the average number of employees is needed for the DAM and 4-FSS.

It depends on the SSC how the employer will report on employees: on paper or electronically. For example, the DAM can be submitted on paper only if there are no more than 10 employees. The DAM also affects the restrictions for the simplified tax system and a patent. On a patent, the number of employees should not exceed 15 people, and on a simplified tax system - 130. If there are more employees, the taxation system will have to be changed.

Register in Elba and generate tax reports.